Illinois has a dirty little secret buried in its tax history

Illinois has a dirty little secret buried in its tax history – the first income tax approved in Illinois was a progressive tax. Fortunately, the progressive tax was ruled unconstitutional and was never implemented. But now the threat of a progressive tax hike is back again. Originally, Illinois didn’t have an income tax. When the...

Illinois has a dirty little secret buried in its tax history – the first income tax approved in Illinois was a progressive tax. Fortunately, the progressive tax was ruled unconstitutional and was never implemented.

But now the threat of a progressive tax hike is back again.

Originally, Illinois didn’t have an income tax. When the Illinois Constitution was written in 1870, it did not directly authorize the state to tax income.

In 1932, Illinois approved its first income tax – a progressive income tax, which taxed income at ever-increasing rates. But the Illinois Supreme Court immediately voided the progressive income tax, ruling that an income tax in itself was unconstitutional. Graduated rates also violated the rule of uniformity in the state constitution’s revenue article.

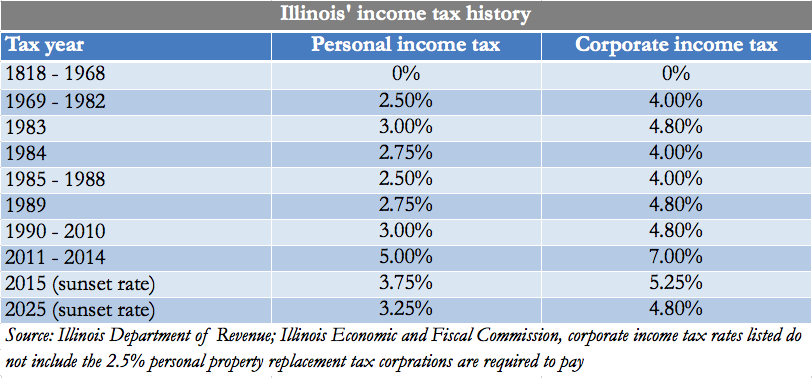

Political leadership in Illinois ramped up their efforts to pass an income tax again the 1960s. Then-Republican Gov. Richard Ogilvie proposed a 4 percent flat rate tax on personal and corporate income. On July 1, 1969, a flat-rate income tax was signed into law – with a 2.5 percent flat rate applied to individuals and a 4 percent flat rate applied to corporations.

The constitutionality of taxing income was still a topic of debate. But that debate came to an end when the 1970 Illinois Constitution allowed the state to levy a tax on income. Although the constitution allows for a flat rate income tax, it strictly prohibits a graduated, or progressive, income tax.

The 1970 Constitution established limits on the difference between the personal income tax rate and the corporate income tax rate. Specifically, the corporate income tax rate is not allowed to exceed the personal income tax rate by more than a ratio of 8 to 5. That means that for every 1 percent of personal income tax, the state can apply a 1.6 percent tax on corporate income.

Illinois’ income tax rates have fluctuated since Ogilvie singed the tax into law. A temporary tax increase was passed in 1983, after which the rates reverted to 1982 levels. The personal and corporate income tax rates were increased again in 1989. The higher rates were scheduled sunset but became permanent on July 1, 1993.

Most recently, Illinois lawmakers passed a record income tax increase in 2011, temporarily raising rates on personal income to 5 percent from 3 percent, and on corporations to 7 percent from 4.8 percent. Those rates are scheduled to sunset in 2015 and again in 2025.

Instead of allowing the tax hike to sunset, lawmakers and special interest groups want to revisit the progressive tax efforts of the 1930s. Now they want to swap out the state’s constitutionally protected flat rate income tax for a progressive tax hike. But the progressive income tax was unconstitutional in the 1930s and it’s still unconstitutional today. Instead of raising income tax rates yet again in Illinois, lawmakers need to keep their promise and reduce the rates for all taxpayers in 2015.