With costs on the decline, 401(k)s increasingly attractive

The list of reasons for denying government workers the benefits of 401(k)-style plans in favor of politician-controlled pensions is short at best, and it’s growing shorter every day.

The costs of running 401(k)-style retirement plans are dropping, making it clearer and clearer that offering workers the option of self-managed plans is the right choice for Illinois’ beleaguered retirement system.

That’s bad news for opponents of real pension reform in Illinois.

They like to cite the costs of self-managed plans as one of the reasons the state should stick with its current pension model, which now has an unfunded liability of $111 billion.

But a new report by the Investment Company Institute and BrightScope, a company that evaluates 401(k) plans, shows that 401(k) costs have dropped significantly since 2009.

The drop in expenses for small plans, which include management and administrative fees, as well as advice and other costs, has dropped by nearly 20 percent.

That’s certainly good news for the private sector, which now relies on 401(k)s as the main retirement vehicle. According to the report:

“With $4.4 trillion in assets at the end of the second quarter of 2014, 401(k) plans have become one of the largest components of U.S. retirement assets, accounting for nearly one-fifth of all retirement assets … More than 52 million workers were actively participating in 401(k) plans in 2012, making them one of the most common sources of retirement assets.”

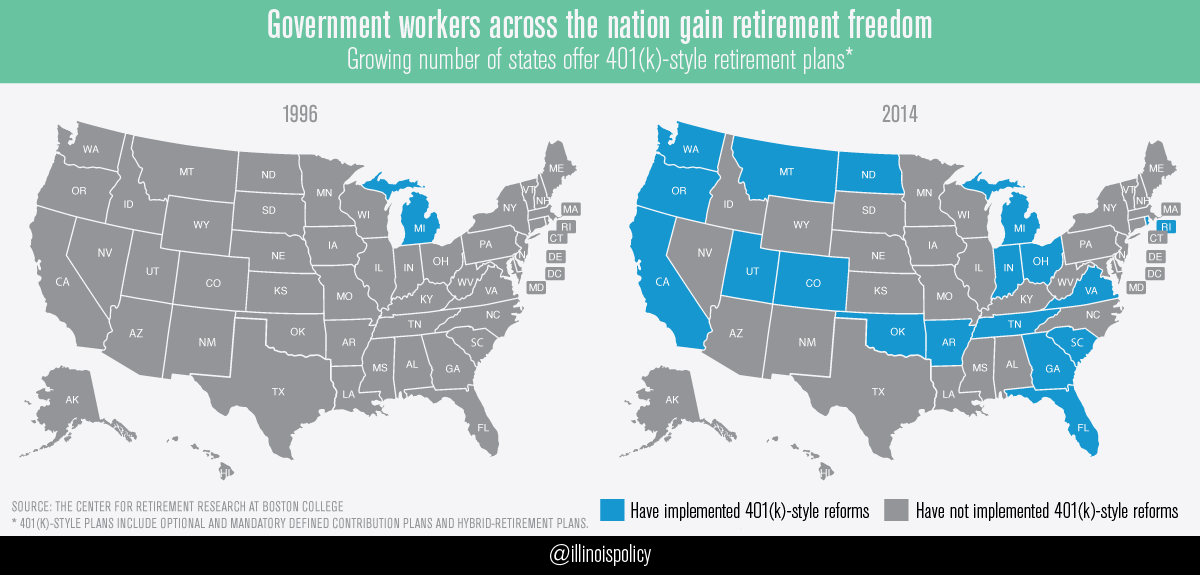

It’s also good news for states around the country that have been embracing 401(k)-style plans as the replacement for unmanageable and unpredictable pension plans. Oklahoma was the most recent state to adopt a 401(k)-style plan for many of its new employees, following the lead of six other states that have modernized their retirement systems since the Great Recession.

The list of reasons for denying government workers the benefits of 401(k)-style plans in favor of politician-controlled pensions is short at best, and it’s growing shorter every day.