Wayne County superintendent solicits school vendors for political contributions

Mitchell’s email documents his efforts to political fundraise off of vendors who have done business with his school district in the past.

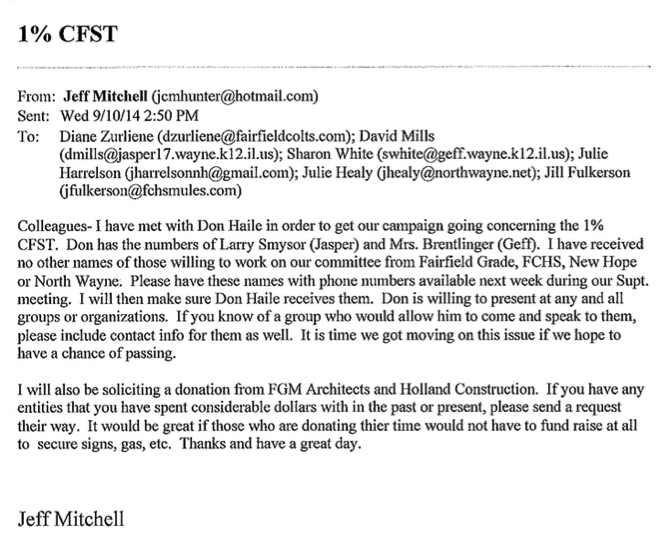

Email records show that a Wayne County superintendent urged his colleagues to raise money in support of a sales-tax hike.

Through a Freedom of Information Act request, the Illinois Policy Institute obtained an email sent by Jeff Mitchell, superintendent of Wayne City CUSD 100, during regular school business hours to superintendents across Wayne County. Mitchell’s email documents his efforts to political fundraise off of vendors who have done business with his school district in the past.

Mitchell’s email specifically asks superintendents across the county to engage in political fundraising by urging them to solicit donations from vendors that districts, “have spent considerable dollars with in the past or present.”

Mitchell explains he “will also be soliciting a donation from FGM Architects and Holland Construction.”

The beneficiary of the fundraising would have been the campaign committee Friends of Wayne County Schools, the disclosed purpose of which is to “support the 1% County Facilities Sales Tax Referendum.” Fortunately, the referendum was defeated at the ballot box when 63 percent of Wayne County voters opposed the tax hike.

However, the Illinois State Officials and Employees Ethics Act prohibits public officials from campaigning for or against any referendum question during public time, and also prohibits the use of public resources in such campaigns. The law is extended to local officials, including school districts, which must enact their own ethics policies that are “no less restrictive” than the state.

The email, sent on a Wednesday at 2:50 p.m., suggest that Mitchell was engaging in fundraising and recruiting supporters for a political committee on the public’s dime.

While fundraising during school hours is troubling enough, Mitchell’s strategy for soliciting campaign donations from school vendors receiving taxpayer money should be extra cause for concern. Architects and construction companies are usually some of the first people in line to profit off of the school facility sales tax.

While it’s not illegal for people and companies who stand to profit off of tax hikes to donate to referendum campaigns, the public should strongly question their motives.

School facility sales tax hike efforts, such as the one attempted in Wayne County, are often not a grassroots effort of parents, students and concerned citizens. Instead, these efforts are choreographed and supported by the companies that profit off of taxpayer dollars.

School districts can vote to put the sales-tax hike referendum back on the ballot for another try as early as April 2015.