Two of Illinois’ five pension systems lost money in 2012

Not a single one of the state’s five public pension systems earned more than 1 percent returns on their investments last year. In fact, two of the five funds actually lost money. Although pension trustees predicted Illinois’ five pension funds would earn more than $5.1 billion in fiscal year 2012, the funds actually earned less...

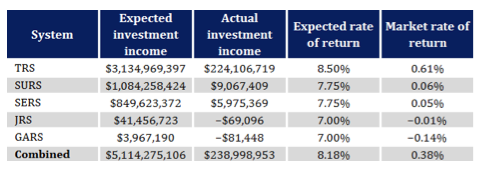

Not a single one of the state’s five public pension systems earned more than 1 percent returns on their investments last year. In fact, two of the five funds actually lost money.

Although pension trustees predicted Illinois’ five pension funds would earn more than $5.1 billion in fiscal year 2012, the funds actually earned less than $239 million. The systems posted a combined investment return of just 0.38 percent, far below the combined 8.18 percent expected.

The simple fact is that the pension systems are broke. Under new accounting rules, the funds have less than 29 percent of the money they should have in the bank today to make their pension payments. None of the five systems even have enough money on hand to pay out benefits to government workers who have already retired, let alone those still working.

The longer lawmakers delay action, the worse Illinois’ pension debt crisis will become. Only major reforms, like moving to defined contribution plans for all future work and tackling the automatic, compounded cost-of-living adjustment can get the problem under control.