Illinois house value growth nation’s 2nd worst in 2019

States with the slowest housing appreciation tend to have worse labor markets, higher taxes and more pension debt.

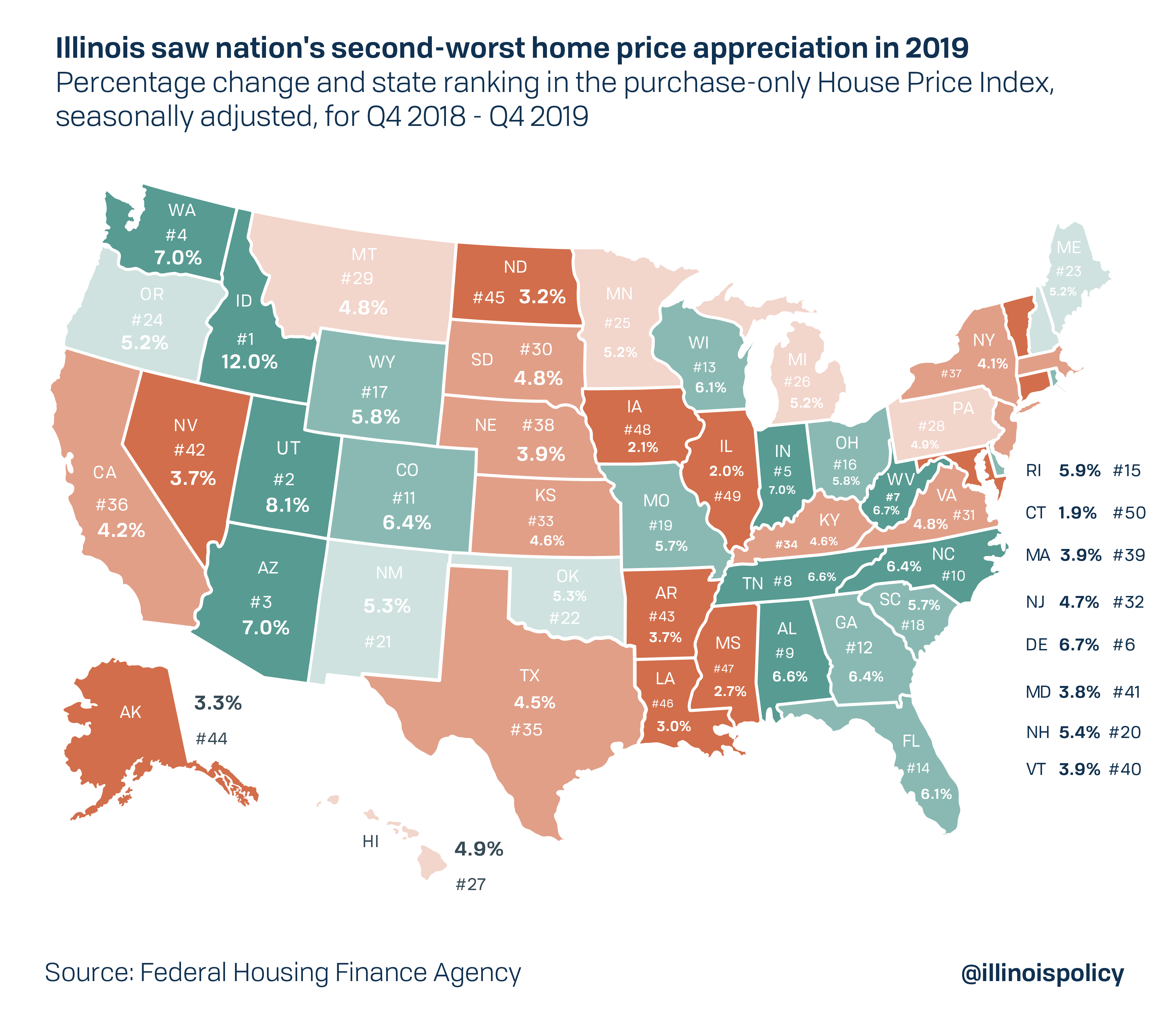

Illinois experienced the second-worst housing appreciation in the nation in 2019, data released Feb. 25 by the Federal Housing Finance Agency shows. The only state to perform worse was Connecticut – the last state to adopt a progressive income tax, and one of the few states in the past decade that raised property tax rates faster than Illinois.

Illinois home prices appreciated at a rate of 2.0% in 2019, well below the national average of 5.1%.

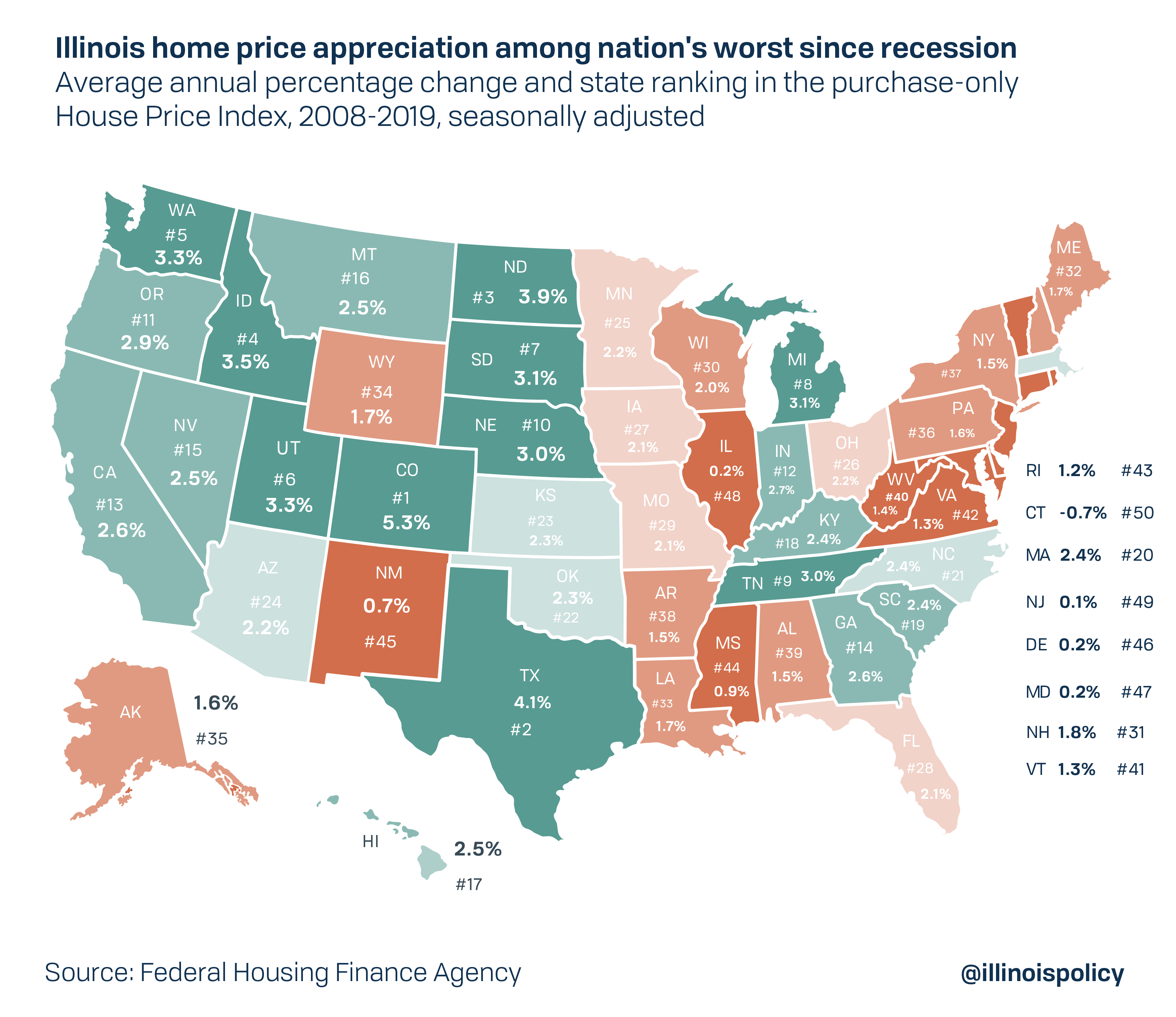

Poor house price growth has become the norm for Illinois. Since the onset of the recession, Illinois’ housing market performance has been among the worst in the nation. Average annual housing appreciation rates have been 0.2% annually since the end of 2007, beating out only New Jersey and Connecticut.

Why are house prices growing so slowly in Illinois?

Persistent bottom rankings for housing appreciation throughout the state begs the question: Why?

Supply

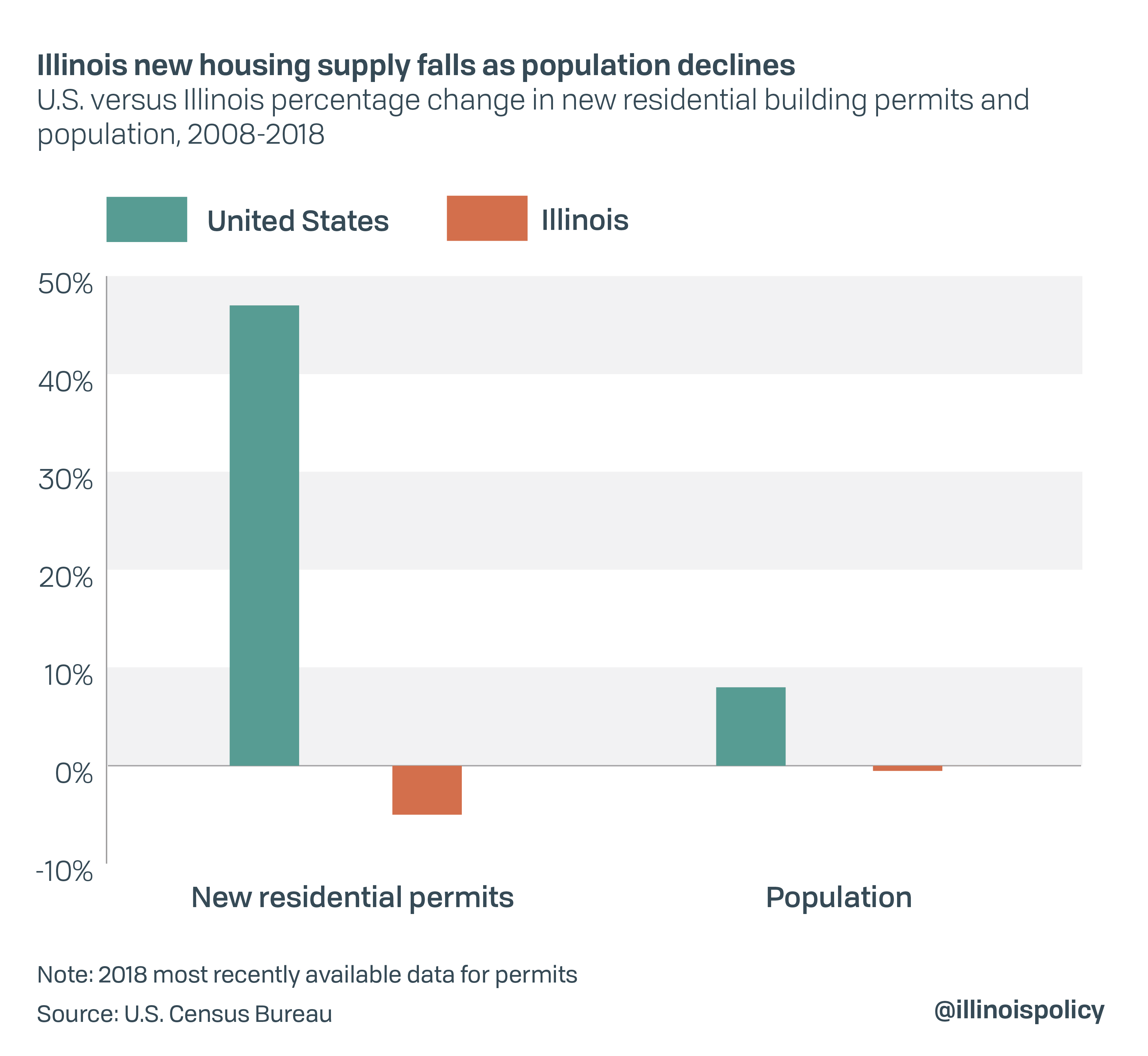

The lagging house price growth indicates demand relative to supply is growing more slowly in Illinois when compared to the rest of the country. While Illinois population has declined 0.05% since 2008, the number of new residential building permits has declined by 4.5%, indicating the supply of new housing units has decreased during the period.

Demand

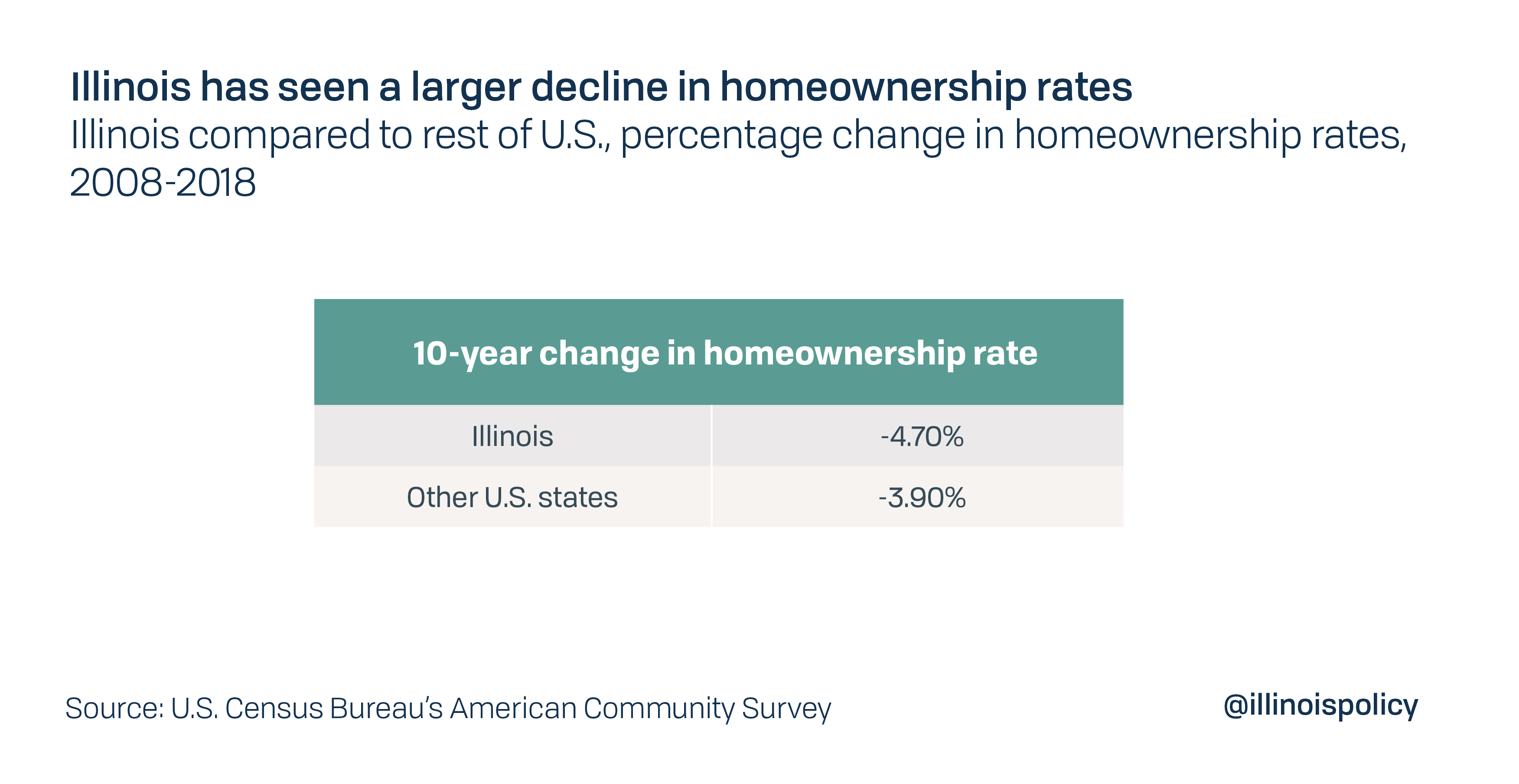

Homeownership rates across the nation have been falling for years. However, this decline has been more pronounced in Illinois than in other states.

Because the rest of the nation has continued to experience population growth, the total number of homebuyers nationwide has continued to increase, up 2.5 million since 2008, despite a decline in ownership rates. Unfortunately for Illinois, six consecutive years of population decline due to falling net migration has resulted in a stagnant population in the past decade. The net decrease in the number of new Illinois residents combined with falling home ownership rates have actually resulted in 90,000 fewer homeowners.

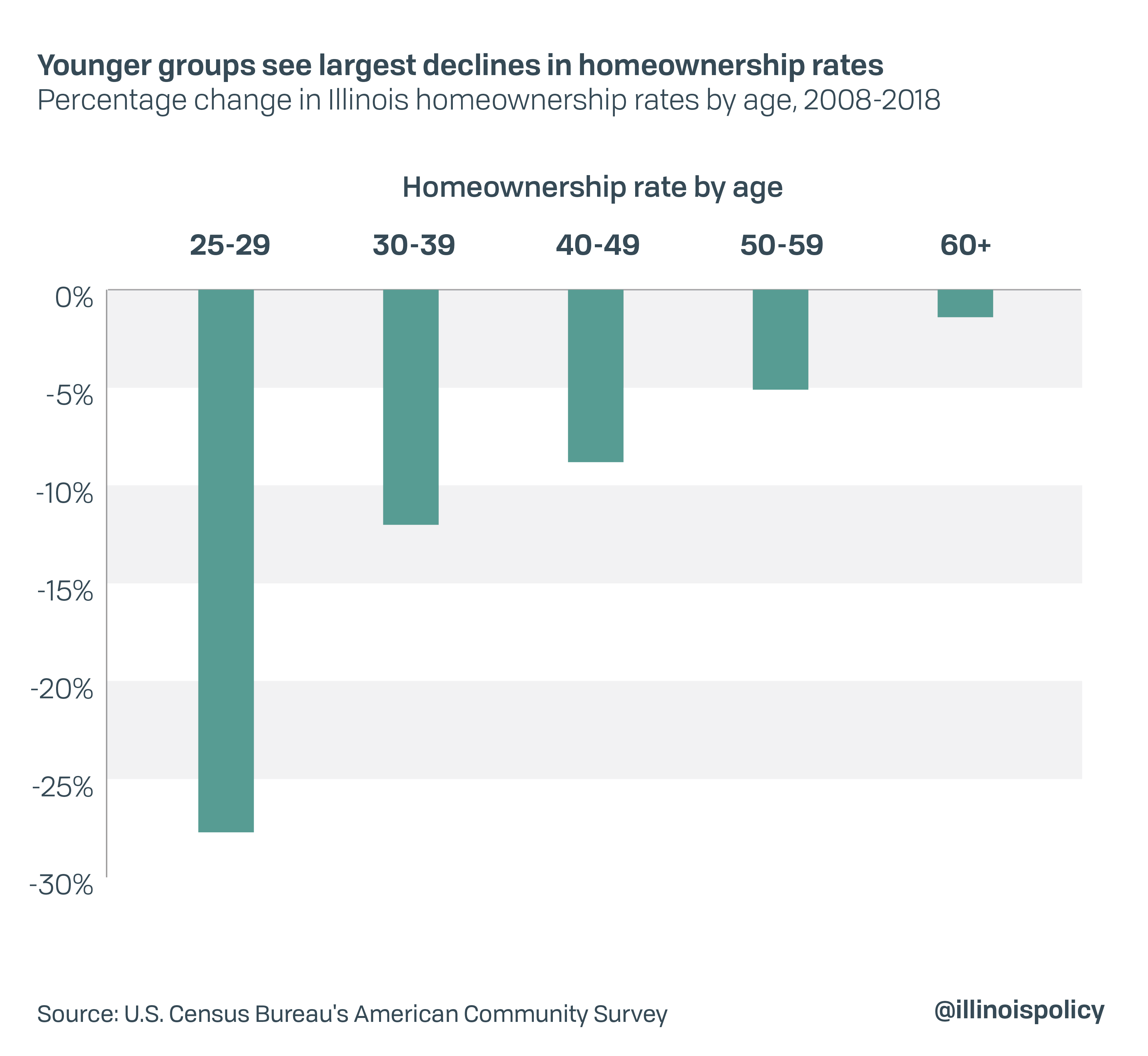

During this period, ownership rates have declined for Illinoisans of all ages. The declines have been steepest for younger Illinoisans, who are also more likely to move between homes than older Illinoisans, further dampening demand for housing.

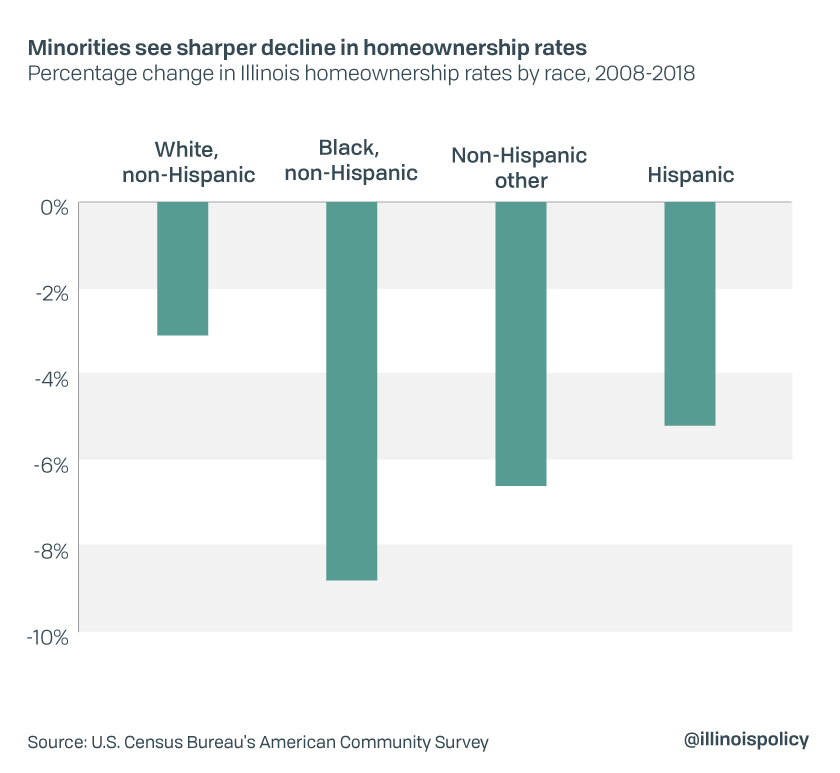

The decline in homeowner numbers, particularly among younger segments of the population, suggests that not only fewer Illinois families are buying homes but that many of them may also face higher risk of losing their home when compared to other Americans. The reduced net flow of young families into homeownership can help explain why house values are not increasing as much in Illinois as in other states. This decline could also affect differences in outcomes among racial or ethnic groups, as minorities saw a larger decline in homeownership than white Illinoisans.

A larger decline in minority homeownership has serious negative implications for wealth gaps among these groups and their white counterparts. Minorities are already less likely to own homes, and tend to have less equity in their homes. A sharper decline in homeownership rates coupled with slow appreciation means that the wealth gaps among these groups will likely be exacerbated.

Why is homeownership falling more in Illinois?

Illinois, being a Midwestern state, would traditionally be considered a relatively “affordable” housing market as house prices in the state are below the national median. However, there are costs beyond the sales price of a house that determine the affordability of a home, and whether or not buying is a worthwhile investment.

There’s no consensus among economists as to why homeownership rates across the country are falling. Some real estate experts have pointed to high home prices and shortages of starter homes to explain the slowdown in the housing markets across the country. Others have pointed to the Great Recession and access to credit as the primary culprits. One of the better explanations is the decline in mobility. The fact that Americans tend to move less than in the past could have led to falling demand for new housing. In Illinois, things have gotten particularly bad because of poor public policy choices.

Taxes

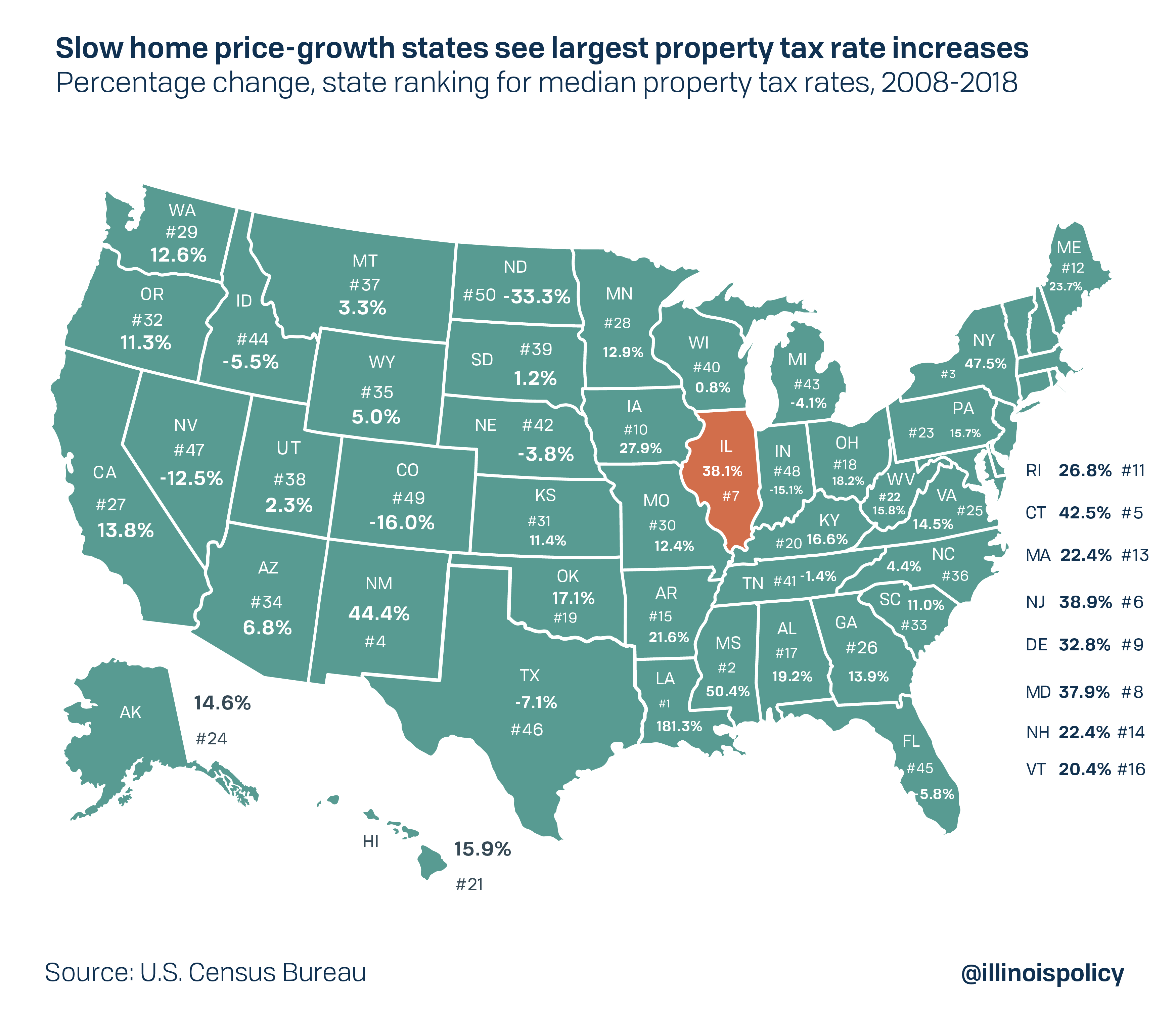

The total cost of homeownership includes items beyond mortgage payments such as income and property taxes, maintenance costs and gains – or losses – in the house’s value. In Illinois, and many other states where house values have struggled to gain ground, high income and property taxes have risen more than in other states, increasing the total cost of homeownership. Illinois is home to the second-highest property taxes in the nation and has experienced the two largest income tax hikes in state history during the past decade.

Many states that have experienced large increases in property tax rates during the past decade have also experienced slow growth in home values. States such as Connecticut, New Jersey, Illinois, Maryland, Delaware, New Mexico, Mississippi and Rhode Island all have seen some of the highest growth in property tax rates accompanied by some of the slowest growth in home prices in the nation.

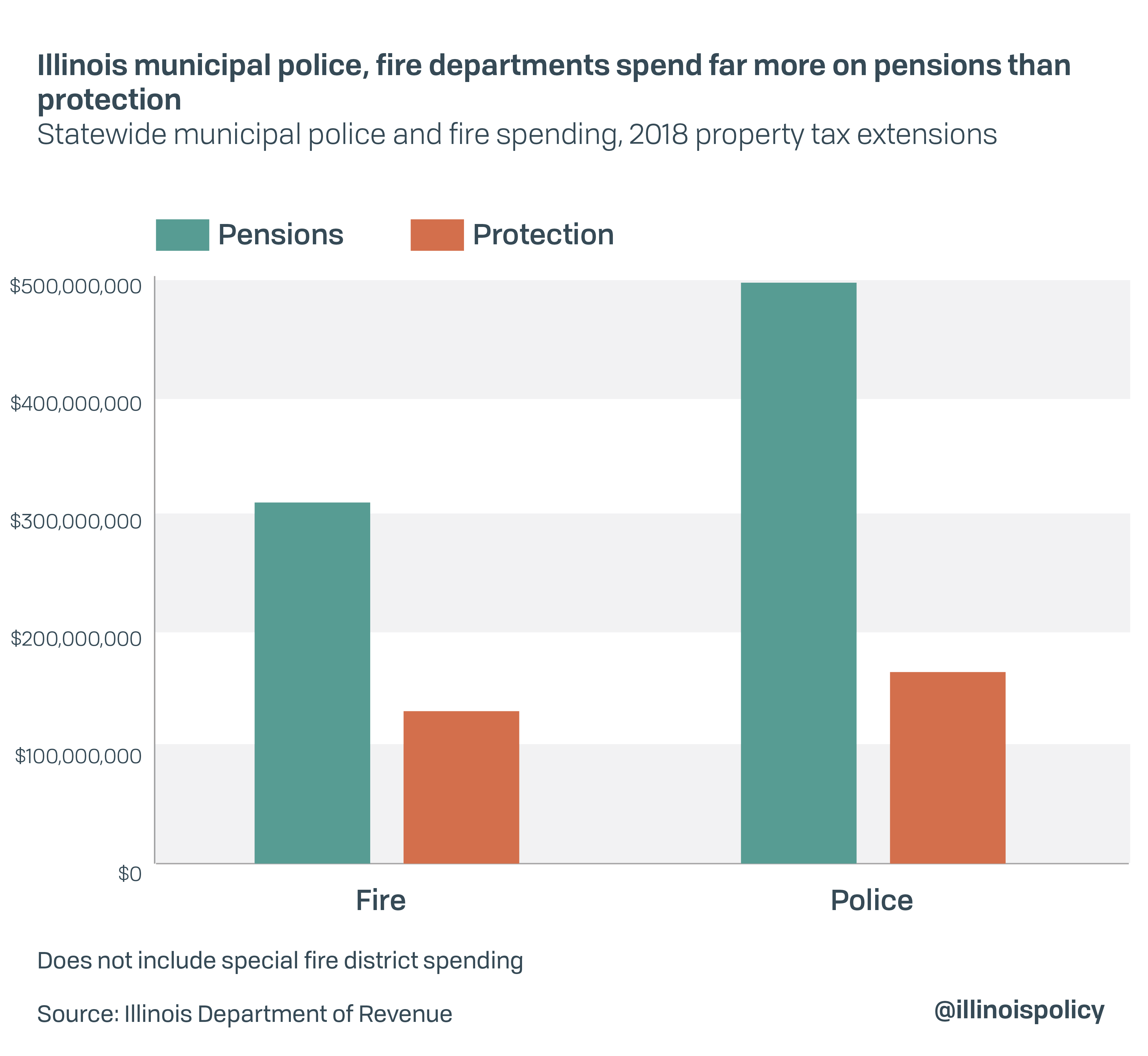

From 2008-2018, the most recent data available, median Illinois property tax rates have risen by 38%, the seventh-fastest in the nation. While in some cases increases in taxes can go toward services that improve communities and increase the values of homes, Illinois tax increases have primarily gone to retiree pensions. At the state level, services have been cutby one-third to some of the most vulnerable residents. At the local level, spending on pensions far outpaces spending on protective services such as police and fire.

Statewide, municipal fire departments spend 2.4 times as many property tax dollars on pensions than on protective services. Meanwhile, the case is even worse for municipal police departments, which spend 3 times as many property tax dollars on police pensions than on protective services.

When a disproportionate amount of property taxes go to pensions rather than local services, property taxes can negatively affect home values. And despite large contributions in recent years, Illinois’ pension funding continues to deteriorate, putting taxpayers and pensioners at risk.

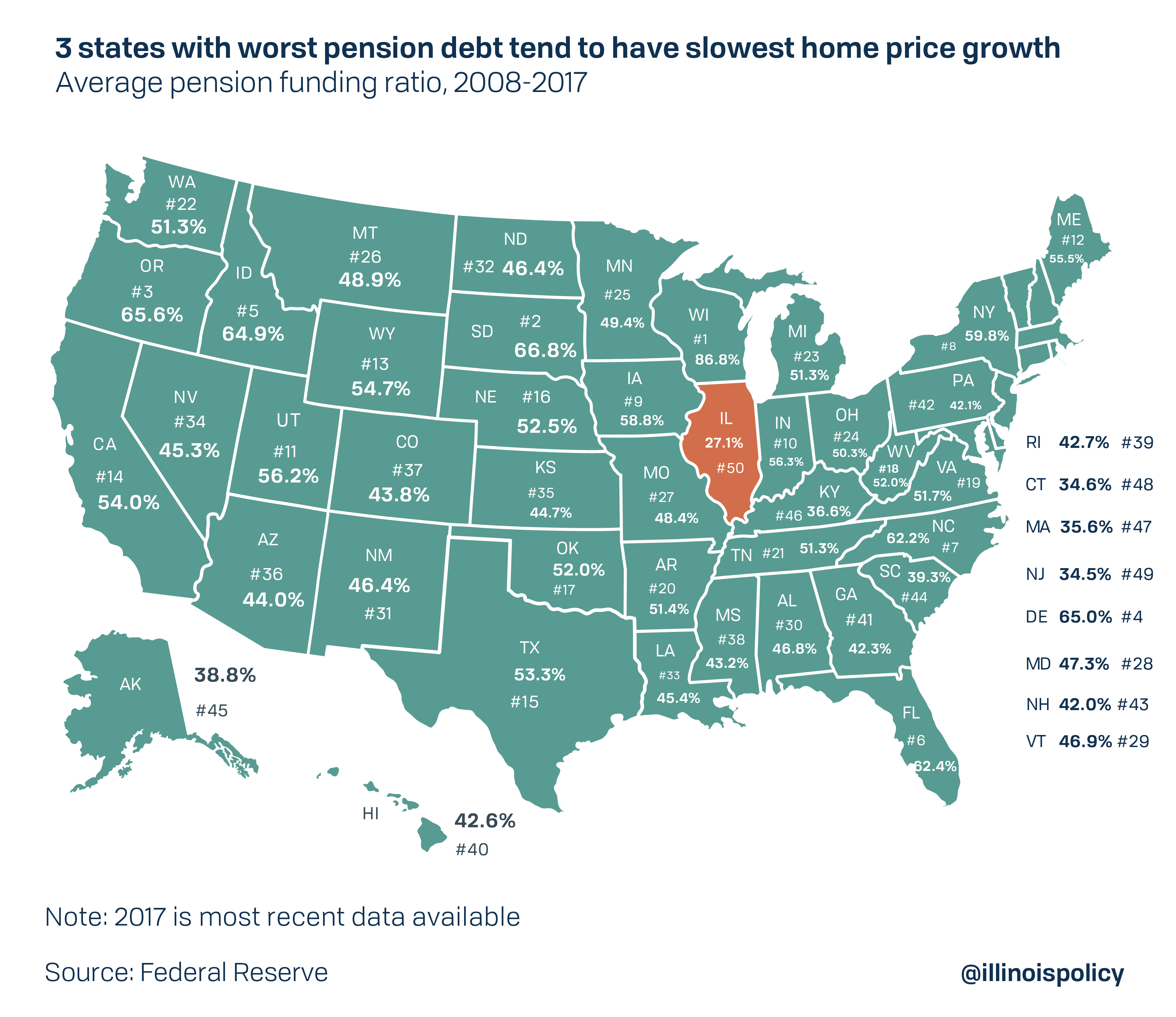

When looking across states, it appears states with the largest share of unfunded liabilities in their public pension systems also tend to have slower house price appreciation. During the past decade, the three states with the worst pension funding ratios also happen to be the three states with the slowest growth in house prices: Connecticut, New Jersey and Illinois.

While we do not investigate whether pension debt causes house prices to grow more slowly, homeownership is often the largest investment a family will make and represents long-term confidence that residing in a given community will be beneficial. Because homes are large assets that cannot easily be turned into cash or transferred, homeowners need certainty surrounding the affordability of remaining in their homes.

Weak housing demand and slow growth in house prices are signs that potential homeowners don’t have confidence in local housing markets. Large, unfunded pension liabilities could be contributing to this lack of confidence. Because homeowners are less mobile than renters, these residents are more likely to be used for revenue – in the form of income and property taxes – to pay for large outstanding costs such as pensions. It is no surprise states with large unfunded pension liabilities also tend to see low growth in house prices.

Labor market

Employment growth and housing price growth are strongly correlated. Recent economic research highlights links between regional labor and housing markets. In their article, “The Recent Evolution of Local U.S. Labor Markets,” authors Maximiliano Dvorkin and Hannah Shell examined the recession and recovery by reviewing the correlation between county-level unemployment rates and changes in housing prices. U.S. counties with larger decreases in housing prices experienced larger increases in the unemployment rate.

Illinois experienced below-average employment growth in 2019, and actually employs fewer people than prior to the recession. Fewer new job opportunities in Illinois could be another contributing factor for the state’s relatively low demand for new housing. It is also likely that less-wealthy Illinois homeowners – whose home values never recovered from the housing crisis – spend less, resulting in a laggard economy and sluggish labor market performance.

Changing the forecast

While Illinois’ 2019 housing market was among the weakest in the nation, experts are predicting similar outcomes for the state’s largest housing market – Chicago – in 2020. These experts have even gone as far as to specifically name the pension crisis as one of the top issues facing the housing market. Without the structural reforms necessary to avoid income and property tax hikes, Illinoisans can continue to expect poor performance in their housing market.

Pursuing further tax hikes is an approach that has already wreaked havoc on the state’s housing market. Instead, the state needs to pursue long-lasting reforms, such as constitutional pension reform. It needs to tie growth in state spending to what Illinois taxpayers can afford, measured by a factor such as growth in state gross domestic product or personal income. Texas and Tennessee have implemented similar spending restrictions, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Ignoring the need for reform and opting for big tax hikes will only aggravate the pain homeowners have already endured.