Meet the company pushing sales-tax hikes across Illinois

Fourteen Illinois counties face higher sales taxes if referendums pass at the ballot box this fall. The tax is called the Illinois County School Facility Occupation Tax, or County School Facility Tax (CSFT) for short. The law authorizing the tax, which passed in 2007, allows school boards representing 51 percent of a county’s student population...

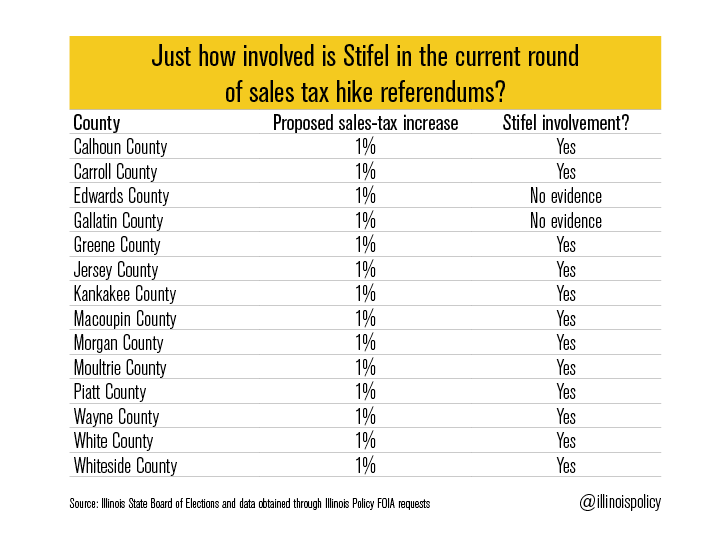

Fourteen Illinois counties face higher sales taxes if referendums pass at the ballot box this fall.

The tax is called the Illinois County School Facility Occupation Tax, or County School Facility Tax (CSFT) for short. The law authorizing the tax, which passed in 2007, allows school boards representing 51 percent of a county’s student population to place a sales tax hike referendum of up to 1 percent on the ballot.

Since 2007, the CSFT referendums have appeared on the ballot 59 times and they’ve passed 24 times, a 41 percent pass rate.

Voters in these counties should be aware of how self-interested corporations are often involved in a sophisticated effort to raise taxes on local residents. One of those corporations is Stifel, Nicolaus & Co.

Stifel, pronounced “Stee-full,” is a multibillion-dollar international investment-banking conglomerate headquartered in Missouri that pushes the CSFT tax. Stifel makes money by handling the bond sales of local governments wanting to borrow large sums of money.

Freedom of Information Act requests submitted by Illinois Policy turned up Stifel involvement with local school boards in at least 12 of the 14 counties with CSFT tax hike referendums this election cycle, and dozens more over the last seven years.

During the primary elections earlier this year, the CSFT referendum was on the ballot in 19 counties, and it passed nine times. Stifel was involved in at least four of the counties where the measure passed.

To the public it may appear that local school districts bring in companies like Stifel to be independent experts to give neutral, fact-based presentations to the board and the public about the facts of CSFT sales tax initiative. But that’s not an honest representation of what Stifel does.

Behind the scenes, Stifel initiates sales tax hike campaigns by having its representatives travel the state meeting with county and school board members, administrators, regional superintendents and other corporate and community groups, all in efforts to convince local officials to launch pro-tax hike campaigns.

Once tax increases are passed in various counties in Illinois, Stifel is often first in line to gain the lucrative contracts to structure and sell school facility bonds to Wall Street, as they did in Champaign County. For companies like Stifel, there are millions of dollars in profits at stake.

Stifel assists school districts in passing tax hikes, and in return they make a not-so-subtle pitch for their services in return. As we found in a Stifel presentation to Sullivan Community Unit School District 300 in Moultrie County on April 14, 2014: “We hope that your District will allow Stifel Nicolaus the opportunity to prove our ability to better serve your District the next time you are considering a bond financing.”

Moultrie County is one of the 14 counties with referendums on the ballot this fall.

Stifel’s campaign plan to hike Champaign County’s sales taxes goes statewide

At an Illinois Association of School Business Officials meeting in 2011, before school administrators from across the state, Stifel distributed materials touting how they helped execute a massive campaign to convince Champaign County school boards and voters to initiate and pass a tax hike in 2009 benefiting Stifel’s bottom line. The net result of the campaign was more than $60 million in new taxes on Champaign County shoppers since the tax was enacted.

The document, along with others obtained by Illinois Policy, reveals Stifel was involved in the tax-hike campaign from start to finish. Our findings included the following:

- Representatives from Stifel, along with former state Rep. Roger Eddy, were the key, initial organizers for the sales tax hike effort.

- Stifel worked with the regional superintendent as a “point person to organized (sic) districts and get information out,” and “to inform and get support from local realtors, rotaries, Farm Bureau, newspaper editorial board, legislators, university leadership.”

- Stifel representatives extensively traveled throughout Champaign County and made presentations to all 14 school boards and superintendents to pass a countywide referendum.

- Stifel, school districts and the county board falsely promoted claims that the sales-tax hike would result in significantly lower property taxes in 13 Champaign County school districts. Only one school district lowered property tax levies over the next five years. The other 12 districts raised property tax levies by an average of 22 percent.

- Stifel helped school districts and superintendents establish, guide and finance a citizen’s steering committee called “Citizens Looking At Supporting Schools,” or CLASS, a formal political action committee with a mission to pass the sales-tax hike in Champaign County.

- Stifel made an in-kind contribution to CLASS to provide polling data on Champaign County voters and distributed the results to an organized meeting of superintendents and school and county board members.

- Stifel was chosen as the vendor in Champaign Community Unit School District #4 to structure and sell alternate revenue bonds for the district.

In a Stifel case study on Champaign County the company said: “In 2009, Stifel assisted Champaign CUSD #4 (the District), along with thirteen other districts in Champaign County, to pass a new 1% County School Facilities Sales Tax (CSFT) implemented on a per pupil basis to be used for school facilities needs by all districts in the County.”

Stifel’s detailed admission of how they and various public officials coordinated campaign activities to pass tax hikes on voters is alarming.

Illinois’ State Officials and Employees Ethics Act prohibits public officials from campaigning for or against any referendum question during public time, and also prohibits the use of public resources in such campaigns. The law is extended to local officials, including school districts, which must enact their own ethics policies that are “no less restrictive” than the state.

Traditionally, Illinois schools have been funded by a combination of property taxes and state tax dollars. By law, the CSFT tax-hike revenues can never be used on instruction. They can only be spent on school facilities for construction purposes.

According to the Illinois State Board of Elections and other public records, the tax-hike referendums have attracted the support of many companies including architectural firms, construction companies, accountants, lawyers and financial companies. Some of the other major companies involved include Unicom-ARC, Chapman and Cutler, BLDD Architects, Kings Financial and more. But Stifel is the main company promoting the tax hikes.

While many companies seek business from local governments in an ethical manner, Stifel crosses an ethical line when they get intimately involved in campaign efforts to raise taxes to the benefit of their bottom line. When considering tax-hike referendums, voters should deeply question the sincerity of any school board who uses Stifel’s services in any capacity.

The bottom line is this: School districts shouldn’t use Stifel, or any other company who may profit from proceedings, as a neutral advisor when making presentations to the public about the facts of a tax-hike referenda.

They likely do not have our kids’ best interest at heart.