The 3 most powerful lessons learned from the 2011 tax hikes

Since the January 2011 tax hikes, Illinois’ recovery slowed down, the rest of the Midwest sped up and the rest of the U.S. significantly accelerated. The Great Lakes states performed in lockstep with how well they fostered the free-enterprise system.

Illinois’ historic 2011 income-tax hikes, which were enacted by former Gov. Pat Quinn along with a tax-hike friendly General Assembly, raised personal income taxes by 67 percent and corporate income taxes by 46 percent.

According to a recent report from Southern Illinois University’s Paul Simon Public Policy Institute, the 2011 tax hikes defined the 2014 election between now-Gov. Bruce Rauner and Quinn. If that is the case, then the majority of voters rejected an extension of the income tax that dealt tremendous harm to the Illinois economy.

Illinois’ failed experiment with the 2011 tax hikes provides three important lessons:

- Policy has consequences on the well-being of Illinoisans. Illinois’ recovery has been thwarted by policy failures combined with Springfield’s inability to address the need for systemic reform.

- Raising income taxes is harmful, especially in the midst of a recovery. The 2011 tax hikes should be fully sunset and not replaced

- After lagging the region and nation, Illinois needs to take on economic reform immediately. In addition, the next time there is a recession, Illinois leaders should use the opportunity to address remaining reform needs to encourage free enterprise, rather than continuing down the path of tax-and-spend failure.

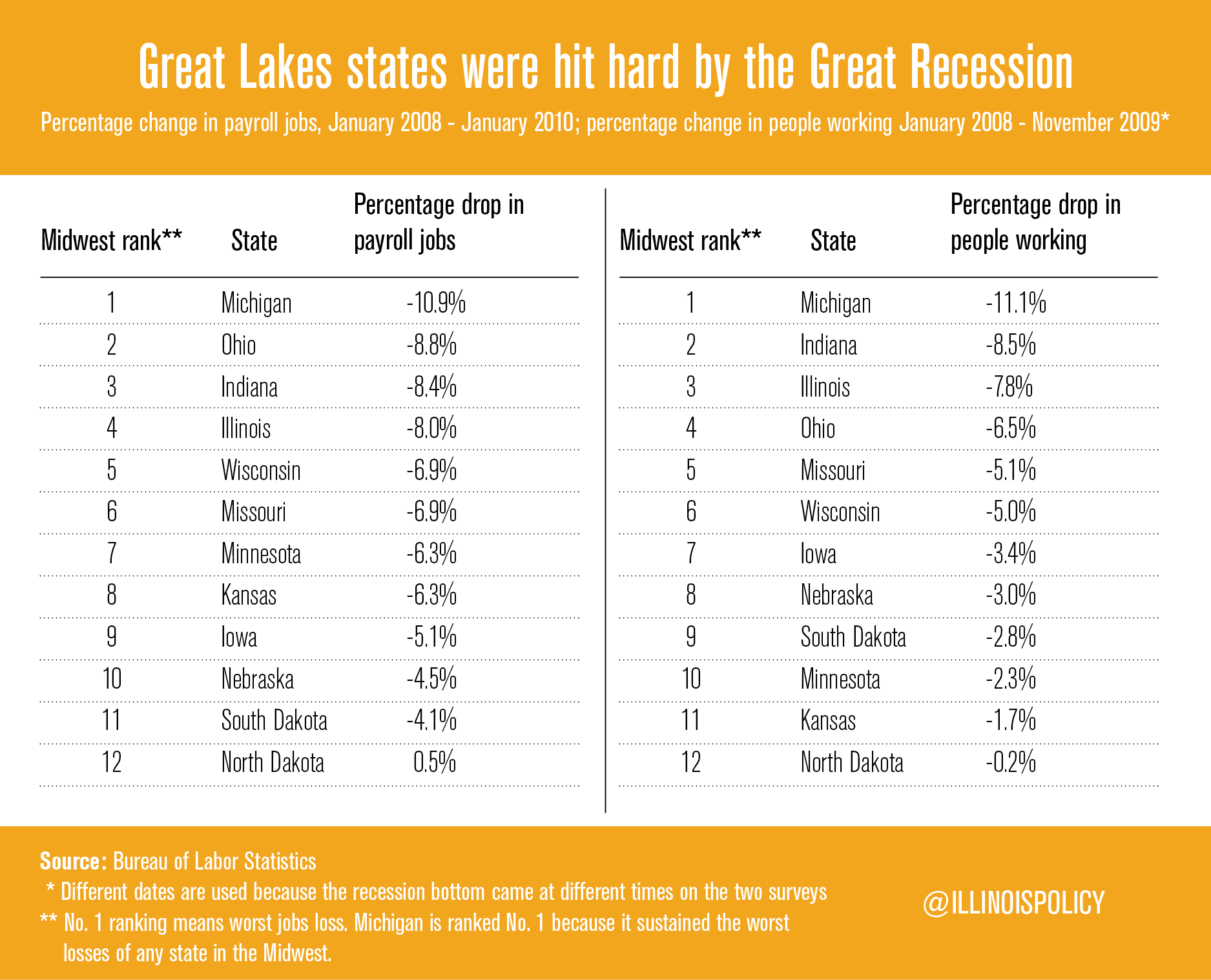

The story of the tax hikes begins with the Great Recession. Midwest states had some of the heaviest economic losses during the downturn. In terms of percentage decline in payroll jobs, Illinois was fourth-worst in the Midwest and 20th-worst nationally. In terms of the number of people working, Illinois’ percentage drop was third-worst in the Midwest and sixth-worst nationally.

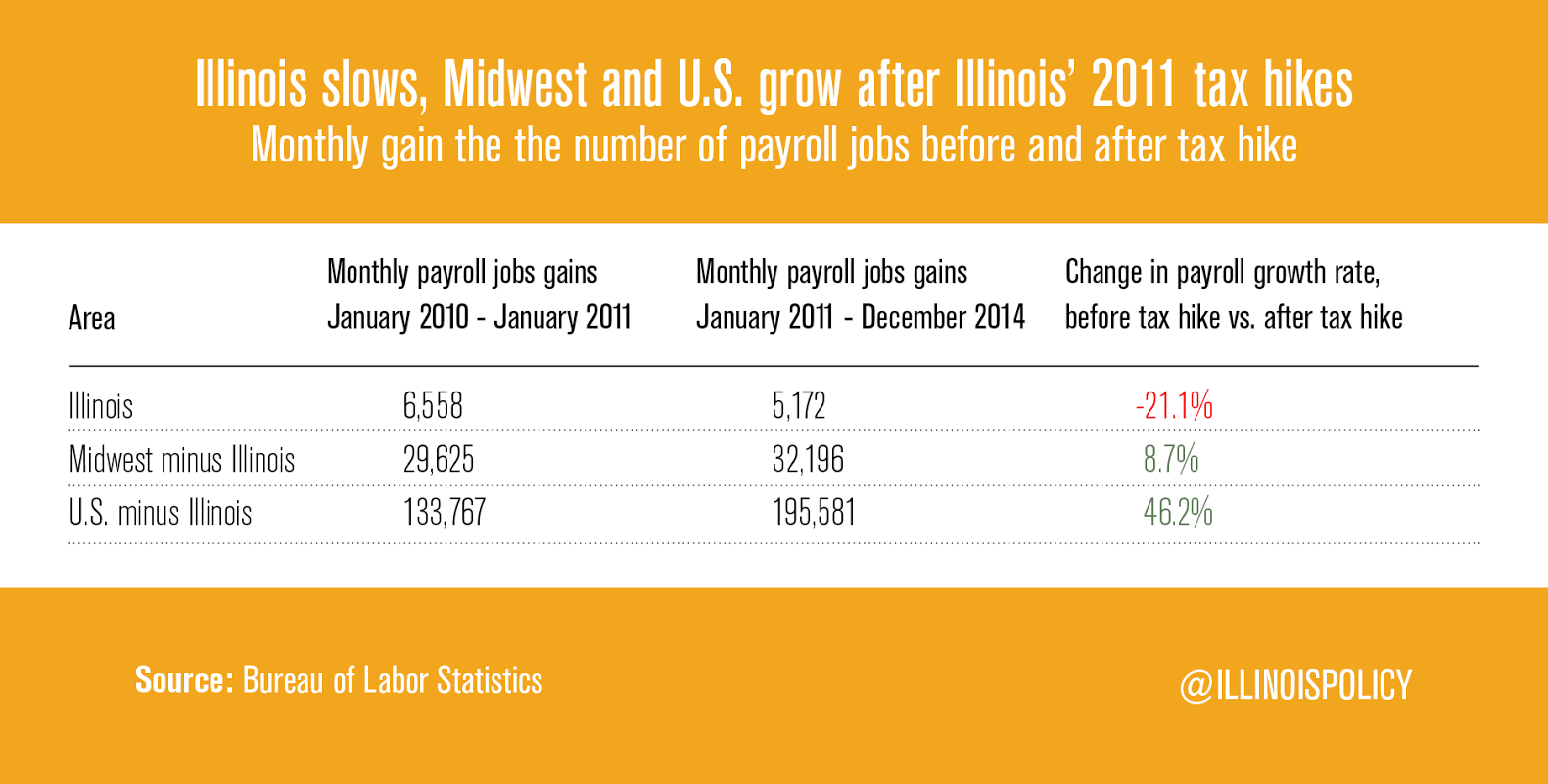

Illinois suffered a steep fall, but the Land of Lincoln began to bounce back in late 2009 through 2010. Up until the January 2011 tax hikes, Illinois was running fifth in the Midwest and 15th nationally for its rate of creating payroll jobs. The state was adding about 6,600 payroll jobs per month.

The 2011 tax hikes changed that, and decelerated Illinois’ recovery just as the rest of the country began to accelerate. The income-tax hike was not only economically harmful, it also provided clarity that Illinois would continue down the road of overtaxing, overspending and overregulating the economy.

Both the household and business-establishment reports from the Bureau of Labor Statistics show the same results. Since the January 2011 tax hikes, Illinois’ recovery slowed down, the rest of the Midwest sped up and the rest of the U.S. significantly accelerated.

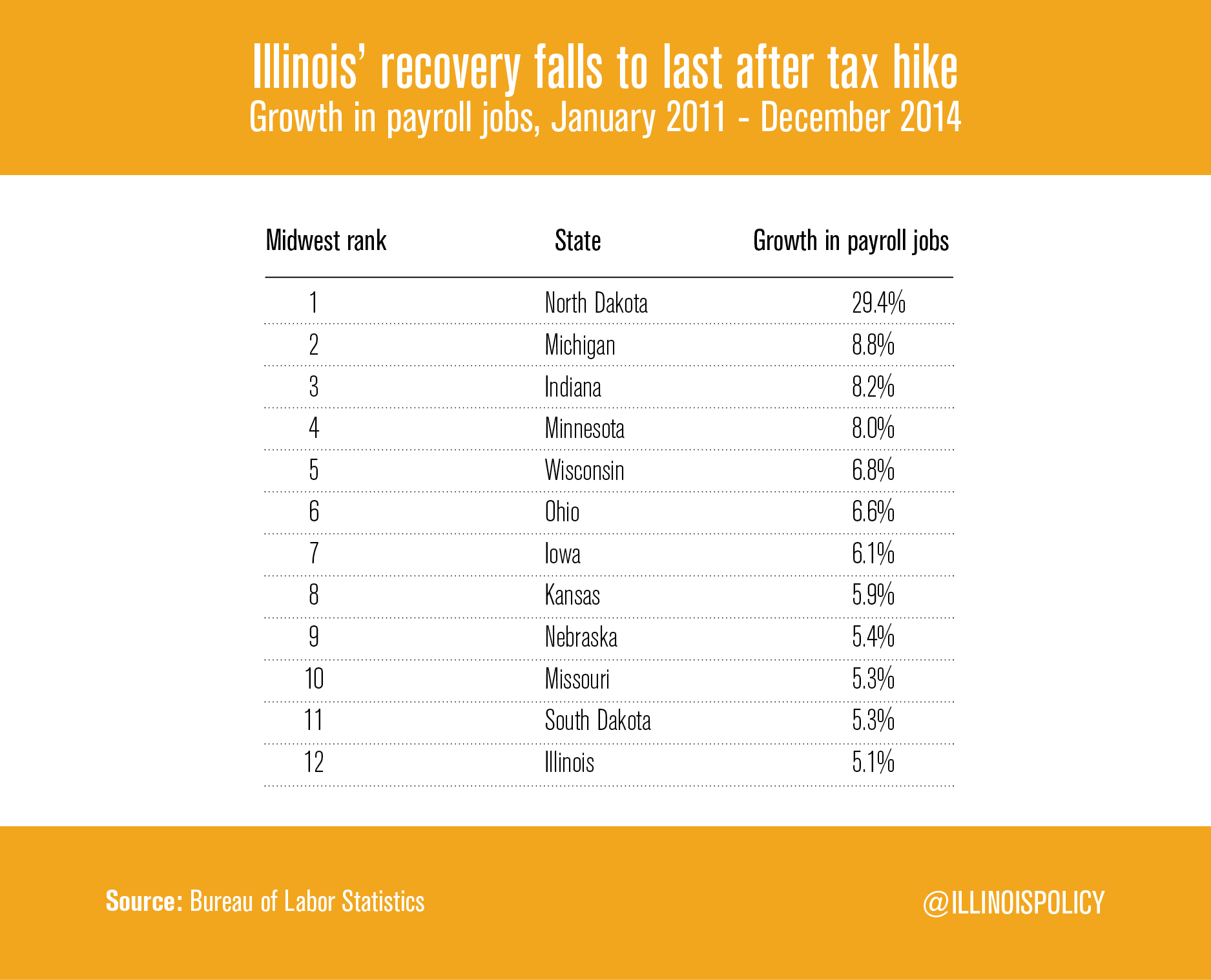

After beginning the recession recovery at 5th in the Midwest, Illinois has dropped to last in the Midwest for job creation rate since the 2011 tax hikes, with Great Lakes peer states Michigan, Indiana, Wisconsin and Ohio leaving Illinois in the rearview mirror.

Illinois’ initial fall was steep, but it was less steep than that of Michigan or Indiana, and roughly equivalent to Ohio’s. However, Michigan, Indiana and Ohio all caught and surpassed Illinois on the road to recovery, with Indiana as the clear outperformer of the group.

The Great Lakes states performed through the recession in lockstep with how well they fostered the free-enterprise system. Indiana’s package of income-tax cuts, property-tax reform, Right to Work and a light regulatory burden propelled the Hoosier State out of the recession ahead of its neighboring peers. In contrast, Illinois’ income-tax hikes, forced unionism, out-of-control property taxes and smothering regulatory burden have landed Illinois with the worst recovery in the Midwest, and arguably the worst recovery nationally.