Why Illinois’ corporate franchise tax should be repealed immediately

This bewildering tax is disproportionately harming small-business owners across the state.

Illinois’ corporate franchise tax makes no sense. It is convoluted and economically harmful, and should be repealed. Even the term “franchise tax” is misleading and outdated, as it is not a tax on the franchise locations of a larger business, such as a chain of Burger Kings. Rather, it is a tax on entrepreneurs and investments in Illinois for the privilege of doing business here.

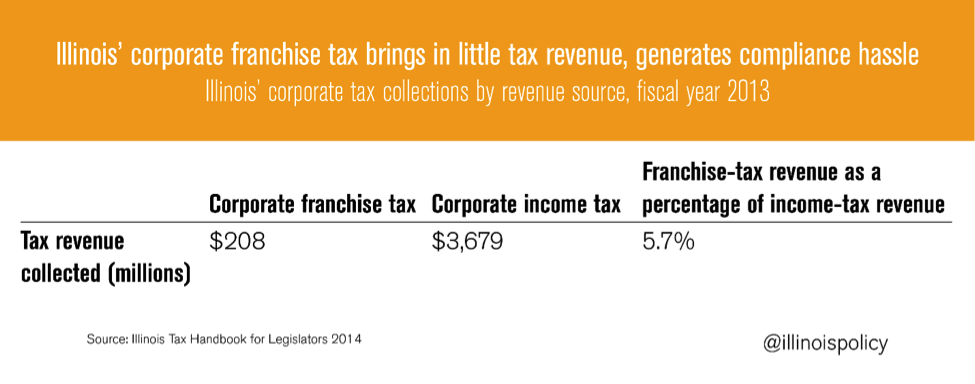

The franchise tax brings the state a very small stream of revenue relative to its heavy compliance cost. In fact, the corporate franchise tax collects only 5.7 percent of what the well-understood corporate income tax brings in.

The corporate income tax is based on a formula used in many states and at the federal level, and brings in revenue at a much lower compliance cost relative to the revenue generated. The franchise tax, on the other hand, has a high compliance cost, which saps energy and ingenuity out of the Illinois economy. Most states have repealed their franchise taxes for these reasons.

Consider the following exercise in figuring out how to pay the franchise tax, based on Illinois’ franchise-tax filing papers:

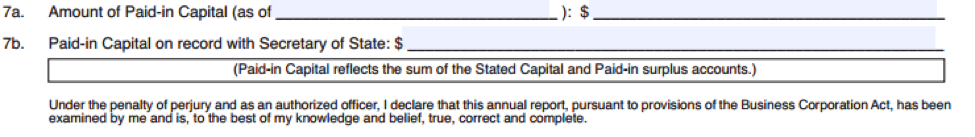

If you’re an entrepreneur filing a franchise tax for the first time, you need to calculate your “paid-in capital,” a foreign concept to many small-business owners. Confused business owners often need to pay for accounting and legal help to figure this out.

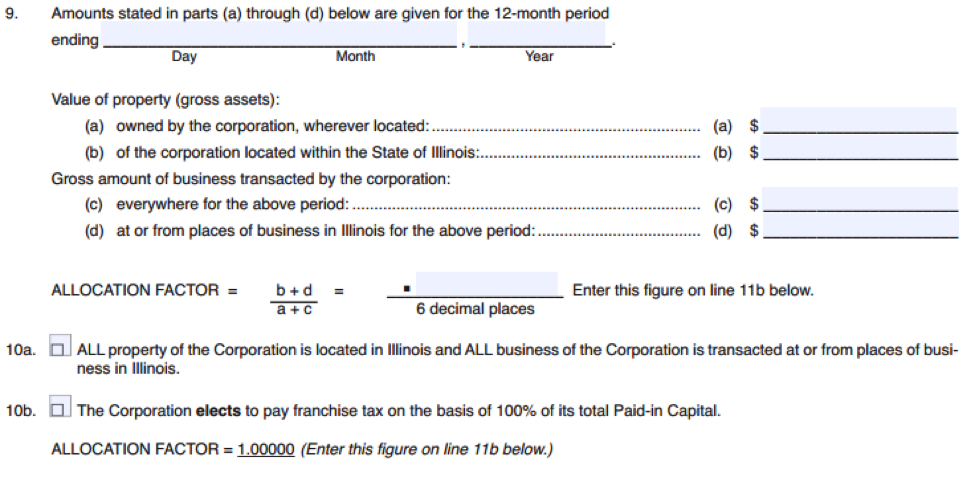

Next, the calculation of “paid-in capital” is combined with a measure of business property in Illinois along with a measure of business activity in Illinois, then put through another formula to arrive at an “allocation factor.”

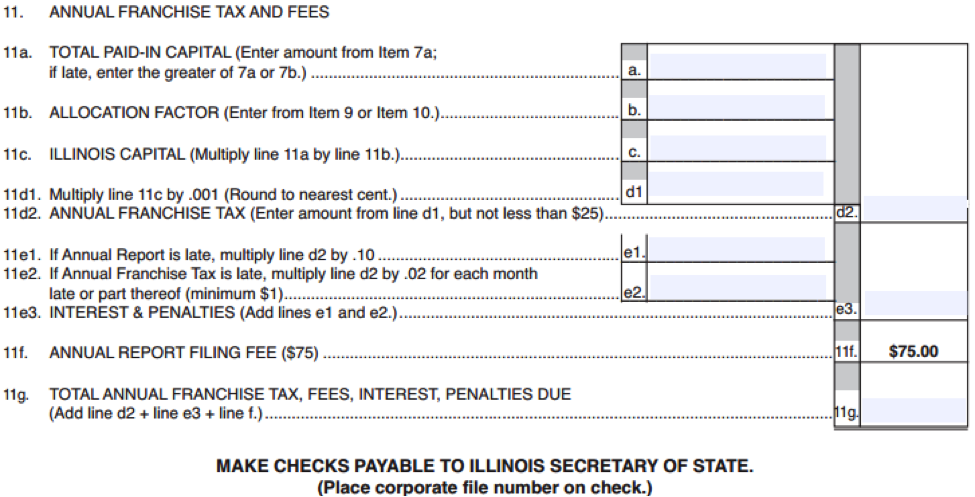

The measurements of “paid-in capital” and “allocation factor” are then used to calculate the final franchise-tax liability, which must be no less than $25. The franchise tax is then combined with filing fees, possible late charges and interest payments to calculate the final payment amount for a check payable to the Illinois secretary of state.

A Chicago-area attorney estimates the effective compliance costs for businesses as such:

- A larger corporation with regular access to a paralegal or accountant could complete this process quickly with a phone call and perhaps two hours of discussion between management and the accountant.

- Smaller businesses and entrepreneurs who only do this once a year probably spend four hours trying to figure out their tax liability and how their corporate model fits the nonintuitive tax formula. They often blow it off in frustration.

- Meanwhile, the secretary of state’s office and state government in general need to be staffed with people who spend time receiving, reviewing, filing, issuing receipts and perhaps auditing corporations for a tax formula that makes no sense.

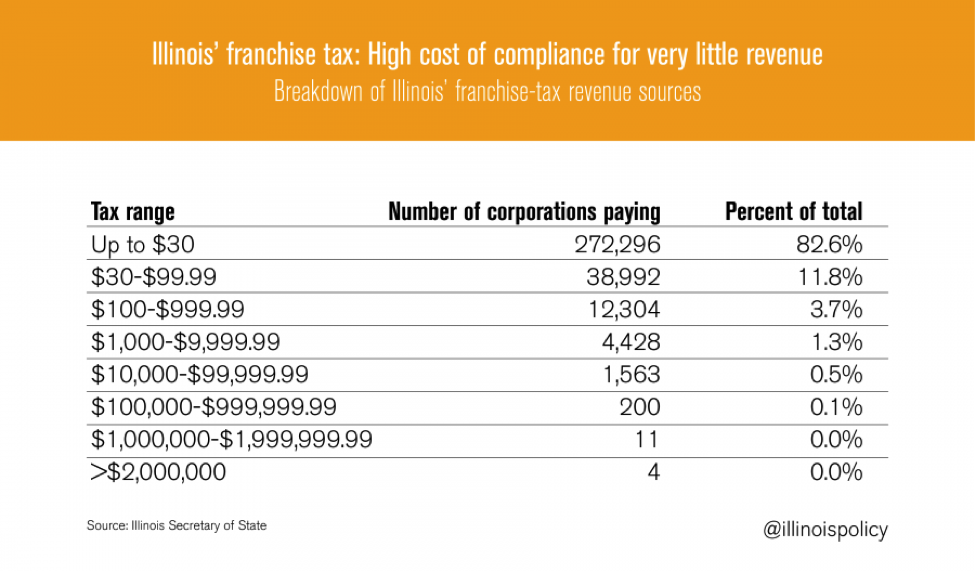

At the end of the day, the cost to comply with the corporate franchise tax is higher than the actual tax liability for the vast majority of Illinois corporations, especially for the smaller players. More than 82 percent of Illinois corporations pay less than $30 per year in franchise taxes, 94 percent pay less than $100 per year, and 98 percent pay less than $1,000 per year.

The franchise tax is an awful way to generate tax revenues. It complicates the tax code with an unnecessary layer of taxation that is difficult to comply with, has a strange calculation formula and hurts small businesses the most. Entrepreneurs in Illinois need relief, and repealing the franchise tax is a great place to start.

Image credit: Onasill ~ Bill Badzo