Analysis reveals growth in pension debt damaged both taxpayers and retirees

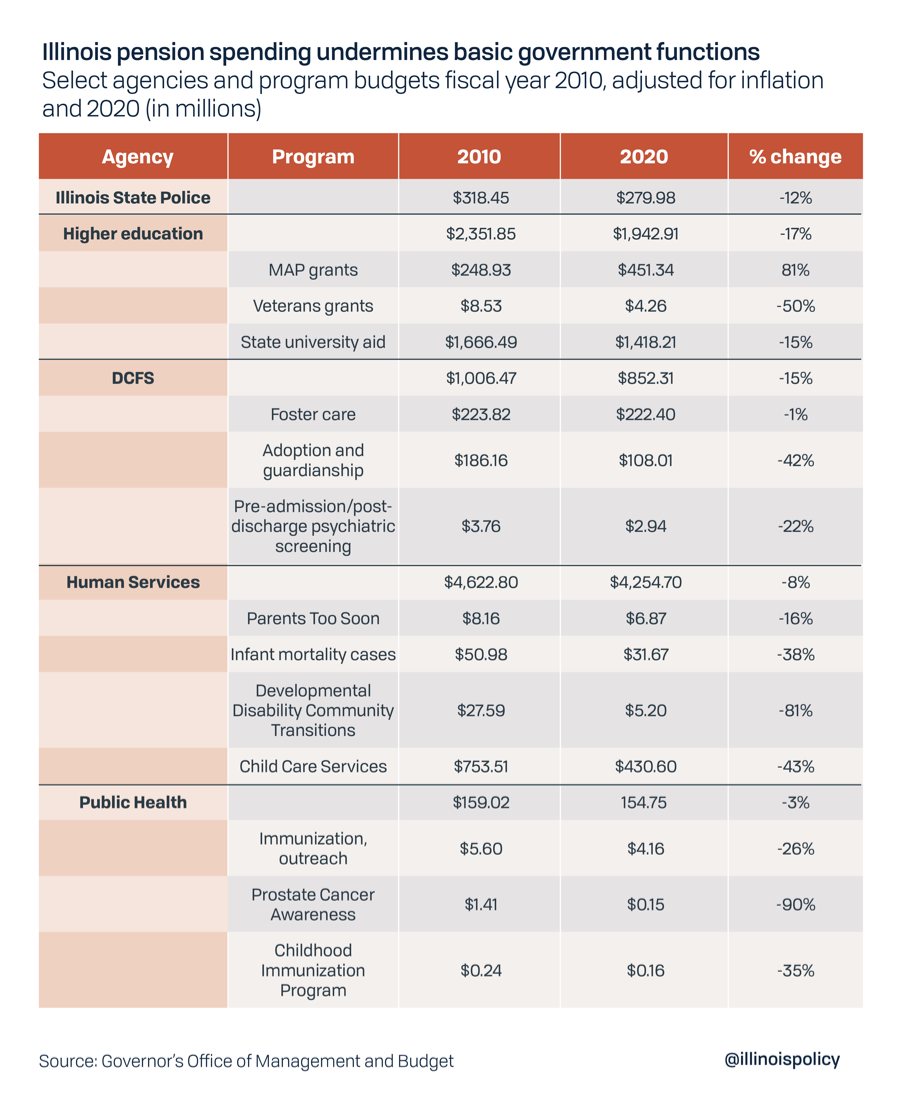

CHICAGO (Sept. 9, 2019) – Rapidly increasing pension payments have eaten into spending the state can dedicate to social services such as child protection, state police and college money for poor students, according to new analysis from the nonpartisan Illinois Policy Institute. Over the past 20 years, state spending on social services has dropped by 32% while spending on public pensions has grown 501%.

The state’s unfunded pension debt is piling up at the expense of Illinois’ poor, disadvantaged and retirees alike. Within 30 years, the money available in Illinois’ public pension funds could run dry.

This danger to Illinois’ most vulnerable signals the need for solutions and reform. Adam Schuster, director of budget and tax research for the Illinois Policy Institute, will share what solutions are possible during today’s luncheon, “The pension problem: What happens now?” at the City Club of Chicago.

How pensions have crowded out core government services:

- Since 2000, state spending has been cut by 32% on a range of core services including child welfare, social services, police protection and college for low-income students.

- This comes while state spending dedicated to pension funds has increased by 501%.

- The service areas that have seen the largest cuts in state funding serve some of the state’s most vulnerable including Illinois’ developmentally disabled, veterans, child care, adoptions, psychiatric screenings and infant deaths.

- Local governments are also cutting core services to pay for pension debt. For example, the cities of Peoria and Harvey have laid off police officers and firefighters to make payments.

How the system hurts retirees who rely on pension benefits:

- Analysis from the report also revealed the retirement system is putting retirees at risk of losing their benefits entirely if solutions are not implemented.

- An actuarial stress test found retirement systems would run out of money between 2039 and 2048 if another recession hit the state. The State Universities Retirement System would be the first to run out of money to pay its beneficiaries.

- During the last recession in 2009, the state-run pension funds lost 20% of their asset value.

Quote from Adam Schuster, director of budget and tax research:

“The status quo is unsustainable for Illinois. Taxpayers face a future in which they’re asked to pay more in taxes and receive fewer government services than ever because the state can’t afford them. Retirees face a future where the pensions they were promised won’t be there for them.

“Illinois must come together to end the pension crisis once and for all. The only solution that can save ensure services for vulnerable Illinoisans aren’t crowded out is a constitutional amendment that would protect pension benefits retirees have already earned while allowing for changes in future benefits.”

To read the full analysis, “Illinois public services being cut to pay unsustainable pension costs,” visit illin.is/pensionsoverservices

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977