Increasing property and sales taxes will likely offset proposed savings from the governor’s progressive tax amendment

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

MEDIA CONTACT: Rachel Wittel (312) 607-4977

Typical family to pay $244 more in state and local tax burden despite promised “fair tax” relief

Increasing property and sales taxes will likely offset proposed savings from the governor’s progressive tax amendment

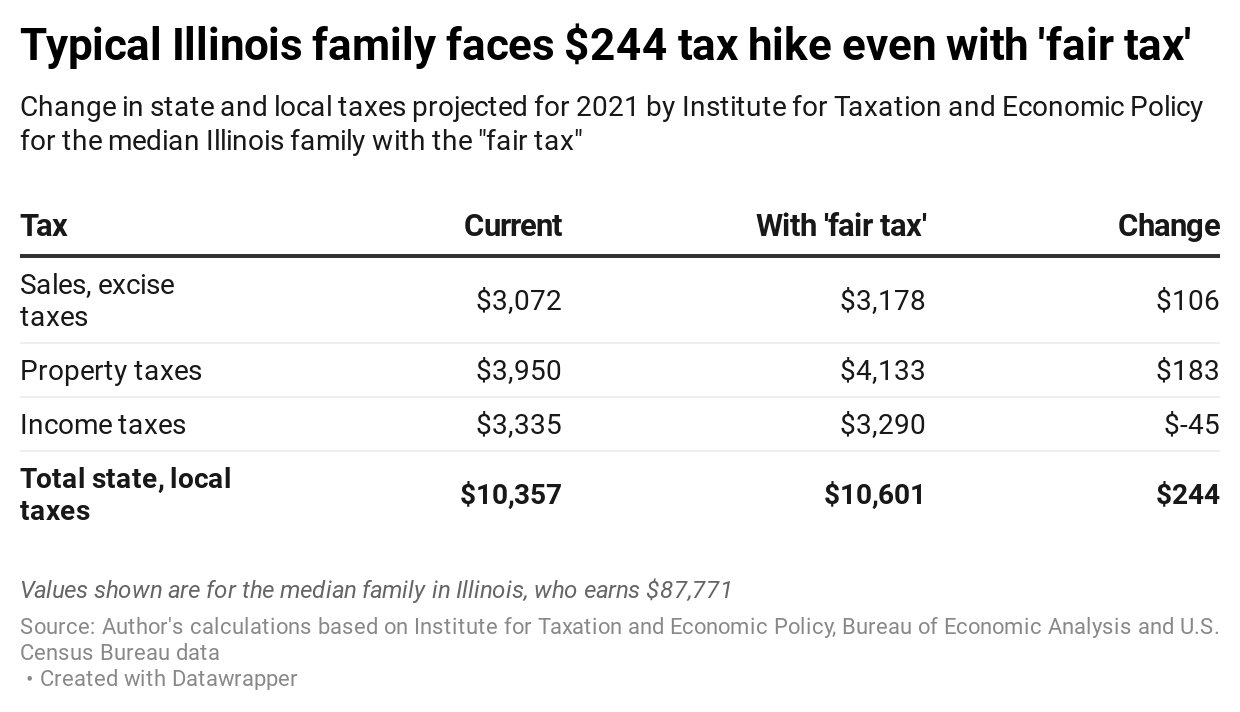

CHICAGO (Oct. 27, 2020) – With just one week until Election Day, new Illinois Policy Institute analysis shows any promised savings from Gov. J.B. Pritzker’s progressive tax would be offset by the state’s increasing property and sales taxes. Experts found the typical Illinois family can expect to pay $244 more in state and local taxes next year even with the “fair tax.”

The median Illinois family, earning about $87,771 annually, could expect to pay $106 more in state and local sales and excise taxes, plus $183 more in local property taxes – already the second-highest in the nation. Meanwhile, the tax relief promised by Pritzker under the progressive tax would only reduce state income taxes by $45.

The increase in state and local taxes would likely push the combined state and local tax burden above $10,600 for the median Illinois family.

Bryce Hill, research analyst at the nonpartisan Illinois Policy Institute, offered the following statement:

“While the governor claims the progressive tax amendment is the ‘fair’ option for Illinois families to provide relief, Illinois’ structural spending reveals the major flaws in his argument. Even if Pritzker’s progressive tax provides some income tax savings to the typical Illinois family, that relief will be more than offset by the state’s increasing sales and property taxes.

“So long as state lawmakers refuse to consider constitutional pension and other spending reforms, Illinoisans will continuously be asked to pay more. The progressive tax is not about reducing taxes for the middle class; it’s about eliminating taxpayer protections from the state constitution and opening the door for a litany of new taxes.”

To read more about the failed promises of the “fair tax,” visit: illin.is/familytax.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.