Rahm’s phony pension fix fails taxpayers and city workers

Politicians are celebrating their pension “fix” for the city of Chicago. But their plan is nothing more than a massive property tax hike – it increases city contributions by $4 billion through 2025. More importantly, it doesn’t solve the pension problem. Mayor Rahm Emanuel’s pension plan does nothing to improve the retirement security of city...

Politicians are celebrating their pension “fix” for the city of Chicago. But their plan is nothing more than a massive property tax hike – it increases city contributions by $4 billion through 2025. More importantly, it doesn’t solve the pension problem.

Mayor Rahm Emanuel’s pension plan does nothing to improve the retirement security of city workers. It requires them to contribute more to their pensions, pay higher taxes and see cuts in their cost-of-living adjustments, while receiving no control over their own retirement future. On top of that, the plan completely ignores the city’s worst-funded pension systems: police and fire.

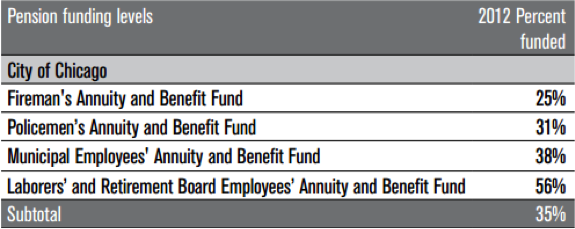

The police officers’ fund has just $0.25 for every dollar required to pay out future benefits – the firefighters’ fund, just $0.31. They are among the worst-funded pension systems in the nation. And with no real plan to fix them, it’s only a matter of time before they run dry.

Unfunded police and fire pensions make up nearly half of the city’s $20 billion pension debt. Together, the unfunded liabilities for these funds amount to nearly $6,000 for every Chicago resident.

Chicago’s budget director, Alex Holt, said that without some fundamental changes, the retirement plans are so underfunded that they could begin having cash flow problems as soon as “a couple years” from now.

Short of suggesting that the Chicago police and fire funds should be included in a statewide reform plan, Emanuel hasn’t said what he wants in a pension reform bill.

Emanuel started to get it right two years ago when he visited Springfield and called for bold reforms. He recognized the need for structural change and told state lawmakers that 401(k) plans should be a part of Chicago pension reform.

Since then, Rahm has dropped the ball on real reform and only seems interested in plugging the pension hole with tax hikes. But the Illinois Policy Institute developed a plan that incorporates real pension reform similar to what Rahm advocated for without soaking taxpayers.

- Allows workers to control and own their own hybrid retirement plans

- Gives workers a self-managed 401(k)-style retirement plan and provides them with a Social-Security-like benefit

- Gives workers retirement security they can count on

- Makes retirement costs a stable and predictable portion of city budgets

- Helps prevent indiscriminate cuts to core government services

- Protects taxpayers from paying higher taxes to fund ever-growing pension shortfalls

Our holistic pension reform plan is the only plan on the table that puts Chicago back on a path to financial security. The plan takes control of retirements away from politicians and put it in the hands of city workers, where it belongs.