IMRF should not be used as a model for Chicago

A key tenet of the current Chicago pension reform proposal, which is headed to Gov. Quinn’s desk, is an Illinois Municipal Retirement Fund-style funding mechanism that seeks to guarantee that pension payments are made to Chicago’s funds each year. The mechanism allows the state to divert millions of dollars away from the city and into Chicago pension...

A key tenet of the current Chicago pension reform proposal, which is headed to Gov. Quinn’s desk, is an Illinois Municipal Retirement Fund-style funding mechanism that seeks to guarantee that pension payments are made to Chicago’s funds each year. The mechanism allows the state to divert millions of dollars away from the city and into Chicago pension funds if the city doesn’t make its full pension payment.

IMRF is seen as the “gold standard” when it comes to funding pension systems across the state, in large part because of its funding mechanism. But a deeper look shows IMRF-style reforms should not be used for Chicago. Here are three reasons why:

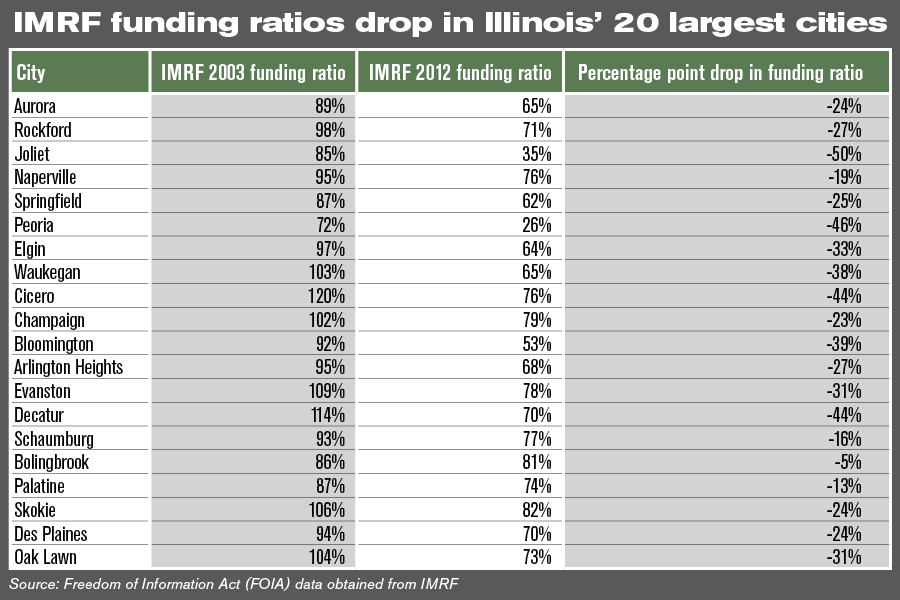

- IMRF funding ratios are not as good as people think. Most of Illinois’ 20-largest cities had funding ratios of more than 90 percent just 10 years ago. Today, half of these cities have funding levels of 70 percent or lower.

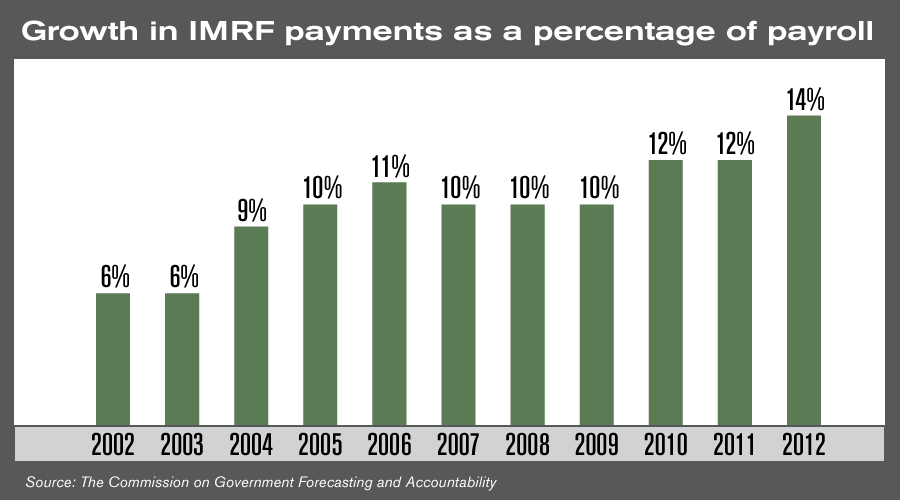

- IMRF pension contributions are eating into local budgets. Funding ratios are one metric used to measure the health of a pension system. An equally important metric is just how large pension contributions (which come from taxpayers) are as a percentage of city payroll. As contributions increase, there is less money left for education, public safety and infrastructure.

IMRF pension payments totaled just 6 percent of payroll in 2002. Skyrocketing pension costs have pushed payments to 14 percent of payroll in just 10 years.

Taxpayers, through increased city contributions, are now putting in 2.7 times what employees put in. In 2002, that number totaled 1.3.

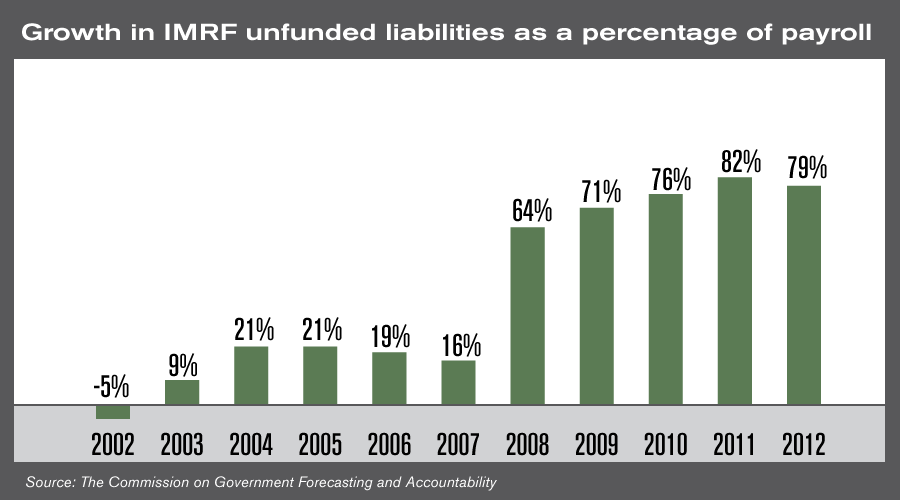

- Despite higher taxpayer contributions, unfunded liabilities continue to grow. Unfunded liabilities continue to grow despite the massive increase in pension contributions. A decade ago, IMRF systems were relatively well funded, but today unfunded liabilities total nearly 80 percent of payroll.

It’s not fair to ask Chicago to implement an IMRF-style funding mechanism. First, this mechanism is failing local governments across the state by eating into city budgets and core government services. And second, the plan calls for a funding guarantee, while keeping collective bargaining agreements behind closed doors.

But there’s an alternative plan on the table that doesn’t require tax hikes or cuts in city services. Read more about the Illinois Policy Institute’s pension plan for the city for Chicago.