Report: $1.4B more needed from taxpayers for Illinois universities

A commission reported $1.4 billion is needed from taxpayers as soon as 2035 to fix the state funding drop at Illinois public universities. Instead, they should be pushing for pension reform.

Illinoisans could end up paying an additional $1.4 billion over the next 10 to 15 years to cover declining state funding at Illinois’ public universities, according to a new report.

But the report overlooks the issue driving the funding gap: rapidly rising pension costs.

The study released by Illinois Commission on Equitable Public University Funding found the percentage of operational funding for public universities covered by the state declined by more than half since 2002, leading institutions of higher learning to raise tuition and fees.

To reduce the financial burden on students, the report recommended three ways to bridge the “adequacy gap” in higher education funding. All three increase the burden to taxpayers:

- Illinoisans pay an additional $135 million for higher education each year until fiscal year 2035.

- Illinoisans pay an additional $100 million for higher education each year until fiscal year 2040.

- Or the state increases higher education spending by about $60 million each year until the adequacy gap is filled.

While commission members look to taxpayers to cover the cost of declining funding at Illinois’ public universities, an Illinois Policy Institute analysis highlighted an alternative that would instead put the responsibility on lawmakers: pension reform.

Illinois’ 12 public universities received nearly $530 million less in operational funding in the 2024 state budget than they received 15 years ago, thanks in large part to pension payments increasing more than seven-fold during that time.

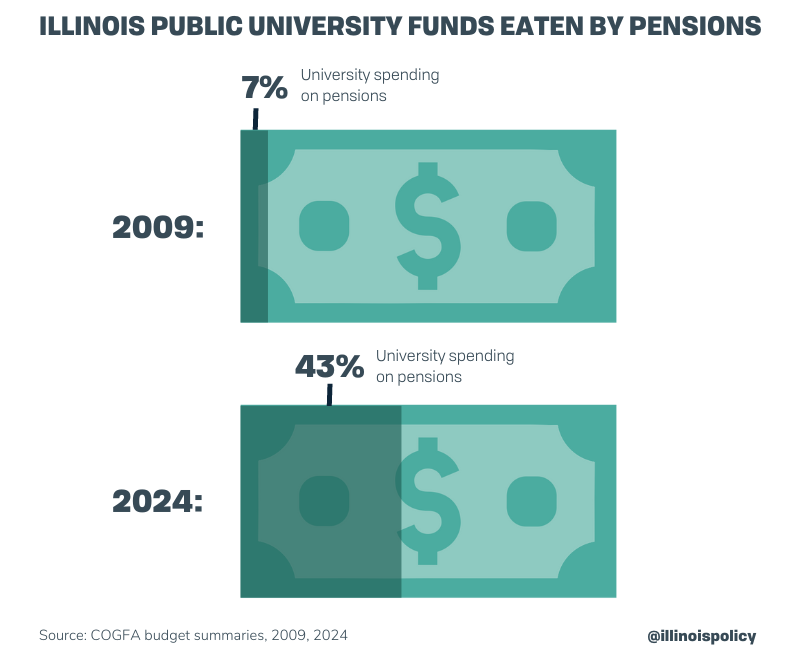

A 2009 budget summary showed just over 7 cents of each higher education dollar from state general funds went to pay for faculty pensions rather than supporting instructors and students in the classroom.

Starting July 1, 2023, those pension payments to the State Universities Retirement System consumed 43 cents of every higher education dollar from state general funds.

Growing pension contributions have forced Illinois’ higher education institutions to divert more dollars away from improving services and accessibility, driving up total costs and driving down operational spending.

An Illinois Board of Higher Education report found as SURS payments increased, universities were forced to become more reliant on raising tuition and fees on students to maintain operational budgets.

Consequently, 11 out of 12 of Illinois’ 4-year public institutions of higher learning have raised tuition prices and fees since fiscal year 2009, adjusted for inflation. That forces students and their families to bear the rising costs, driven by pensions.

The average price of in-state tuition and fees at Illinois’ public universities is now the fourth highest in the nation.

Without long-term structural reforms, Illinois’ $27.7 billion university pension debt will continue to grow and consume a greater share of state higher education spending, leaving students and taxpayers to cover the difference.

A “hold harmless” pension reform plan such as one originally developed by the Illinois Policy Institute – based loosely on bipartisan 2013 reforms – could help to eliminate state and local unfunded pension liabilities and achieve retirement security for pensioners.

Previous analysis showed changes such as capping pensionable salary, replacing 3% compounding raises with true cost-of-living increases and adjustments to realign benefits with historical inflation rates would have saved the state $2.4 billion in the first year alone, and more than $50 billion by 2045. It would also get the state’s pensions up to 100% funding to fully secure retirements.

Adding $1.4 billion to taxpayers’ burden will not fix state universities’ financial problem as long as pensions keep eating an ever-increasing share of their budgets.