Why Illinois shortchanges people dependent on government services

Politicians have repeatedly prioritized funding state-worker pay and benefits over social services and other vital programs.

Proponents of more tax hikes want Illinoisans to believe that overspending isn’t the cause of the state’s dire situation. They throw out statistics to try to paint Illinois as a low-spending, undertaxed, small-government state that just doesn’t have enough funds to pay for vital social services.

But the fact is, Illinois has had more than enough tax revenue to fund its core operations and social service needs. Taxpayers have put in more than their share. Rather, the state’s real problems stem from its unrealistic promises and misplaced budget priorities. That’s the reason the state keeps shortchanging people dependent on core government services.

Politicians from both parties are to blame for the state’s fiscal mess. But it’s hard to ignore the underlying political constant of the last 30-plus years: Illinois House of Representatives Speaker Mike Madigan.

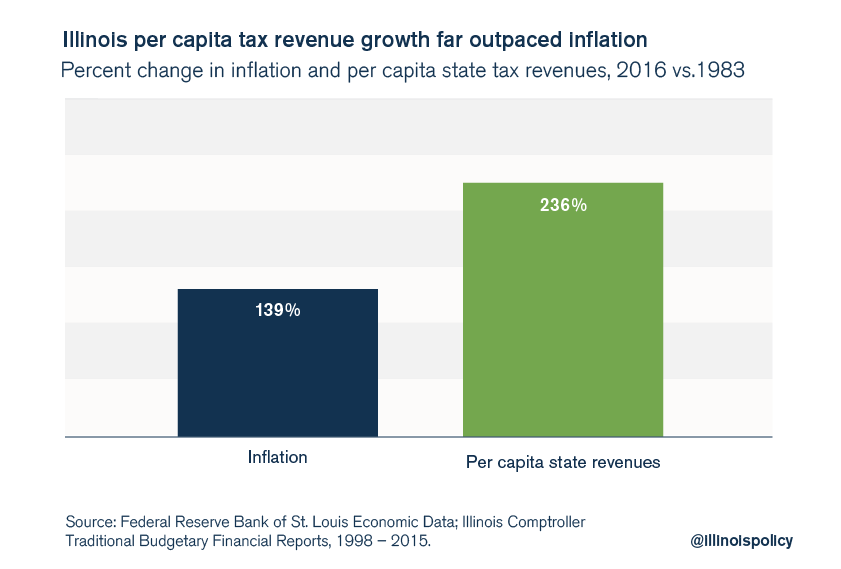

Since 1983 – the year Madigan became House speaker – state per capita revenues have grown 70 percent more than inflation. Per capita revenues grew by 236 percent, while inflation rose by just 139 percent.

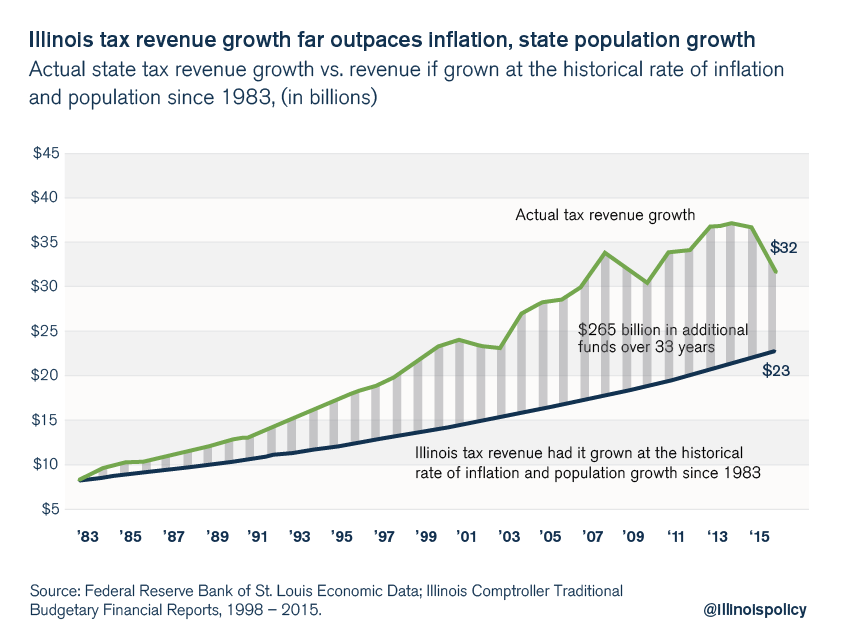

As a result, Illinois politicians have had $265 billion more to spend than if state tax revenues had simply grown at the pace of inflation since 1983. That amount equals the money it takes to run today’s government nearly eight times over.

No, Illinois hasn’t suffered from a lack of tax revenues. The real fault lies in how Illinois politicians have spent taxpayer dollars.

Under Madigan’s leadership, spending on government workers has taken top billing – at the expense of core government programs and social services. That misplaced prioritization can be seen time and time again.

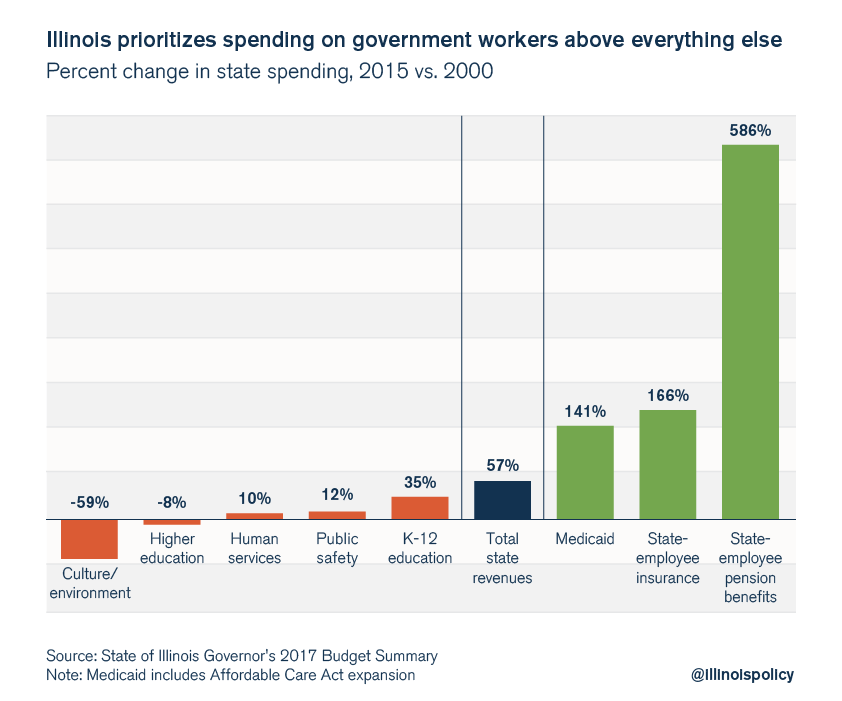

Compare state spending in 2015 to spending levels in 2000:

- Politicians increased spending on state-worker pensions by 586 percent, or $6.6 billion. By contrast, spending on human services was up only 10 percent, or $498 million, during that same period.

- Spending on state-worker employee insurance increased 166 percent, or $1 billion. By contrast, higher education was actually cut by 8 percent, or $175 million.

The reality is people dependent on social services and core programs have been harmed for more than a decade because politicians’ spending priorities haven’t included them. Instead, politicians have prioritized spending more on state workers – whose unions fund their election campaigns – over the needy.

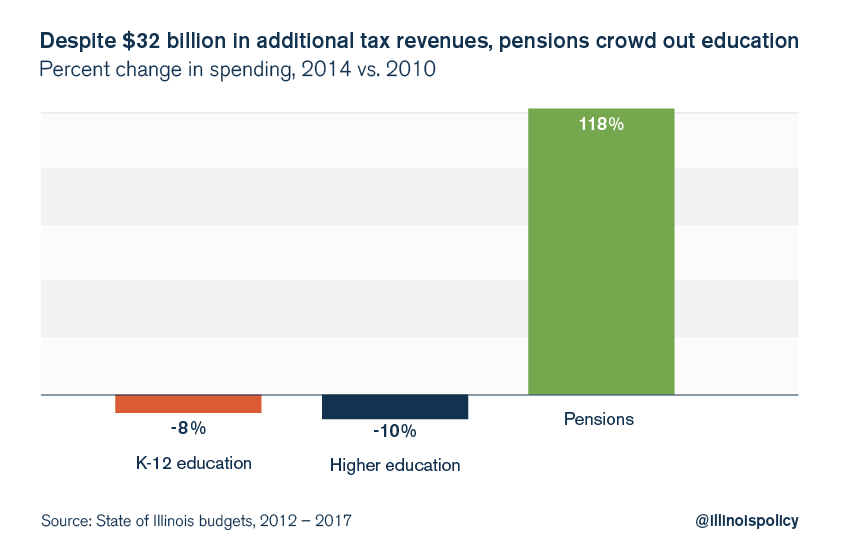

Even an extra $32 billion in revenue from the 2011-2014 income-tax hike didn’t temper how politicians prioritized their spending.

Politicians spent 90 percent – or more than $28 billion – of those additional revenues on state-worker pensions, crowding out funding for nearly everything else. Both K-12 and higher education funding were cut by nearly 10 percent in that four-year period.

More money in the hands of politicians only removed the pressure to enact spending and pension reforms. Lawmakers just kept funneling money to where it was most politically expedient – state-worker pay and benefits.

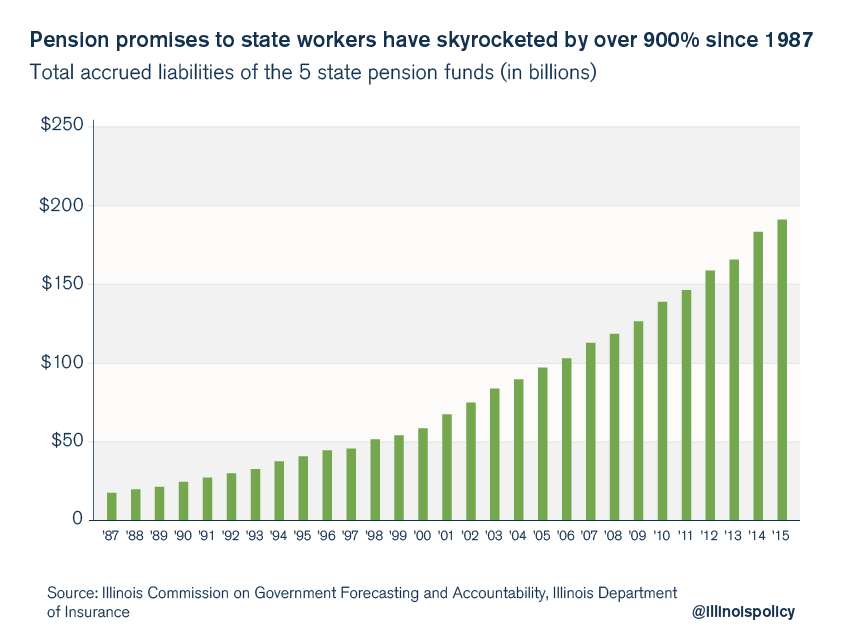

Opponents of reform want Illinoisans to believe the General Assembly had no choice but to pump more money into pensions due to years of underfunding. But underfunding is only part of the story. The bigger issue – and one that doesn’t get enough attention – is just how fast politicians have increased their pension promises to state workers since 1987.

In all, state-worker retirement benefits have grown 900 percent since 1987, or an average of 9 percent each year. In 1987, state workers had accrued just $18 billion in total pension benefits. By 2015, benefits earned by state workers had skyrocketed to $191 billion.

That massive increase in promises is one of the principal reasons the state has a $111 billion pension shortfall. Benefits have grown far faster than politicians can fund them.

Today, government workers can retire in their 50s, receive generous cost-of-living adjustments, and contribute little to their overall pension benefits. That in turn allows career state workers to collect millions of dollars in pension benefits over the course of their retirements.

Politicians on both sides of the aisle have proven over and over again where their true priorities lie. Rather than ensure that social services and other vital programs receive funding, they’ve prioritized state-worker pay and benefits.

Tax-increase proponents can distract with all the statistics they want about how Illinois needs to hike its tax rates to solve the state’s problems, but people don’t buy that.

Illinoisans’ day-to-day reality tells them differently. They’re already feeling the pain of the nation’s highest property-tax burden. They’re already trying to make ends meet in a state with the nation’s worst jobs recovery. They’re watching manufacturing jobs relocate across the border. Their neighbors are leaving the state in record numbers. And as a recent Gallup poll shows, only 25 percent of Illinoisans have confidence in their government – the lowest among the 50 states by a wide margin.

Illinoisans are tired of being hoodwinked. They know tax hikes aren’t the solution to their problems.

It’s time for Illinois politicians to be held accountable for their bad decisions, rather than asking taxpayers to keep bailing them out.