Warning shots fired, Chicago pays $200M penalty for bad reputation in bond issue

The most recent round of city borrowing is a sign of things to come.

Chicago’s financial crisis is no longer business as usual – in the wake of the city’s bond rating falling to junk status, its debtors are coming to collect.

Chicago was forced to issue bonds on May 27 to raise nearly $700 million from the financial markets yet again because the city has been given until June 8 to repay some of the money it owes. Banks can demand this kind of forced repayment if the city’s rating drops to junk status.

But this is just the beginning of Chicago’s problems. It has much more debt to restructure, including nearly $30 billion in city and sister-government pension debt.

Whether the market will help Chicago out of its problems will depend on two things: what premium Chicago is willing to pay to borrow the money and whether lenders think they’ll eventually get paid back.

And the latter depends on whether Chicago’s politicians are serious about reform.

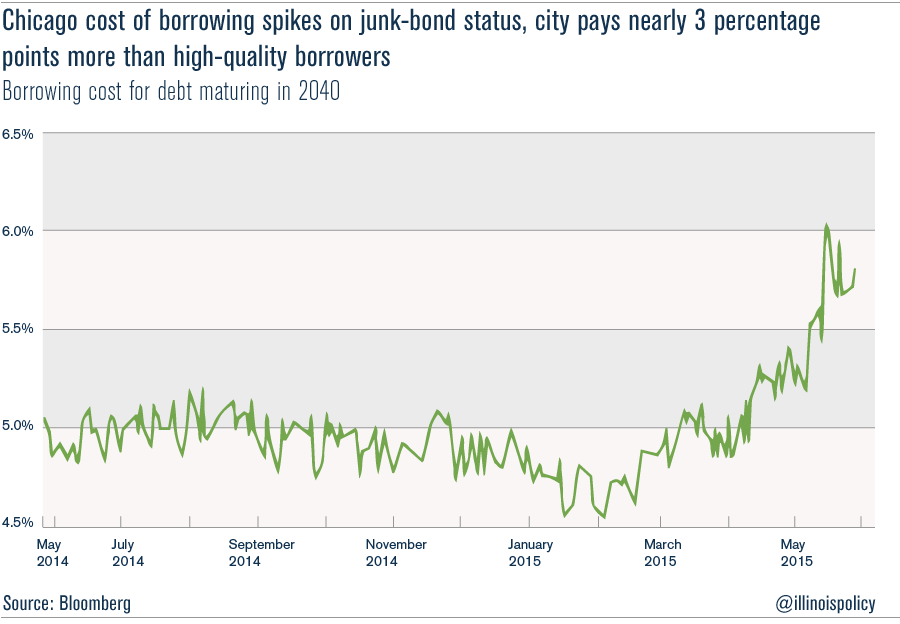

Unfortunately, the most recent round of borrowing is a sign of things to come. To convince lenders to part with their money, Chicago will have to pay significantly higher interest rates than it has recently. The city’s junk-bond rating from Moody’s Investors Service means the bonds are now speculative and carry a higher chance of default.

Not only is Chicago paying a higher rate, but it’s also paying lots more than other cities that manage their finances well. Chicago is now paying an interest rate that’s nearly 3 percentage points higher than high-quality borrowers with triple-A credit ratings (e.g., Austin, Boston and Indianapolis).

For this one round of borrowing alone the city will spend nearly $200 million in “penalty” interest costs over the life of the bond compared with triple-A-rated cities. That’s money that could be spent on putting more policemen on the street, hiring more teachers or building better roads. The city could fund the entire Chicago Public Library system for nearly two years with those funds.

But lenders will only accept high interest rates if they feel they will ultimately get repaid. At some point, they’ll back away if they don’t see the reforms necessary to fix the pension crisis.

And that’s where the real risk lies, starting with Mayor Rahm Emanuel’s recent critique of Moody’s. Emanuel called the junk-bond rating decision “irresponsible.”

Fighting the rating agency isn’t the way for Emanuel to signal he’s serious about reform – especially when rating agencies are notorious for calling crises much too late. The financial markets are fully backing Moody’s, as evidenced by the high interest rates Chicago was paying even before the downgrade.

Emanuel’s call to push off paying pension debt even further into the future is also ludicrous. That’s precisely how Chicago got into the crisis in the first place.

Lenders won’t put up with more pension holidays and pension underfunding. They’ll see right through that plan and punish the city even further.

And Emanuel’s gamble on casinos to save city-worker pensions won’t end the crisis either. This plan would do nothing to reform the city’s spending and pension problems.

Instead, Emanuel should do what he claims he’s good at – taking advantage of crises.

He should leverage the market’s ominous warning signs to propel an even deeper discussion with the unions over the real reforms needed to save the city and its worker pensions. They have a vested interest in ensuring Chicago remains one of the greatest cities in the world.

If he doesn’t, the markets will have the last word.

Image source: Puparrazi PhotographY