Illinoisans 51% more likely to be laid off, 21% less likely to be hired than U.S. average

While Illinois claws back jobs from the COVID-19 associated downturn, in-depth analysis shows why the state is struggling more than most other states’ economies.

Illinois added 66,000 jobs from mid-July to mid-August, continuing participation in the national jobs rebound from the COVID-19 downturn. The additional jobs now bring the state’s unemployment rate to 11% – a welcome improvement, but still well above the national unemployment rate of 8.4%.

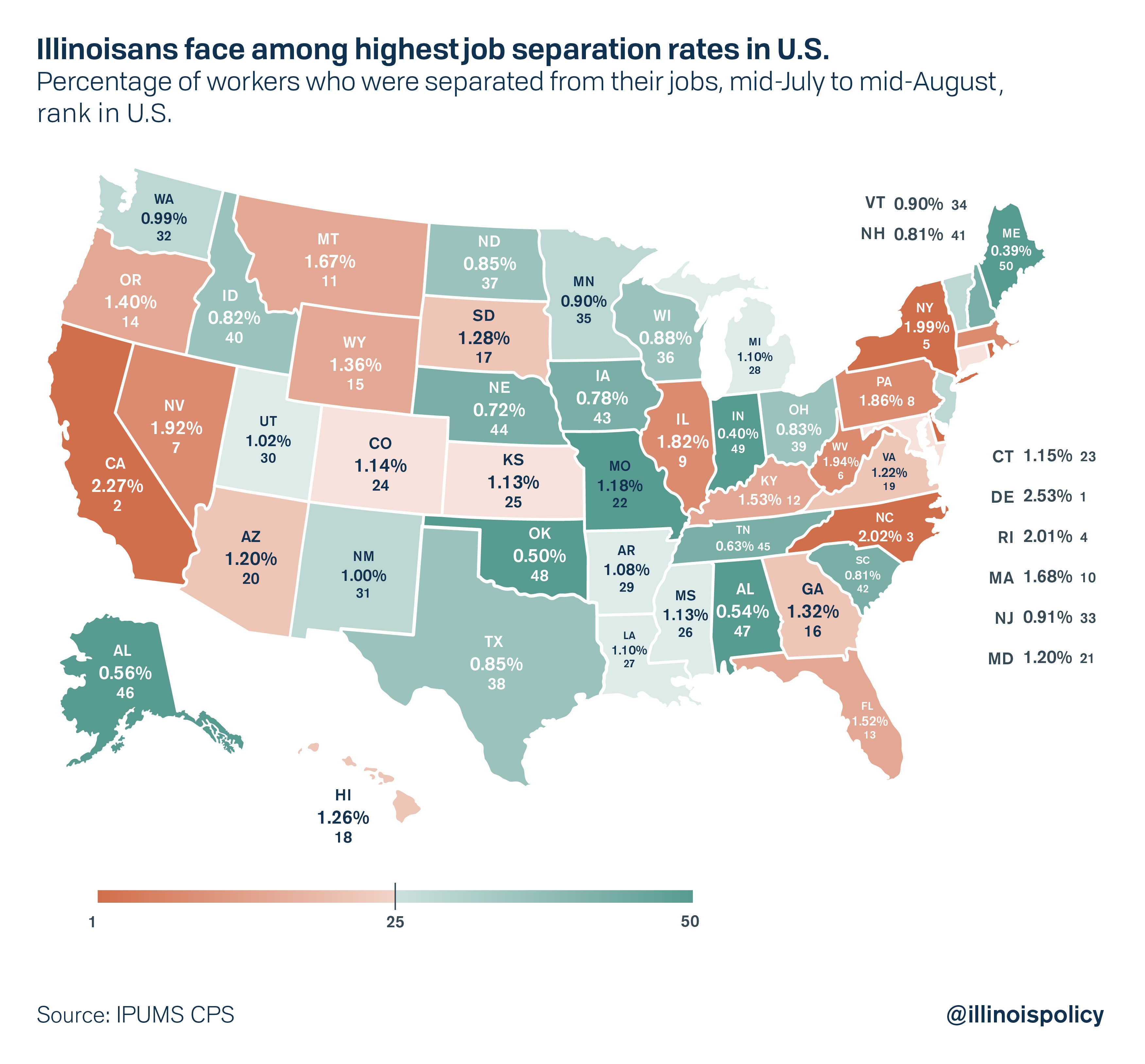

While growing payrolls mark signs of a continued recovery for the state amid the sharpest downturn in recorded history, 695,000 Illinoisans remain unemployed, and the state’s labor market rebound continues to lag the rest of the nation. Analysis reveals job separations in Illinois continue to hover well above the rest of the country. Job separations in Illinois are still 51% higher than the national average, the ninth highest in the nation.

The higher job separation rate means Illinoisans were 51% more likely to become unemployed than the average U.S. worker. A far higher separation rate during the past month is an indication that businesses in Illinois were likely struggling more than those in other states, and were continuing to reduce payrolls in either an attempt to stay afloat or because they were closing their doors permanently.

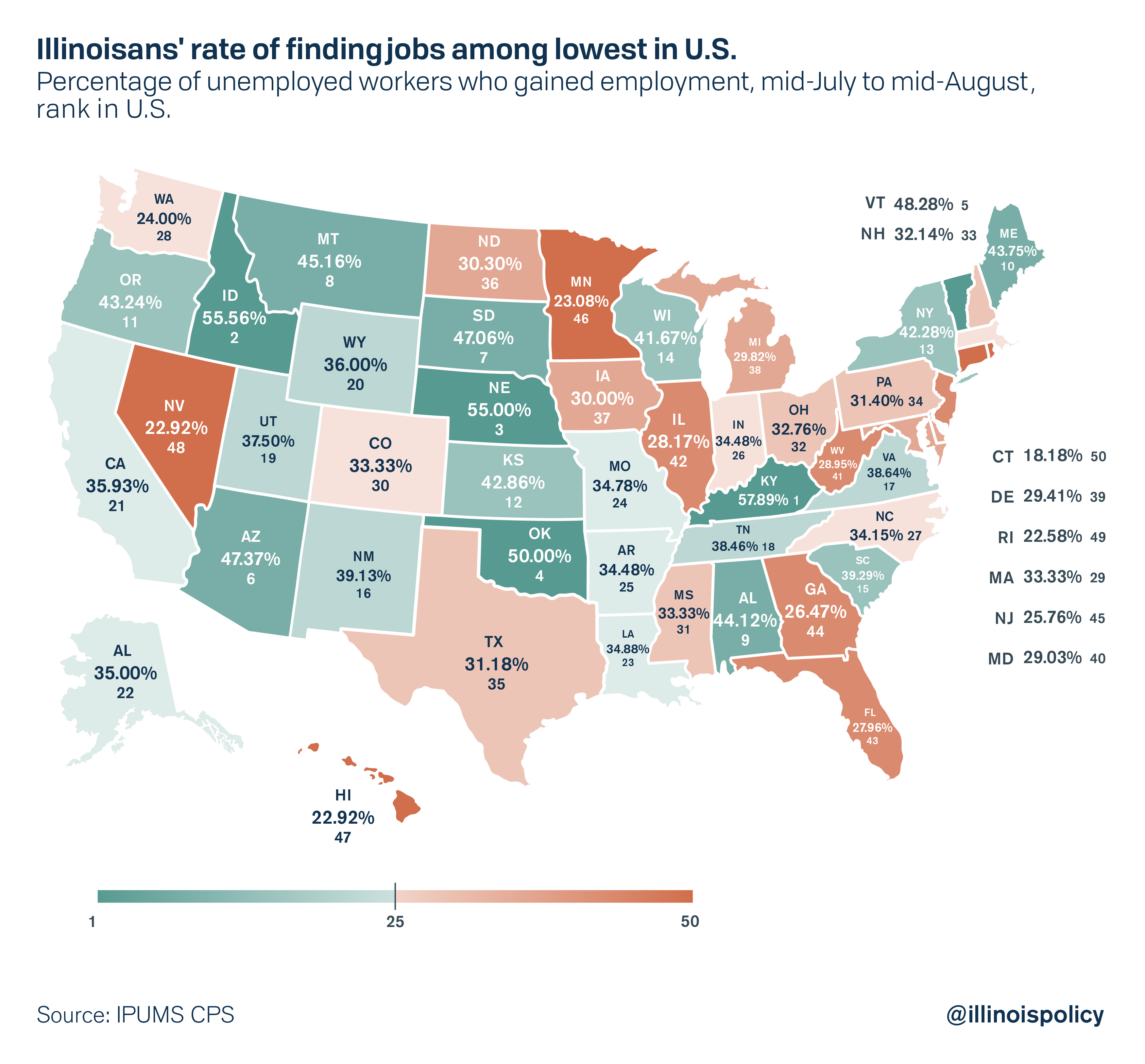

Further evidence of the state’s below-average labor market is found in the rate for the state’s workers finding jobs. Unemployed Illinoisans were 21% less likely to find a job than the average U.S. worker, which makes Illinois the ninth worst in the nation for jobseekers. Combining lower than average job finding rates and higher than average job losses means Illinoisans endure unemployment for longer than residents of other states.

The combination of high separation rates and low job-finding rates bodes ill for the state’s economic recovery. Many businesses are still bleeding jobs, unable to maintain payrolls during times of restricted economic activity. In the worst-case scenario for these businesses, payroll declines are because businesses are shutting permanently. At the same time, low job-finding rates for unemployed Illinoisans are evidence of persistent low demand amid the COVID-19 pandemic and state-mandated restrictions, and greater uncertainty about the future of the state’s business environment.

The August numbers are another step in the right direction, but Illinois is still facing a long road to recovery and must focus on policies that will foster a healthy labor market where businesses can feel confident in their futures and hire Illinoisans who are in desperate need of work.

State leaders are trying to persuade voters to pass a $3.7 billion tax hike that will especially hit the small businesses that create most Illinois jobs. Lawmakers already set rates for the initial tax hike that would be up to five times greater on small businesses than on large ones. More than 100,000 small businesses will face tax hikes of up to 47%, just as they are trying to recover from COVID-19 restrictions, if voters approve the “fair tax” on the Nov. 3 ballot.

Economists argue against increasing taxes during a recession, but Gov. J.B. Pritzker so far has put $56.5 million of his own money into a campaign to convince voters his $3.7 billion income tax hike is truly a “fair tax.” His proposal would give lawmakers more power to raise state income taxes, including on retirement income.

Low job finding rates indicate the number of new job openings remains low when compared to the number of active job seekers. This is because the COVID-19 pandemic and associated restrictions caused aggregate spending to decrease, thus reducing the net gain to a business for resuming hiring activities. Unfortunately, that also means a tax increase would exacerbate the problem, acting as a drag on the recovery.

The impacts of the tax hike would likely fall on job seekers in low-income households and minority households – those who already have been disproportionately hurt by the COVID-19 pandemic.

Illinois must avoid tax hikes now more than ever to ensure Illinois fully participates in the national economic recovery. A massive income tax hike that punishes job seekers will only serve to exacerbate inequality and make the state less competitive.