Illinois lawmaker introduces bill to kill death tax

Dollar for dollar, the death tax is likely the most economically harmful tax levied in Illinois.

State Rep. Ed Sullivan of Illinois’ 51st District has introduced House Bill 434 to repeal Illinois’ death tax. On a dollar-for-dollar basis, the death tax is likely the most economically harmful tax levied in Illinois.

The death tax is projected to bring in $200 million in state tax revenue per year for the next two years. But given the economic damage the tax causes, this is a poor trade-off. That damage includes major harm to family farmers and other family-business owners, who are forced to sell assets to pay the tax when they pass down their business; as well as harm to investments made in Illinois, which are liquidated to pay the tax. Furthermore, the tax is a major driver of out-migration. An Illinois Policy Institute migration study found that on a percentage basis, the death tax is Illinois’ strongest driver of out-migration.

As a result of damaging the investment-capital stock, the federal death tax costs the U.S. five times as much in GDP as it generates in tax revenue, according to the Tax Foundation. For Illinois, that means generating $200 million in revenue from the death tax comes at the expense of $1 billion in annual GDP growth, a foolish trade-off.

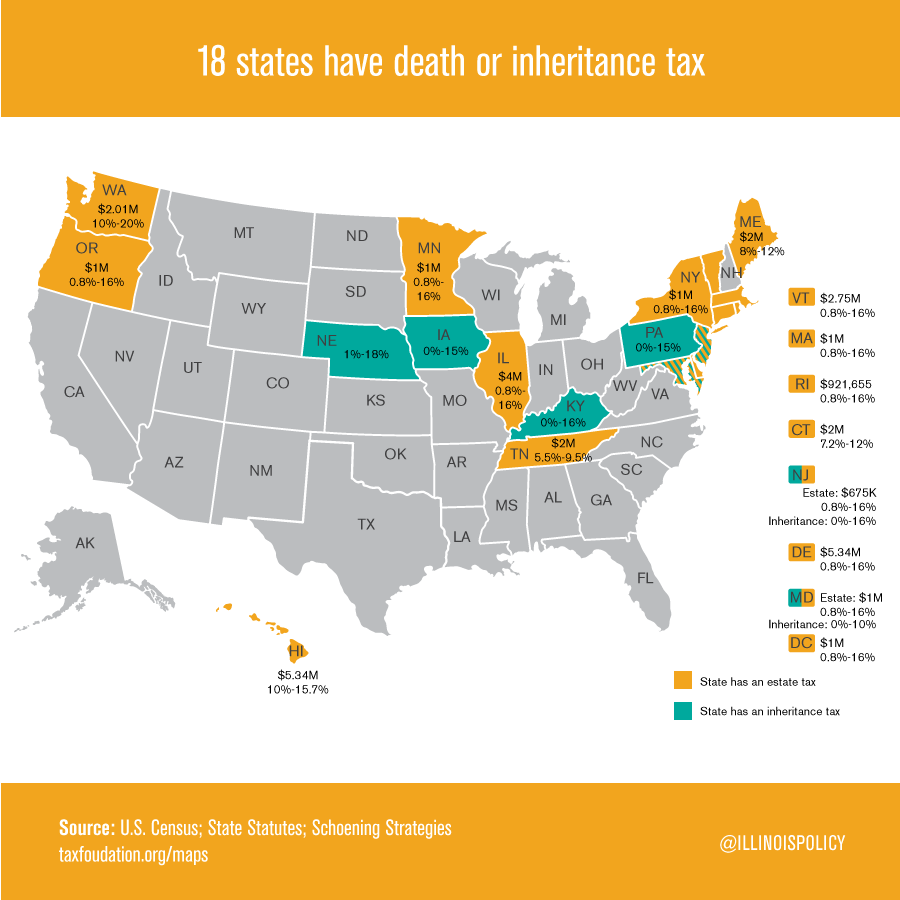

At the state level in Illinois, the ratio of economic damage is likely much worse than $5 in GDP loss for every $1 in tax revenue generated. That’s because in addition to destroying economic growth, there is also the uncalculated harm of driving wealth and businesses out of the state. Not only does the death tax significantly lower GDP, it also drives wealth to one of the 32 states that impose no such tax. Not a single retirement state in the Sun Belt imposes this harmful tax.

Illinois’ 2014 Tax Handbook for Legislators implicitly admits the death tax is a driver of out-migration by pointing out that local areas do not impose a death tax because people would simply move away to avoid it. The same occurs at the state level, as Illinoisans can move to neighboring Wisconsin, Indiana or Missouri, or any of the southern retirement states, to avoid the tax.

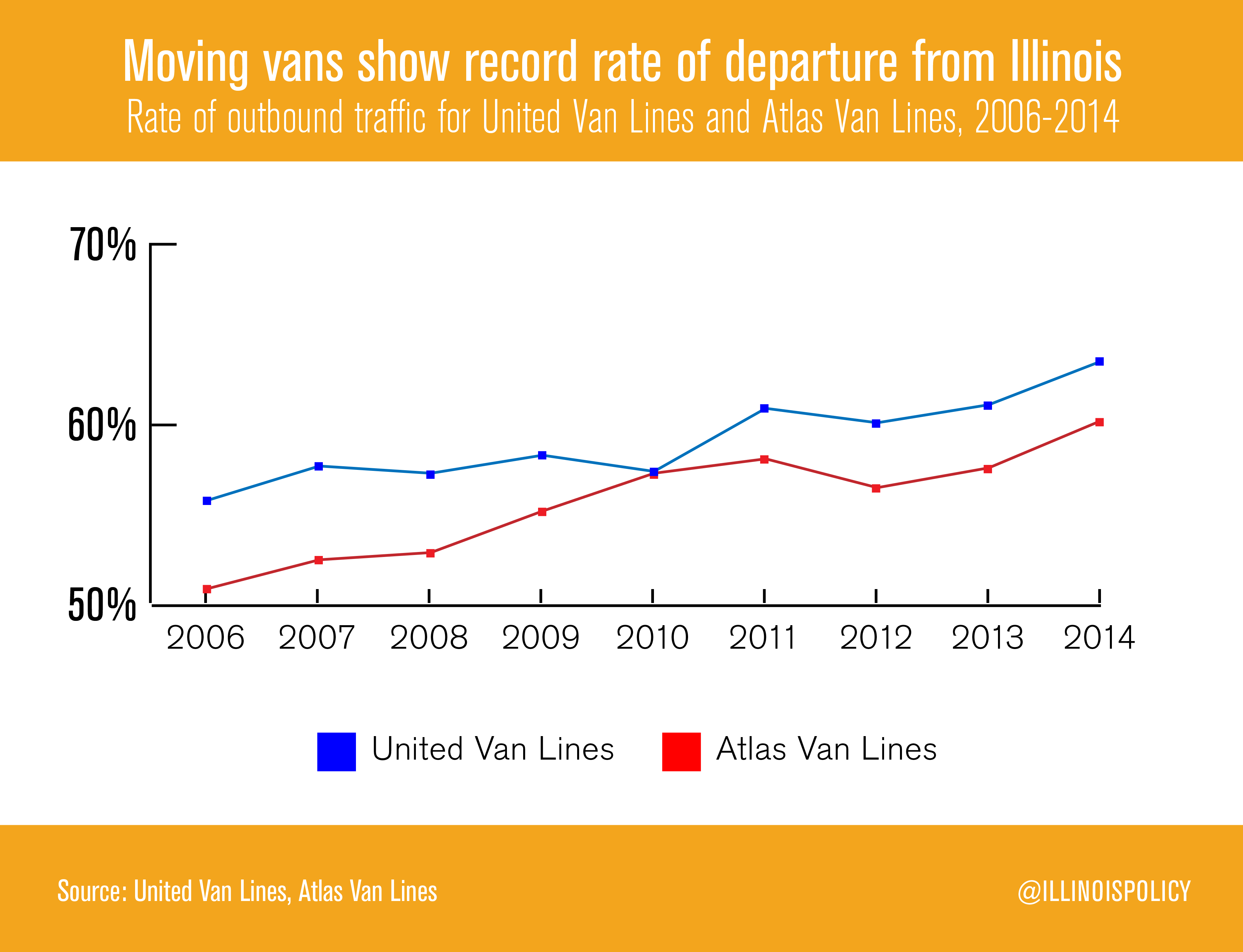

Data from moving companies United Van Lines and Atlas Van Lines, which are primarily movers for businesses, military and wealthy families, show that Illinois consistently has one of the nation’s highest rates of exporting wealth. Illinois’ outbound rate hit all-time highs for both companies in 2014.

It is hard to imagine a more anti-entrepreneur, anti-family-business policy than to force the second generation of entrepreneurs or farmers to sell off a chunk of their Illinois business on the very day it’s handed down to them. Repealing the death tax would stop the state’s punishment of family farms and family-owned businesses. This repeal can be offset with new revenues from the recently enacted Amazon tax.

Repealing the death tax would not involve much revenue loss for the state, and that revenue could be easily generated elsewhere. Repeal would, however, keep more economic growth in Illinois, and go a long way in helping the Land of Lincoln shed its reputation as a state that taxes everything that moves, breathes and even dies.