THE PROBLEM

The focus of Illinois’ current education funding system is not what’s best for students – it’s who controls the flow and distribution of taxpayer money.

Nowhere is this more evident than in the state’s General State Aid, or GSA, for education budget – Illinois’ largest single education appropriation for K-12 education. Originally intended to support the state’s neediest school districts, the $4.8 billion GSA has become, in a single decade, a twisted mess of formulas that provide large, special subsidies to a few select districts.

As recently as 2000, the vast majority of the GSA was distributed to school districts that demonstrated need. Nearly 90 percent of aid went to districts that lacked the local funds to meet the state’s minimum funding standards. But because of changes to the GSA formulas, billions in special subsidies now flow to Chicago and districts in Cook County and its collar counties.

To understand how this is happening, it’s important to realize the GSA is set up to distribute funds based on property wealth and the low-income population in each school district. When a district has lower reported property wealth, it receives more state aid. Throughout the GSA formulas, however, are special laws and loopholes districts can take advantage of to underreport their property wealth.

In 2013, a majority of more than $500 million in special state education subsidies related to property wealth went to just 40 districts – all in Cook County and its collar counties. Chicago’s take of the total was more than $280 million. In contrast, downstate districts received just 3 percent of the $500 million.

Another one of these loopholes – related to tax increment financing, or TIF, districts – allows school districts statewide to not report more than $18 billion in property value located in special economic zones. Chicago excludes the most – it does not report more than $10 billion of property located in TIFs. Cook County and its collar counties exclude more than $5 billion.

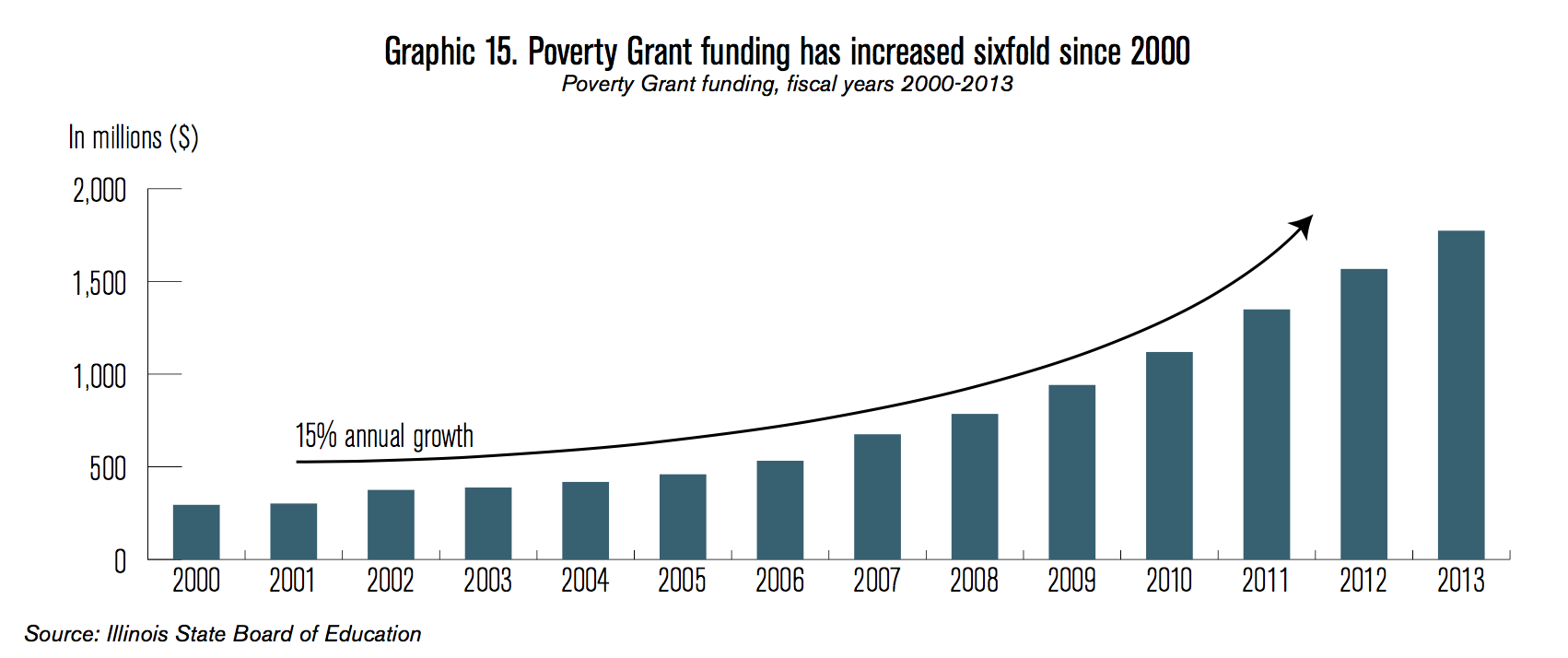

And the formulas that determine who qualifies as poor have broadened, causing the state to consider thousands more students as low-income. In 2000, the amount of GSA funds dedicated to support low-income children was just less than $300 million. Today, support for low-income students has skyrocketed to $1.8 billion.

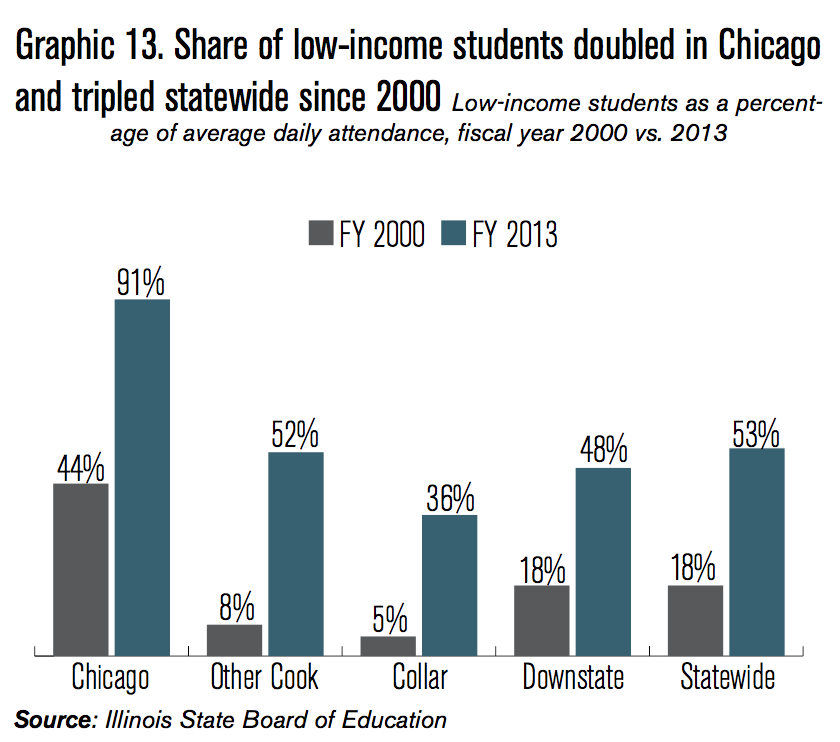

These formula changes have disproportionately benefited Chicago, Cook County and its collar counties. Today, more than 90 percent of Chicago students are considered poor – in 2000, only 44 percent of Chicago students were considered poor.

THE SOLUTION

All special subsidies need to be ended immediately — the solution to Illinois’ funding issues isn’t about tweaking the formulas and making fixes so that political power between different regions in the state can be temporarily equalized. To fix Illinois’ broken education system, financial power needs to be taken away from politicians and special interests. As long as they direct the system, it won’t be about accountability – it will be about dollars and who controls them.

The only real solution is to transition to a new education funding system – one that provides parents with increasing control over the flow and distribution of money.

Illinois doesn’t need to start from scratch. Alternatives already exist and have proven effective in other states across the country, including Wisconsin and Indiana.

WHY IT WORKS

A system where parents control the flow and distribution of money empowers families to hold schools accountable. And with more alternatives, parents can determine which school is best for their children’s needs.

It’s time for parents to control the flow and distribution of money in education. Only then will the struggle be about what really matters – how to educate Illinois children.