Taxpayers on the hook for risky investments in state pension systems

Politicians have made a mess of Illinois’ finances, in large part through their mismanagement of state and local pension systems. With most of the state’s pension funds heading toward insolvency, it’s no surprise that politicians’ actions – from using government-worker retirements as slush funds, to trading retirement benefits in exchange for union support, to taking...

Politicians have made a mess of Illinois’ finances, in large part through their mismanagement of state and local pension systems. With most of the state’s pension funds heading toward insolvency, it’s no surprise that politicians’ actions – from using government-worker retirements as slush funds, to trading retirement benefits in exchange for union support, to taking on too much investment risk – are being so highly criticized.

One of those issues – who should be on the hook if pension investments go sour – is getting even more scrutiny, and rightly so. Illinois’ pension funds are allowed to make all sorts of risky bets with their investments, from real estate to derivatives to commodities to junk bonds. If those investments don’t perform and the pension funds end up with a shortfall, it’s taxpayers who are expected to make up the difference.

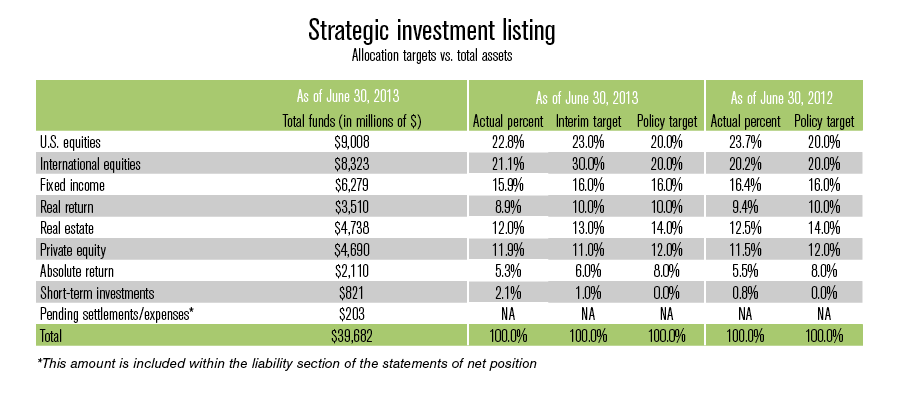

The Illinois Teachers’ Retirement System, for example, has investments of nearly $1.5 billion in junk bonds and unrated securities. It holds nearly $4.7 billion in real estate. And that’s on top of the more than $17 billion it has invested in U.S. and international equities. Bets also include derivatives, foreign currencies and other complex investment strategies.

Now, one should not have a problem with a fund taking on different risks to diversify its portfolio. As a matter of fact, diversification in the private sector is the key to enhancing returns and reducing risk.

But risky investments can be a huge problem. Especially when politicians “guarantee” government workers fixed benefits for life and put taxpayers on the hook if those investments go south.

That problem is compounded because Illinois’ pension funds are grossly underfunded. What if those in charge decide to up the risk for a chance to beef up returns? Why not? If they get it wrong, they’ve got a backstop – taxpayers.

Think this is unlikely? Just look at what San Diego is doing. According to The Wall Street Journal:

“A large California pension manager is using complex derivatives to supercharge its bets as it looks to cover a funding shortfall and diversify its holdings.

“The new strategy employed by the San Diego County Employees Retirement Association is complicated and potentially risky, but officials close to the system say it is designed to balance out the fund’s holdings and protect it against big losses in the event of a stock-market meltdown.

“San Diego’s approach is one of the most extreme examples yet of a public pension using leverage—including instruments such as derivatives—to boost performance.

“San Diego County’s embrace of leverage comes as many pensions across the U.S. wrestle with how much risk to take as they look to fulfill mounting obligations to retirees. Many remain leery of leverage, which helped magnify losses for pensions and many other investors in the financial crisis. But others see it as an effective way to boost returns and better balance their holdings.”

Let’s remember, politicians are in charge of these funds (no, politicians don’t technically “run” them, but you can bet they have a big influence in how they are run).

Illinois politicians have proven time and again over the last two decades that their incentives do not align with those of taxpayers. If you need proof, just look at the facts: Illinois has the worst credit rating in the nation, one of the most underfunded pension systems and the highest jobless rate in the Midwest.

At their core, these pension funds aren’t fair to anybody in Illinois. Not government workers whose pensions are nearly insolvent, not taxpayers who may have to bail them out and not to residents who could see cuts to core government services.

The best solution is to move government workers onto 401(k)-style plans that give workers control over their retirements. That means no more broken promises by politicians and no more risky investments backed by taxpayers.