Medicaid is one of Illinois government’s largest and fastest-growing expenses, accounting for more than 28 percent of the state’s total operating budget.1 It has also been a prime target of waste, fraud and abuse, earning a “high risk” designation from the U.S. Government Accountability Office.2

Most states, including Illinois, have focused fraud-prevention efforts on provider fraud. This is despite the fact that the U.S. Department of Health and Human Services reports it is eligibility errors that account for the vast majority of improper payments made by the Medicaid program, not provider errors.3,4

Illinois took significant steps in 2012 to rein in waste, fraud and abuse by launching new efforts to improve the Medicaid program’s integrity. Those reforms have been wildly successful, ensuring only those truly eligible for Medicaid benefits are enrolled in the program and saving taxpayers millions of dollars.

But there remains room for significant improvement. Under the leadership of former Gov. Pat Quinn, the state weakened the role of the independent experts hired to assist the state in improving program integrity. The state also limits eligibility monitoring to just once per year, despite the fact that many life circumstances that could affect eligibility often occur more frequently.

The Department of Healthcare and Family Services and the Department of Human Services should immediately revise their policy manuals to require more frequent data matches for all individuals enrolled in Medicaid and other welfare programs. This monitoring can be phased in, starting with the highest-risk cases and the most frequently updated databases. To deter eligibility fraud and encourage compliance with income reporting, the departments should also forward all cases canceled due to fraud or misrepresentation to the appropriate authorities for prosecution and benefit recovery.

Gov. Bruce Rauner should also seek greater flexibility in utilizing independent eligibility specialists during contract negotiations. Although statutory authority is not necessary to implement these changes, lawmakers can assist implementation by providing the executive branch with greater flexibility and express authorization.

The problem

In 2010, the Office of Inspector General at the Illinois Department of Healthcare and Family Services conducted a comprehensive audit of the state’s passive redetermination process.5 Under this process, Medicaid enrollees simply receive a letter telling them their eligibility will continue unless and until they proactively tell state officials that they are no longer eligible.6

The audit found that 34 percent of randomly selected Medicaid files contained eligibility errors.7 The vast majority of errors were attributed to clients refusing to report information affecting eligibility, mostly in the areas of income and other basic eligibility requirements, such as citizenship, residency and household composition.8 As a result, the inspector general recommended the state immediately abandon the passive redetermination process.9

A subsequent report by the Illinois auditor general found that state workers consistently failed to protect program integrity.10 The auditor general’s report identified several case files that were missing evidence that income had ever been verified.11 For others, state workers did not bother to collect paystubs at all and simply “verified” applicants’ wages verbally or through handwritten notes.12 Other files were missing evidence the state had ever verified Social Security numbers, citizenship or even residency.13 In fact, some files were missing applications altogether.14

Those problems were just for the eligibility checks the state actually performed. The auditor general’s report also noted that between 15 and 20 percent of Medicaid cases were overdue for their annual determination.15 The delays for these cases ranged anywhere from three months to more than five years.16

The Medicaid program’s eligibility verification processes were in a state of disarray. Taxpayers were paying millions of dollars to provide welfare benefits to individuals who were no longer eligible and, in some cases, may have never been eligible in the first place. By 2012, the Medicaid program was facing a $2.7 billion structural deficit, and every dollar spent on individuals who were ineligible was one less dollar available for the truly needy.

The Medicaid Redetermination Project

In 2012, a large bipartisan majority of the Illinois General Assembly required the Department of Healthcare and Family Services to launch the Illinois Medicaid Redetermination Project.17,18 That project was designed to root out waste, fraud and abuse in the Medicaid program by requiring enhanced eligibility verification for those enrolled in the program.

The state hired an independent vendor to check an assortment of federal, state and commercial databases to verify eligibility for individuals enrolled in Medicaid. The vendor used enhanced data-matching technology to verify and cross-check income, residency, identity, employment, citizenship status and other eligibility criteria for enrollees and applicants.

During the first year of operation, the project identified eligibility errors in thousands of cases, recommending eligibility cancellation in half of the cases reviewed by independent experts.19 A delayed program launch and early contract challenges by the state’s government unions resulted in the vendor being unable to review all the cases it intended to complete. But by the end of the first year, the state had identified and disenrolled roughly 300,000 ineligible individuals from the program as a result of the initiative.20 In the second year, the state disenrolled an additional 400,000 ineligible individuals from the program.21 This represents more than 10 percent of Illinois’ entire Medicaid program removed each year.22

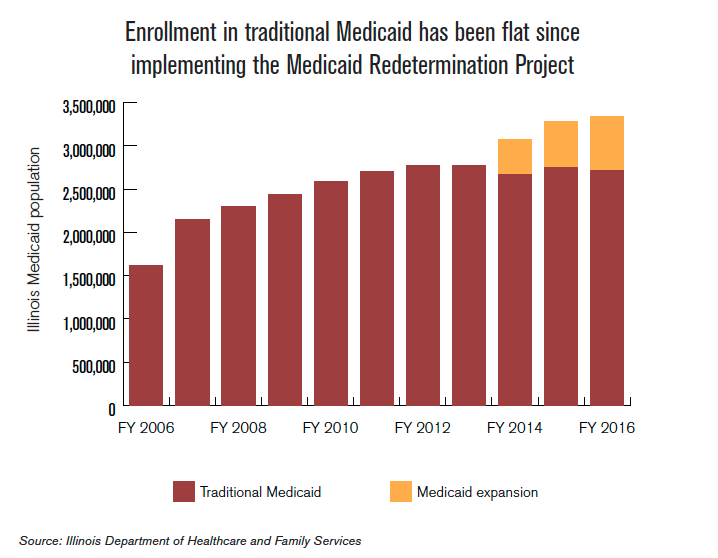

After more than a decade of Medicaid enrollment continuing to spiral out of control, enrollment growth was completely flat in fiscal year 2013 and actually would have declined in 2014 if not for the state’s expansion of Medicaid under the Affordable Care Act.23

The project has also led to significant savings for taxpayers. State officials initially projected that the enhanced program-integrity initiative would save taxpayers $350 million per year. Based on the results of the second year, taxpayers can now expect to save between $390 million and $430 million per year, with greater savings accumulating over time. 25 This represents approximately 2 percent of the state’s nearly $20 billion Medicaid budget.26 As the state rolls out its managed-care reforms, savings are expected to become more predictable, as the state will pay a fixed, capitated rate to managed-care plans for each enrollee, rather than paying health-care providers directly for services provided to Medicaid patients.27

The Medicaid Redetermination Project’s stunning successes have led at least a dozen additional states to propose, consider or implement similar reforms.28

AFSCME challenges Medicaid reforms

Shortly after the state signed a contract with an independent vendor to help review eligibility, the American Federation of State, County and Municipal Employees, or AFSCME, filed a legal challenge to the contract, arguing that the state should have instead hired new, dues-paying state workers to do the job.29 AFSCME’s complaint ignored the fact that state workers’ failure to do the job adequately prompted the state to hire an independent vendor in the first place.

Although then-Gov. Pat Quinn promised for months that he would fight AFSCME’s legal challenge, he signed a backroom deal with the union to curb the vendor’s contract in December 2013.30,31 Quinn signed this deal shortly before his 2014 re-election campaign began heating up. Between 2002 and 2014, AFSCME donated more than $715,000 to Quinn’s campaigns.32 AFSCME also donated more than $2 million to an independent political action committee focused on Quinn’s re-election in the 2014 general election.33

Under the revised agreement, the vendor makes an automated, preliminary eligibility assessment based upon its data-matching software.34 Rather than having the vendors’ eligibility specialists review all data and making a final recommendation, state workers are provided access to the vendor’s data-matching software and reporting system.35 State workers then utilize the available information to make an eligibility determination.36 The state then processes those determinations and individuals who are found no longer eligible or refuse to cooperate are removed from the program.37

Upgrades to further improve program integrity

Illinois took significant steps in 2012 to rein in waste, fraud and abuse by launching new efforts to improve program integrity. But there remains room for significant improvement. Currently, state workers check Medicaid eligibility just once per year, despite the fact that many life circumstances that could impact eligibility often occur more frequently.

Illinois can strengthen program integrity by monitoring eligibility more frequently. Federal data show that individuals in poverty typically remain there for only a short time. Nearly half of individuals who fall into poverty for at least two months will leave poverty within four months, and the vast majority will exit poverty within a year.38 The median length of time individuals spend in poverty is just six to seven months.39

Individuals with lower incomes, the group most likely to receive welfare benefits, also experience much more volatility in their annual earnings.40 For example, more than 40 percent of workers in the bottom income quintile see their earnings rise by more than 25 percent from one year to the next.41 Nearly half of those changes are the result of gaining employment.42 By reducing the amount of time between these periodic checkups, Illinois could identify these income and employment changes sooner.

Although new federal regulations typically limit states to performing redeterminations only once per year, federal law provides states with a workaround that grants additional authority to begin the redetermination process whenever the state receives information that could have an effect on an individual’s eligibility.43,44 Illinois could use this authority to launch the eligibility redetermination process when the state receives information from semiannual, quarterly or even monthly eligibility monitoring that indicates a possible change in income or other eligibility factors.

Illinois already requires employers to submit monthly reports detailing their employees’ wages as part of the unemployment compensation program.45 Employers also submit employment and wage information on all new hires.46 The state and its contractors are currently using this data to weed out ineligible enrollees during annual redeterminations, but could cross-check this and other data more frequently to ensure redeterminations are conducted immediately after changes in income or other factors.

A recent policy change in Georgia gives insight into potential savings Illinois could capture through more frequent eligibility monitoring. According to state officials, performing eligibility checks every six months reduces total Medicaid costs by approximately 1.2 percent, compared to annual eligibility checks.47 In Illinois, semiannual eligibility monitoring could provide another $225 million to $250 million per year in taxpayer savings, in addition to the funds already being saved through the Medicaid Redetermination Project. To put this in perspective, the state saved approximately $240 million in fiscal year 2013 by cutting provider reimbursement rates by roughly 2.7 percent.49

More active monitoring in Medicaid could also have spillover effects in other welfare programs, leading to additional savings. The majority of Medicaid enrollees are also receiving other types of welfare, including cash assistance, food stamps or public housing, among other benefits.50,51 By flagging those wrongfully receiving Medicaid, Illinois could identify related fraud and abuse by the same individuals receiving other types of state-administered welfare benefits.

Conclusion

Medicaid is one of Illinois’ largest and fastest-growing line items, crowding out resources for all other state priorities. Sadly, it has also been a prime target for wasteful spending. Illinois took significant steps in 2012 to rein in waste, fraud and abuse by launching new efforts to improve program integrity. Those reforms have been wildly successful, ensuring only those truly eligible for Medicaid benefits are enrolled in the program and saving taxpayers millions of dollars. Other states are now looking to follow Illinois’ lead.

But there remains room for significant improvement. Under the leadership of former Gov. Pat Quinn, the state weakened the role of the independent experts hired to assist the state in improving program integrity. The state also limits eligibility verification to just once per year, despite the fact that many life circumstances that could impact eligibility often occur more frequently.

The Department of Healthcare and Family Services and the Department of Human Services should immediately revise their policy manuals to require more frequent data matches for all individuals enrolled in Medicaid and other welfare programs. This monitoring can be phased in, starting with the highest-risk cases and the most frequently updated databases. In order to deter eligibility fraud and encourage compliance with income reporting, the departments should also forward all cases cancelled due to fraud or misrepresentation to the appropriate authorities for prosecution and benefit recovery.

Gov. Bruce Rauner should also seek greater flexibility in utilizing independent eligibility specialists during contract negotiations. Although statutory authority is not necessary to implement these changes, lawmakers can assist implementation by providing the executive branch with greater flexibility and express authorization.

Illinois policymakers should act to upgrade the state’s successful Medicaid Redetermination Project, as these reforms could save taxpayers up to $250 million per year. These changes are critical steps in protecting resources for the most vulnerable and respecting taxpayers. Every dollar spent on individuals no longer eligible for welfare is a dollar stolen from the truly needy, from classrooms, from public safety or from necessary tax relief.