Pritzker ‘fair tax’ would hit over 4 million Illinoisans with marriage penalty, potentially give wealthy couples a marriage bonus

A progressive income tax would force nearly all joint filers in Illinois to pay higher income taxes than they would as single filers. Meanwhile, some wealthy couples would save thousands in state income taxes.

While Gov. J.B. Pritzker has spent the past two years campaigning for a progressive income tax that he claims will only hit the rich, the plan also comes with a rare marriage penalty that subjects joint filers to higher income tax rates than single people.

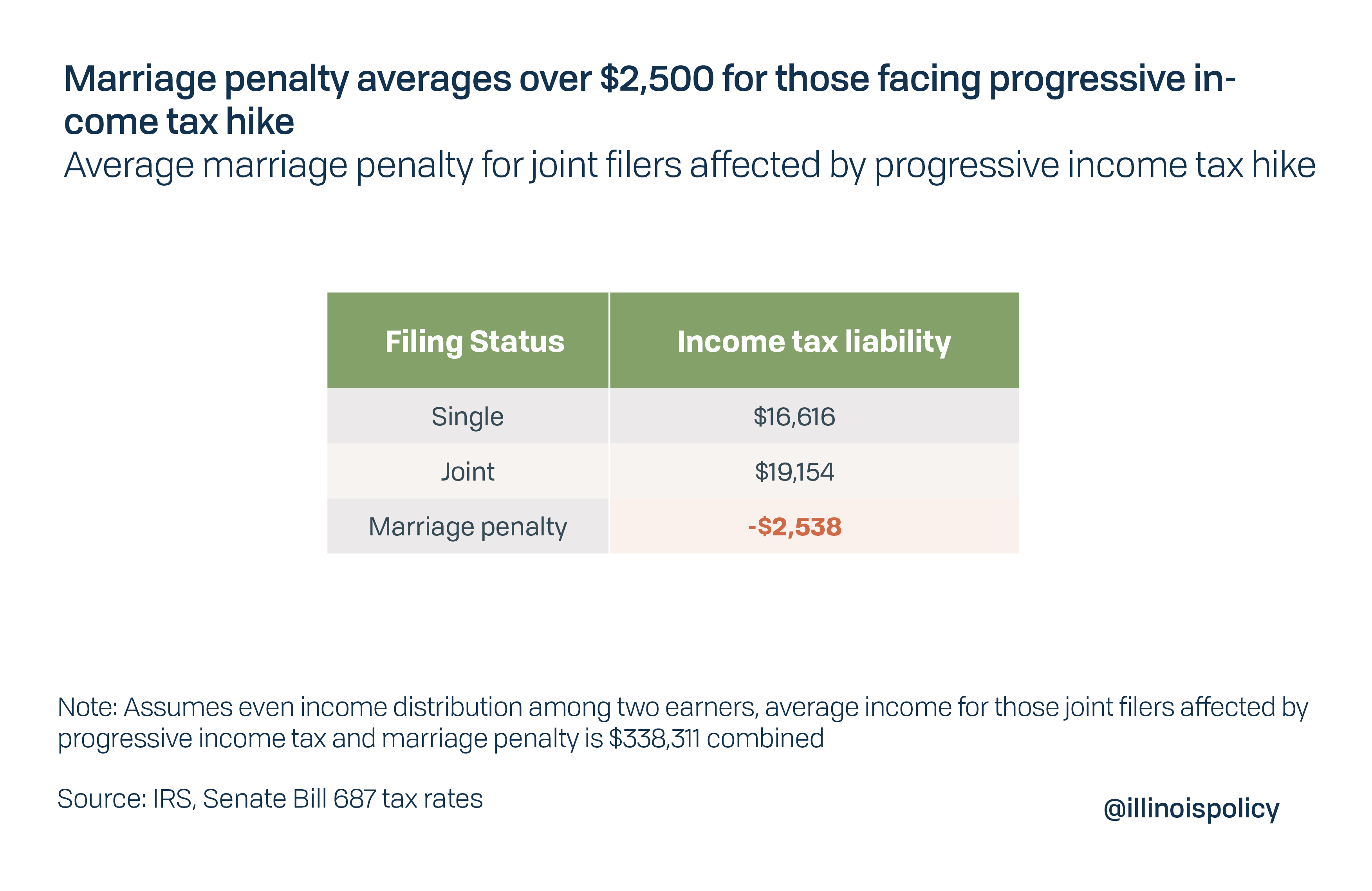

The marriage penalty would average more than $2,500 for those facing tax hikes if voters approve the progressive tax Nov. 3. More than 4 million married Illinoisans would be impacted.

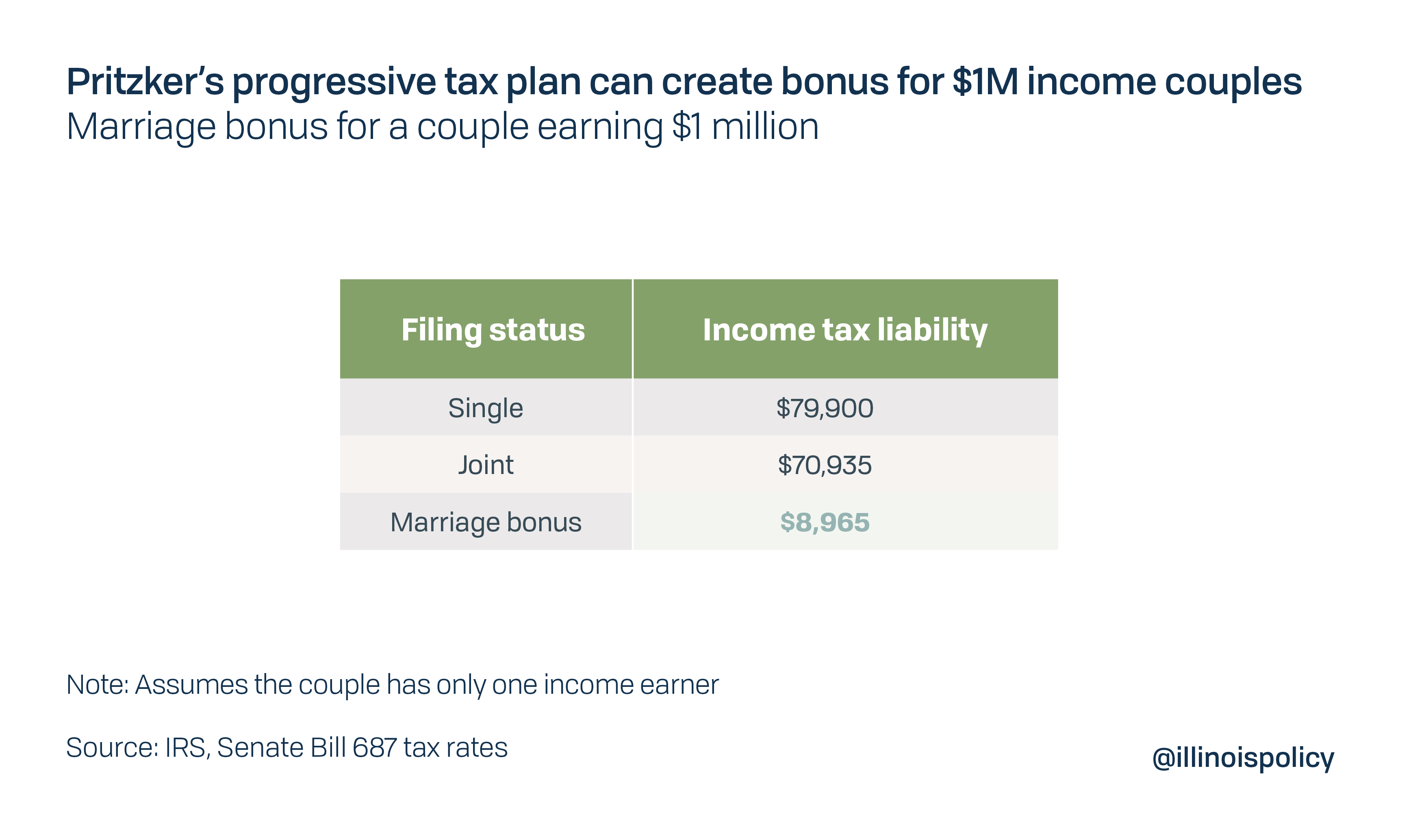

At the same time, couples who earn more than $1 million would not face a marriage penalty at all under Pritzker’s plan. And many couples earning between $350,000 and $1 million would actually see a marriage “bonus.”

Academic research on the marriage penalty has found that by punishing two-income households, this tax policy disproportionately harms the careers of married women and widens the gender pay gap. Conversely, tax structures that avoid marriage penalties, such as a flat income tax, result in more women working, a reduction in the gender pay gap and improved outcomes for all.

Most Illinois couples would be hit by a marriage penalty

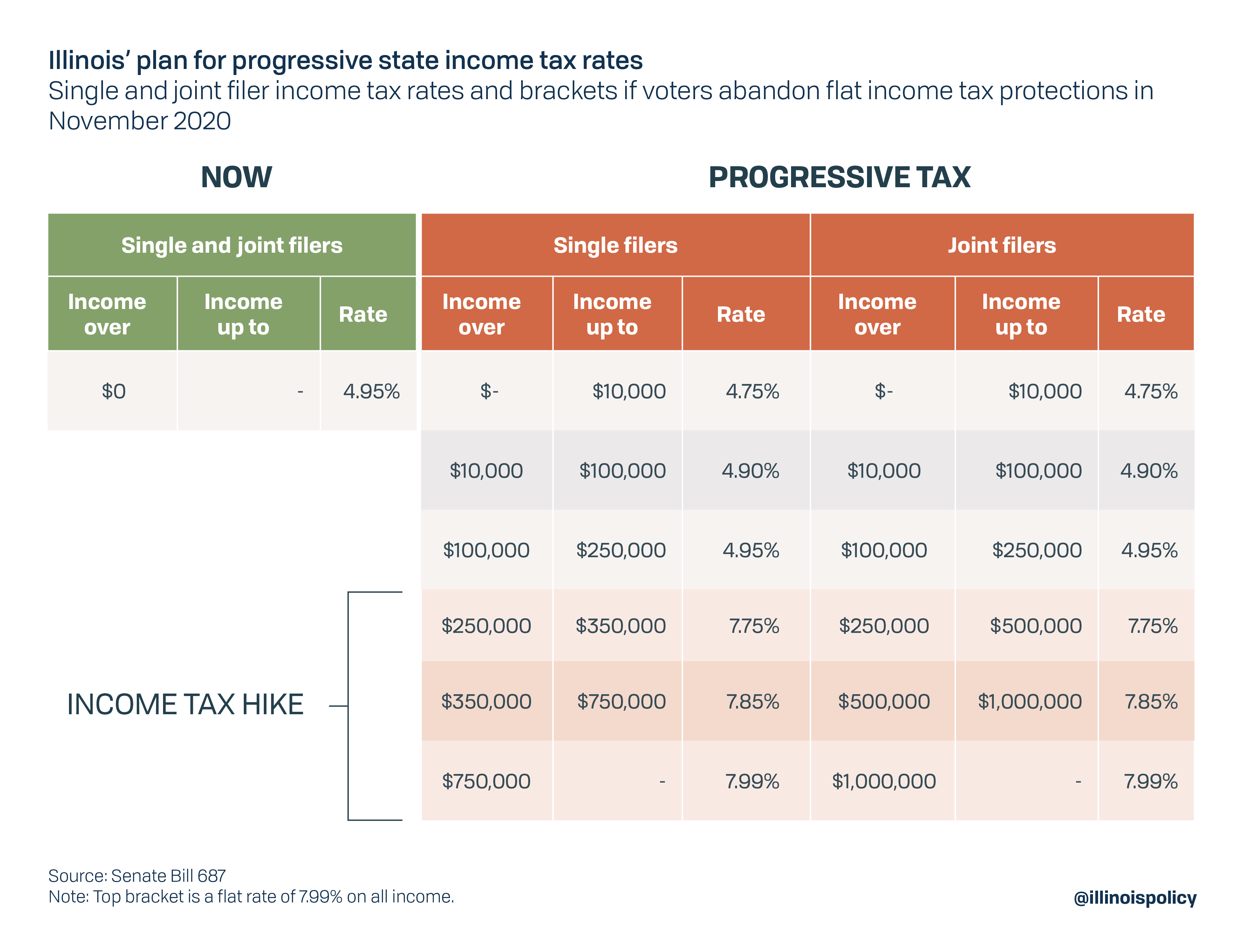

A marriage penalty is when a progressive income tax structure pushes joint filers into a higher income bracket and tax rate, or raises their total effective tax rate, taking more money from them than it would have had they filed separately as single individuals at lower rates.

While the marriage penalty will affect nearly all Illinois couples, the effects will be largest for those with higher incomes or among couples with disparate earnings. Not only will higher earners be subject to a large income tax increase under a progressive income tax hike, but the marriage penalty will also make their income tax liability substantially larger.

Take the average couple affected by the progressive income tax hike. This couple earns roughly $340,000 in income. Under the current flat income tax, they pay just over $16,700 in income taxes, but under the progressive income tax, they would be asked to pay more than $19,150 in state income taxes. Making matters even worse for this couple, is that their income tax hike could have been avoided altogether if they were allowed to file separately.

For those who are affected by the progressive income tax hike, the average marriage penalty will be more than $2,500, resulting in a 15% increase in state income tax liability.

Another interesting component to the governor’s tax plan is the potential for large marriage bonuses for high-income couples earning between $350,000 and $1 million. For example, if an individual earning $1,000,000 in taxable income gets married and his or her spouse chooses not to work and focuses on raising children or volunteering, filing jointly could save the couple nearly $9,000 in state income taxes.

While the governor has been selling his plan as a way to soak the rich, marriage bonuses do not exist for those earning less than $350,000 in the governor’s progressive income tax structure.

Most governments avoid a marriage penalty

While a marriage penalty taxes a couple more for combining their incomes, there can be a very different outcome when the two spouses have very different incomes or one doesn’t work. The person with the higher income is likely to move into a lower marginal tax bracket thanks to the two incomes essentially being “averaged” between the two spouses.

In his tax plan, Pritzker only gives the luxury of being able to reduce income tax burdens by filing jointly to couples with the highest incomes.

Illinoisans will likely be forced to endure the marriage penalty, because filing separately on state income taxes would require the couple to file separately on their federal income taxes. The result of filing separate income tax returns at the federal level would likely reduce the value of exemptions and deductions available for federal income taxes, and force couples to pay a higher effective income tax rate than if they filed jointly. In states that avoid marriage penalties couples see no penalty from filing jointly and can even reduce their state and federal income tax burdens by doing so.

Of the 43 states that tax some form of income, only 15 have marriage penalties built into their tax structures, according to the nonpartisan Tax Foundation. The federal income tax also avoids a marriage penalty in tax brackets for those earning less than $518,400. If Illinoisans approve the progressive income tax in November, Illinois would become the 16th state with a marriage penalty in its tax system.

Under the proposed progressive income tax structure, nearly all – roughly 96% – of couples who file jointly would face higher income tax liabilities than if they filed separately. Most couples earning more than $10,000 and up to $1 million in taxable income would face a marriage penalty. The most recent IRS data reveals that there were 2.06 million joint income tax returns for Illinoisans in that income range, indicating that more than 4 million Illinoisans will likely be hit by the marriage penalty.

Ironically, the governor’s plan also creates the potential for rare marriage bonuses for wealthy individuals when their spouses have lower incomes that can reduce their effective tax rate.

At the same time, the richest Illinoisans would not be subject to a marriage penalty under the governor’s plan, as the top income tax rate contains a flat “recapture” provision, another rare policy.

North Carolina and Kentucky both got rid of their marriage penalty when they changed from a progressive income tax to a flat income tax.

How a marriage penalty hurts second earners

Income tax structures that contain marriage penalties violate the tenets of good tax policy because they create perverse incentives for labor supply decisions. During the Clinton administration, the Congressional Budget Office warned that marriage penalties can alter the behavior of individuals, encouraging second earners to work less or not at all. Federal income tax brackets have since been modified to avoid the marriage penalty stemming from income tax brackets in most cases.

Empirical analysis has also demonstrated that taxing second earners at higher rates, such as through a marriage penalty, can have substantial negative effects on the labor supply of second earners, particularly in the early and late stages of careers, and can reduce lifetime earnings. The effects of the marriage penalty can be especially damaging for women, because more often than men, women are faced with the decision of whether to re-enter the labor force. This is exacerbated when couples have children.

Due to the negative effects of marriage penalties and the distortions they create in labor supply decisions, these policies likely increase gender wage gaps. These policies can contribute to the difference in career choice and investments in human capital among men and women, and lead to an overall reduction in lifetime labor force participation for women that further widens pay gaps.

Economists have recommended that governments introduce policies that encourage women to work more continuously throughout their lives, such as getting rid of marriage taxes in order to reduce the gender pay gaps.

Analysis of data from the federal Current Population Survey shows prime working-age women in states with marriage penalties are 4.2 percentage points less likely to be labor force participants (see appendix). Research has also found that an efficient way to encourage labor force participation among women is through a proportional tax, such as a flat income tax. Some economists even call for lower taxes on women because they are more responsive than men to tax policy changes.

Based on these academic findings, the decision to scrap Illinois’ constitutionally protected flat income tax in favor of a progressive income tax would likely have negative consequences for Illinois’ workforce, which has already been declining in recent years. It would likely widen gender pay gaps.

Rejecting the ‘fair tax’ would halt an Illinois marriage penalty

The creation of marriage penalties for most Illinoisans and the potential for marriage bonuses exclusively for high-income earners flies in the face of the rhetoric used by Pritzker’s campaign when promoting the “fair tax.”

State leaders seeking to support working families should not be pushing tax policies that discourage women from working or punish them with taxes for getting married. They especially should not push a policy that yields windfalls for the rich for making the same decisions.

Preserving Illinois’ constitutionally protected flat income tax structure would avoid both of these issues.