Workers’ compensation is a significant cost to Illinois taxpayers and drains scarce tax dollars from government coffers. A previous report in this series estimated the direct cost of workers’ compensation to state, county and municipal governments is $402 million in worker payouts per year.1

Building upon those findings, this report estimates that the total cost of workers’ compensation to all units of government in Illinois is $982 million per year. These costs comprise $255 million at the state level and $727 million at the local level. Reforming Illinois’ workers’ compensation system could generate nearly $300 million in taxpayer savings.

This report uses sample data from local governments to estimate the annual cost of workers’ compensation to Illinois taxpayers. It also uses a formula to estimate the cost of workers’ compensation for public construction projects.

According to the new findings in this report, the annual cost of workers’ compensation for school districts and park districts is $122 million per year, and $102 million per year for various other units of local government. The estimated cost of workers’ compensation on public construction projects is $356 million per year.

These costs, combined with the existing $402 million state, county and municipal governments pay in workers’ compensation costs, bring the total taxpayer cost of workers’ compensation to $982 million.

These findings drive home the point that Illinois politicians must reform the workers’ compensation system to ensure better stewardship of tax dollars.

There are a variety of reform proposals that would lead to better overall stewardship of taxpayer dollars, along with better results for workers and employers. Reform proposals specifically targeted for local governments include adopting the federal definition of catastrophic injuries for the Public Safety Employee Benefits Act, and eliminating the effective bump in take-home pay given to some injured government workers under the Public Employee Disability Act. In addition, governments should structure light-duty programs to bring injured workers back on the job doing light work.

Additional areas ripe for reform in the workers’ compensation law include:

- Repealing the majority of former Gov. Rod Blagojevich’s 2005 workers’ compensation law;

- Tying the medical fee schedule to Medicare reimbursement rates or private insurance reimbursement rates;

- Prohibiting physician dispensing beyond the first few days of an injury, which would eliminate the financial incentive for doctors to overprescribe opioids;

- Putting Illinois’ maximum wage-replacement rate in line with other states’ by capping it at 100 percent of the state’s average weekly wage;

- Putting Illinois’ minimum wage-replacement rates in line with other states’ for temporary total disability, permanent partial disability and permanent total disability so workers do not receive effective pay hikes for being injured;

- Giving more weight to American Medical Association guidelines in determining the amount of injury awards; and

- Clarifying the definitions and application of “traveling employee” and injury causation to limit judicial activism in interpreting the law.

As a caveat, Illinois’ workers’ compensation system costs taxpayers in other ways that lie beyond the scope of this report. One example is the cost of workers’ compensation for nonprofits that receive state money to provide services to the needy, such as the Ray Graham Association. According to President and CEO Kim Zoeller, the Ray Graham Association has 400 employees who provide care for 2,000 Illinoisans with intellectual and developmental disabilities. After one substantial claim, the Ray Graham Association now pays $1 million per year in workers’ compensation costs.2

Illinois’ unbalanced workers’ compensation system also deprives state and local governments of untold millions in tax revenues that the increased investment and employment from a healthier business environment would otherwise generate. This is especially true of the industrial sector. However, those items are beyond the scope of this report.

Workers’ compensation is a state and local government budget issue

On Feb. 13, 2015, Gov. Bruce Rauner issued Executive Order 15-153 to create the bipartisan Local Government Consolidation and Unfunded Mandates Task Force. The purpose of the task force was to study issues of local government consolidation and unfunded mandates. On Dec. 17, 2015, Lt. Gov. Evelyn Sanguinetti released a study on cost drivers for local governments, which was the result of the executive order.4

The study included a survey of more than 500 units of local government to assess how costly and burdensome local governments perceived various state mandates to be. The survey found that workers’ compensation is one of the most significant unfunded mandates that concern local governments. In particular, the survey results showed that workers’ compensation is the third-most burdensome mandate for municipalities, and the fourth-most costly mandate for counties.5

Furthermore, townships named workers’ compensation as the sixth-most expensive mandate, with an average cost of $25,000-$50,000 per year. Fire protection districts said workers’ compensation is the costliest mandate, totaling an average of $25,000-$50,000 per year. School districts ranked workers’ compensation No. 4 for most expensive mandates, with an average cost of $50,000-$150,000 per year. And community college districts viewed workers’ compensation as the third-most costly mandate, with an average cost of $50,000-$150,000 per year.

In addition, workers’ compensation imposes significant costs on state government. In 2012, Illinois Attorney General Lisa Madigan wrote6 a brief to explain the challenges faced by her office in defending the state against workers’ compensation claims by state employees. In 2015, state Rep. Mark Batinick, R-Plain eld, requested workers’ compensation data from Illinois’ Legislative Research Unit and authored an article in The (Springfield) State Journal-Register7 about how the workers’ compensation system drives up taxpayer costs at both the state and local levels. Batinick estimated that Illinois taxpayers pay an excess of $190 million beyond what they would pay if the state’s costs were in line with costs in the average American state.

Thus, workers’ compensation for public employees and for workers on public works projects is clearly a significant cost for Illinois taxpayers. Not only do taxpayers bear the burden of paying for government wages, health insurance, pensions and other benefits, but Illinois taxpayers also have to fund workers’ compensation costs that surpass those among the other states in the region. There are two main reasons workers’ compensation costs are so high for Illinois taxpayers:

- Illinois’ workers’ compensation costs are out of line with those of other states because Illinois’ laws and judicial rulings have created a much more expensive system than those in surrounding states. Many of the legal cost drivers are codified in Illinois’ workers’ compensation statutes. Additional costs come from statutory requirements that pertain specifically to injuries for government employees. And still more costs are added by expansive judicial rulings that extend workers’ compensation to situations many states don’t find compensable.

- Illinois has 7,000 units of government, by far the most of any state in the nation.8 Duplicative layers of government increase payroll costs, which drive up workers’ compensation costs. Some areas of the state have more than a dozen layers of government. Each layer of payroll can add to the overall workers’ compensation bill.

Simply put, Illinois’ workers’ compensation system is a taxpayer budget issue for state government, local governments and public construction projects. The extraordinary cost to Illinois taxpayers derives from statutory differences compared with other states, expansive, pro-plaintiff judicial rulings, and excess layers of government that add to total government payrolls.

Adding up the taxpayer cost of workers’ compensation

The cost of workers’ compensation to taxpayers permeates Illinois’ many layers of government and various government payroll cost structures. This report looks at the direct cost to taxpayers for workers’ compensation payments made to state, municipal and county workers. In addition, it looks at the other layers of government spending with additional workers’ compensation costs, including:

- Illinois’ 859 school districts9

- Illinois’ municipal, county, township and other special police and fire districts

- Illinois’ 1,431 townships10

- Illinois’ 3,227 special district governments11

Publicly funded construction projects governed by Illinois’ Prevailing Wage Act

WORKERS’ COMPENSATION COSTS FOR SCHOOL DISTRICT AND PARK DISTRICT GOVERNMENTS: ESTIMATED $122 MILLION PER YEAR

School district government: Estimated $102 million

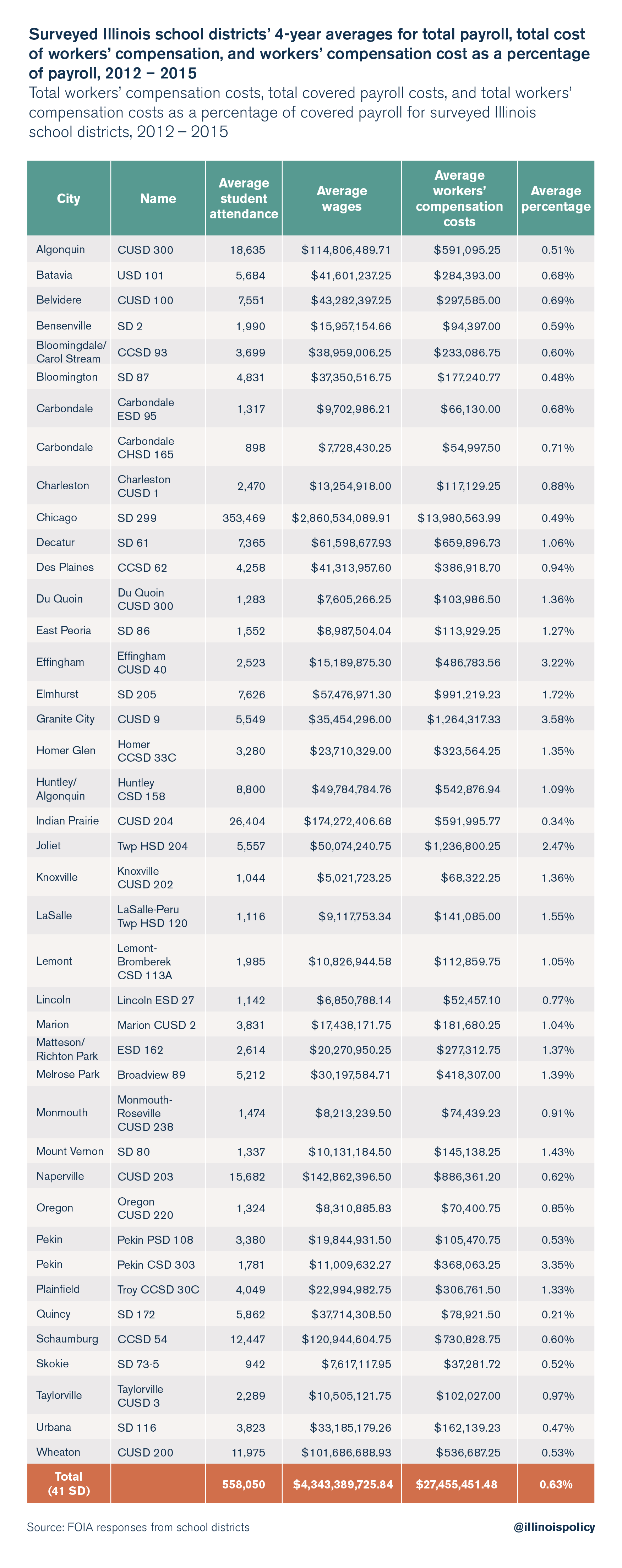

The school districts covered in this study represent nearly 560,000 Illinois students, or more than a quarter of all Illinois students. The school districts range in size from Carbondale (898 students) to Chicago (353,469 students).12

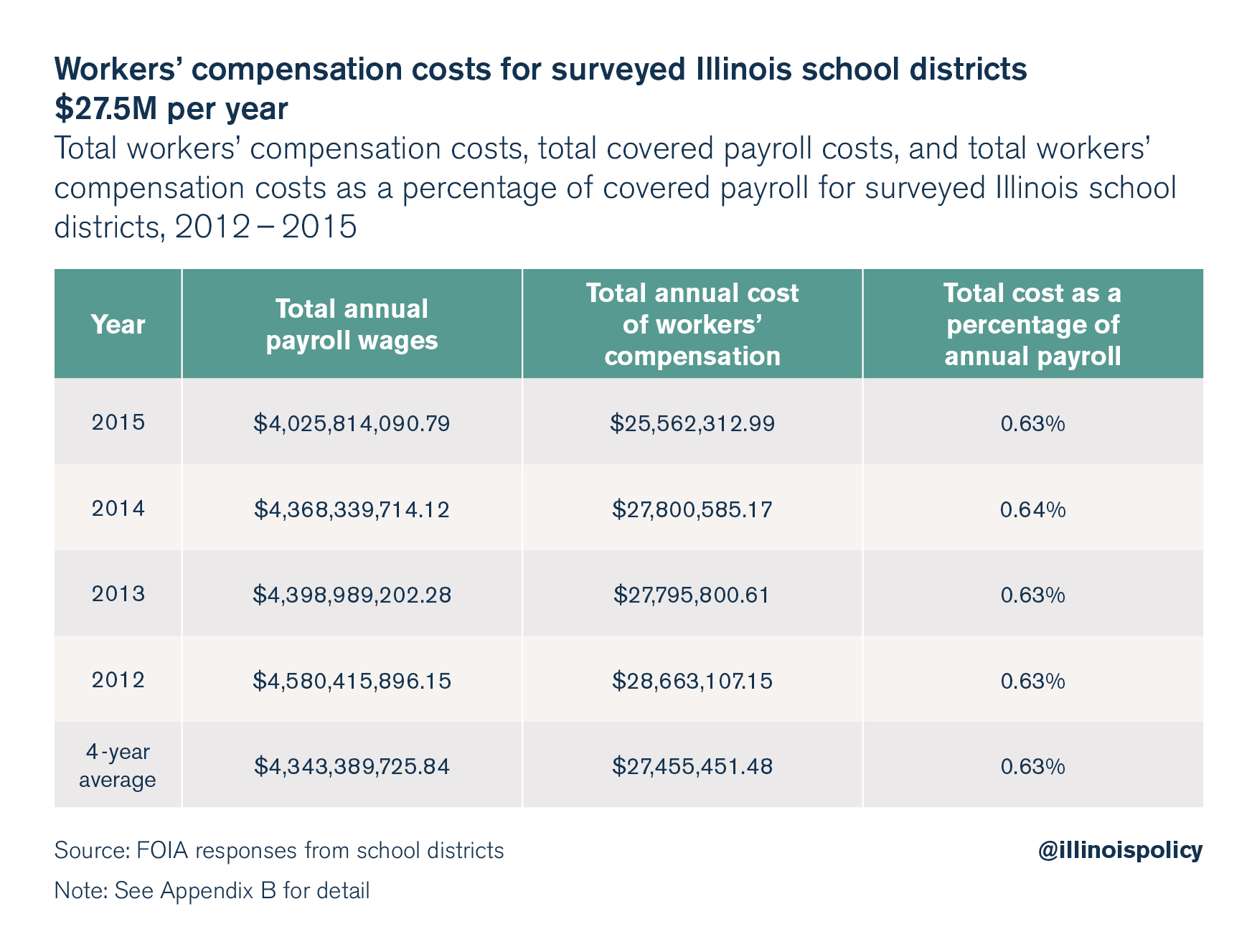

The total annual wages covered by these school districts averaged $4.3 billion per year over the four years from 2012 through 2015. The total annual workers’ compensation costs for these school districts averaged $27.5 million per year over the four years from 2012 through 2015, which equals 0.63 percent of average annual payroll.

These school districts, which represent 27 percent of the student population of Illinois, have an average annual cost of $27.5 million per year. If the same cost rate is projected to include the remaining areas covering the other 73 percent of the Illinois student population, the total school district cost for workers’ compensation is an estimated $102 million per year.

Park district government: Estimated $20 million

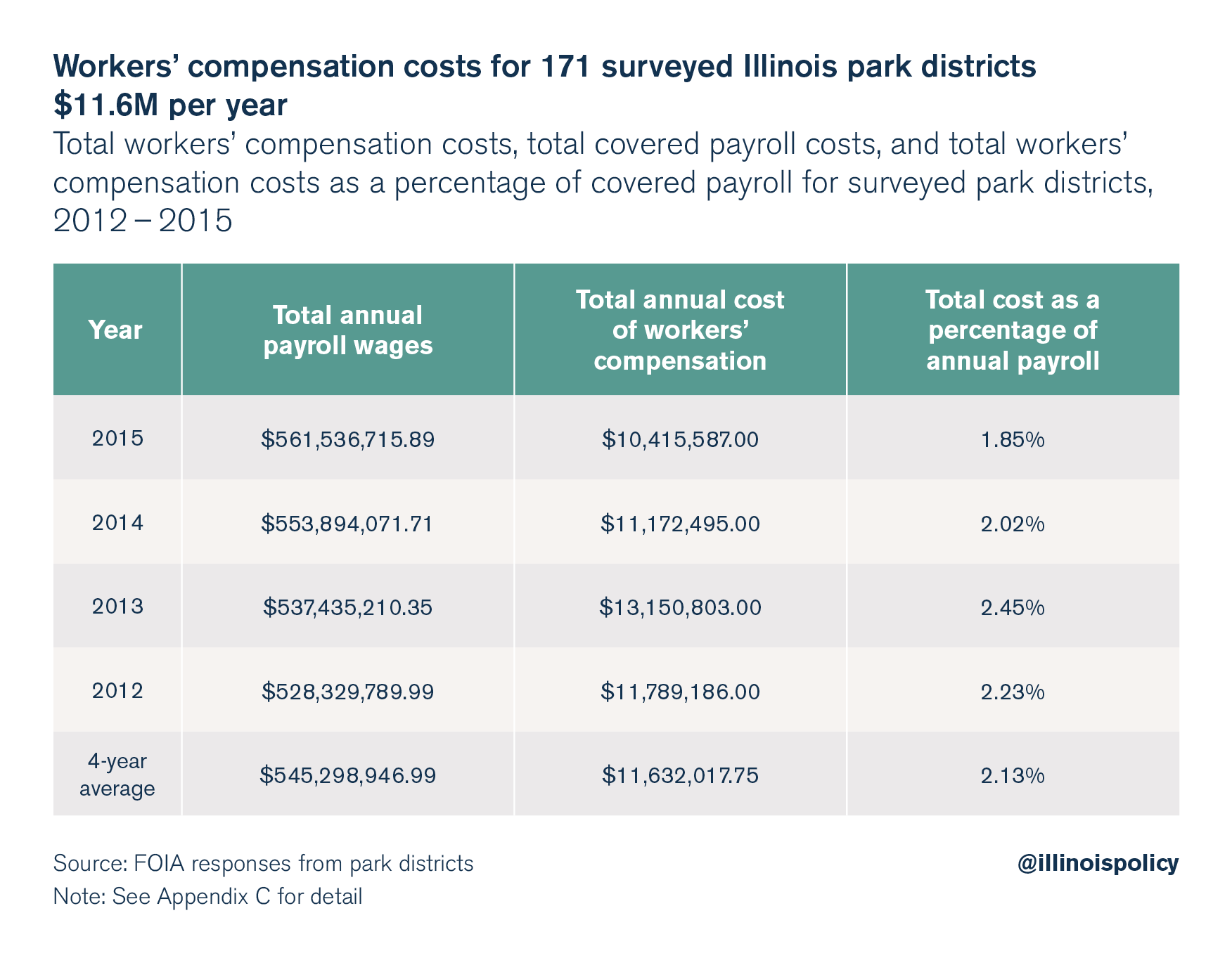

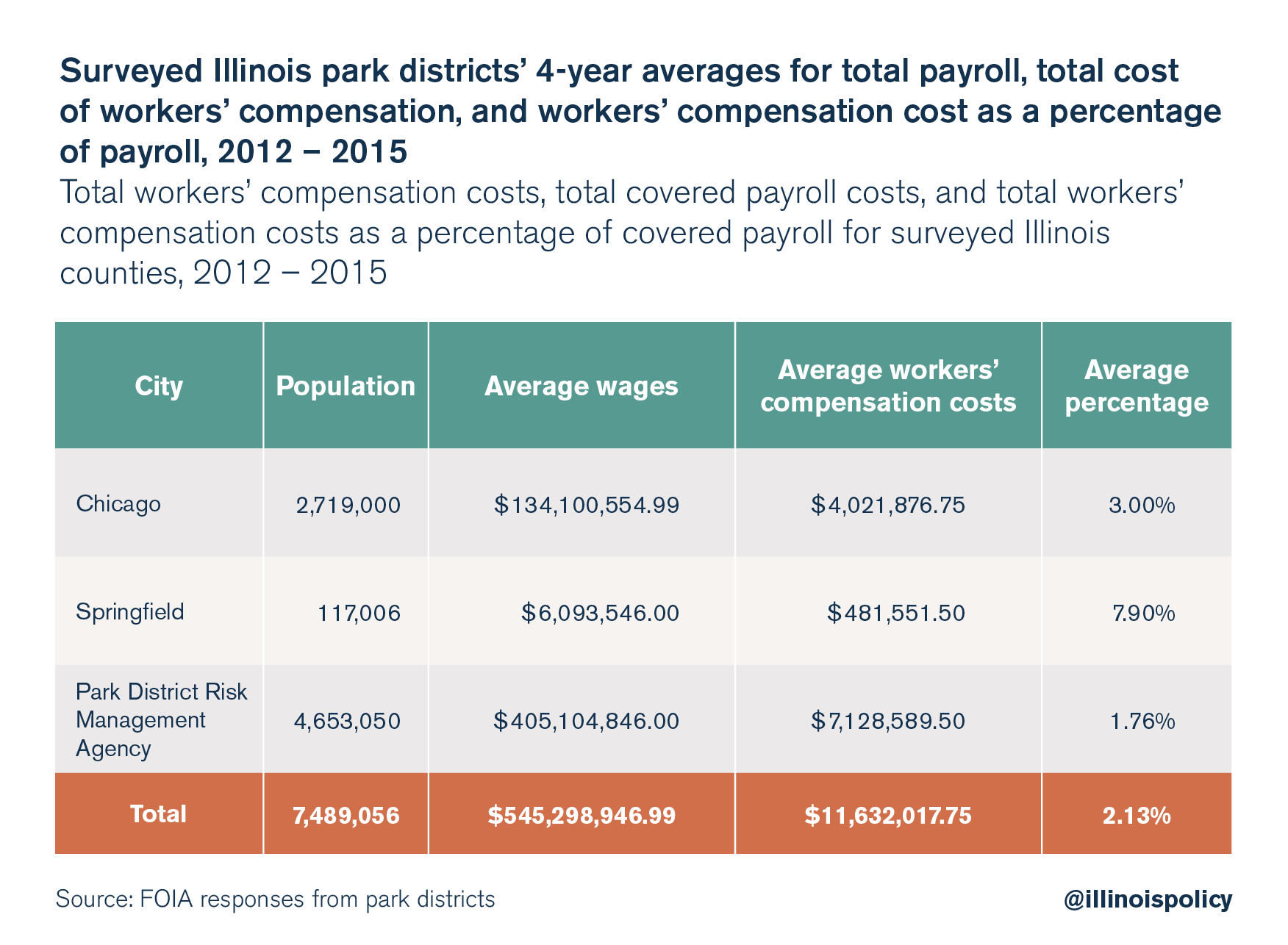

A total of 171 sample park districts covering 7.5 million Illinois residents returned data responsive to Illinois Policy Institute’s Freedom of Information Act request. These park districts paid an average of $11.6 million per year for workers’ compensation on an average combined annual payroll of $545 million. Workers’ compensation costs were thus 2.13 percent of average annual payroll for park districts.

These park districts, which cover areas that contain 58 percent of the population of Illinois, have an average combined annual payroll cost of $545 million and an average annual workers’ compensation cost of $11.6 million. If the same cost rate is projected onto areas covering the other 42 percent of the Illinois population, the total workers’ compensation cost for park districts is an estimated $20 million per year on $940 million of total payroll.

WORKERS’ COMPENSATION COSTS FOR MUNICIPALITIES AND COUNTIES: ESTIMATED $270 MILLION PER YEAR

Workers’ compensation costs for municipalities are an estimated $225 million per year, covering $5.4 billion of annual payroll costs. Workers’ compensation thus amounts to 4.17 percent of municipalities’ annual payroll costs. Furthermore, workers’ compensation costs for county governments total an estimated $45 million per year, covering $3.2 billion of annual payroll costs, which amounts to 1.42 percent of counties’ annual payroll costs.13

DIRECT WORKERS’ COMPENSATION COST FOR ALL OF LOCAL GOVERNMENT: ESTIMATED $494 MILLION PER YEAR

Based on these estimates, the total annual cost of workers’ compensation for municipal government ($225 million), county government ($45 million), school districts ($102 million) and park districts ($20 million) across Illinois is $392 million per year. These are many of the most significant layers of government in Illinois.

All told, the data contained in this study cover an estimated $5.4 billion of annual municipal payroll, $3.2 billion of county payroll, $15.9 billion of school district payroll and $0.9 billion of park district payroll, which add up to $25.4 billion of local government payroll across Illinois. Bureau of Labor Statistics payroll wage data for 2015 show that local governments in Illinois had total payrolls of $28.7 billion for the year.14 Thus, approximately $3.3 billion of local payroll is not covered by these estimates, making up the fraction of local government spending on townships, special police and fire districts, and other special districts.

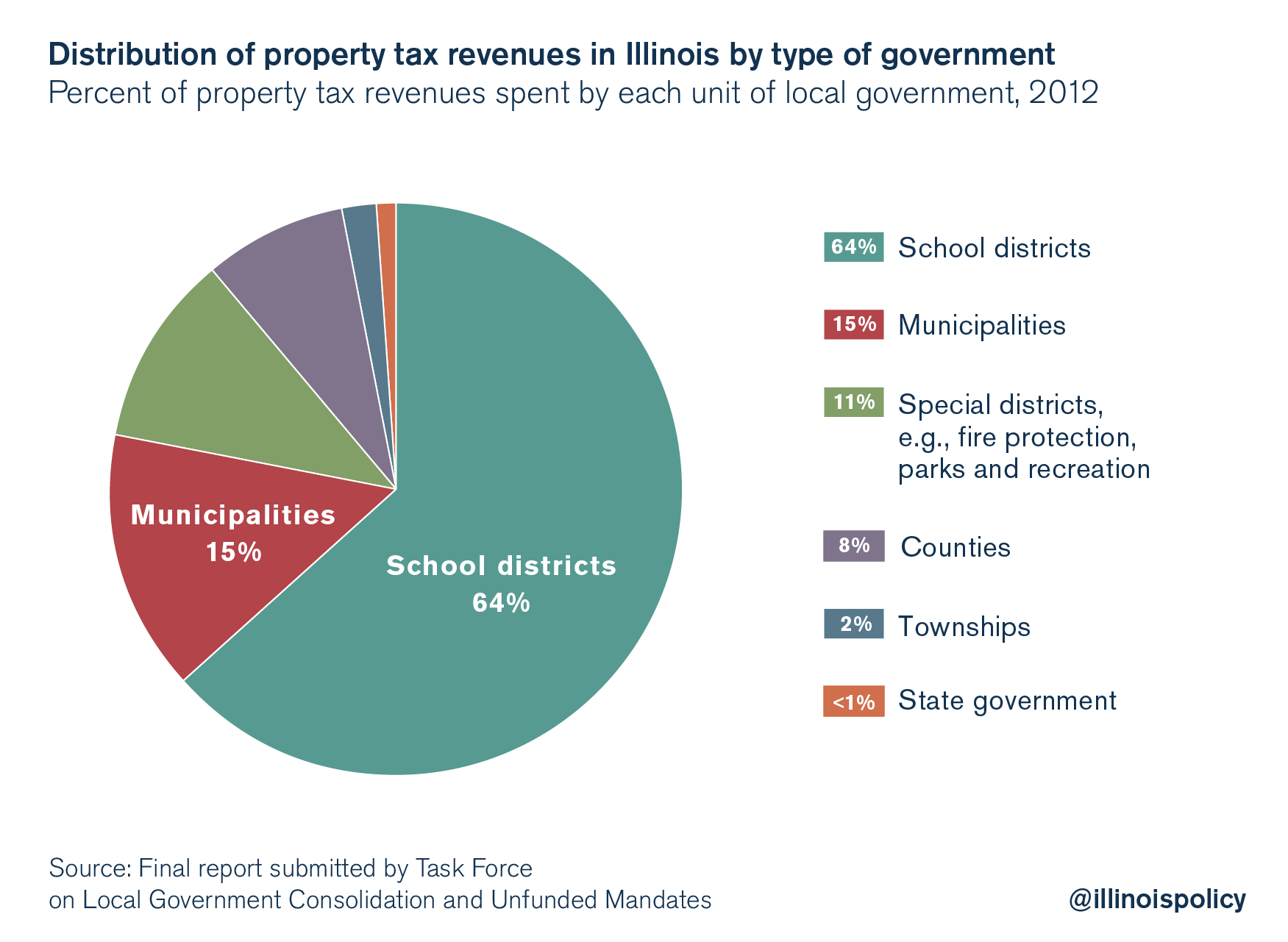

Using the distribution of property tax revenue in Illinois as a guide, this breakdown seems roughly correct. Townships receive 2 percent of property tax revenue, and special districts receive 11 percent. However, park districts are already accounted for in this study and would be removed from special districts.

This study was not able to obtain reliable data for police districts, fire districts or townships. However, if the remaining $3.3 billion of local payroll is assumed to have workers’ compensation costs equal to the average of municipalities and park districts (3.1 percent of payroll), then the additional cost of workers’ compensation for this local payroll would be $102 million per year.

The 3.1 percent blended municipal/park district ratio is used as an estimate because combined townships, police districts, fire districts and other special districts are assumed to resemble combined municipalities and park districts, respectively. In particular, public safety workers in police and fire districts should have disproportionately high workers’ compensation costs, which are seen in municipalities where public safety employees are on the municipal payroll. In fact, fire districts that were surveyed by Sanguinetti’s office identified workers’ compensation as their most burdensome unfunded mandate, designating workers’ compensation as a more costly burden than municipalities did.

Some significant local government funding doesn’t come from property taxes. Those nonproperty tax funds include: state funding for schools, money from the Local Government Distributive Fund for municipalities and counties, sales taxes for municipalities and counties, distributions of personal property replacement taxes, and other funds that local governments ultimately spend. However, these are not distributed in such a way that would substantially alter the ratios implied by the chart of property tax distributions.

DIRECT WORKERS’ COMPENSATION COSTS FOR STATE GOVERNMENT: $132 MILLION PER YEAR

Workers’ compensation costs for state government are an estimated $132 million per year, covering $5.3 billion of annual payroll costs. This amounts to 2.5 percent of annual covered state payroll costs.15

WORKERS’ COMPENSATION IMPLIED TAXPAYER COSTS FOR STATE AND LOCAL PUBLIC WORKS CONSTRUCTION PROJECTS: ESTIMATED $356 MILLION PER YEAR

One final area for which taxpayers pay significant workers’ compensation costs is public works projects, which are largely covered under Illinois’ prevailing wage law. Construction labor costs come with especially high workers’ compensation costs.16 The cost of workers’ compensation is incorporated in the bids that contractors and construction companies submit for public works projects.

According to 2013 data from the U.S. Census Bureau, Illinois state government spent $3.7 billion on construction, while local governments spent $7 billion, for a total of $10.7 billion in annual construction costs.17 Previous studies have estimated the labor cost for public works projects from 2518 – 50 percent19 of total construction costs, which can depend on the type of project and on whether the construction project is new construction (lower labor-to-total-cost ratio) or a maintenance project (higher labor-to-total-cost ratio). For estimation purposes, labor costs are assumed to equal 37.5 percent of total cost.

Under this assumption, the total labor cost for public works projects in Illinois is $4 billion per year. Direct wages make up approximately 64 percent of labor costs, with pension, health care and other items making up the remaining 36 percent, based on prevailing wage data.20 Thus, the direct wage cost from which workers’ compensation would be calculated is approximately $2.6 billion per year.

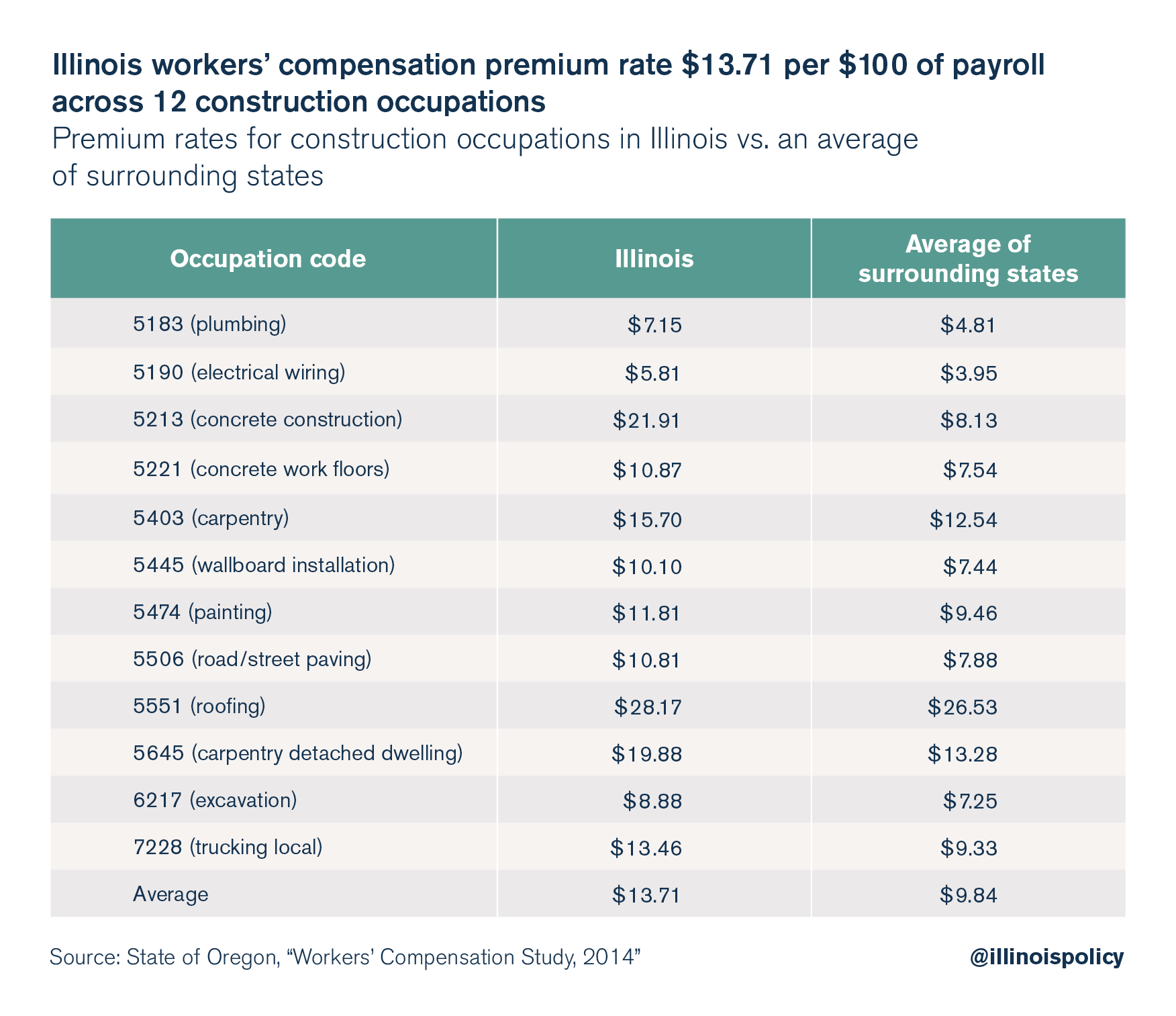

The state of Oregon’s 2014 workers’ compensation report includes premium rates for a variety of occupations, including 12 common occupations for construction and public works projects.21 These occupations have an average premium rating of $13.71 per $100 of payroll in Illinois, compared with an average of $9.84 per $100 of payroll in surrounding states.

This works out to a cost of $356 million of workers’ compensation for public works projects (13.71 percent of $2.6 billion), with $123 million for state and $233 million for local projects.

WORKERS’ COMPENSATION COSTS FOR ALL UNITS OF GOVERNMENT, ESTIMATED $982 MILLION PER YEAR

The total taxpayer costs of workers’ compensation for all units of government amount to an estimated $982 million per year. That can be broken down into $255 million in state costs and $727 million in local costs. This is based on a direct cost to the state of $132 million for public employees and an additional cost of $123 million for public works projects, and a direct cost to local governments of $494 million, plus an additional cost of $233 million for public works projects.

Potential savings

A previous study found that Illinois’ workers’ compensation rates are a third higher than the average in surrounding states.22 For construction occupations, Illinois is 40 percent higher according to data on 12 construction occupations from the 2014 Oregon report. This works out to an additional estimated $265 million in costs for taxpayers.

Detailed below is a series of proposals for cost savings that would bring Illinois’ costs in line with surrounding states’. And Gov. Bruce Rauner has put forward additional reform proposals.23 If Illinois’ costs simply fell to the average in surrounding states, state and local governments could save on workers’ compensation costs.

If Illinois’ costs decreased to levels near those in surrounding states, the state would save an estimated $75 million, and local governments would save an estimated $190 million. In addition, if Illinois government workers’ compensation costs are unusually high compared with the state’s average workers’ compensation costs, there is potential for more savings.

COST DRIVERS AND PROPOSALS FOR CHANGE

Several factors contribute to the high costs of workers’ compensation in Illinois. First, high medical reimbursement levels, indemnity payments and wage-replacement rates increase costs. The statutory requirements that drive these costs have been described in a previous report24 and are briely summarized below.

Simply put, Illinois’ laws, including the Illinois Workers’ Compensation Act, are out of line with the laws in surrounding states.

Illinois Workers’ Compensation Act

The Illinois Workers’ Compensation Act covers all public employees in Illinois with the exception of police and fire fighters in Chicago. Despite marginal cost-saving changes made to the Illinois Workers’ Compensation Act in 2011, Illinois still has the highest costs in the region. The “2016 Oregon Workers’ Compensation Premium Rate Ranking Summary” ranks Illinois’ as the most expensive system in the Midwest and seventh-most expensive in the country, measuring workers’ compensation costs as a percentage of payroll.25 A broad approach to reforming Illinois’ law is necessary to bring taxpayer costs in line with those in surrounding states.

Among the reforms Illinois needs are further changes to its workers’ compensation statutes. The following proposed revisions to the Illinois Workers’ Compensation Act were addressed in a previous report: 26

- Repealing the majority of former Gov. Rod Blagojevich’s 2005 workers’ compensation law;

- Tying the medical fee schedule to Medicare reimbursement rates or private insurance reimbursement rates;

- Prohibiting physician dispensing beyond the first few days of an injury, which would eliminate the financial incentive for doctors to overprescribe opioids;

- Putting Illinois’ maximum wage-replacement rate in line with other states’ by capping it at 100 percent of the state’s average weekly wage;

- Putting Illinois’ minimum wage-replacement rates in line with other states’ for temporary total disability, permanent partial disability and permanent total disability so workers do not receive effective pay hikes for being injured;

- Giving more weight to American Medical Association guidelines in determining the amount of injury awards; and

- Clarifying the definitions and application of “traveling employee” and injury causation to limit judicial activism in interpreting the law.27

Light duty

State and local governments can achieve cost savings by implementing light-duty work programs to bring injured workers back to work in jobs that would not interfere with recovery from injury. Often an employee collecting workers’ compensation would be able to perform light office work, which would not pose a threat to the employee’s health. For example, the city of Chicago has implemented some improvements in bringing injured police officers back to work, though more remains to be done.28

When a worker returns for light-duty work, workers’ compensation payments are adjusted so that taxpayers cover only the difference between the worker’s previous wages and his or her new wages, assuming the new wages are lower. The state of Illinois should ascertain and implement best practices for light-duty work for workers’ compensation recipients, and local governments should follow suit.

Conclusion

Workers’ compensation is a salient issue for private-sector employers, especially those who have the option to avoid Illinois’ regulatory costs by setting up shop in other states. However, there are two parts of the economy where Illinois’ workers’ compensation costs cannot be avoided, and both involve costs that are covered by taxpayers. Taxpayers cover nearly $1 billion of the cost of workers’ compensation for government employees and workers on public works construction projects each year. The potential for savings is in the hundreds of millions.

There are many reasons to reform workers’ compensation. Changes to the system could result in workers receiving better medical care by ensuring that medical providers, employees and employers all have an incentive to pursue best practices. Reforms could also reduce costly burdens on employers. And the data in this report point to one more reason for reform: Illinois should revise workers’ compensation laws to make government a better steward of scarce tax dollars.

Appendix A – Methodology

This report focuses specifically on the surveyed cost of workers’ compensation to taxpayers for school district and park district employees, and on the estimated cost to taxpayers of workers’ compensation for public works projects.

Illinois school districts and park districts were asked for data related to their workers’ compensation costs through FOIA requests. These requests were sent to a total of 112 school districts of various sizes, and to a sampling of park districts. Estimates in this report are based on the FOIA responses from county and municipal governments that represent a significant portion of Illinois’ population. Some units of government did not reply or did not reply with full information. The Park District Risk Management Association also sent data for 169 park districts represented in its risk pool. Local governments were asked for the following information from the years 2010 – 2015:

- The total annual payroll (full- and part-time)

- The total number of employees (full- and part-time)

- The total cost of workers’ compensation each year (claim payouts and premiums paid)

Part of the above analysis is based on the data received from these FOIA requests.

In total, the FOIA requests resulted in complete information for wages and workers’ compensation payouts for 41 school districts and 171 park districts of various sizes for the years 2012 – 2015. These sample costs can be used to project the total cost onto county and municipal governments across the state. However, these results cover only the cost to school districts and park districts, not the thousands of additional units of government across Illinois. For those remaining units of government, an assumed cost ratio was used, given the similarity of those governments to other types of local government in Illinois.

Furthermore, public works construction projects involve workers’ compensation costs that are ultimately borne by taxpayers. These costs are priced into bids for public construction work. To estimate these costs, an average was taken on premium rates for 12 construction occupations, and this average was multiplied against the estimated direct wage labor costs on public works projects.

Appendix B

Appendix C

Endnotes

- Michael Lucci and Mindy Ruckman, “Workers’ Compensation for State, County and Municipal Workers Costs Illinois Taxpayers $400 Million Per Year,” Illinois Policy Institute, Fall 2016.

- Austin Berg, “Why All Illinoisans Need Action on Workers’ Comp,” Illinois Policy Institute, December 8, 2016.

- Exec. Order No. 15-15, “Executive Order Initiating Consolidation of Local Governments and School Districts, and Eliminating Unfunded Mandates,” February 13, 2015.

- Task Force on Local Government Consolidation and Unfunded Mandates, Delivering Efficient, Effective, and Streamlined Government to Illinois Taxpayers, (December 17, 2015).

- Ibid.

- Illinois Chamber of Commerce, Background on Workers’ Compensation Claims Filed by State Employees and Reforms Proposed by the Office of the Attorney General, (March 2012).

- Mark Batinick, “Illinois Can Find Savings in Workers’ Comp Reforms,” Springfield State Journal-Register, March 4, 2015.

- U.S. Census Bureau, 2012 Census of Governments, Individual State Descriptions: 2012, September 2013, 80.

- Ted Dabrowski and John Klingner, “Too Many Districts: Illinois School District Consolidation Provides Path to Efficiency, Lower Tax- payer Burdens,” Illinois Policy Institute, Spring 2016.

- U.S. Census Bureau, 2012 Census of Governments, 80.

- U.S. Census Bureau, 2012 Census of Governments, 81.

- Illinois Local Education Agency Retrieval Network, Illinois State Board of Education, accessed January 9, 2016.

- Ibid.

- Bureau of Labor Statistics, “Quarterly Census of Employment and Wages 2015, County Employment and Wages,” accessed November 1, 2016.

- Ibid.

- Michael Lucci, “Illinois’ Broken Workers’ Compensation System,” Illinois Policy Institute, June 4, 2015.

- U.S. Census Bureau, “State and Local Government Finances by Level of Government and by State: 2013 Survey of State and Local Government Finances,” 72-74, accessed November 1, 2016.

- Richard Vedder, Michigan’s Prevailing Wage Law and Its Effects on Government Spending and Construction Employment, (Mackinac Center for Public Policy, September 2, 1999).

- Sarah Glassman, Michael Head, David G. Tuerck, Paul Bachman, “The Federal Davis-Bacon Act: The Prevailing Mismeasure of Wages,” (Beacon Hill Institute, Suffolk University, February 2008).

- “Current Prevailing Wage Rated by County,” Illinois Department of Labor, accessed January 6, 2017.

- Ibid.

- Michael Lucci, “Illinois Remains Most Expensive State in the Midwest for Workers’ Compensation”, Illinois Policy Institute, Fall 2016.

- Bruce Rauner, “My Case for Workers’ Comp Reform,” Crain’s Chicago Business, December 28, 2016.

- Michael Lucci and Mark Adams, “Workers’ Compensation Reform Means Jobs, Tax Savings,” Illinois Policy Institute, Spring 2016.

- Chris Day, Mike Manley and Jay Dotter, Oregon Workers’ Compensation Premium Rate Ranking Summary, (Oregon Department of Consumer and Business Services, Central Services Division, October 2016).

- Ibid.

- Illinois Chamber of Commerce, The Impact of Judicial Activism in Illinois, 6.

- Tim Novak, “After Decades on Disability, Cops Are Put Back to Work,” Chicago Sun-Times, November 4, 2016.