Nation’s worst credit rating costs Illinois millions more in interest payments

Illinois has the lowest credit rating in the nation. And just like people with poor credit scores, the state must pay higher interest rates. Higher rates mean higher interest payments that drain the budget and leave less money for education, health care and public safety. For every $1 billion of new borrowing, Illinois taxpayers are...

Illinois has the lowest credit rating in the nation.

And just like people with poor credit scores, the state must pay higher interest rates.

Higher rates mean higher interest payments that drain the budget and leave less money for education, health care and public safety. For every $1 billion of new borrowing, Illinois taxpayers are on the hook for $16.4 million in additional interest payments compared with AAA-rated states.

Illinois hasn’t been a AAA-rated state since February 1979.

“The extra yield investors demand to own 10-year Illinois bonds rather than AAA munis has surged 0.55 percentage point since May to 1.64 percentage points, data compiled by Bloomberg show. The gap grew after lawmakers on May 31 passed a budget with a $2 billion hole…. Though Illinois is rated six steps below AAA, it trades at near-junk yield levels.”

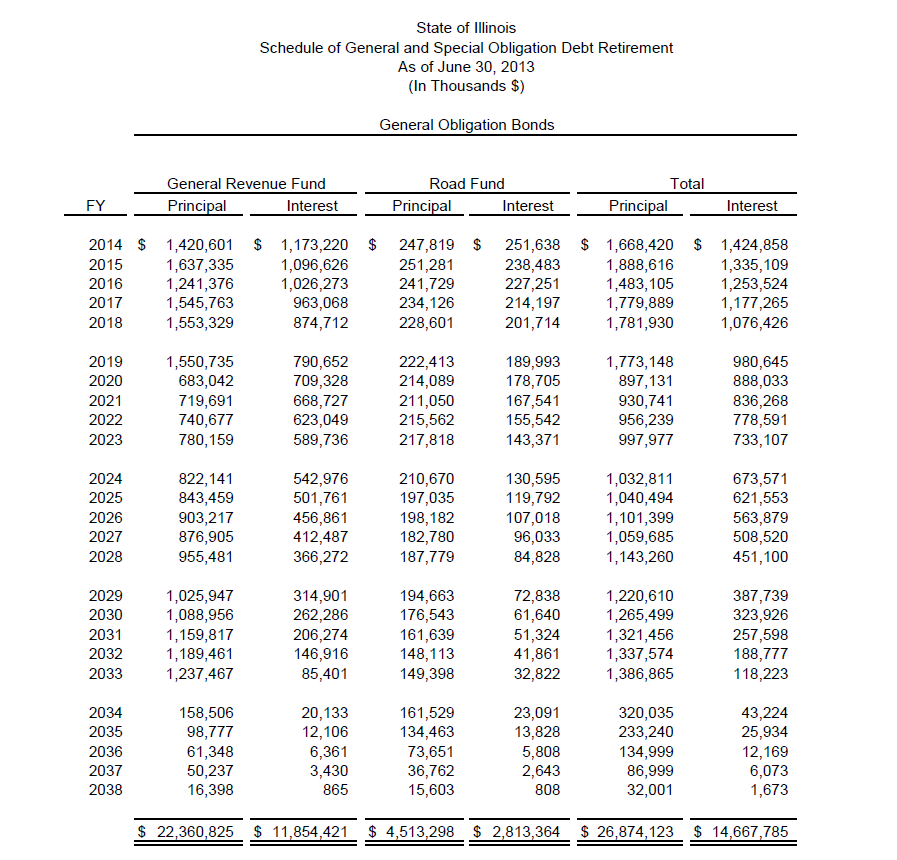

Interest costs on Illinois’ current general obligation debt already cost Illinois taxpayers more than $1 billion a year, according to the Illinois comptroller.

And the cost to Illinois isn’t just higher interest payments – it’s lost jobs, lost economic growth and forgone opportunity because the state’s failed governance has chased families, entrepreneurs and businesses out of the state for decades.

The writing on the wall is clear. Illinois needs a complete overhaul.

For the state to become a leader in economic growth and job creation, lawmakers must modernize the way they budget and spend. That means Illinois’ political leadership needs to discern what government can and should be doing, and return to the basics of good public policy – a balanced budget and limited spending. Only then will Illinois put an end to a cycle of credit downgrades and set the foundation for a positive outlook.