Lessons from Illinois: Pension obligation bonds only delay the day of reckoning

Illinois resorted to POBs because pension costs were quickly increasing. But instead of reforming the system, political leaders chose to paper over the problem with debt.

Kansas and Kentucky hold more than $30 billion in unfunded pension debt, collectively. Both states have their eyes set on issuing pension obligation bonds, or POBs, to shore up their underfunded pension systems. But political leaders in both states should look to Illinois for a simple lesson on this maneuver – POBs only delay the day of reckoning.

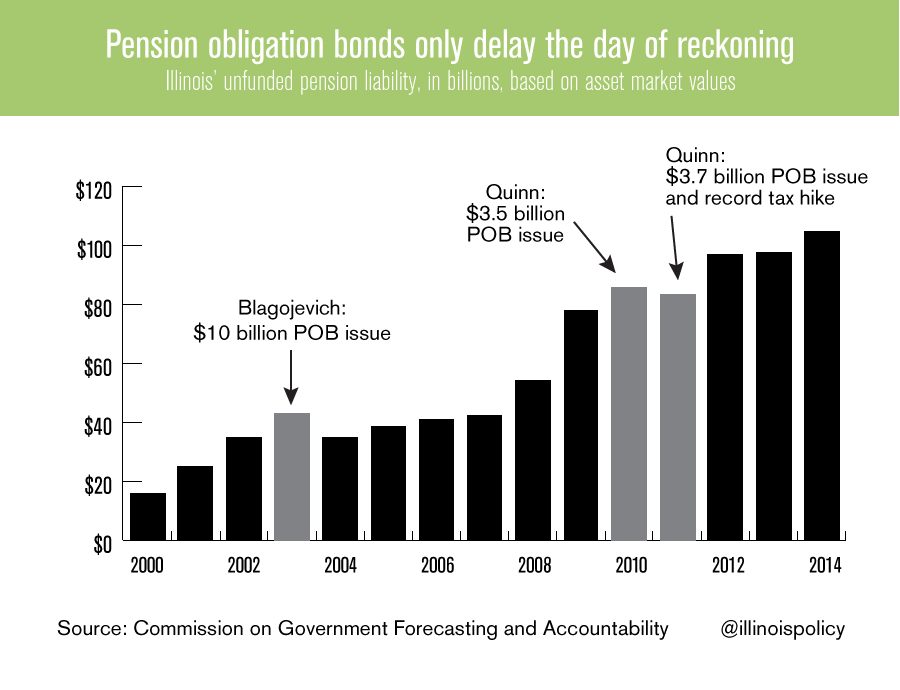

Illinois has issued three massive rounds of pension obligation bonds totaling billions of dollars in the past 12 years.

Former Gov. Rod Blagojevich issued $10 billion in pension obligation bonds in 2003.

Former Gov. Quinn followed suit, issuing POBs two years in a row to cover the state’s annual pension payment. Quinn issued $3.5 billion in POBs in 2010 and another $3.7 billion during the 2011 budget year.

After two years of borrowing billions to hide the ballooning problem, Quinn backed himself into a corner. He couldn’t make the next pension payment or cover the principal and interest of the newly borrowed money. With the state’s credit rating at stake, tapping the bond market again wasn’t an option.

Instead of borrowing again, Quinn increased the state’s income tax by a record 67 percent in 2011. That tax hike drained more than $31 billion from Illinois families, entrepreneurs and businesses during the first four years of its existence.

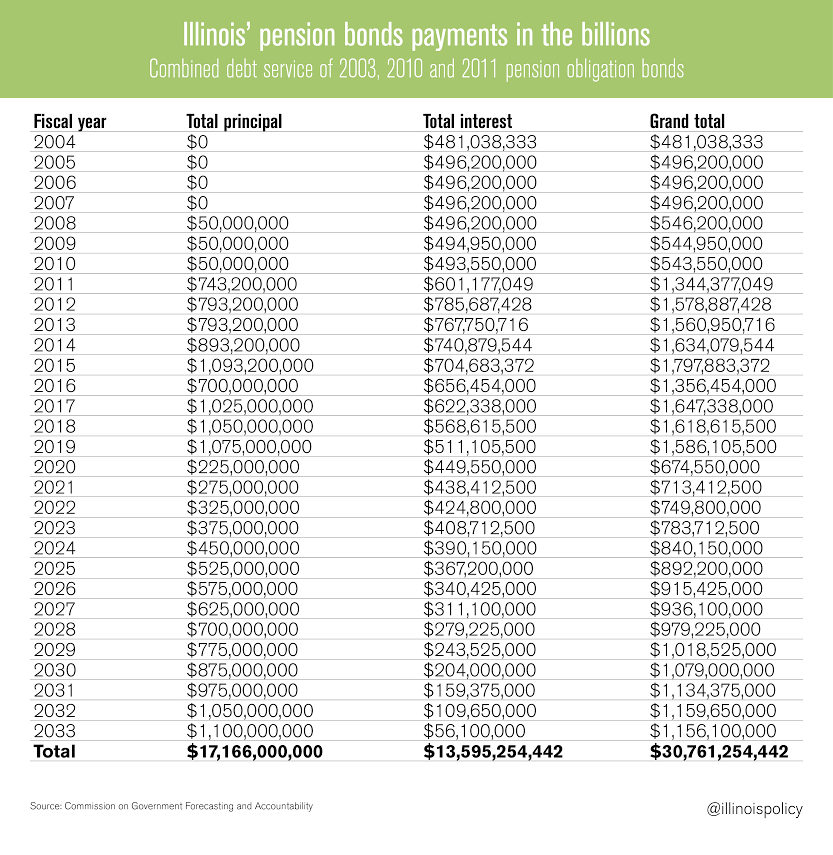

Illinois used the tax-hike revenue to pay approximately $3.6 billion in old bills, make approximately $8 billion in POB payments and put the remaining $21 billion into the state’s pensions systems, according Illinois Senate President John Cullerton.

Even with the massive inflow of extra cash from the tax hike and the POBs, Illinois’ pension systems are still a disaster today.

Illinois’ unfunded pension liability did drop to $35 billion from $43 billion the year after Blagojevich’s round of POBs. But the POBs and the tax hike did nothing to address to root cause of Illinois pension crisis – the politician-run defined-benefit pension plans. And because the lawmakers refused to pass comprehensive pension reform, the unfunded pension liability has more than tripled since then.

Now Illinois is on the hook for an unfunded pension liability that currently exceeds $111 billion and an additional $19 billion in pension obligation payments between 2016 and 2033.

Illinois resorted to POBs because pension costs were quickly increasing. But instead of reforming the system, political leaders chose to paper over the problem with debt.

And that’s the problem with borrowing to pay for pensions – it allows lawmakers avoid today’s crisis by shifting the state’s current pension burden onto future generations. Kansas and Kentucky should avoid making this mistake.