Post-recession pain points in Illinois: a breakdown

From the beginning of the Great Recession in January 2008 through August 2014, Illinois is still down 157,100 payroll jobs, more than any other state in the U.S. Some sectors of Illinois’ economy have recovered completely, while others remain dramatically below pre-recession levels. Manufacturing and construction have had it the worst through the recession era,...

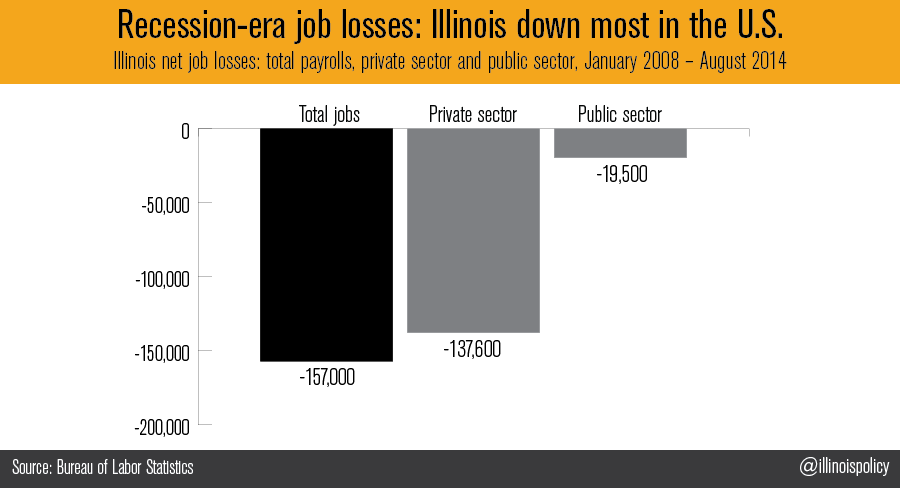

From the beginning of the Great Recession in January 2008 through August 2014, Illinois is still down 157,100 payroll jobs, more than any other state in the U.S.

Some sectors of Illinois’ economy have recovered completely, while others remain dramatically below pre-recession levels. Manufacturing and construction have had it the worst through the recession era, while education, health care and social services have bounced back best. In general, the goods sector has suffered terribly, while the service sector has recovered.

Private- vs. public-sector job losses

Both the private sector and public sector in Illinois are still down from pre-recession job levels. In percentage terms, overall payroll jobs are still down 2.6 percent, with the private sector down 2.7 percent while the public sector is down 2.3 percent.

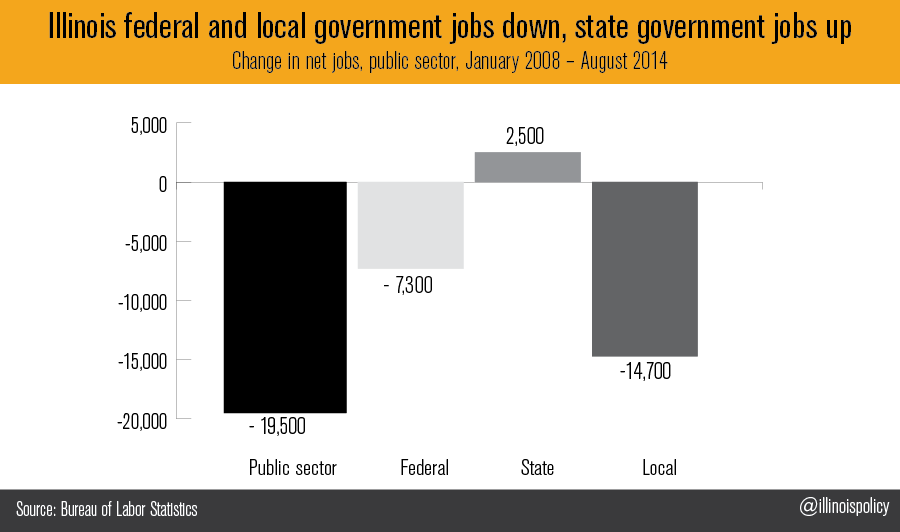

Within the public sector, Illinois is down 7,300 federal jobs (-8.3 percent), up 2,500 state jobs (1.7 percent) and down 14,700 local jobs (-2.4 percent).

Goods-sector jobs vs. service-sector jobs

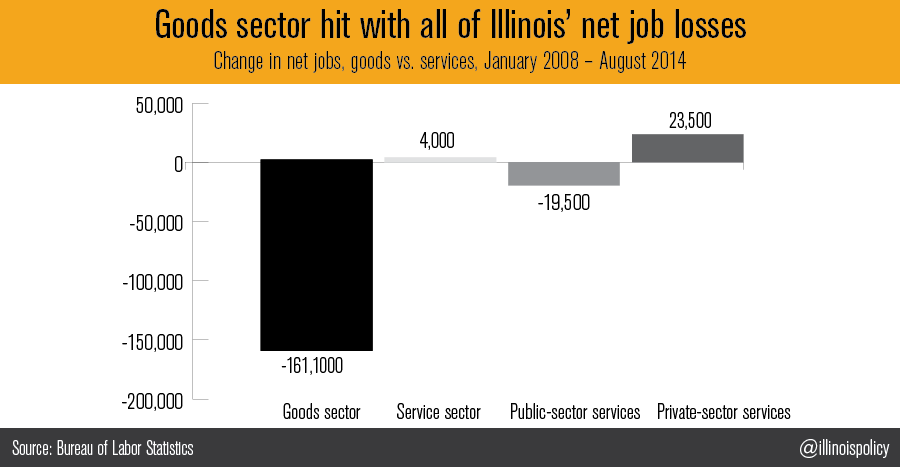

The goods sector, made up primarily of manufacturing and construction, has sustained 103 percent of Illinois’ net job losses since the Great Recession began. The goods sector is down further since the recession began (-161,100 jobs, -17 percent) than is the state of Illinois as a whole (-157,100 jobs, -2.6 percent).

Public-sector services are down 2.3 percent, while private-sector services are up 0.6 percent.

Goods-sector jobs

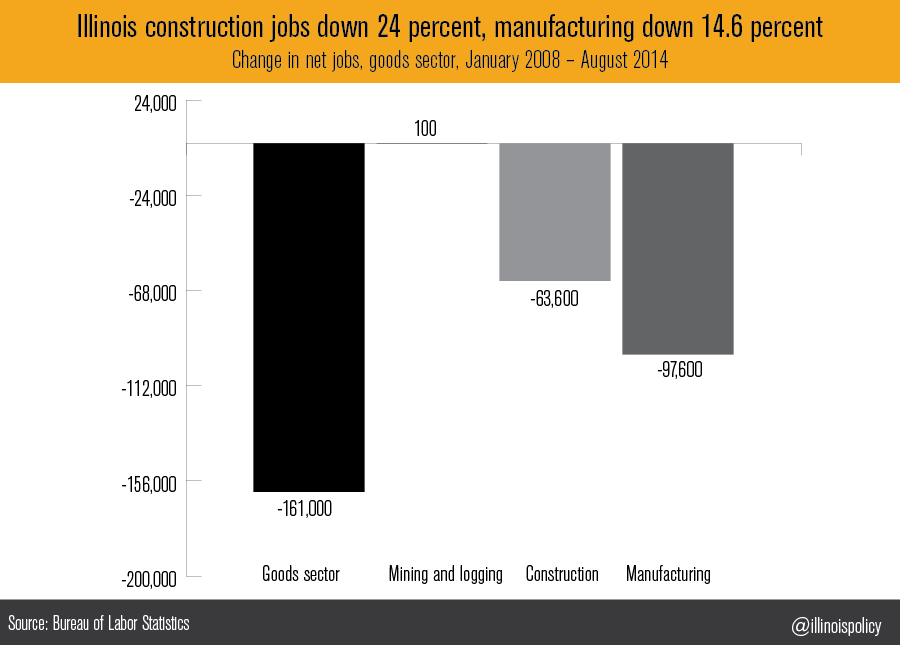

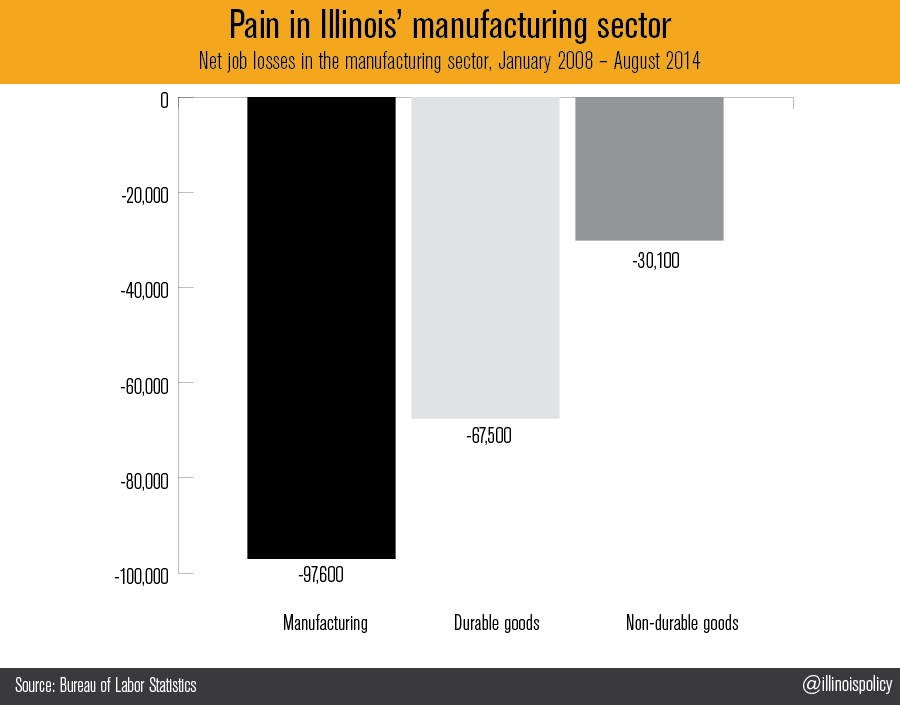

The goods sector is made up primarily of construction and manufacturing. Construction and manufacturing jobs are down 24 percent and 14.6 percent, respectively, through the course of the recession era.

This places Illinois at the bottom of the Midwest for goods-producing industries when compared to pre-recession levels. Compared to pre-recession levels, Illinois is at -23.9 percent on construction jobs, second only to -25.9 percent for Missouri. For manufacturing, Illinois is at -14.6 percent, second only to Missouri and Kansas, which are both at -15.0 percent.

Within manufacturing, jobs for the production of durable goods are down 16.4 percent, while jobs for the production of non-durable goods are down 11.6 percent.

Service-sector jobs

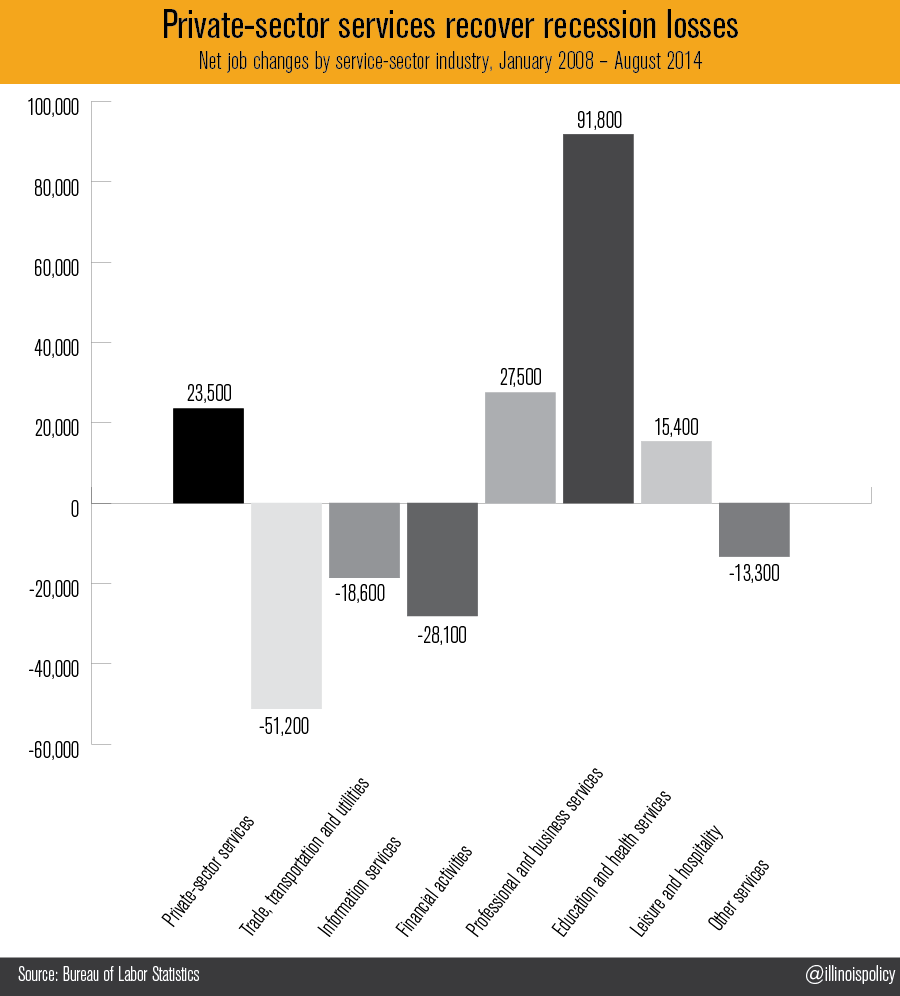

Illinois’ private-sector services have recovered all of the net job losses sustained during the Great Recession. The state is up 23,500 private-sector service jobs through August 2014 (0.6 percent).

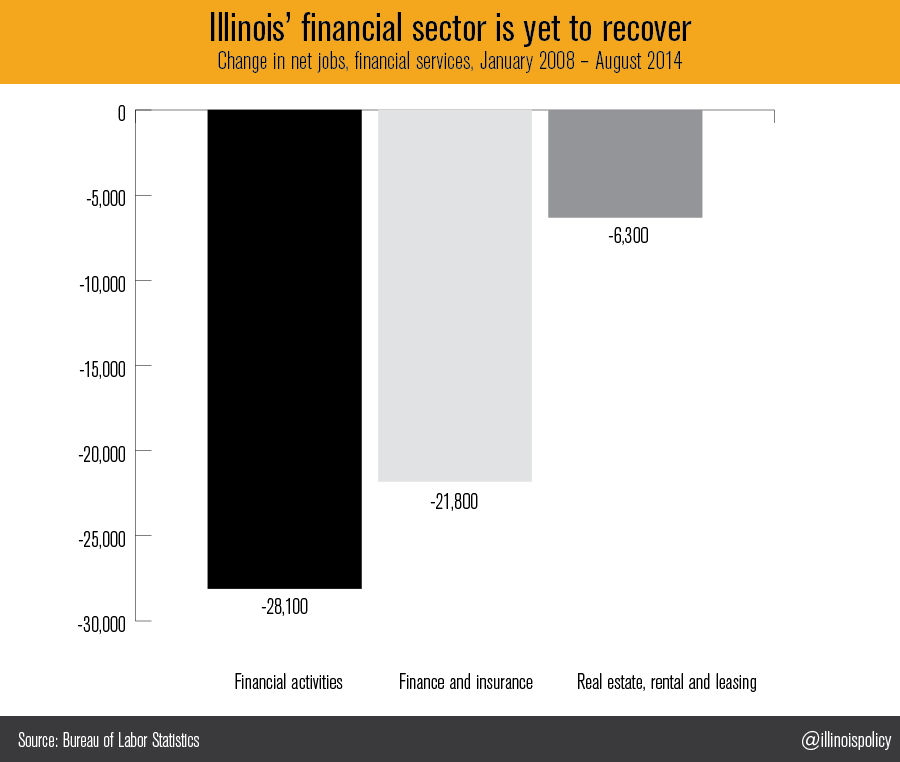

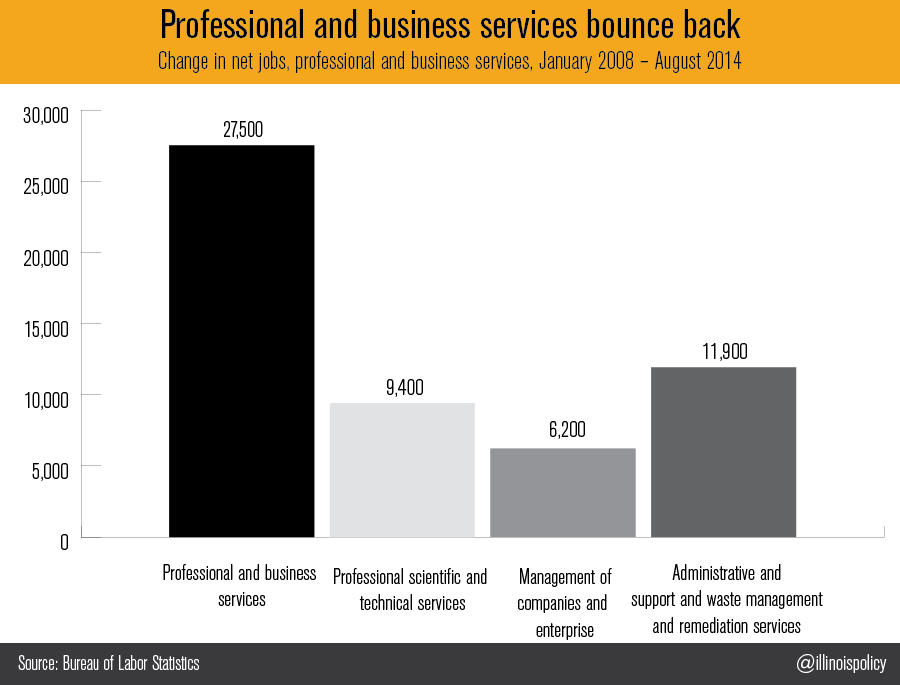

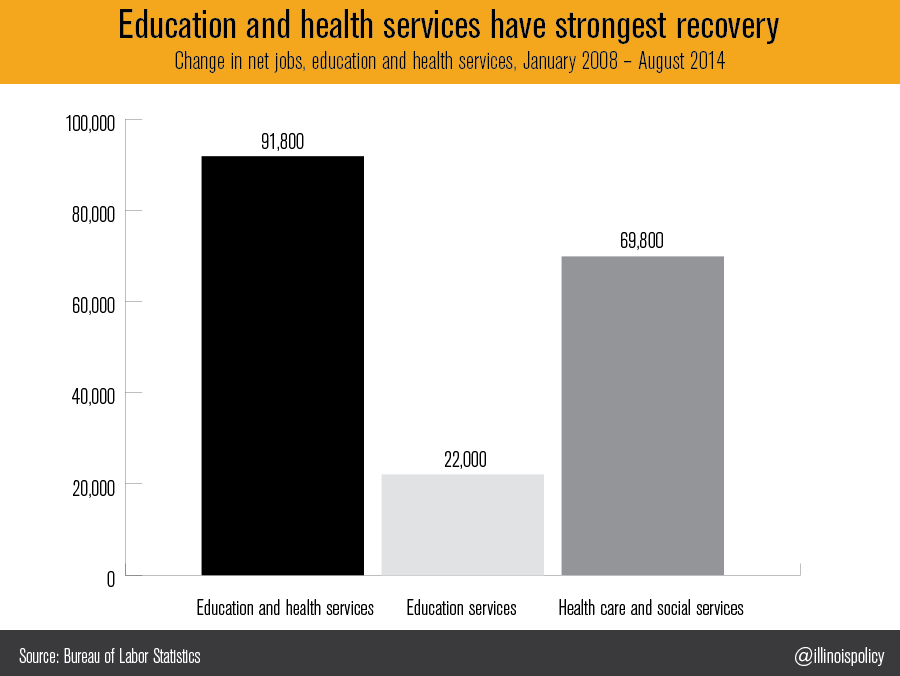

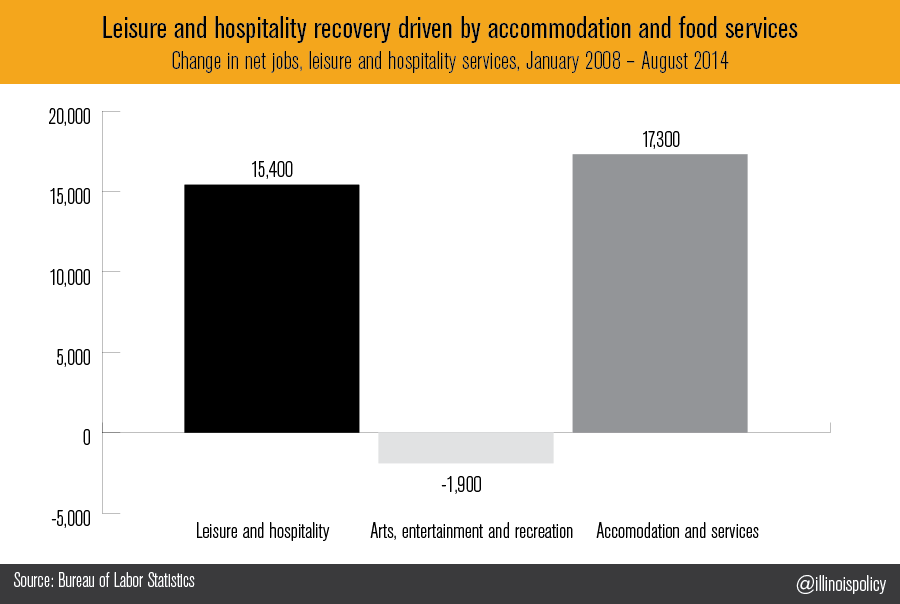

By industry, trade transport and utilities jobs are down 4.2 percent, information jobs are down 18.6 percent, financial activities jobs are down 7.1 percent, professional and business services jobs are up 3.2 percent, education and health services jobs are up 11.6 percent, leisure and hospitality jobs are up 2.9 percent, and other services jobs are down 5.1 percent.

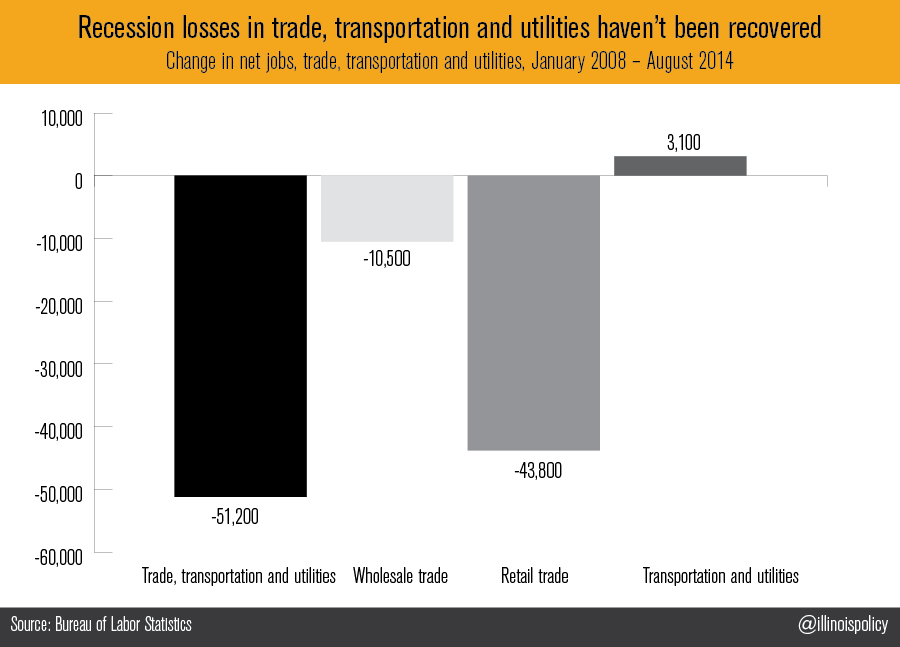

Job losses in trade, transportation and utilities were driven by a 6.9 percent decline in retail trade and a 3.4 percent decline in wholesale trade. Transportation and utility jobs are up 1.2 percent through the recession era.

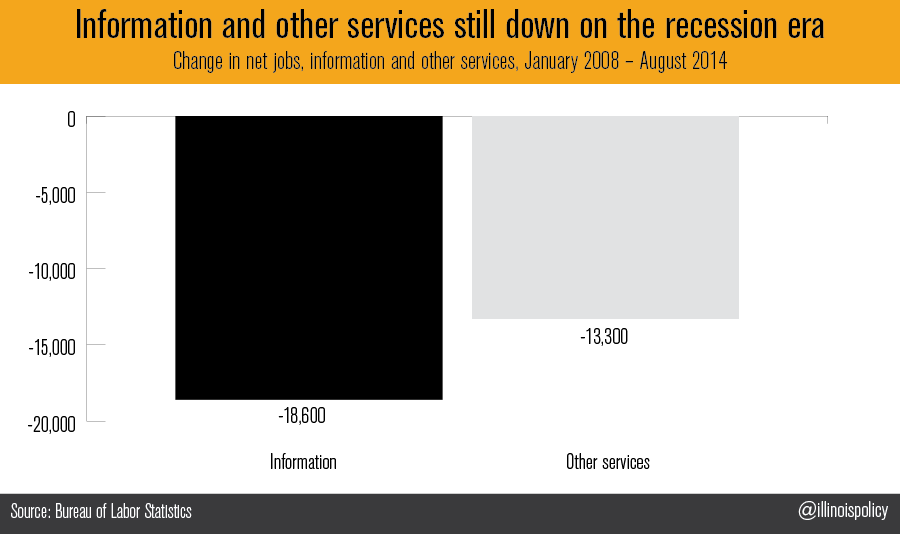

Information services jobs took a hard hit, and remain down 16.1 percent. Other services are down 5.1 percent.

Jobs in Illinois’ financial sector are down 7.1 percent over the recession era. In percentage terms, real-estate and rental-leasing jobs are down most, still 7.7 percent below pre-recession levels. Finance and insurance jobs are 6.9 percent below pre-recession levels.

Professional and business services have done better than break even over the recession era, despite the fact that Chicago, the Midwest capital for professional and business services, has been described by the U.S. Chamber of Commerce as a “dystopian nightmare” for entrepreneurs who want to start a professional services firm. The 32-day wait-time for such entrepreneurs is four times longer than the next worst city, New York.

Education and health-services jobs are the bright spot for Illinois, relatively speaking. Education jobs are up 16.6 percent, while health-care and social-services jobs are up 10.6 percent, compared to pre-recession levels.

The net gains in the leisure and hospitality industries were driven by a 3.8 percent gain in accommodation and food services, which more than offset the 2.4 percent losses in the smaller arts, entertainment and recreation sector.

Slow recovery in the land of Lincoln is a consequence of anti-business state policies. And over the recession era, Illinois state government’s primary policy mistake was the historic 2011 tax hike, which led to Illinois’ job-creation rate slowing by one-third.

Illinois’ uneven recovery highlights the state’s economic pain points which are largely policy-driven. The sectors, including manufacturing, construction, information, and trade transport and utilities, are generally hurt by specific policy errors that do not influence the rest of the service sector.

Illinois should revisit its policies on property taxes, workers’ compensation, forced-unionism, the minimum wage and prevailing wage laws, which are very influential policies that exacerbate the pain points in the Illinois economy.