Illinois’ recipe for exodus: 7 different tax structures proposed for 2015

You’re a small business owner planning out your budget for the next five years. You expect explosive growth and a lot of hiring. But your financial future is uncertain, so you factor business risks and uncertainties into your plan. At least you can count on your state government for stability and a clear tax structure...

You’re a small business owner planning out your budget for the next five years. You expect explosive growth and a lot of hiring. But your financial future is uncertain, so you factor business risks and uncertainties into your plan.

At least you can count on your state government for stability and a clear tax structure going forward, right?

Wrong.

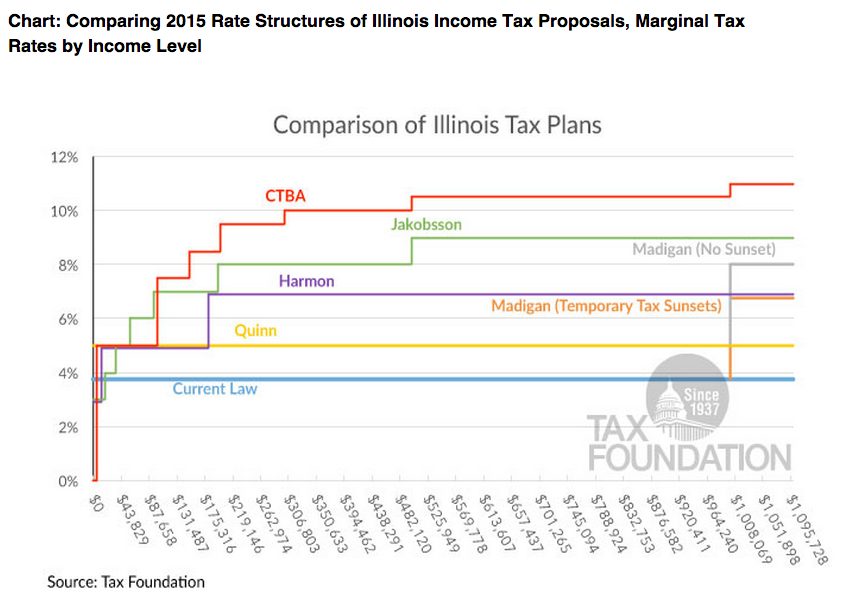

There have been seven different tax structures proposed for Illinois in 2015. They ranged from the legally mandated tax hike sunset that was promised to voters to taxation as high as 11 percent on some incomes.

So what do you do? You find another state with a friendlier climate and grow jobs there.

There’s no telling how many businesses have left or expanded elsewhere over the years. Caterpillar Inc. announced this week that it will expand in Georgia, AM manufacturing is leaving for Indiana and OfficeMax Inc. famously decided on Florida over Illinois.

That’s exactly what millions of people are doing. On net, 1.25 million more people have left Illinois than entered since 1985. Not only that: The average taxpayer who leaves Illinois earns $65,400. The average taxpayer who enters Illinois earns $56,700.

It’s clear what is happening. Illinois is exporting its higher-income earners, who are also job creators and investors.

The Illinois General Assembly deserves a “thank you” from states such as Indiana, Wisconsin, Florida and Texas. Because that’s where Illinois’ talent is going.

After decades of exodus from Illinois, the General Assembly has found yet another way to put its best and brightest on the path to another state.

The choice is clear: Either the current politicians leave state government, or more talented Illinoisans will leave the state altogether.