Madigan wrong again: Workers’ compensation is a direct budget issue

Reforming Illinois’ workers’ compensation laws could save state and local governments hundreds of millions of dollars per year.

The estimated cost to Illinois’ state and local governments of compensating workers injured on the job is just under $600 million per year. Gov. Bruce Rauner has placed fixing Illinois’ workers’ compensation system high on his turnaround agenda in order to rein in these costs as well as to free Illinois’ economy from the dampening effects of the current costly regime. For years, manufacturing and construction firms across the state have urged lawmakers to change the state’s workers’ compensation laws, and manufacturers leaving the state of Illinois frequently cite runaway workers’ compensation costs as their main reason for relocating.

Workers’ compensation is a significant line item in state and local government budgets. Attorney General Lisa Madigan has explained how Illinois’ low causation standard makes it difficult for her to defend the state against workers’ compensation claims, which add hundreds of millions of dollars per year to government costs.

House Speaker Mike Madigan, however, has insisted that the General Assembly and the governor address the state budget deficit solely through spending cuts and tax hikes, dismissing Rauner’s structural reform proposals, including changes to the workers’ compensation system, as nonbudgetary issues.

But workers’ compensation directly affects the state’s budget.

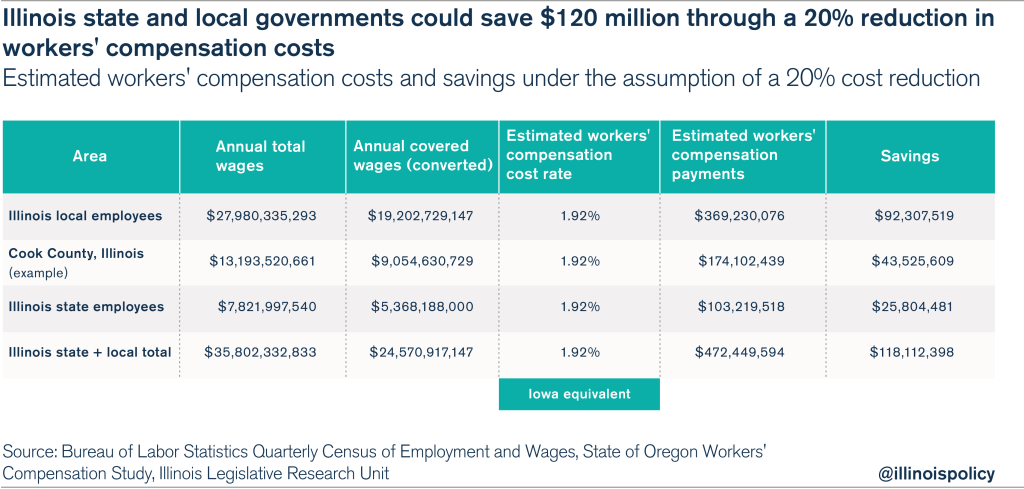

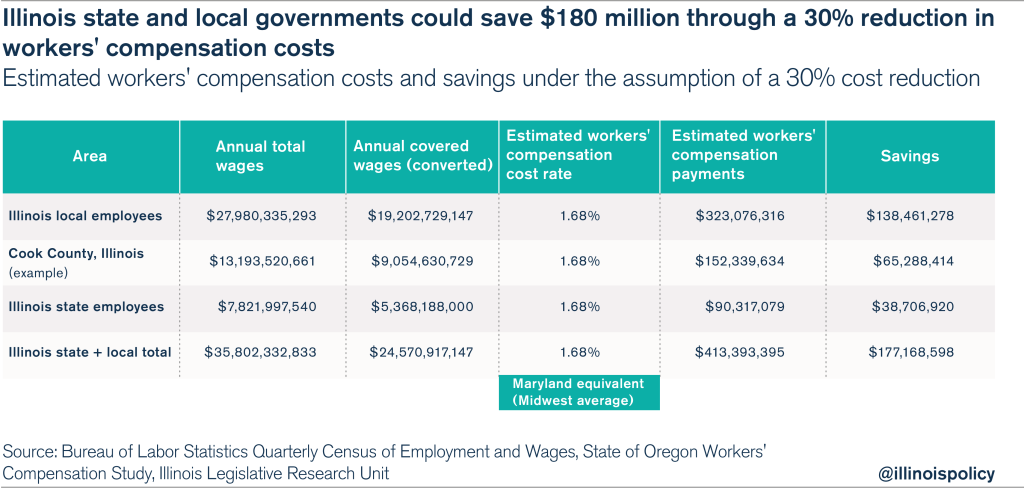

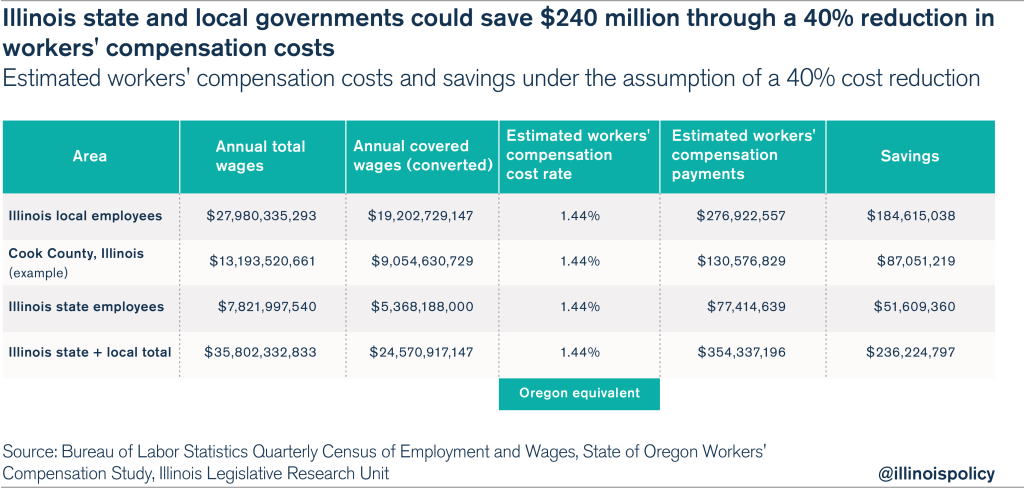

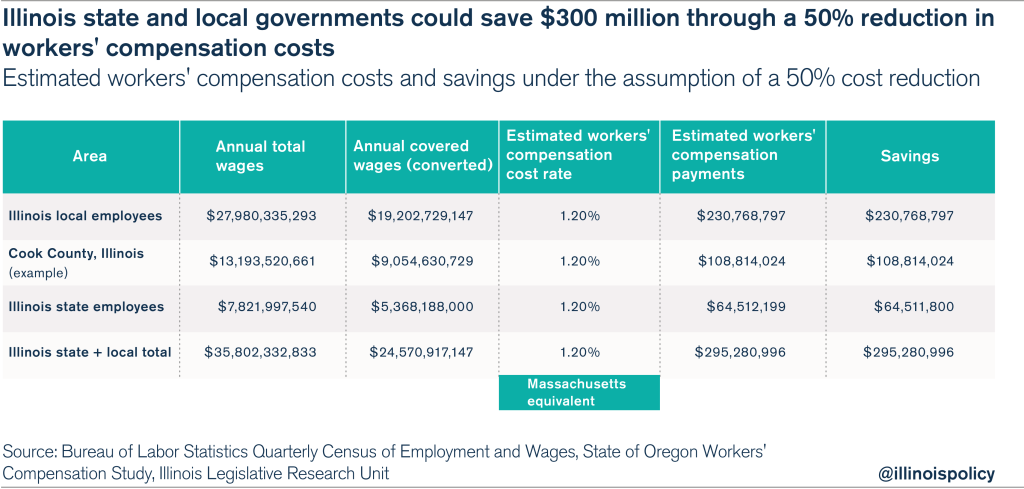

Depending on the particular changes implemented, workers’ compensation reform could provide Illinois state and local governments savings of between $120 to $300 million per year in payroll costs alone. This does not include the savings the state could achieve on construction projects, which involve occupations for which workers’ compensation is most expensive, but which do not entail direct government payroll costs. Nor do the savings cited count the increased tax revenue that could result from the economic stimulus of reforming workers’ compensation.

According to data from Illinois’ Legislative Research Unit, the state of Illinois pays approximately $130 million per year in workers’ compensation benefits on a payroll of $5.4 billion in covered wages, or wages that are subject to workers’ compensation benefit requirements. Thus, the workers’ compensation costs for Illinois state employees equal 2.4 percent of covered payroll. Similarly, other Illinois employers pay 2.35 percent of covered payroll in workers’ compensation costs.

Workers’ compensation costs for state employees can be used to extrapolate costs for local governments. The state has $5.4 billion in covered wages out of a total state payroll of $7.8 billion. Illinois’ local governments have a combined payroll of $28 billion. Applying the state government’s ratio of covered wages to total wages, local governments would have an estimated $19.2 billion in covered wages. At the state’s workers’ compensation cost rate of 2.4 percent of covered payroll, local governments would spend an estimated $460 million per year on workers’ compensation costs. Adding this number to the state’s $130 million in annual workers’ compensation costs results in total estimated state and local government workers’ compensation costs of $590 million per year.

Workers’ compensation reform would result in a lower effective cost rate as a percentage of payroll for state and local governments. Comparing Illinois’ cost rate with rates in other states demonstrates the potential savings.

For example, a 20 percent reduction in cost rates would put Illinois in line with Iowa, resulting in a total savings of $118 million for Illinois state and local governments.

A 30 percent reduction in costs would place Illinois on par with Maryland, which also reflects the Midwest average. Illinois state and local governments would save $177 million per year under this scenario.

If Illinois reduced its workers’ compensation costs by 40 percent to line up with Oregon, its state and local governments would save $236 million.

Finally, a 50 percent reduction in workers’ compensation costs would align Illinois with Massachusetts, resulting in $295 million in savings for Illinois state and local governments.

If Illinois simply had a cost rate in line with the regional average, which equals about 1.68 percent of payroll, state and local governments in Illinois would save $177 million. Furthermore, if the state government wanted to collect all of the savings from reforming workers’ compensation, it could also reduce disbursements from the Local Government Distributive Fund proportionate to the expected workers’ compensation savings for local governments.

This analysis estimates the direct cost of workers’ compensation based on state payrolls. As noted above, two important factors are not included in this analysis:

- The increased tax revenue that would be achieved from greater private-sector income and investment

- The reduced cost of public construction work as contractors incorporate lower workers’ compensation costs in their bids

The possible budgetary savings from workers’ compensation reform amounts to hundreds of millions of dollars per year. Therefore, it is imperative that the General Assembly institute workers’ compensation reform to shrink the state’s budget deficit.