Moody’s: Chicago taxpayers on the hook for growing pension contributions

Chicago’s contributions to its government-worker pension funds will jump to $1 billion in 2016 from $500 million in 2015, according to a new report by Moody’s Investors Service.

Mayor Rahm Emanuel, during his budget address in September, said that his proposed 2016 budget would solve the city’s structural budget deficit “once and for all.”

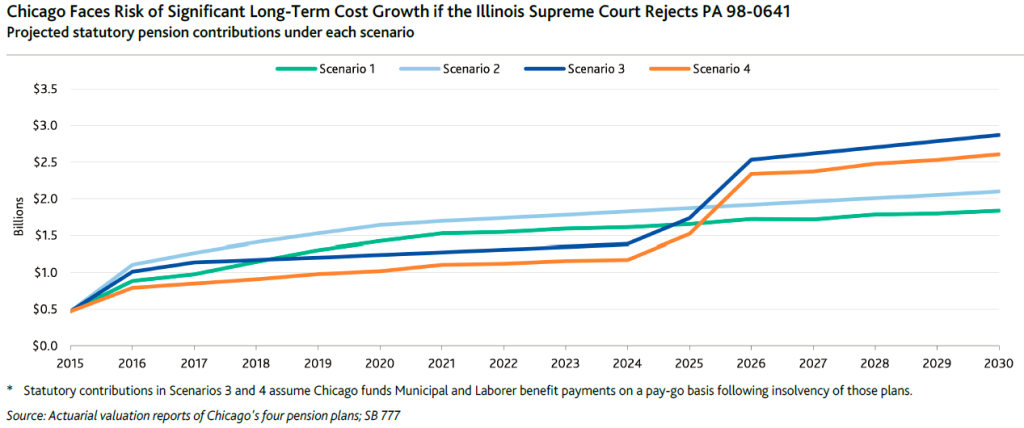

Regardless of what the mayor claims, the city’s government-worker pension crisis is only going to get worse, according to a new report from Moody’s Investors Service. Moody’s analysis of four different scenarios shows that, in all cases, the city’s required contributions to government-worker pensions will increase significantly over the next 15 years.

The mayor’s budget, which Chicago’s City Council passed Oct. 28, included $700 million in tax hikes, including a $318 million property-tax hike that will rise to $543 million a year by 2018.

The money from that property-tax increase will go toward paying Chicago’s contributions to its police and fire pension funds – ostensibly to help get the city’s pension crisis under control.

But as Moody’s highlights in its report, the mayor’s 2016 budget plan depends on two separate developments going in the city’s favor:

- That Gov. Bruce Rauner will sign a bill allowing Chicago to extend its timeline to repay police and fire pensions by 15 years, reducing the financial burden on the city in the short term. If the governor doesn’t sign the bill, city contributions to the police and fire pension funds will increase by $500 million in 2016 and beyond.

- That the Illinois Supreme Court will ultimately uphold the city’s municipal and laborers pension-reform plan – which increases city contributions to the funds in the short term, but includes benefit reforms that lessen pension costs in the long term.

Unfortunately for city taxpayers, Moody’s report shows that regardless of the outcome of the police and fire bill and the municipal and laborers pension-reform court case, government-worker pension payments are going to rise significantly over the next 15 years.

Under any scenario, Chicago’s contributions to its four government-worker pension funds will jump to around $1 billion in 2016 from $500 million in 2015. By 2030, the city’s contributions will be three to nearly six times higher than its original 2015 payment.

And Moody’s projection of city government-worker pension contributions is actually conservative. It assumes unfunded liabilities won’t rise due to a drop in stock markets or in the event actuarial assumptions change. If those things happen, the city’s required contributions will grow even higher than the ratings firm projects.

Real, long-term solutions

No matter what happens with the police and fire bill and the municipal and laborers pension-reform law, Moody’s says Chicago’s long-term government-worker pension situation will remain a significant cause for concern and a threat to the city’s credit-worthiness.

Instead of passing massive tax hikes that only serve to burden residents, it’s time the city focused on passing real reforms that can help fix the pension crisis in the long run.

Positive reforms for the city include moving all new city employees into 401(k)-style plans, offering optional 401(k)-style plans to current workers, and freezing city employee salaries to shrink the growth in accrued pension benefits.

In addition, Chicago should end teacher pension “pickups” – under which Chicago Public Schools pays for a majority of its teachers’ required employee pension contributions as a special benefit.

And if all these reforms ultimately prove unsuccessful in slowing the growth of Chicago’s government-worker pension liabilities, the city should be given the option to declare bankruptcy.