2015 State Business Tax Climate Index: Illinois drops to 31st

Illinois’ burdensome tax climate for businesses will continue to hold the state back from creating jobs and growing the economy in 2015. The Tax Foundation issued its 2015 State Business Tax Climate Index, reporting that Illinois dropped two positions in the ranking since last year, to 31st from 29th. Prior to 2011, Illinois steadily ranked...

Illinois’ burdensome tax climate for businesses will continue to hold the state back from creating jobs and growing the economy in 2015. The Tax Foundation issued its 2015 State Business Tax Climate Index, reporting that Illinois dropped two positions in the ranking since last year, to 31st from 29th.

Prior to 2011, Illinois steadily ranked in the top half of the index. But its ranking plummeted as a result of the dramatic tax hikes of 2011, when state lawmakers enacted historic increases in the individual and corporate income tax rates. Since then, Illinois’ ranking has hovered around the 30th position in the annual rankings. If state lawmakers resist the temptation to interfere with the automatic income tax rate reductions that are set to go into effect Jan. 1, 2015, Illinois might just return to the top half of the index next year.

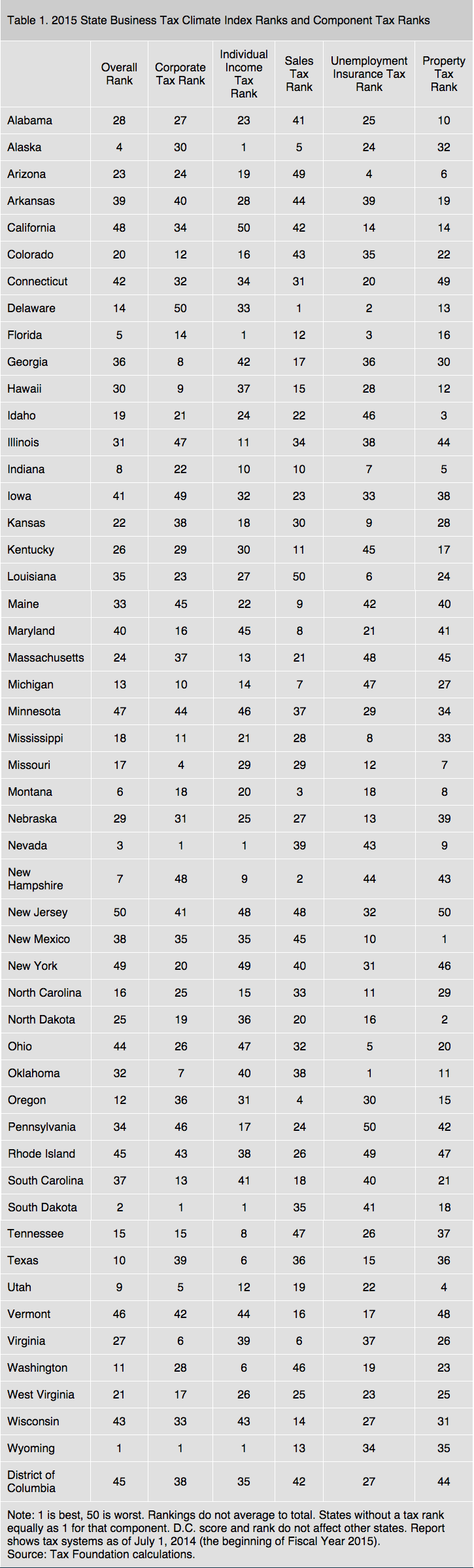

The index, now in its 11th edition, measures how well each state’s tax codes are structured by analyzing over 100 variables in five different tax categories: corporate tax, individual income tax, sales tax, property tax and unemployment insurance, or UI, tax.

The Tax Foundation calculated Illinois’ overall ranking for 2015 and its ranking in each of the five tax categories as follows:

Overall State Business Tax Climate: 31st

Corporate tax: 47th

Property tax: 44th

UI tax: 38th

Sales tax: 34th

Individual income tax: 11th

It is clear from reviewing the separate rankings in each tax category that the only saving grace within Illinois’ tax structure is the relatively simple, flat-rate individual income tax (the score in this tax category counts for one-third of the total index score). The complexity and high rates in all the other tax categories drag Illinois down. The analytical process used by the Tax Foundation to create the index punishes states for overly complex, burdensome and economically harmful laws, but rewards them for transparent and neutral tax laws that do not distort business decisions.

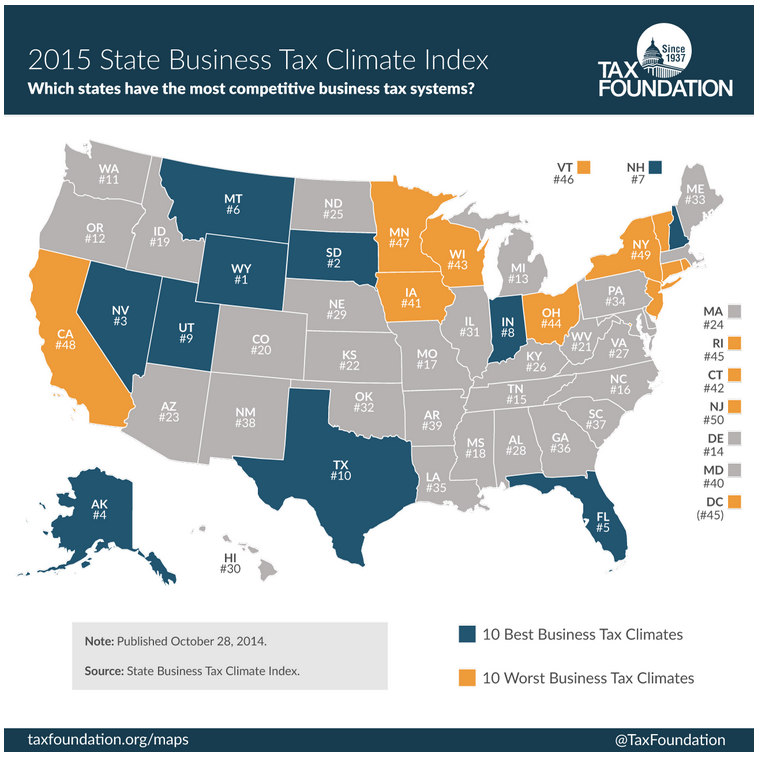

One factor that jumps out from the map is that Illinois is lagging far behind three neighboring states: Indiana is ranked eighth, Michigan is ranked 13th and Missouri is ranked 17th. If Illinois wants to compete effectively with its neighbors, it should review the ways in which these states have succeeded in creating a stronger business tax climate. Then it should consider implementing some competitive reforms.

To see the comparative rankings for all the states for overall business tax climate and each tax category, see the chart below:

A state’s ranking can rise or fall significantly because of its own actions, but it can also rise or fall because of changes or reforms made in other states. This year’s index shows the dramatic progress a state can make in moving up the rankings with a concerted effort to improve its tax structure. North Carolina, as a result of rate reductions and significant reforms of its individual and corporate income tax and its sales tax, moved far up the ranks to 16th in this year’s rankings from 44th just one year ago. The most significant reform was to move from a progressive individual income tax to a lower-rate flat tax.

Surprisingly, Illinois has the opportunity to move up the ranks during 2015 if state lawmakers simply do nothing. Because the Tax Foundation based the new index rankings on state tax laws in effect on July 1, 2014, Illinois’ 2015 ranking does not take into account the automatic reduction in individual and corporate income tax rates scheduled to occur on Jan. 1, 2015. Just as Illinois’ ranking plummeted when these temporary tax increases went into effect, and stayed consistently lower ever since, the ranking will surely improve if the automatic rate reduction is allowed to take effect.

Last year, the Tax Foundation made it very clear that if Illinois proponents of a progressive individual income tax had been successful in their efforts, Illinois’ ranking would have plummeted again, putting it firmly in the bottom 10 of the rankings.

The goal of the State Business Tax Climate Index is to start a conversation between taxpayers, policymakers and lawmakers about how their states compare with the rest of the country and how they can make reforms in their tax systems that will make them more competitive. If Illinois does not heed the analysis included in the index and take action to improve its business tax climate, it runs a terrible risk of remaining stuck in the mud without any traction for growing the economy or creating new jobs. Let us do the things required to create an encouraging business environment.