Household incomes have plunged by 8.2% across the nation since President Obama took office. In the President’s old stomping grounds, median household income dropped by 2.6% just between 2010 and 2011. And now Gov. Quinn is working to take even more from families in Illinois through higher taxes.

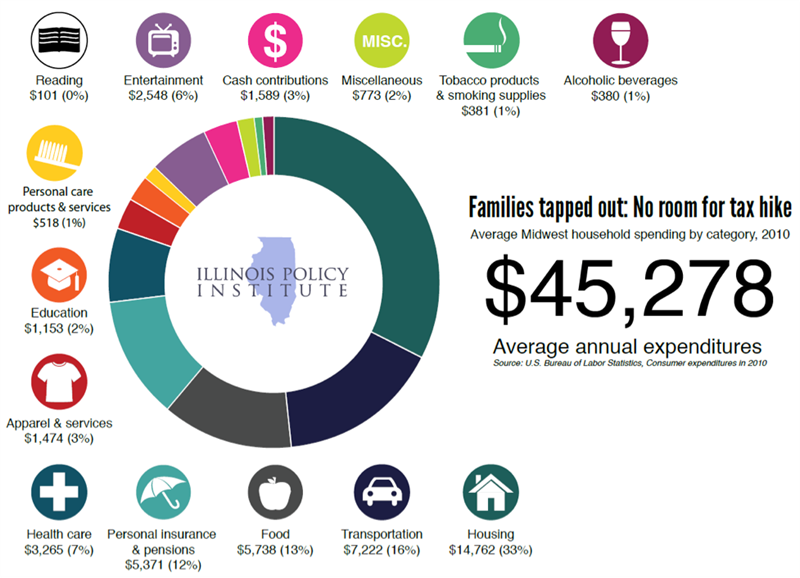

But there’s no room left in the family budget for another tax hike. Much of the average family’s budget in Illinois is already tied up in items that families need to stay afloat – such as mortgage payments, rent, car payments, groceries and health care.

The little money left over at the end of the month is spent on things like family movie nights, trips to grandma’s house and kids’ softball fees.

The family budget shrinks even more when lawmakers increase taxes. Illinois families already saw their tax bill increase by $1,500 last year. But that wasn’t enough to satisfy Quinn’s hunger for higher taxes.

The Governor is already cooking up another multi-billion dollar tax hike for Illinois.

Passing a progressive income tax is “one of my goals before I stop breathing,” Quinn said.

Advocates for progressive tax argue that it would only increase taxes on the super wealthy. This is far from the truth. In 31 of the 34 progressive income tax states, a family of four with a taxable income of $50,000 is taxed at a higher rate than Illinois will tax families after the rate sunsets to 3.75 percent from 5 percent in 2015.

Make no mistake; a progressive income tax would increase the tax bill for Illinois’ middle class. It would destroy jobs and prevent the entrepreneurial activity that Illinois desperately needs.

Instead of improving Illinois’ fiscal footing, Gov. Quinn continues to flaunt his disconnect with economic reality.

Illinois doesn’t need higher taxes. It needs a government that will put taxpayers first by balancing its budget, cutting spending and cutting taxes.