Teacher pension spending rose drastically; general education spending increased incrementally

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

CONTACT: Melanie Krakauer (312) 607-4977

40 cents of every Illinois general education dollar diverted to pensions

Teacher pension spending rose drastically; general education spending increased incrementally

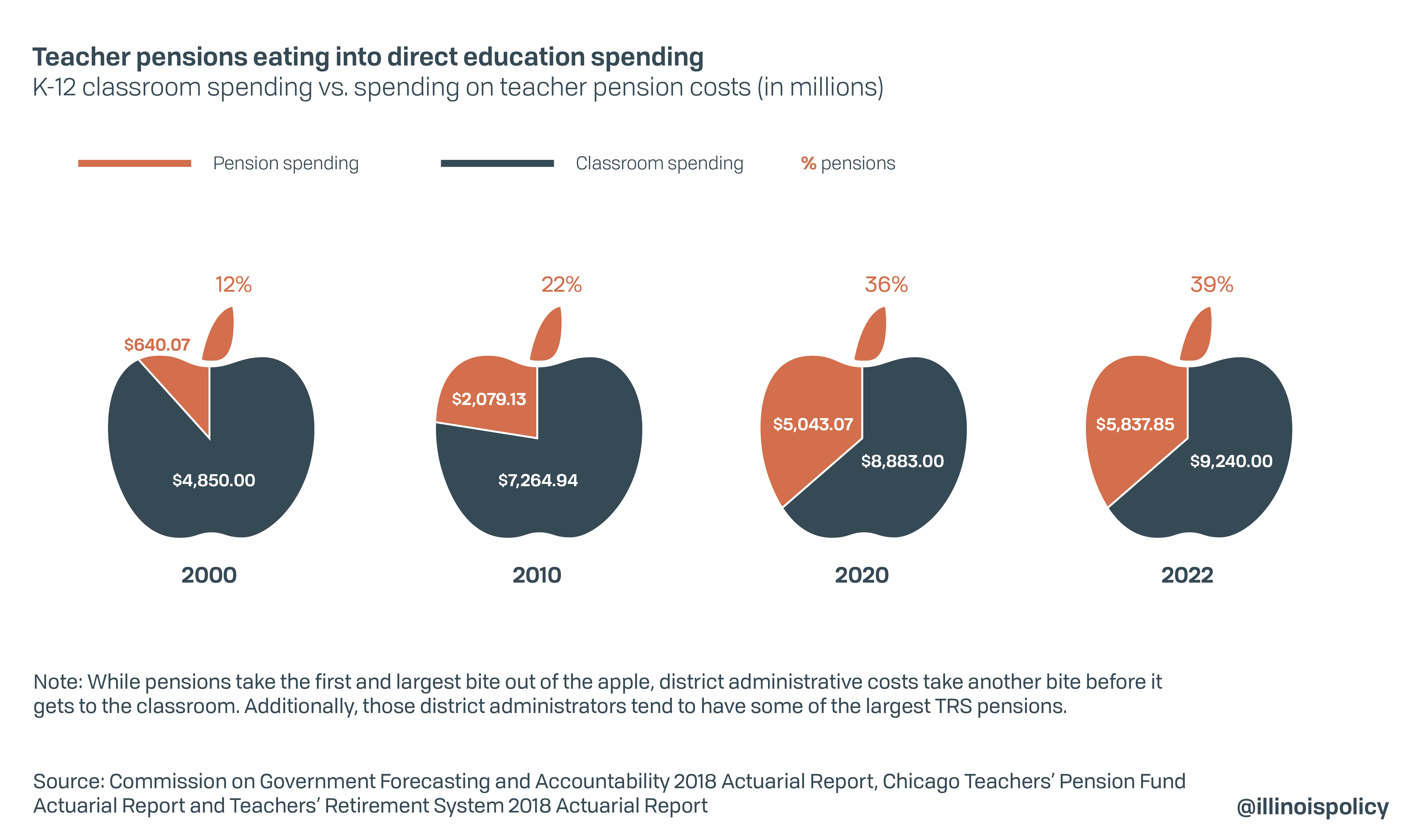

CHICAGO (Sept. 23, 2021) – Growing pension costs are quickly crowding out the state resources that can be allocated for spending on classrooms and teachers’ salaries. Since 2000, Illinois has seen a more than 450% increase in teacher and administrator pension spending, while general education spending has increased just 17%, adjusted for inflation.

Research from the Illinois Policy Institute found 39% of the money the state spends on education for this school year will be diverted away from teachers and students to meet required pension payments.

With more money going to pensions each year, a smaller share is left for teachers and the classroom, as growth in direct education spending has been constrained by rising pension contributions. This leaves poorer districts at a disadvantage and contributes to a reliance on property taxes to pay for education.

How general education spending gets eaten up by pension spending:

- Pension costs commanded approximately 20% of the state’s total education spending only a decade ago, before doubling to where it is today.

- Since 2010, spending on pensions has more than doubled, to nearly $6 billion in the 2022 budget from less than $2.1 billion in nominal dollars. Meanwhile, education spending in the budget, including administrative costs, grew modestly to $9.2 billion from $7.3 billion.

- Excessive administrative costs caused by Illinois’ overabundance of districts, with district administrators who also bring in some of the largest pensions, further eat into the 61% of the money that goes to direct education spending—meaning even less makes it to classrooms.

Adam Schuster, senior director of budget and tax research for the nonpartisan Illinois Policy Institute, offered the following statement:

“Illinois’ biggest problem is a pension monster that is growing too fast to be contained. Public school students and young teachers deserve resources for classrooms, but end up playing second-fiddle to out-of-control pension costs.

“Without real pension reform, Illinois will struggle to meet the ambitious $350 million annual growth in state education spending promised in the 2017 in education funding formula. Without adequate state support, hundreds of schools across the state will be forced to raise property taxes. In communities without adequate local property wealth, schools could also see cuts in programs, increased class sizes, or teacher layoffs.

“This cycle would exacerbate education funding inequities. But it can be avoided with reasonable modifications to the future growth in pension benefits that leaves teachers and administrators with generous and secure retirements, while allowing more new state dollars to flow to classrooms.”

To read more about how pensions are crowding out education costs, visit: illin.is/educrowdout.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.