Illinois metro areas gain 14,200 jobs in June

While a majority of Illinois metro areas experienced expanding payrolls in June, the state still lags the nation in post-recession jobs growth.

A majority of Illinois metropolitan areas showed net jobs growth in June, according to preliminary data from the Bureau of Labor Statistics. Total net statewide job gains during the month amounted to 18,100, with the Chicago area’s 12,800 net additional jobs accounting for the vast majority of gains.

Illinois’ June job gains give a much-needed boost to a state that has failed to keep up with the growth of the rest of the U.S. economy in the post-recession period and especially since the Prairie State’s massive 2017 income tax hike.

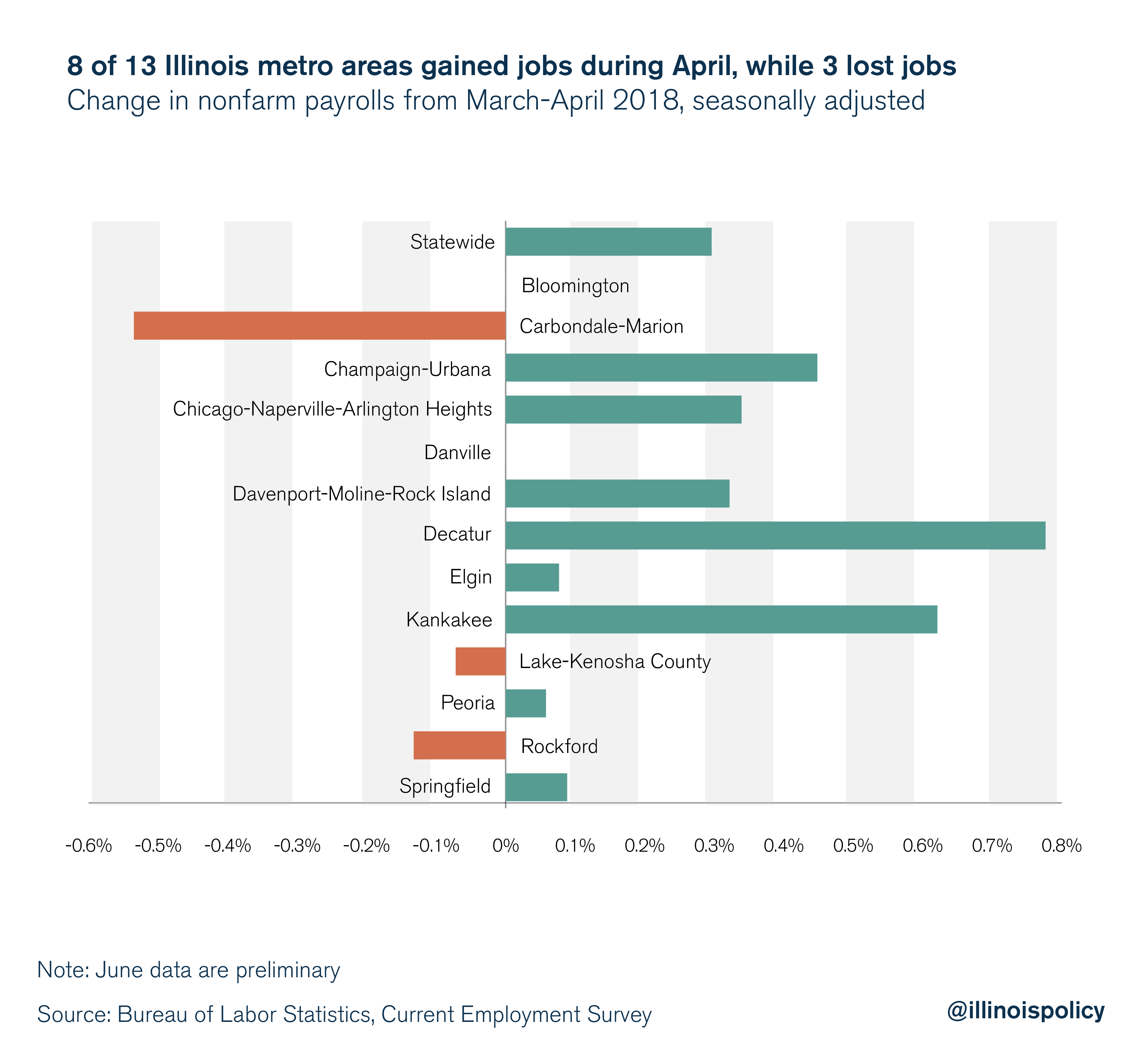

Following Chicago, Davenport-Moline-Rock Island picked up 600 jobs (+0.32 percent); Champaign-Urbana added 500 jobs (+0.45 percent); Decatur expanded payrolls by 400 jobs (+0.78 percent); Kankakee gained another 300 jobs (+0.62 percent); Elgin added 200 jobs (+0.08 percent); Springfield saw an additional 100 jobs (+0.09 percent); and Peoria gained 100 jobs (+0.06 percent).

Meanwhile, some places across the state experienced a net decline in payrolls in June. Carbondale-Marion lost 300 jobs (-0.53 percent); Lake-Kenosha County payrolls contracted by 300 (-0.07 percent); Rockford payrolls shrank by 200 (-0.13 percent). Bloomington and Danville experienced no change in payrolls from May to June.

Although the preliminary data suggest June was a big month for jobs growth in Illinois, it is important to note that 7,400 of the new jobs were created in the government sector. While the numbers are good news for Illinois today, the expansion of government payrolls combined with Illinois’ rigid public salary structure could crowd out private sector employment, and cause higher unemployment in the long run.

2017 tax hike hinders Illinois’ economy

Unfortunately for Illinois workers, healthy jobs growth like the state saw in June has become an anomaly. Other states often enjoy similarly robust jobs growth rates. For example, Illinois’ June growth rate matches the growth often observed in Texas, which also frequently surpasses that rate.

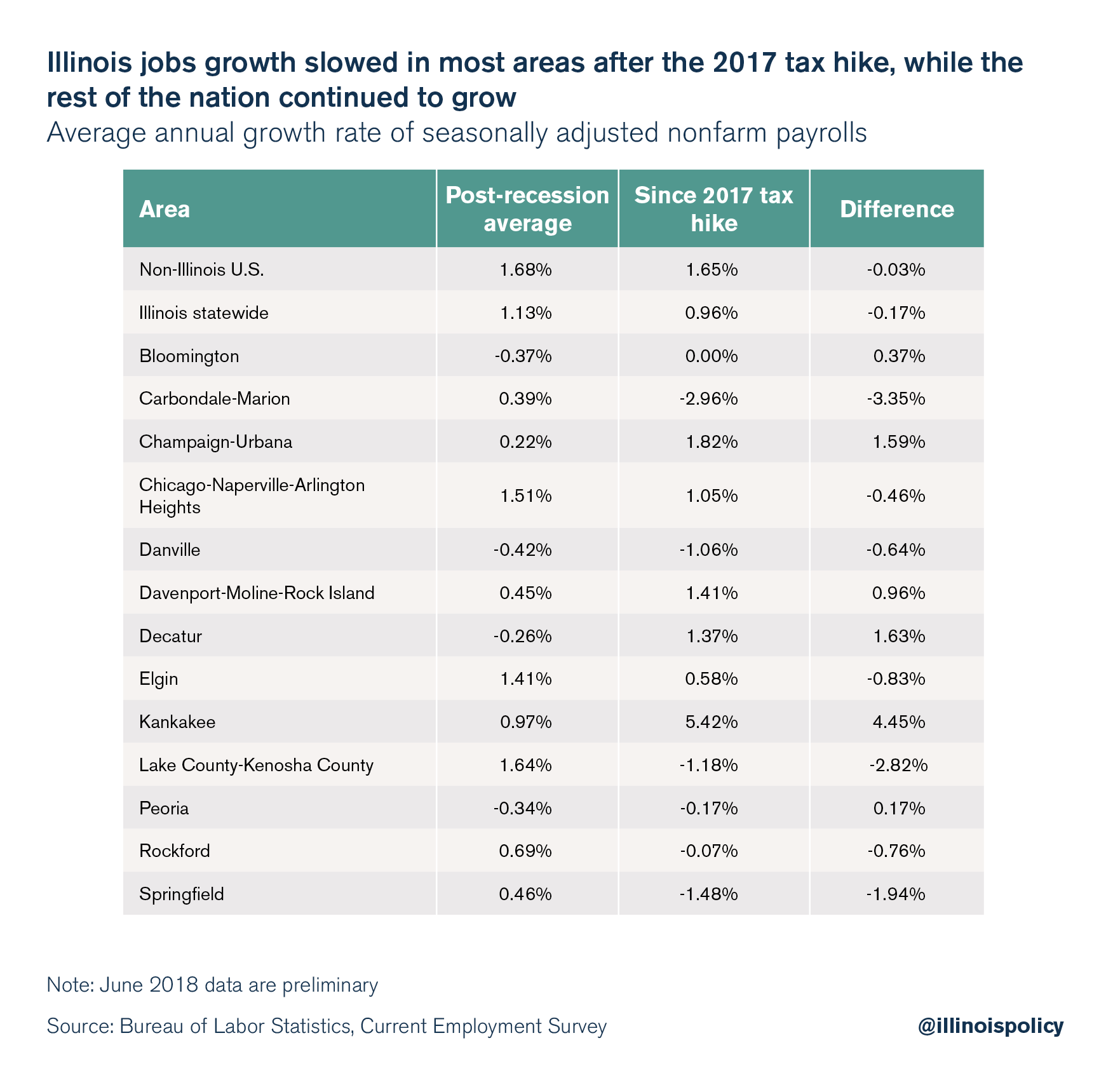

The last time Illinois experienced a greater rate of jobs growth was in June 2017 – which was also largely driven by the government sector – the month before the General Assembly passed the largest permanent income tax hike in state history. In the time since the tax hike, Illinois has lagged the rest of the nation in jobs growth. Illinois’ jobs growth was already falling behind the rest of the country in the post-recession period – in no small part due to the “temporary” income tax hike in 2011. But since the 2017 tax hike, the gap between Illinois and the rest of the nation has widened.

It is worth noting the June 2018 data are preliminary and will likely be revised next month. In fact, May’s numbers were revised to 7,700 jobs gained, down from 8,600 first reported. Thus, Illinoisans won’t know for sure what June’s jobs numbers were until August.

However, this is certain: Since the end of the recession and throughout the past year, Illinois has created fewer opportunities for workers than most of the nation.

Time for a change

Last year’s permanent income tax hike was the latest in a long line of poor public policies that have hurt the state’s economy. Despite the harm of increasing taxes, lawmakers in Springfield voted to increase income taxes $5 billion last year. Yet, notwithstanding the additional revenue, the 2018 budget ended the year with a deficit that could amount to as much as $1.2 billion, and the 2019 budget is as much as $1.5 billion out of balance.

Furthermore, major credit rating agencies have agreed that neither budget since the tax hike has adequately addressed the largest drivers of the state’s poor credit rating: pensions and the bill backlog. Illinois’ credit rating remains the lowest in the nation.

Finally, despite having $5 billion in additional income tax revenues, the state took on more debt to pay some of its backlog of bills, kicking the can even further down the road on the $7.6 billion bill backlog that remains.

Moving in the right direction

June’s jobs growth should offer some hope to Illinoisans weary of anti-growth policies and the state’s seemingly endless fiscal problems.

The brighter job news comes on the heels of some encouraging signs from Springfield as well, such as the bipartisan support for a spending cap constitutional amendment garnered this spring. Although the spending cap never made it to a vote, members of the Illinois House of Representatives and Senate have pledged to reintroduce the legislation next year. The spending cap would have tied the growth in state spending to the long-run average growth in the economy, avoiding the need for economically damaging future tax hikes.

Further giving hope to taxpayers, bipartisan opposition thwarted a harmful progressive tax constitutional amendment in the House.

Illinoisans should demand their lawmakers enact the pro-growth reforms that could help make good jobs numbers the norm moving forward instead of an aberration.