Progressive tax means higher taxes for 98 percent of Illinois educators

Some Illinois lawmakers and special-interest groups are pushing for a so-called fair tax, or progressive income tax in Illinois. Among the leading advocates of the progressive tax is Illinois Education Association, or IEA, which misleadingly claims the progressive tax would “increase taxes on the rich” while “cutting taxes on the middle class.” The reality is...

Some Illinois lawmakers and special-interest groups are pushing for a so-called fair tax, or progressive income tax in Illinois. Among the leading advocates of the progressive tax is Illinois Education Association, or IEA, which misleadingly claims the progressive tax would “increase taxes on the rich” while “cutting taxes on the middle class.” The reality is the progressive tax-rate structure endorsed by the IEA and others would dramatically increase taxes on 98.5 percent of Illinois educators.

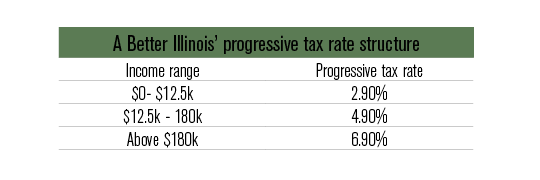

Under Illinois law, the individual income tax rate will be 3.75 percent in 2015. But state Sen. Don Harmon, D-Oak Park, has introduced a progressive rate structure in which income tax rates would increase as a person’s income increases. Below is the rate structure proposed by Harmon and endorsed by the IEA-backed organization A Better Illinois:

As the chart above shows, a higher 4.9 percent applies to income earned after $12,500. Compared with Illinois’ statutorily required 2015 income tax rate of 3.75, anyone with taxable income above $22,000 would see their overall tax bill increase – this includes the vast majority of Illinois public school educators.

Each year, the Illinois State Board of Education, or ISBE, releases public data sets with the name, school district and annual salary of more than 160,000 Illinois educators. The most recent data set is for the 2011-12 school year and is available on the ISBE website.

The Illinois Policy Institute used the ISBE spreadsheet to analyze how much the proposed progressive tax rate structure would cost Illinois educators in state taxes, and then compared that amount to the 2015 statutorily required income tax rate of 3.75 percent.

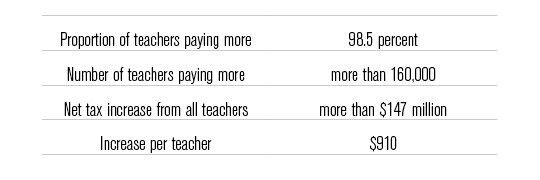

The analysis found that if every teacher were single with no children, then 98 percent – more than 159,000 educators – would pay higher taxes under Harmon’s progressive tax plan. The average annual tax increase would be $500 if all Illinois educators were single.

But not all educators are single. And tax bills generally are calculated based on total household income, taking into account both spouses’ salaries. So the Illinois Policy Institute also ran an analysis of how much the proposed progressive tax would cost Illinois educators if they fit the demographic profiles of teachers nationally when it comes to marriage rates, number of children and working status of spouses. The analysis found that in this scenario, approximately 98.5 percent of Illinois teachers live in households that would pay more taxes under the progressive income tax. Their households would pay an estimated $910 each year in higher taxes under the progressive tax structure proposed by Harmon and endorsed by the IEA.

This means that statewide, teachers would fork over more than $147 million in higher taxes to state government.

In 2013, the IEA held training sessions for its members, aimed at mobilizing teachers to serve as the foot soldiers for the progressive tax campaign. Teachers were told that advancing this proposal would result in lower taxes for them, but more money for schools. However, as the above analysis shows those claims are false – and it’s Illinois educators who would pay.

It’s disheartening to see the IEA advocate for increases taxes on its own members. Illinois educators have the right to know what a progressive income tax would mean for them. It’s not just a tax increase on the super-wealthy. It’s also a tax increase on teachers.