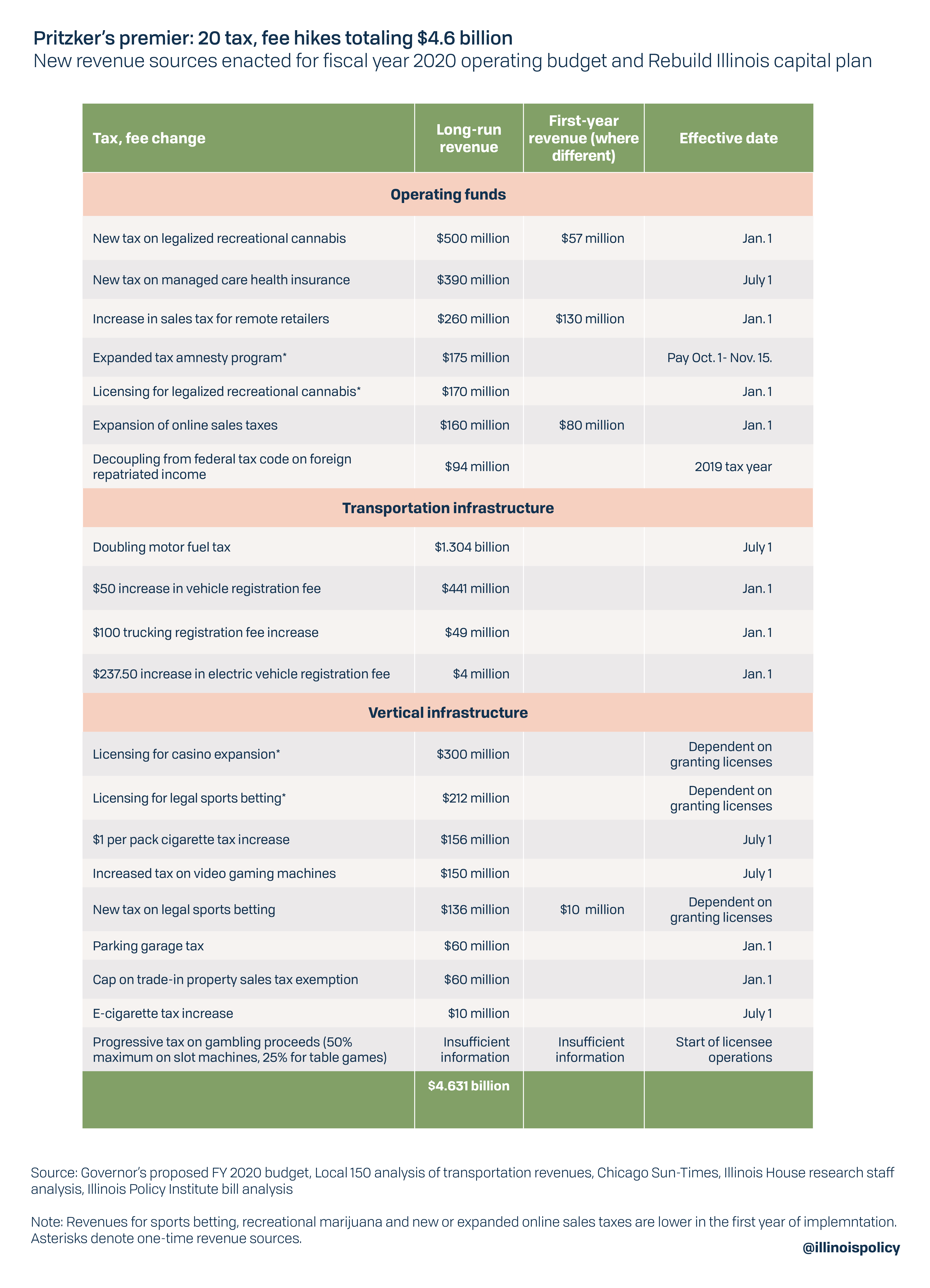

20 tax and fee hikes totaling $4.6 billion coming soon for Illinoisans

The Illinois General Assembly and governor devised 20 different ways to take more money from taxpayers to finance spending on government operations and infrastructure.

Illinois residents will soon be facing new or higher taxes and fees on gas, vehicle registrations, parking, marijuana, gambling, online shopping and more following actions at the Statehouse. In total, 20 new ways to extract money are estimated to raise $4.6 billion to pay for infrastructure and the state’s fiscal year 2020 operating budget – which despite the new money may still be as much as $1.3 billion in the red.

The changes span three different bills – SB 690, SB 689, and SB 1939 – and total 2,029 pages. All three bills were passed in a single weekend, meaning neither taxpayers nor lawmakers had time to fully read them.

Gov. J.B. Pritzker signed SB 689 on June 5 and is expected to sign the remaining two bills. The biggest tax hike proposed by Pritzker – scrapping Illinois’ constitutionally guaranteed flat tax and replacing it with a progressive income tax – would require voter approval on the November 2020 ballot to be enacted. Senate Democrats have estimated the rates signed by the governor would raise just over $3 billion.

While Pritzker has claimed his progressive tax plan would lower or at least not raise taxes on 97% of Illinoisans, just two of the revenue changes enacted this spring – doubling the motor fuel tax and increasing vehicle registration fees – more than wipe out any tax relief the governor promised. In fact, a typical Illinois family with two vehicles will end up $105 in the hole. And that’s assuming lawmakers don’t target the middle class for more revenue by changing the progressive income tax rates they passed.

Notably, the General Assembly passed and Pritzker signed a state budget that members of both parties claimed was balanced. The truth is it is out of balance by as much as $1.3 billion, despite significant new revenue.

Although Pritzker originally proposed 19 new or higher taxes and fees worth $6.9 billion, not all of his proposals were enacted and some new measures were passed that had not been previously discussed in public. Taxes Pritzker proposed but the General Assembly did not pass include the following:

- Reducing the tax credit available to retailers for collecting sales taxes on behalf of the state ($75 million)

- A new 5-cent statewide tax on plastic bags ($19 million to $23 million)

- A statewide $1-per-ride fee on ridesharing ($214 million)

- A 7% tax on streaming services such as Netflix and Spotify ($150 million)

- Increased taxes on beer, wine and liquor ($120 million)

New tax and fee hikes not previously proposed include:

- A $100 increase in vehicle registration fees for large trucks

- Increased sales taxes on remote online retailers

- New sales tax for online marketplaces

- New progressive tax schedule for gambling proceeds that imposes lower taxes on table games than slot machines

Prior to the changes enacted this spring, Illinois residents already faced one of the highest total state and local tax burdens in the nation.

New revenue to balance general revenue budget ($1.7 billion)

Analysis from the Illinois Policy Institute has found the fiscal year 2020 spending plan is out of balance by up to $1.3 billion. This is despite more than $1 billion in new revenue for the first year. Several revenue sources proposed are one-time sources, while others will be lower in the first year but increase in subsequent years.

Recreational cannabis tax ($500 million)

Lawmakers have publicly stated they expect $57 million in tax revenue from the first six months of taxing recreational marijuana which will increase to $500 million annually after five years.

New tax on managed care health insurance organizations ($390 million)

Managed health care organizations, a type of health insurance company intended to control costs, will be hit with a new assessment fee based on the number of members they have and whether they are private or part of the state’s Medicaid program.

As explained by the Civic Federation, the plan will free up $390 million in general revenues through a combination of increased federal reimbursements and shoring up Medicaid accounts that are not part of the general operating budget.

Increase in sales tax for online remote retailers ($260 million)

Following the Supreme Court decision last year making it easier for states to require online retailers to collect sales taxes, lawmakers required companies such as Amazon to collect the state’s 6.25% tax on all transactions as of Oct. 1. Now, remote online retailers will also be required to collect the local portion of sales tax for online purchases based on where packages are being delivered. Combined state and local sales taxes average 8.74% across Illinois and range as high as 10.25% in Chicago.

Expanded tax amnesty program ($175 million)

Taxpayers who have failed to pay all income taxes owed to Illinois will have a chance to clear their liabilities without penalty from Oct. 1 to Nov. 15. This tax amnesty program will accelerate collections that would likely have been made through enforcement activity at some point, making this a one-time revenue source that will somewhat reduce future revenue collections.

Recreational cannabis licenses ($170 million)

The governor’s proposed budget counted on $170 million in revenue from license sales to recreational marijuana dispensaries. This is likely to be a mostly one-time source of revenue with significantly lower collections in subsequent years.

Expansion of online sales tax to marketplace facilitators ($160 million)

Online marketplaces that facilitate transactions between third parties, such as Etsy and Ebay, will now be required to collect the state’s 6.25% portion of the sales tax.

Decoupling from federal tax code treatment for foreign derived income ($94 million)

The federal Tax Cuts and Jobs Act created a credit for businesses that export goods and services internationally, intended to encourage this income to be brought back to the United States. Because of interactions between Illinois’ corporate income tax code and the Internal Revenue Code, this would have reduced the effective state tax rate to 5.9% from the regular 9.5% corporate income tax (which includes the 2.5% personal property replacement tax).

This change eliminates that credit, imposing higher taxes on foreign-derived corporate income.

New revenue to finance “horizontal” capital spending on roads and bridges ($1.8 billion)

Pritzker campaigned on a new capital plan for Illinois, originally proposing $41.5 billion for his “Rebuild Illinois” plan. The plan passed by the General Assembly spends even more, at $45 billion over six years, including $10 billion in expected federal matching grants.

Senate Democrats have said $33.2 billion of the total new spending will go to transportation infrastructure, such as roads and bridges. Lawmakers refer to those projects as “horizontal” infrastructure spending.

The Illinois Policy Institute released an alternative no-tax-hike capital plan that would have enabled state and local governments to invest $10 billion more in repairing existing infrastructure, not including federal matching dollars. It emphasized transportation project need rather than the age-old practice of rewarding political loyalty with shiny new projects.

The horizontal infrastructure proposal Pritzker plans to sign is financed by a number of increased taxes and fees on Illinois drivers. Even with these taxes and fees, the proposals do not raise enough revenue to pay for all new spending. The plan also relies on over $20 billion in new bond debt.

Double state’s motor fuel tax ($1.3 billion)

Illinois’ motor fuel tax will increase from 19 cents to 38 cents per gallon, effective July 1.

This makes Illinois’ total gas tax burden the second-highest in the nation and possibly the highest when accounting for additional local authority to raise fuel taxes. Chicago will be able to add an additional 3 cents to its current 5 cents per gallon tax. Lake County and Will County will be able to impose a new 8 cent per gallon tax and the remaining collar counties of DuPage, Kane, and McHenry will be able to increase their per gallon taxes from 4 cents to 8 cents.

The state’s motor fuel tax will also automatically increase every year on July 1 going forward because it has been pegged to inflation. Drivers will be notified on June 1 of the size of the increase, which cannot exceed one penny per year. The total increase will hit nearly 25 cents by 2025, based on current inflation projections.

An analysis produced by Local 150 of the Operating Engineers, a union that does infrastructure work for the state, estimates the changes will raise more than $1.3 billion in total.

$50 increase in vehicle registration for regular passenger vehicles ($441 million)

Most drivers will see their vehicle registration fee increase from $101 to $151. The plan differs from Pritzker’s proposal to implement a tiered registration fee based on the age of a vehicle, which would have gone as high as $199 per year. Illinois’ vehicle registration fee was just $79 as recently as 2009.

$100 increase in registration fees for large vehicles ($49 million)

Large vehicles such as buses, trailers and semi-trucks will see a $100 increase in their respective vehicle registration fees.

15-fold increase in electric vehicle registration fee ($4 million)

The registration fee for electric vehicles would rise to $250 per year from $35 every other year. Previous proposals would’ve increased the fee as high as $1,000 per year, but the enacted increase matches the Pritzker plan to raise $4 million annually.

New revenue to finance “vertical” capital spending on buildings ($1.1 billion)

In addition to the state’s new transportation infrastructure spending, the Rebuild Illinois plan allocates billions of dollars for new spending on buildings such as state facilities and public universities. The bulk of funding comes from expanding gambling in the state.

Illinois’ last major capital plan in 2009 also relied extensively on revenue from gambling. A ProPublica investigation found revenues over the course of the plan were about $1.1 billion less than lawmakers projected.

New casino licenses ($300 million)

The bill authorizes new casinos in Chicago, Waukegan, the south suburbs of Chicago, Walker’s Bluff, Rockford and Danville. Additionally, horse racing tracks, truck stops and airports will have expanded authority to operate video gambling machines.

The Chicago Sun-Times reports that combined revenue from sports betting licenses and casino licenses will be about $500 million. This suggests about $300 million will come from expanded traditional gambling licenses.

Licenses for legalized sports betting ($212 million)

Sports betting will now be legal in Illinois. Initially, only existing gambling interests such as sports venues, racetracks and casinos will be eligible for licenses. Online sports betting companies such as FanDuel and DraftKings will have to wait 18 months before they can apply.

The governor’s proposed budget counted on $212 million in revenue from the sale of these licenses.

$1 per pack increase in cigarette taxes ($156 million)

Chicago already imposes the highest cigarette tax in the nation, at $7.17 per pack as of 2016. Illinois charges the fourth-highest cigarette tax in the Midwest at $1.98. The capital plan hikes this tax by $1 per pack.

According to the Illinois Department of Revenue, tax dollars generated by cigarette sales have declined every year since fiscal year 2015. Cigarette taxes are highly volatile, as shown in the Tax Foundation’s recent analysis of cigarette tax revenues from 1955 to 2018 across all 50 states. This can be attributed in part to a general decline in smoking, as well as the ability of smokers in high-tax states to buy tobacco from bordering low-tax states.

Increased tax on video gaming machines ($150 million)

The tax rate for proceeds from video gambling machines will increase to 33% from 30%, with an additional 1% increase in the rate the following year.

Sports betting taxation ($136 million)

The governor’s proposed budget predicted tax revenue from legalized sports betting could raise $77 million to $136 million per year.

Parking garage tax ($60 million)

Parking garage users would see an increase in their taxes starting Jan. 1, 2020. For hourly or daily parking garages, taxes would go up by 6%. Monthly or annual parking spaces would be slapped with a new 9% tax.

Cap on sales tax exemption for traded-in property ($60 million)

Trade-ins for property similar to the purchase, such as trading in a used vehicle during the purchase of a new vehicle at a car dealership, have traditionally been exempt from sales tax. SB690 caps that exemption at $10,000 of value, meaning amounts above that will now be subject to sales tax.

E-cigarette tax increase ($10 million)

Electronic cigarettes and vaporizers will see a new tax of 15% on wholesale value. Although a summary of the operating budget released by the governor’s office claims the new revenue will be used to fill holes in the operating budget, the text of the bill indicates the new revenue will be dedicated to vertical capital projects along with the tax hike on regular cigarettes:

“(c) Beginning on July 1, 2019, all of the moneys from the additional taxes imposed by this amendatory Act of the 101st General Assembly received by the Department of Revenue pursuant to this Act and the Cigarette Use Tax Act shall be distributed each month into the Capital Projects Fund.”

Graduated tax schedule differentiating between table games and slots (insufficient information for revenue estimate)

The gambling bill creates a new tax schedule which imposes higher taxes on slot machines – topping out at 50% for proceeds of over $200 million – compared with table games, which would see a maximum rate of 20% on earnings over $25 million. For both table games and slots, the tax rates get progressively higher with higher gambling proceeds.

While no revenue estimate exists for this change in isolation, total new revenue from gambling expansion is predicted to be about $700 million, according to ABC 7 Chicago.

Add up all 20, and Illinoisans’ new tax and fee bill is $4.6 billion

Springfield’s solution to every problem seems to be taking more money from taxpayers. Whether the goal is balancing a budget or investing in infrastructure, Illinoisans deserve better.

While it’s too late to stop many of the new taxes and fees imposed this year, lawmakers should make a small gesture of respect toward taxpayers and show a willingness to challenge the status quo by repealing automatic increases in the motor fuel tax. At the very least, they should be accountable for votes to hike taxes.

Taxpayers can also take matters into their own hands by rejecting a progressive income tax on the ballot in November 2020. Only when lawmakers are sent a clear message that more tax hikes are unacceptable can Illinois begin to deal with the structural overspending at the root of the state’s fiscal crisis.

Correction: A previous version of this piece cited 21 tax and fee hikes raising $4.7 billion, rather than 20 tax and fee hikes raising $4.6 billion. This previous analysis included a real estate transfer tax hike generating $68 million, but this tax was removed in a later amendment.