Illinois loses 6,800 payroll jobs in April, while Texas gains 64,100 jobs

Illinois lost 7,800 private-sector jobs in April, and the state jobless rate fell to 7.9 percent, according to the Bureau of Labor Statistics. Illinois remains the worst in the Midwest and third-worst nationally for joblessness. Illinois’ private-sector jobs loss came against a gain of 1,000 government jobs, leaving the state with a net loss of...

Illinois lost 7,800 private-sector jobs in April, and the state jobless rate fell to 7.9 percent, according to the Bureau of Labor Statistics. Illinois remains the worst in the Midwest and third-worst nationally for joblessness.

Illinois’ private-sector jobs loss came against a gain of 1,000 government jobs, leaving the state with a net loss of 6,800 payroll positions. That loss puts Illinois dead last nationally for month-over-month change in nonfarm payroll jobs.

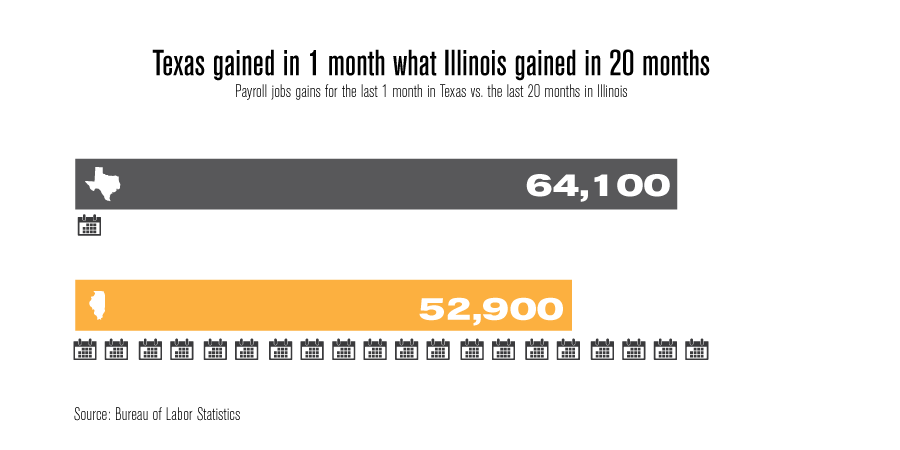

Texas, on the other hand, led the nation with a monthly gain of 64,100 payroll jobs, more than Illinois has produced in the last 20 months combined.

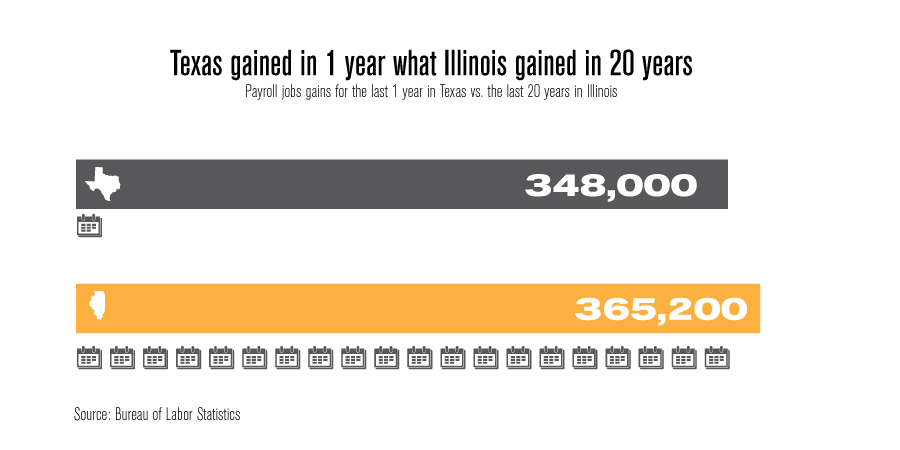

Texas has made a net gain of 348,000 payroll jobs in the last year, nearly equal to what Illinois has gained in the last 20 years combined.

With another monthly payroll setback, Illinois continues to rank last in the Midwest for recovering payroll jobs since the Great Recession began. Nonfarm payrolls are now 3.1 percent lower than at the start of the recession. Michigan is second-worst, with payrolls 2.8 percent lower than at the start of the recession.

In the Midwest, Illinois and Michigan have the worst and second-worst jobless rates, respectively.

Illinois’ historic 2011 tax hike led to slower job growth in Illinois, even as the rest of the country accelerated its job-creation rate. With payroll job losses in three out of the last four months, lawmakers can’t afford to extend the 2011 tax hike.

Legislators should sunset the 2011 tax hike and then focus on following the lead of pro-growth states by eliminating all taxation on work and investment. That means eliminating the income tax and transitioning to consumption taxes.