A tax plan for growth: tax taking, not making

Illinoisans should only be taxed when they spend their money, not when they earn it.

Illinois needs a tax code that cultivates economic growth. The first step toward that end is sunsetting the 2011 income tax hikes, which caused so much economic harm, without raising any new revenues through new taxes.

A pro-growth tax code would tax as few activities as possible. For example, Illinois currently taxes both earning money and spending money. Extensive economic research points to a solution for growth: Illinois should tax taking, not making. That means Illinoisans should only be taxed when they spend their money, not when they earn it.

The logic is simple: if Illinois wants a growing economy and more work, the state should stop taxing growth, investment and work.

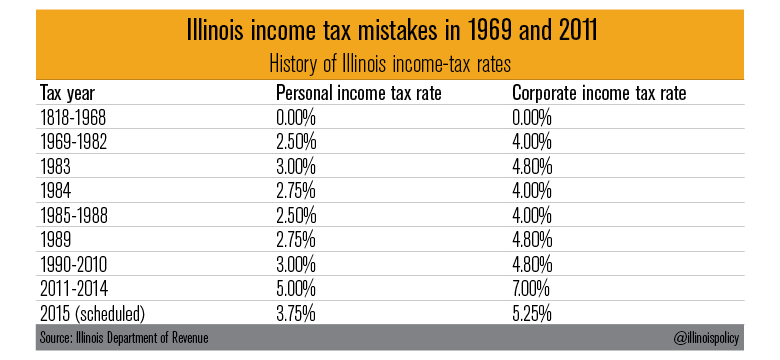

Illinois started taxing productivity in 1969, and then raised income and corporate taxes dramatically in 2011.

Income taxes punish production and success. While punishing production is economically harmful, punishing success is morally indefensible. It is wrong for the government to take more and more of a person’s production just as he or she is trying to get ahead in life.

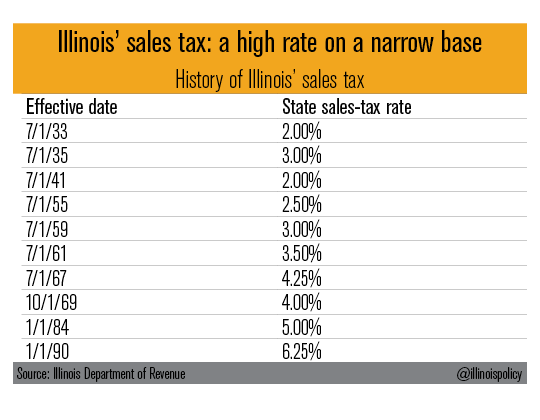

Illinois’ sales-tax code also needs reform because it is both biased and outdated. For example, the retail sale of goods is taxed while the retail sale of services is not. This is largely because the Illinois sales tax was introduced in the early 20th century, when most sales were of goods. Today, most sales are of services.

The ideal structure for a sales tax is to tax all consumption evenly and at low rates. Illinois’ goods sector has shrunk as a proportion of the state economy, but the tax on goods has consistently risen. The sales-tax rate is high because it is imposed on such a narrow base of sales.

Governor-elect Rauner’s “Bring back blueprint” notes the possibility of expanding the sales tax to include some services. But it is important that Illinois change the way the state levies taxes, rather than simply create new revenue sources. That means when one new tax is introduced, another one should be eliminated. A sales-tax expansion could be done as a way to eliminate the personal and corporate income tax altogether.

These steps set out a general tax-reform plan that would result in increased economic growth, better job creation and business inflow.

- Sunset the 2011 tax hikes by controlling government spending.

- Eliminate personal and corporate income taxes, and lower the sales-tax rate.

- Broaden the sales tax to offset the lost revenues by including the final retail sale of all goods and services.

- Create a partial sales-tax exemption for lower-income families so the plan does not result in a net tax increase for low-income earners.

- Exempt business-to-business transactions from the sales tax, as taxing these transactions would cause “tax pyramiding” and increased compliance costs. Ultimately, these taxes are simply passed on to the consumer through higher retail prices. This exemption could be done by expanding something like the manufacturer’s purchasing credit to include all business-to-business transactions.

Right now, Illinois is a laggard state that leads the Midwest in exporting talent. Pro-growth tax reform would help make Illinois a destination state with more opportunity for Illinoisans who have become too accustomed to seeing opportunities hop over the nearest border.