Nearly all Illinois public universities report higher costs, less money to operate

Every Illinois public university received about one-third less operational funding from the state in fiscal year 2024 than 15 years ago. University of Illinois spending per student dropped by nearly half.

Eleven of Illinois’ 12 public universities have been forced to raise the price of tuition and fees during the past 15 years as state funding for university operations declined by $530 million in real terms.

That’s according to an Illinois Policy Institute analysis that found the state’s public universities will collect 17.2% less to fund operations from state general funds this year than in FY 2009, adjusted for inflation. University pension payments increased more than seven-fold during the period, likely aggravating that drop.

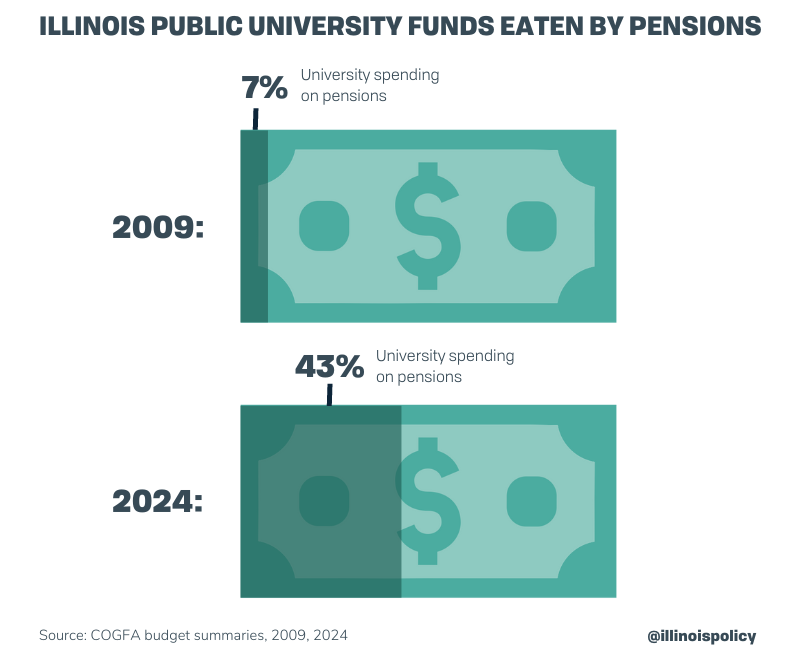

A 2009 budget summary shows just over 7 cents of each higher education dollar from state general funds went to pay for faculty pensions rather than supporting instructors and students in classrooms.

Starting in fiscal year 2024, those pension payments to the State Universities Retirement System consumed 43 cents of every higher education dollar from state general funds.

Growing pension contributions to SURS have forced Illinois’ higher education institutions to divert more dollars away from improving services and accessibility, driving up total costs and driving down operational spending.

A closer look at the change in tuition and fees, enrollment and operation funding at Illinois’ 12 public universities during the past 15 years shows which ones have been most harmed by crowd out from the $27.7 billion Illinois owes to SURS.

The increase in tuition and fees at virtually every state institution comes as each university saw massive drops in operational funding from the state, ranging from 32 to 34%.

With the exception of the University of Illinois, the universities also experienced massive declines in enrollment. So much so, that per-pupil operational spending actually increased at some universities – not because total spending increased, but because enrollment declines were even more extreme than cuts in state funding.

An Illinois Board of Higher Education report found as SURS payments increased, universities were forced to become more reliant on raising tuition and fees on students to maintain operational budgets.

A corroborating Center for Tax and Budget Accountability report determined more than two-thirds of the revenue collected by state universities in FY 2021 came from tuition and fees compared to just 28% less than two decades earlier.

That has made Illinois less-competitive for its own students. Illinois’ state universities average the fourth-highest in-state cost for tuition and fees in the nation.

Amid the skyrocketing tuition costs, Illinois is also losing college-bound high school graduates at the second-highest rate in the nation. According to the most recent data from the National Center for Education Statistics, Illinois has the second-largest net loss of degree-seeking undergraduate students in the U.S.

Illinois’ SURS pension debt has grown by one-third since FY 2009, when adjusted for inflation. Without long-term structural reforms, university pension debt will continue to grow and students will continue to see tuition rise.

Polling shows a majority of Illinois voters want pension reform today to lower the state’s nation-leading tax burden and stop the crowd-out of core government functions, such as higher education.

A “hold harmless” pension reform plan similar to one originally developed by the Illinois Policy Institute and based loosely on bipartisan 2013 reforms could help to eliminate the state’s unfunded pension liability. It could also secure state retirees’ futures.

Previous analysis showed changes such as setting a limit to how high a salary can go before pensions are limited, replacing compounding 3% annual raises with true cost-of-living increases and adjustments to realign benefits with historical inflation rates would have saved more than $50 billion by 2045. It would also get the state’s pensions up to 100% funding to fully secure retirements.