Pension solutions: reforming retirement age

By Benjamin VanMetre, John Klingner

Pension solutions: reforming retirement age

By Benjamin VanMetre, John Klingner

THE PROBLEM

Illinois’ $100 billion pension crisis is the worst in the nation.

The Illinois General Assembly’s failed attempts to solve the pension crisis in the past have only perpetuated Illinois’ problem. Politicians have done nothing more than tinker at the margins of reform to avoid making tough decisions. The reality is minor changes won’t be enough to protect the retirements of the more than 268,000 active members in Illinois’ five state pension systems, nor will it be enough to protect the retirements of the more than 200,000 current retirees.

The retirement age is one of the most powerful levers lawmakers can use to reform Illinois’ pension system.

The simple problem with the retirement age for Illinois government workers is this: workers are living longer and the labor force’s demographics are changing. Retired workers are collecting more retirement benefits for longer periods than in the past.

The problem is compounded by the growing disparity between the age at which public sector employees can retire compared with private sector workers.

Stung by a weak job market, declining earnings and low home values, older Americans have accepted the reality of a retirement that comes later in life and no longer represents a complete exit from the workforce.

According to a recent poll, 82 percent of working Americans age 50 or older say it is at least somewhat likely they will work for pay in retirement.

The survey also found that 47 percent of working survey respondents now expect to retire later than they previously thought and, on average, plan to call it quits at about 66.

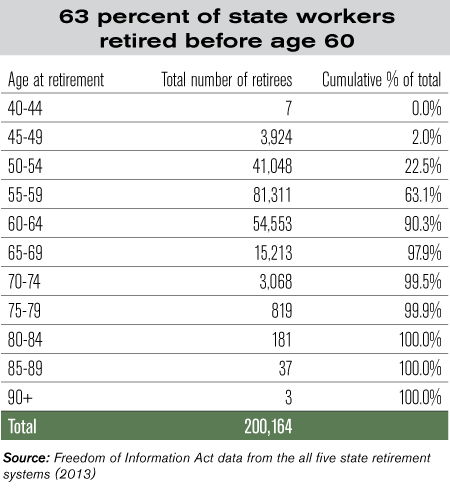

These very same workers who are forced to delay retirement are also expected to fund the retirements of the more than 63 percent of Illinois’ 200,000 government pensioners who retired at or before the age of 60.

The government workers who retired early in life did nothing wrong. They made an economic decision that is lucrative and fair game under current law. But the state can no longer afford to offer these benefits.

Unlike their private sector counterparts, Illinois government workers are able to retire in their 50s while collecting most of their final average salary. This puts a tremendous strain both on taxpayers and the pension systems themselves.

It’s unfair to force taxpayers to bail out a broken pension system that allows government workers to retire a decade or more before they can. It’s also not fair that young government workers are trapped in a pension system that may collapse before they reach retirement age.

Early retirements bankrupting all five systems

Early retirements combined with large final salaries are bankrupting all five state pensions systems.

There are more than 200,000 current retirees across Illinois’ five state retirement systems. More than 60 percent of Illinois government pensioners retired before the age of 60. The average pension for workers who retired before the age of 60 with at least 30 years of service credit is $63,424.

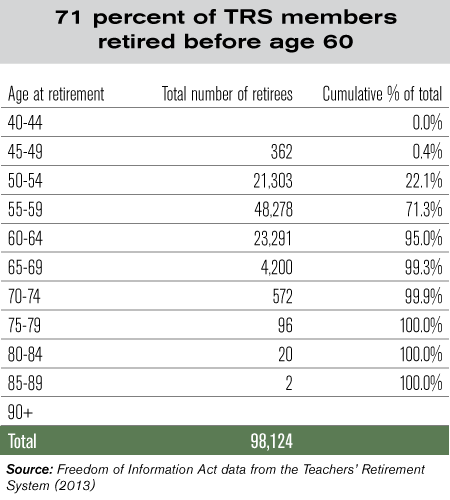

Teachers’ Retirement System

There are more than 98,000 current retirees in Illinois’ Teachers’ Retirement System, or TRS – Illinois’ largest state pension fund. TRS members include Illinois’ local teachers and educational administrators, excluding the city of Chicago. Members of TRS with 35 years of service can retire at age 55 and still draw a starting pension equal to 75 percent of their final average salary.

More than 71 percent of TRS members retired before the age of 60. The average pension for TRS members who retired before the age of 60 with at least 35 years of service is $70,491.

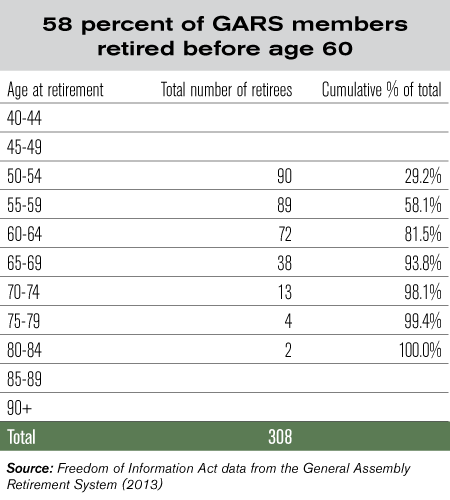

General Assembly Retirement System

There are more than 300 current retirees in Illinois’ General Assembly Retirement System, or GARS. GARS members include members of the Illinois General Assembly and other constitutional officers. Members of GARS can retire at age 55 with 20 years of service and still draw 85 percent of their final average salary.

More than 58 percent of GARS members retired before the age of 60. The average pension for GARS members who retired before the age of 60 with at least 20 years of service is $83,974.

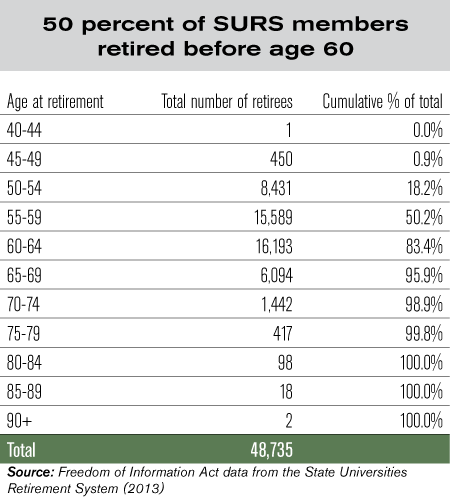

State Universities Retirement System

There are more than 48,000 current retirees in Illinois’ State Universities Retirement System, or SURS. SURS members include professors, teachers, administrators, and many service and clerical workers employed in public universities, community colleges and other qualified state agencies. Members of SURS can retire at any age with 30 years of service and still draw 66 percent of their final average salary.

More than 50 percent of SURS members retired before the age of 60. The average pension for SURS members who retired before the age of 60 with at least 30 years of service is $69,111.

State Employees’ Retirement System

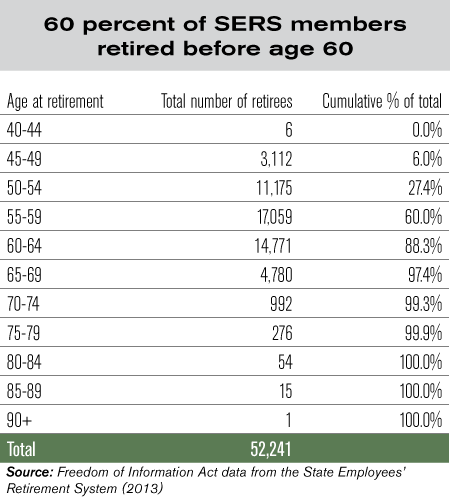

There are more than 52,000 current retirees in Illinois’ State Employees’ Retirement System, or SERS. SERS members include employees of various state-level offices and departments. Members of SERS covered by Social Security can retire at age 60 with 25 years of service and still draw 55 percent of their final average salary. Members of SERS not covered by Social Security can retire at age 60 with 25 years of service and still draw 41.75 percent of their final average salary.

Sixty percent of SERS members retired before the age of 60. The average pension for SERS members who retired before the age of 60 with at least 25 years of service is $46,972. However, most of these retirees also receive Social Security.

Judges’ Retirement System

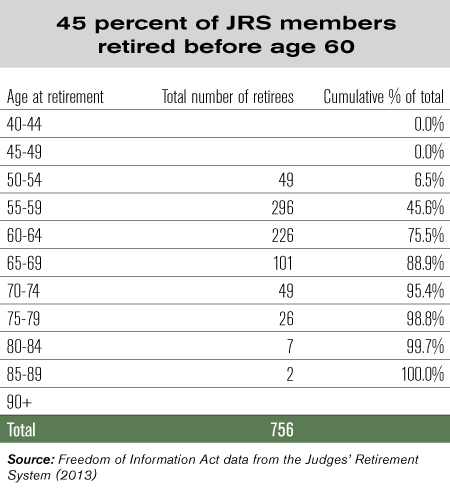

There are more than 750 current retirees in Illinois’ Judges’ Retirement System, or JRS. Members include Illinois judges across Illinois. Members of JRS can retire at age 60 with 10 years of service and still draw 35 percent of their final average salary. However, a majority of judges do not fit this category. Nearly half of JRS members retire with at least 20 years of service.

More than 45 percent of JRS members retired before the age of 60.7

THE SOULTION

State lawmakers recognized the importance of reforming the current retirement age when they enacted changes to the pension program – which included increasing the retirement age to 67 – for new employees starting after January 2011. But those reforms left out the majority of Illinois workers and retirees.

Lawmakers in Illinois should follow the lead of Rhode Island’s 2011 pension reform and align the retirement age with the Social Security retirement age – 67 years old – while still protecting workers who are nearing retirement under current law.

To protect workers currently nearing retirement, the new retirement age should be discounted proportionally based on how close workers are to retirement. The closer employees are to their current legal retirement age, the fewer additional years should be added to that retirement age, provided the new age should be no lower than 59.

Government workers should be free to retire when they wish, but should not begin collecting a pension until they have reached the Social Security retirement age. Illinois simply can’t afford to have government workers retiring at 54 and collecting millions in pension benefits.

WHY IT WORKS

If Illinois lawmakers are serious about pension reform, they will align the government worker retirement age with those in the private sector.

Following Rhode Island’s pension reform by aligning the retirement age with Social Security ensures that older workers near retirement will be affected less, but that the retirement age is equitably increased to protect Illinois’ pension system from insolvency.