Illinois government workers who switch careers can lose big chunk of retirement savings

Pensions punish government workers who leave state employment early. 401(k)s don’t.

Nearly two-thirds of new public school teachers in Illinois will leave their jobs before qualifying for a pension. New teachers have to work 10 years before they qualify for a pension in Illinois.

When teachers who work less than 10 years leave, they only get back a portion of what they put into the pension system. And they get none of what their employer contributed. Nor do they receive the interest on those contributions.

That’s unfair. Teachers who make the personal decision to change career paths essentially have to rebuild their retirement savings from scratch.

But two lawmakers have put forth proposals to change that.

State Sen. Dale Righter, R-Mattoon, and State Rep. Jeanne Ives, R-Wheaton, introduced 401(k)-style plans under which state workers would be able to keep all the retirement benefits they’ve earned, not just their employee contribution, when they leave their job.

Pensions punish teachers who leave early

Millennial workers change jobs nearly four times before age 32, according to a recent study from networking site LinkedIn. But Illinois’ pension systems punishes government workers if they want to change careers before qualifying for a pension.

Workers who haven’t “vested” – meaning they haven’t worked long enough to qualify for a pension – have to take a refund instead.

For example, it takes 10 years for new teachers – enrolled under the less generous Tier 2 plan begun Jan. 1, 2011 – to vest in a pension. Unfortunately, most teachers don’t stick around long enough to vest.

According to a 2014 Bellweather Education Partners report, nearly two-thirds of new Illinois teachers will leave teaching before vesting in the fund.

The only amount they’ll get back from the pension system is their direct employee contributions.

Teachers don’t get to keep the contributions the state made to their pension. And they don’t get to keep the interest those contributions earned while invested in the fund.

That leaves them “on a poor retirement savings path,” according to Bellweather.

The 401(k) alternative

Workers should be able to take their entire retirement earnings with them if they change jobs.

State workers shouldn’t be trapped in their job because they have to wait to qualify for a retirement benefit.

401(k)-style plans solve that problem. It’s one of the many reasons they’re superior to pensions.

Under Righter’s and Ives’ proposed 401(k)-style plans, state workers not covered by Social Security would set aside more than 15 percent of their salary each pay period. Each worker would contribute a mandatory 8 percent of each paycheck into his or her own 401(k)-style account, and the state would match that contribution with another 7.3 percent.

Workers would vest in their retirement benefits after just one year of work. That means no penalty for leaving government employment. Workers won’t have to take a refund worth only a fraction of the benefits they’ve accumulated, as they have to do in the current pension system.

Instead, the 8 percent employee and 7.3 percent employer contributions a worker receives – as well as the investment returns earned on them – stay in that worker’s personal retirement account no matter where that worker goes or what job he or she take.

That portability makes a big difference when saving for retirement and provides workers with much more freedom.

A teacher’s 401(k) account balance vs. pension refund

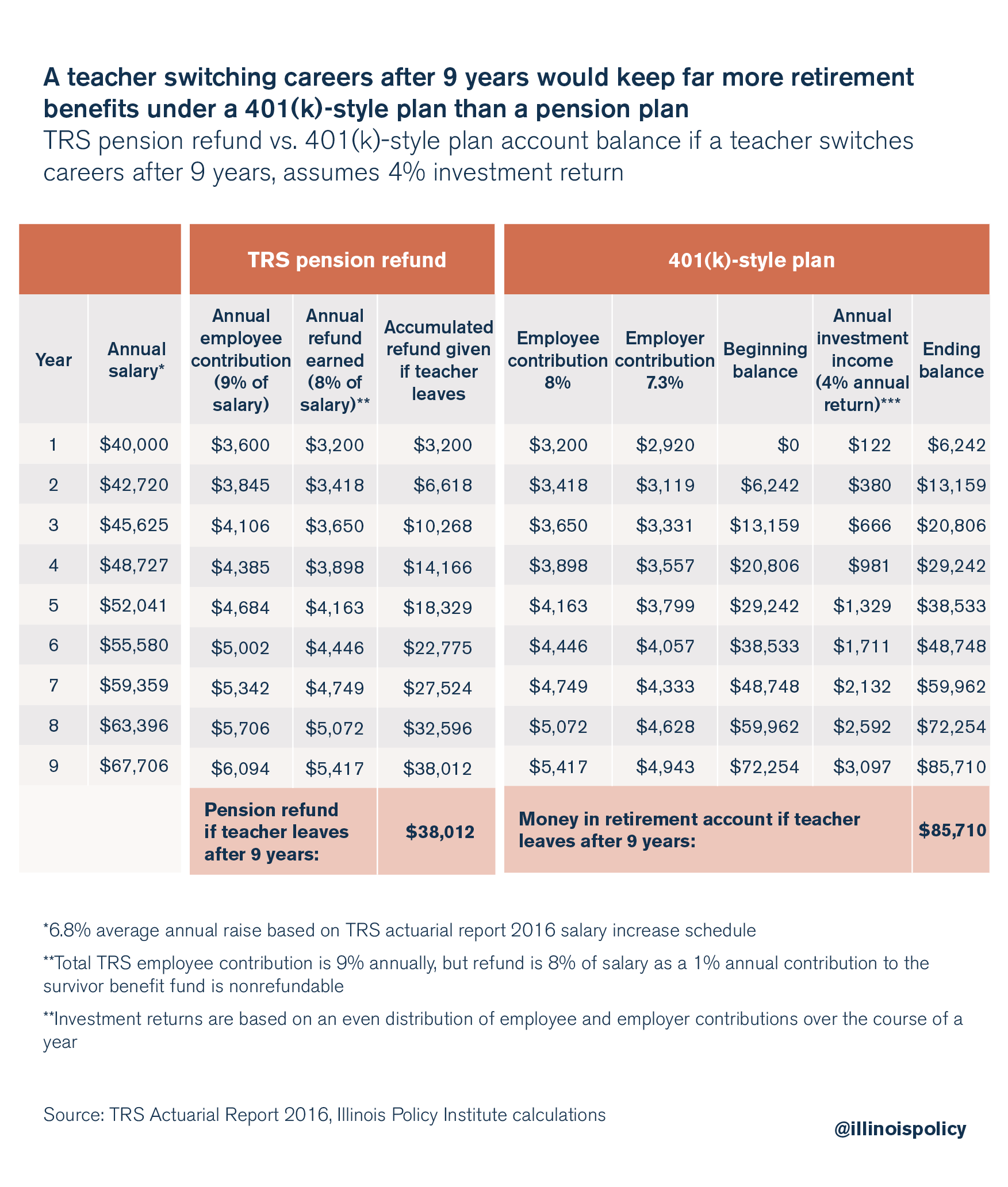

For example, take a young teacher who has decided to change careers after nine years of service in Illinois.

Let’s assume she was hired under the Tier 2 plan, received a starting salary of $40,000 and an annual raise of 6.8 percent every year (based on TRS actuarial assumptions).

Under Tier 2 pension rules, her nine years of service don’t qualify her for a pension. So the teacher has to take a refund of her employee contributions when she leaves.

She won’t get back her employer contributions the state made toward the pension fund. Nor will she get back the interest made on her employee and employer contributions.

Worse, she won’t even get back the full amount of her employee contributions. The teacher contributed 9 percent of her salary each year, but she will only get 8 percent back. One percent of her yearly contributions went to a survivor’s benefit fund and is nonrefundable.

In all, the teacher will only receive a refund of $38,000 – a few thousand dollars less than what she actually contributed over her nine years of work.

On the other hand, if that same teacher was enrolled in a 401(k)-style plan, she could leave her job with retirement funds worth far more than her pension refund.

Under a 401(k)-style plan, the money in her retirement account – a collection of employee, employer contributions and investment income – is all hers. She can take it with her with no penalty.

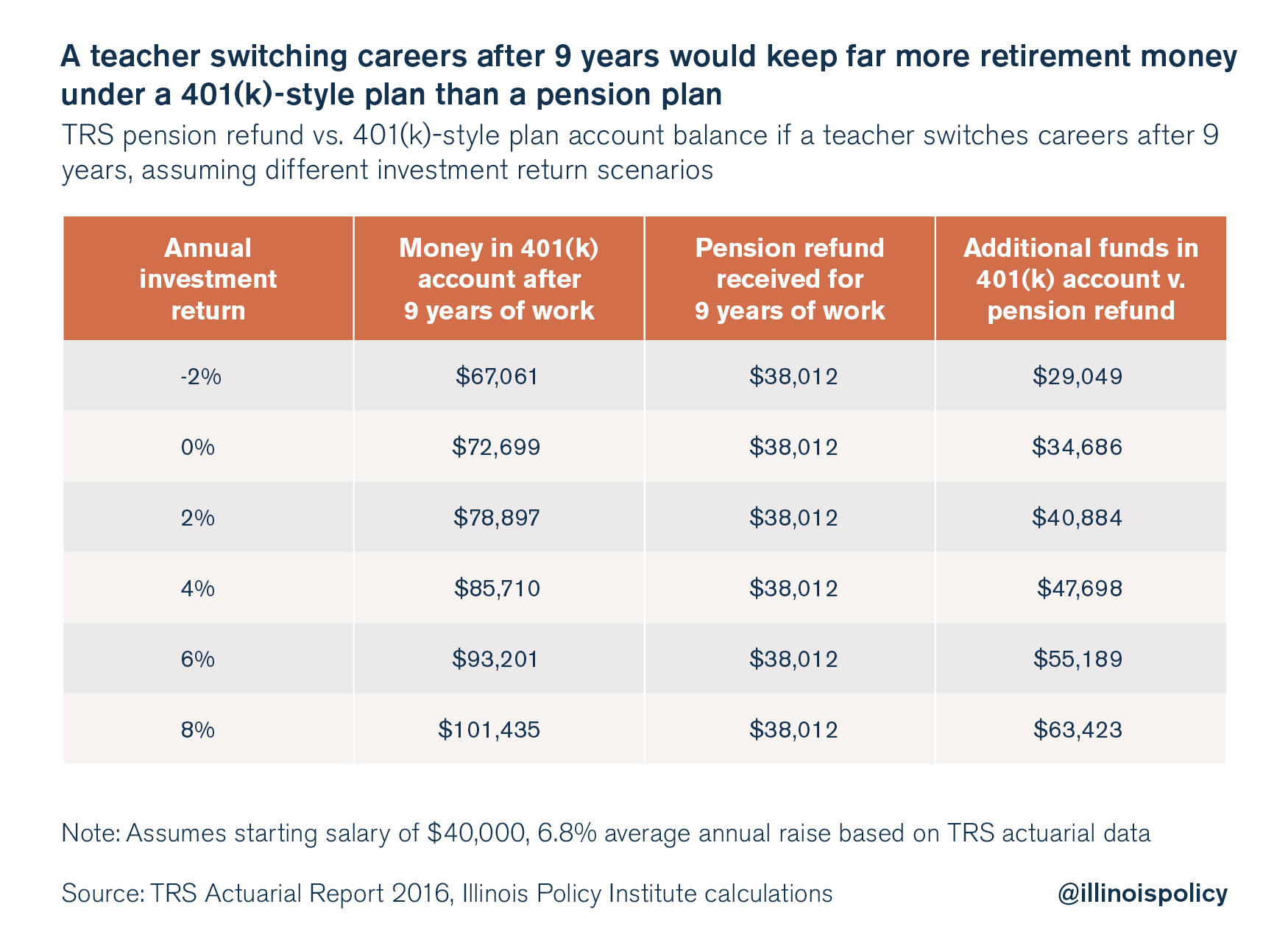

Assuming the teacher earned a conservative 4 percent interest from investments annually, she’d have $85,700 in her retirement account after nine years.

That means she’d have $47,700 more retirement benefits compared with a pension refund.

Even if the teacher had experienced investment losses worth 2 percent every year, she’d still end up with 76 percent more money, or $29,000 more, compared with a refund from the pension system.

Giving state workers 401(k)-style retirement plans

Righter and Ives have both introduced comprehensive 401(k)-style reform plans in the Illinois General Assembly.

Righter’s and Ives’ proposals are based on the state’s optional 401(k)-style plan for state university workers – a plan that has existed in Illinois for nearly 20 years and has over 20,000 members.

Under the lawmakers’ proposals, new state workers would be enrolled in a 401(k)-style plan. Current workers would have the option to join the 401(k)-style plan as well.

Under the 401(k)-style plan, contributions are mandatory and the retirement system vets workers’ investment options.

401(k)-style plans can also provide several million in retirement funds for the average government worker. That allows workers to receive annual retirement benefits similar to pensions.

Each worker’s personal retirement account is portable. Workers can take their retirement funds wherever and whenever they want. And the plans don’t depend on IOUs from House Speaker Mike Madigan, Chicago Mayor Rahm Emanuel or Gov. Bruce Rauner.

A 401(k)-style plan can give teachers and other government workers the freedom to make different career choices without the fear of losing their retirement benefits.

That’s far better than the pension plan workers are forced into today.

To learn more about how retirement benefits under 401(k)s can benefit state workers, click here.