Property tax relief task force votes against ending costly conflicts of interest

Some Illinois lawmakers supplement their income doing property tax appeals work at private law firms. A property tax relief task force that includes some of those lawmakers killed a proposal to end that conflict of interest.

A task force aimed at delivering property tax relief refused to look into property tax abuses, including how state lawmakers, such as Illinois House Speaker Mike Madigan, profit from the system.

On Aug. 29, the Property Tax Relief Task Force voted down a measure introduced by state Rep. Deanne Mazzochi, R-Elmhurst, aimed at studying abuses as well as lawmakers’ conflicts of interest in the state’s property tax system.

Illinois’ property taxes average second highest in the nation. While residents suffer under that burden, some enterprising lawmakers profit from it through work at private law firms that specialize in property tax appeals.

“It is absurd to suggest we can’t have a subcommittee to target conflicts of interest that both sides of the aisle know exist,” Mazzochi said in a statement following the vote. “Today’s vote demonstrates that members of the majority are insincere about real reform.”

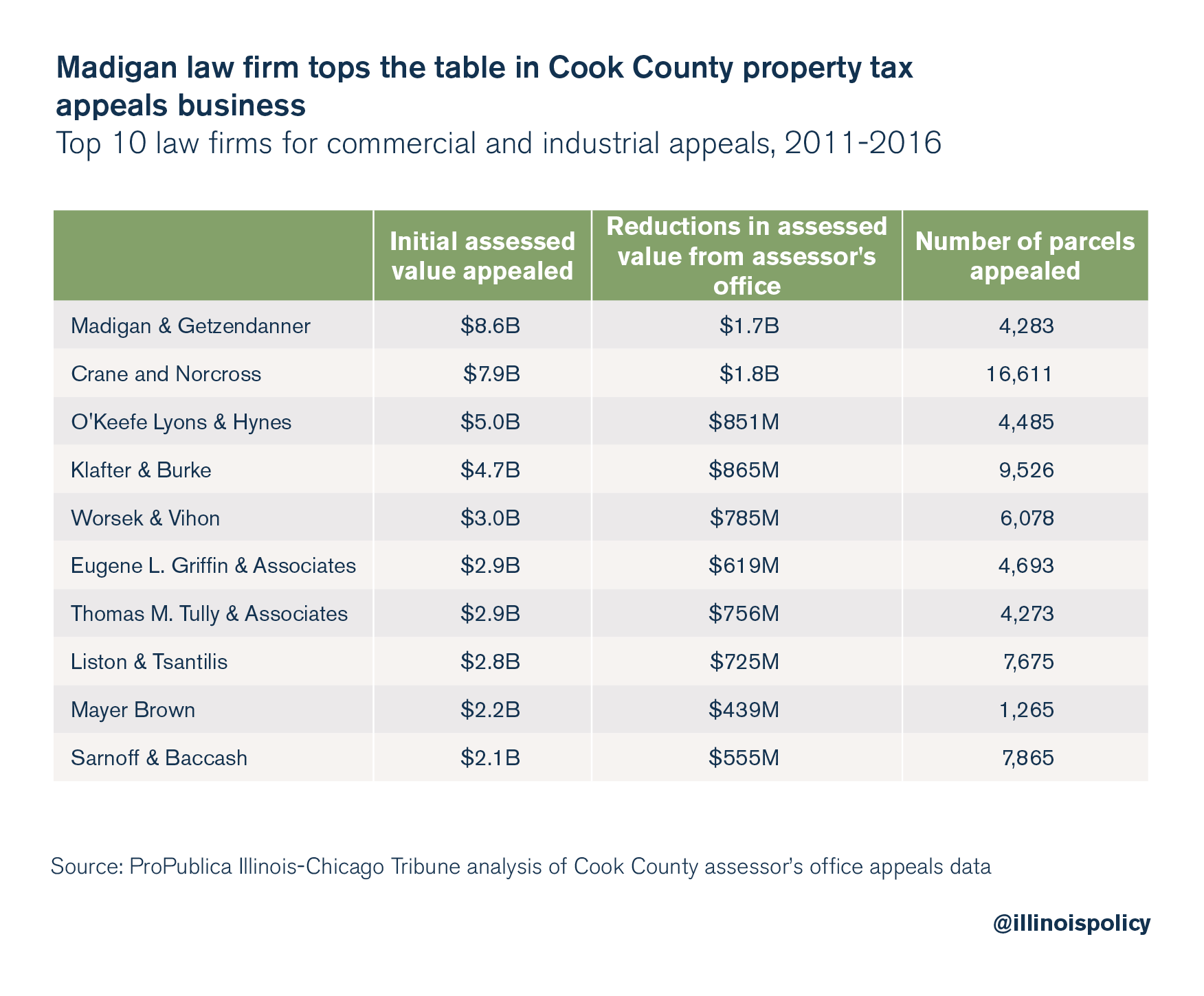

Far from flying under the radar, Illinois officeholders engaged in this self-dealing practice include those at the highest rungs of the Statehouse. A joint 2017 investigation by the Chicago Tribune and ProPublica found private law firm Madigan & Getzendanner, founded by Illinois House Speaker Mike Madigan in 1972, dominated the property tax appeals business from 2011 to 2016

During that period, Madigan’s firm appealed property taxes for nearly 4,300 parcels totaling $8.6 billion in assessed value. No other firm handled more value in commercial and industrial properties during that time. On those parcels, Madigan & Getzendanner won $1.7 billion in assessed value reductions from the Cook County assessor, a 20% reduction overall.

Politically connected property owners benefit by paying lower property tax bills, as does Madigan when his firm takes its cut. But the property tax levy the county must collect is still the same, meaning the burden must fall onto other commercial or industrial property taxpayers. Cook County’s flawed assessment process is in no small part to blame for this system. The 2017 investigation also found that high value properties in the county were systematically undervalued, therefore paying less in property taxes, while lower-value properties were systematically overvalued, meaning they paid more.

“Illinois residents already pay among the highest property taxes in the nation. They don’t need an added corruption tax,” Mazzochi said. “Whose interests are they really looking out for?”

Until recently, powerful Chicago Ald. Ed Burke, 14th Ward, was a partner at Klafter & Burke, No. 4 on the top 10 list of Cook County law firms for commercial and industrial property tax appeals. Burke resigned from the firm in August, shortly after the Chicago City Council unanimously passed Mayor Lori Lightfoot’s ethics reform package that included tougher restrictions on council members engaging in conflicts of interest. Lightfoot specifically called out Burke, who after more than 50 years in office faces a 14-count federal indictment claiming corruption related to his use of aldermanic power. His wife was just picked by her peers as chief justice of the Illinois Supreme Court.

After voting to send Gov. J.B. Pritzker’s progressive tax proposal to voters on the November 2020 ballot, state lawmakers formed the Property Tax Relief Task Force to study ways to cut property taxes before asking Illinoisans to give them more power over income taxes. The task force’s findings are due by the end of 2019

“If this task force wants to achieve meaningful reform, we must address the problem of high-level political insiders who game the system, whether at the state, county or local level,” Mazzochi said.

Illinois cannot deliver lasting tax relief without addressing the root cause of state and local tax hikes: massive, unfunded pension and health insurance liabilities for government workers. But state leaders are fully capable of rooting out corruption – if they choose to.

If Illinoisans can’t trust lawmakers to do that much, why should they trust them with more power to increase state income tax rates as would happen were Pritzker’s “fair tax” referendum to pass in 2020?