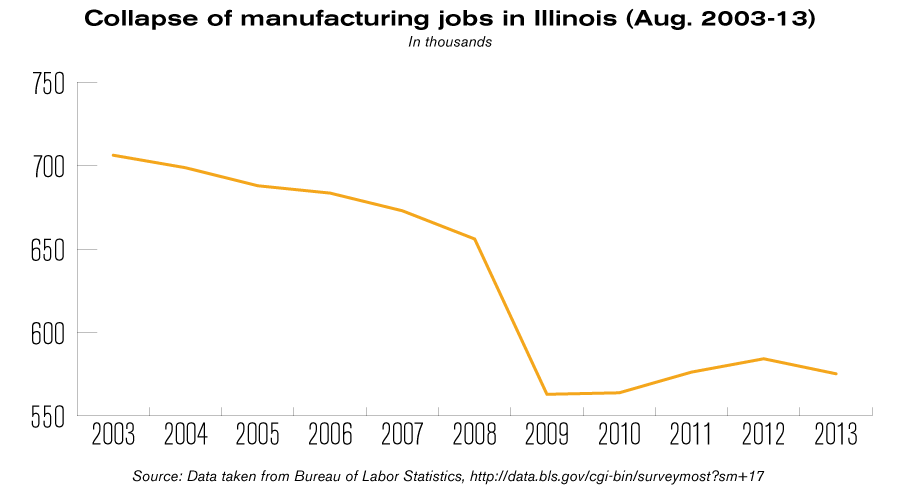

It’s hard not to notice the disappearance of Illinois’ manufacturing sector. Anyone driving through the outskirts of Peoria can witness the closed buildings and half-abandoned neighborhoods. Cities all across Illinois have seen a similar story unfold. Illinois’ manufacturing base has been in decline, losing over 130,000 manufacturing jobs in the past decade.

Even during the past 12 months, in the midst of national economic growth, Illinois lost 9,000 manufacturing jobs. The longstanding trend of decline was exacerbated by the Great Recession, from which Illinois has yet to recover. Illinois still has about 100,000 fewer manufacturing jobs than pre-recession levels.

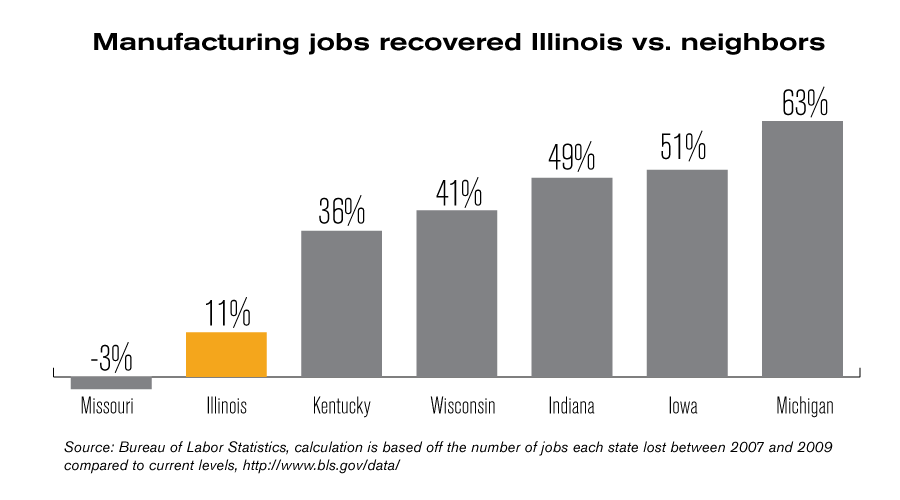

The state’s recovery in manufacturing jobs is borderline anemic compared to many of its neighboring states. Illinois only recovered 11 percent, or 12,300, manufacturing jobs since the recession lows from 2009. Neighboring states such as Indiana and Iowa recovered nearly half of the manufacturing jobs they lost. And nearby Michigan has recovered 63 percent of its lost manufacturing jobs. Illinois is simply losing the battle to create manufacturing jobs.

Illinois manufacturers, such as Caterpillar Inc., have been moving facilities out of the state and opening new facilities elsewhere for years, citing the Illinois’ business policies and fiscal problems as the cause. Recently, Kenall Manufacturing, a lighting company located in northern Illinois, decided to shut its doors and move to Wisconsin, which cost Illinois 400 jobs.

In a final effort to convince companies to stay, Illinois politicians often end up bribing companies with taxpayer money. Gov. Pat Quinn recently handed out tax incentives to Method, a company that manufactures biodegradable cleaning products, while stating: “Illinois is leading the way to a sustainable future by attracting companies and jobs that make our state a healthy place to live, play, work and grow.” Individually selecting private businesses and offering them the public’s tax dollars is not a path to a prosperous manufacturing sector.

Illinois needs a real plan for growth that includes:

Lower taxes. Illinois has the fourth-highest corporate tax rate in the industrialized world. Even worse, Illinois’ lawmakers are now considering a plan to increase taxes even higher with a progressive tax. Meanwhile, states such as North Carolina are becoming more competitive by getting rid of a progressive tax structure and scheduling even lower taxes moving forward. Illinois needs to lessen the state’s personal and corporate tax burden or manufacturing companies will continue to leave. Illinois’ factory leaders pointed to this at the Crain’s Manufacturing Summit, where they contended that it’s important for the state to lower tax burdens and get its fiscal house, in order to reduce the uncertainty of future tax-rate increases. They argued that this is the approach to grow and retaining manufacturers.

Enact Right to Work. In the year, the only states neighboring Illinois to create manufacturing jobs were either Right-to-Work states or states that recently enacted major labor reform. Iowa, Indiana and Wisconsin together created 9,200 manufacturing jobs, while Illinois lost 9,000. Michigan alone, which enacted Right-to-Work legislation in 2012, gained 17,900 manufacturing jobs during this time period.

The state’s business climate is the top concern for manufacturers in Illinois, and labor policy plays a big part. States with right-to-work legislation have more favorable business climates. In fact, nine of the top 10 states with the most favorable business climates had Right-to-Work policies.

States that enact Right-to-Work legislation are seeing their business favorability move in a positive direction. Since enacting Right-to-Work legislation, Michigan moved up four spots on CNBC’s America’s Top States for Business rating. A freer workforce means a more desirable destination for businesses.

Reduce workers’ compensation costs. Illinois enacted minimal workers’ compensation reforms in 2011, changing arbitration processes and some medical costs, in response to exceptionally high workers’ compensation costs. Despite those reforms, the state still has the fourth-highest workers’ compensation rates in the nation. High worker compensation costs are a large deterrent to businesses. Illinois should look to states such as Oklahoma, which recently passed reforms that allow employers to opt out and instead utilize health benefits that contain provisions for workplace injuries. Other states, such as Texas, have already implemented similar reforms and have seen large cost savings for businesses. Some employers in Texas, such as Hobby Lobby, saw a 50 percent savings due to opt-out reforms that maximize employers’ flexibility in designing and administering benefits.

Reduce regulatory burden. Illinois is one of the least-free states in the nation when it comes to regulatory burdens. In fact, Illinois ranks 42nd according to Mercatus Center’s Freedom in the 50 States index. These overbearing regulations restrict all kinds of businesses, from food truck businesses to major energy producers. The regulatory conditions in Illinois are included in calculating Forbes’ ranking of Best States for Business. According to Forbes, Illinois ranks as the 38th best state for business.

Reduce unemployment insurance costs. According to the Tax Foundation, Illinois ranks 43rd in unemployment insurance costs for businesses. The current system is costly and unfair to employers, workers and the taxpaying public. Unemployment insurance policies collect funds from employers and employees, yet the costs are reflected in lower pay for employees. The long-term result of Illinois’ current unemployment insurance policy is higher unemployment and a lower skilled workforce.

Illinois should reform its unemployment insurance policy to a system of unemployment savings accounts. In this system, employees and employers would pay the share they were previously paying into the public system into an individual account. The employee can access this account when unemployed or roll it over into a retirement account if they never lose their job. This system would reduce the abuses of the current system, as employee would not be incentivized into pulling as much as possible out of the system.

Illinois politicians constantly tout their goals to grow the manufacturing sector, yet few offer a real way to accomplish this. It is clear that Illinois needs a change in direction. The state is losing manufacturing jobs while other states are gaining these jobs with pro-business policies. Bold reforms need to be made for Illinois’ manufacturing sector to thrive.