Budget Solutions 2019: The responsible budget for Illinois

By Orphe Divounguy, Bryce Hill, Joe Tabor

Download Report

Budget Solutions 2019: The responsible budget for Illinois

By Orphe Divounguy, Bryce Hill, Joe Tabor

Download Report

Even after a 32 percent income tax hike, the Illinois General Assembly passed a state budget in 2017 that will generate an estimated $1.5 billion deficit in fiscal year 2018. That deficit is projected to grow to $2.15 billion in fiscal year 2019, according to the Governor’s Office of Management and Budget, or GOMB.

The state’s budget problems are serious, but they are solvable. The Illinois Policy Institute’s annual Budget Solutions policy proposals provide a guide to solving the state’s budget problems and providing relief for overburdened taxpayers.

In a healthy economy, the government sector grows. However, this growth must be constrained by taxpayers’ ability to pay. That means a government sector that grows at or below the growth rate of the economy. In Illinois, growth in government spending has far outpaced that of the state’s economy.

That’s why in order to ensure responsible growth – to bend the cost curve of government – Illinois needs a spending cap tied to Illinois’ economic growth. This would ensure the total share of government in economic output remains constant over time.

Indeed, a lack of responsible growth has led to the state’s debt crisis. When the growth of government spending outpaces economic growth, the result is higher government debt, which ultimately means higher taxes on Illinois families and businesses. Due to its enormous debts, Illinois’ credit rating is barely above “junk.”

The first step in addressing the debt problem is to constrain spending so as not to add to current debt levels.

The Illinois Policy Institute’s plan proposes to responsibly increase government spending so that Illinoisans can finally get the tax relief they deserve. The Institute’s plan will lead to budget surpluses that will allow the state to pay down its debt obligations and eventually lead to a full repeal of the 2017 income tax increase.

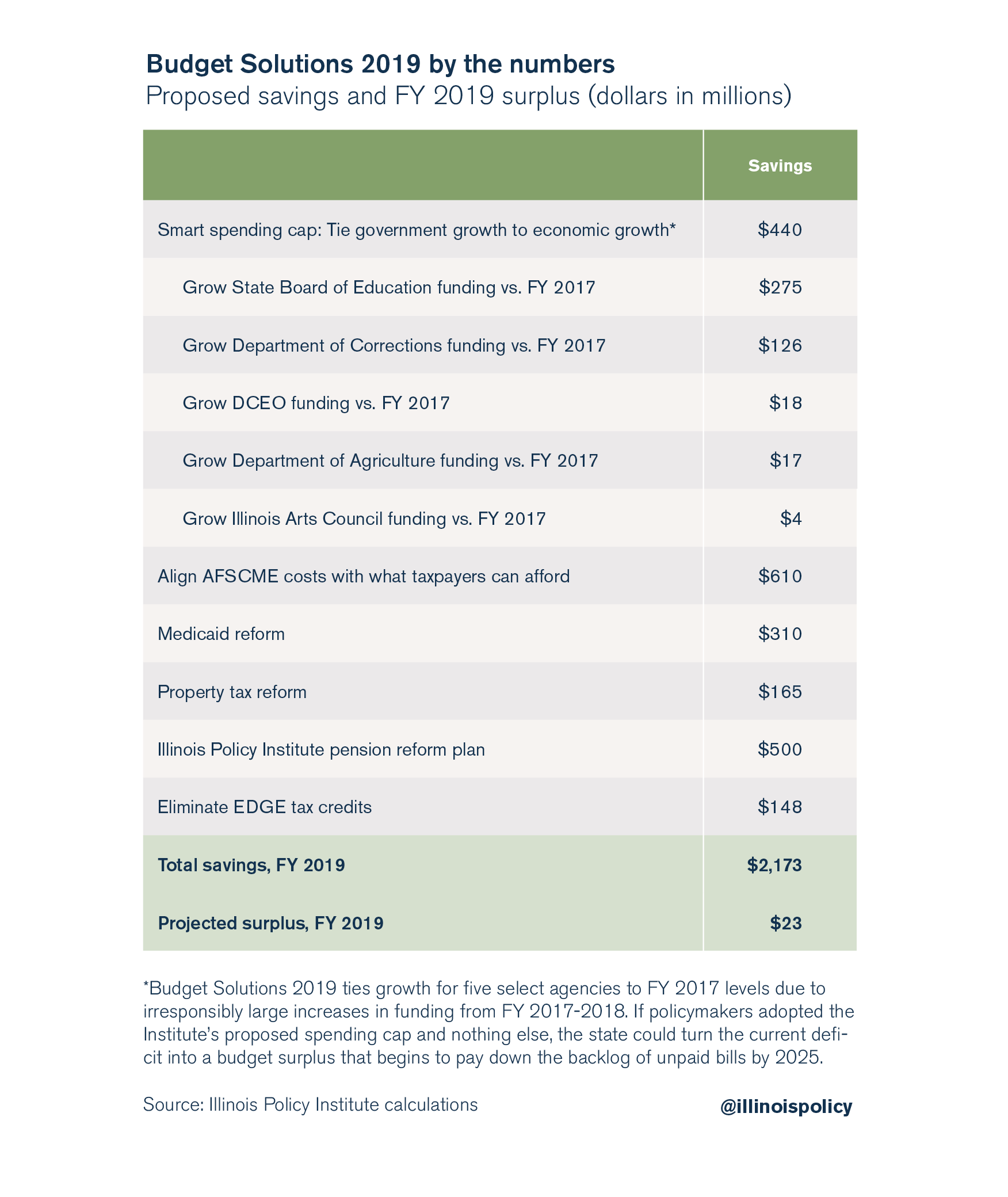

The Institute’s set of solutions is as follows:

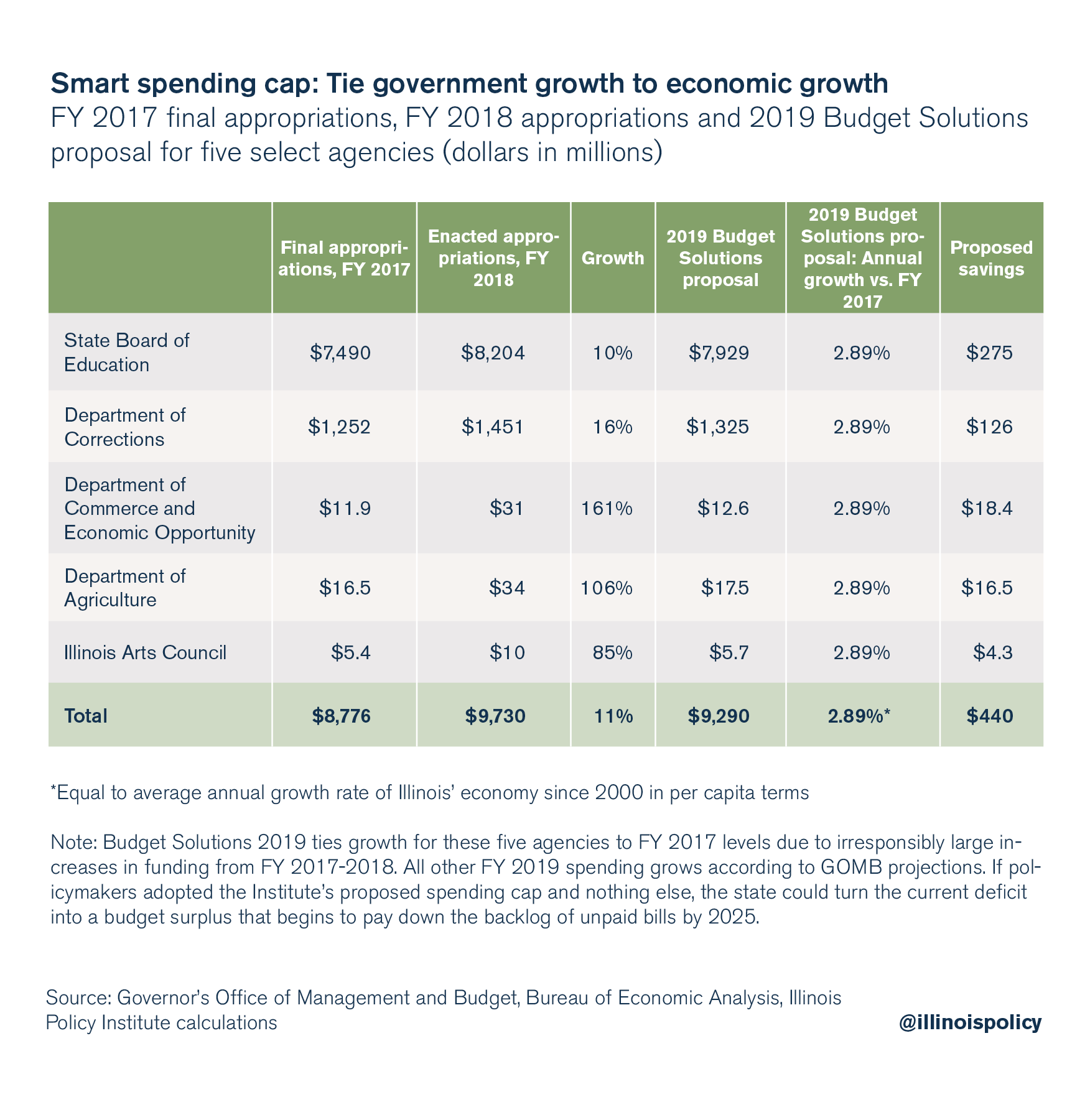

Smart spending cap: An increase in funding for state agencies at the growth rate of Illinois’ economy ($440 million in savings, $515 million in additional funding compared with 2017 appropriations)

When lawmakers haphazardly choose to increase government spending beyond what taxpayers can afford, there are only two options: 1) Raise the already enormous burden of taxation on households; or 2) Mortgage the future of Illinois’ youth by incurring debt. This is why lawmakers must take steps toward addressing structural flaws, instead of scrambling to find ways to generate the funds required to balance a bloated budget.

By capping the annual growth of the following agencies to 2.89 percent (the average annual growth rate of Illinois’ economy in per capita terms since 2000) from fiscal year 2017 levels, the state can save an estimated $440 million this year.

From fiscal years 2017 to 2018, certain agencies saw their budgets increase dramatically. The smallest increase among them – 10 percent for the Illinois State Board of Education – was more than triple the typical growth in the state’s economy. These increases are more than what taxpayers can shoulder, especially in the midst of a fiscal crisis.

By aligning the budget growth of these agencies with what taxpayers can afford – $515 million in additional funding compared with fiscal year 2017 appropriations – the state can better provide essential services without breaking the bank. This plan of action prevents these agencies from seeing their funding slashed, while preventing taxpayers from seeing their taxes increased. There will be no need for increased tax rates, as the increase in agency funding matches the average growth in Illinois’ economy since 2000.

If policymakers adopted the Institute’s proposed spending cap and nothing else, the state could turn the current deficit into a budget surplus that begins to pay down the backlog of unpaid bills by 2025.2

Align AFSCME costs with what taxpayers can afford ($610 million in savings)

If the American Federation of State, County and Municipal Employees does what is in taxpayers’ best interests and accepts a proposed 40-hour workweek and overtime reforms, and allows the state to reduce taxpayers’ state worker health care contributions to 60 percent from 77 percent, the union could save taxpayers $610 million.

Medicaid reform ($310 million in savings)

By rolling back Illinois’ Medicaid expansion and increasing competition in procedures, equipment procurement and prescription drugs, the state can fairly address a significant cost-driver in its budget. The funds the state spends can then be used more efficiently by applying for federal block grants and implementing Medicaid savings accounts.

Provide Illinoisans with property tax relief ($165 million in savings)

Illinoisans deserve property tax relief. Property taxes in Illinois are among the highest in the nation. Between 2008 and 2015, property taxes grew six times faster than Illinoisans’ household incomes.3

The right policy prescriptions would reduce property taxes across the state in order to make buying a home in Illinois a worthwhile investment. To make that realistic, lawmakers must address the main cost-drivers of local government.

At the state level, eliminating the unfair school district carve-outs from the Property Tax Extension Limitation Law, or PTELL, and tax increment financing, or TIF, districts will save the state $165 million in subsidies.

Move all new state employees into a self-managed retirement plan ($500 million in savings)

The state must begin an end to its pension crisis with real, constitutional pension reform that will eventually transfer all new public employees to 401(k)-style plans. The Illinois Policy Institute’s proposal places all new state employees into a self-managed plan based on the plan currently offered by the State Universities Retirement System, and allows current employees to opt into the plan. This plan allows the state to pay $500 million less in taxpayer contributions than the current pension system requires in 2019. Contributions will then gradually increase to align with the projections of the Illinois Policy Institute’s plan.

Eliminating EDGE tax credits ($148 million in additional revenue)

Economic Development for a Growing Economy, or EDGE, tax credits pick market winners and losers, which is not the place of state government. Eliminating the credits will generate an additional estimated $148 million in revenues.

In total, the Illinois Policy Institute’s solutions will save the state over $2.17 billion – more than making up for the projected fiscal year 2019 deficit of $2.15 billion – and put the state on a more stable fiscal path for years to come.

Introduction

Illinois has had a terrible track record with budgets in recent years. The state spent two years without a budget at all, and only passed a budget for fiscal year 2018 after subjecting Illinoisans to a 32 percent income tax hike. The tax increases will only exacerbate Illinois’ migration crisis – pressuring residents to flee the state and punishing those who choose to stay. As people leave the state, they take their pocketbooks with them. That means there are fewer Illinoisans left to pay the bills.

Shortly after the General Assembly passed the 2018 budget, the Governor’s Office of Management and Budget revealed a $1.5 billion deficit even after the additional $5 billion generated by the income tax increase.

All this is while Illinois’ population declined in 2017, dropping to sixth place in the nation, now below Pennsylvania. Negative population growth means a shrinking tax base and a shrinking economy. It will be even more difficult to fill the budget hole the General Assembly has dug for the state without resorting to further job-killing tax hikes.

Regardless of any change in tax policy, so long as the growth in expenditures continues to outpace the growth of revenues, Illinois will find itself in perpetual crisis with ever-growing deficits and debt. This is why a priority for lawmakers should be to balance the budget by restraining the growth of government spending and averting future tax increases.

What Illinois needs is a spending cap, since raising the tax burden fails to address the state’s fiscal imbalance. This is because a tax increase has a negative effect on the tax base. Economic research shows that an increase in the tax burden leads to reduced investment, fewer jobs and lower wage growth.4 However, there is a way out of this hole. Fundamental changes in the budgeting process can address the structural flaws that result in expenditures annually outpacing revenues.

In a healthy economy, the government sector grows. However, this growth should be constrained by taxpayers’ ability to pay. That means a government sector that grows at or below the growth rate of the state’s economy. When the economy grows, tax revenues also grow. That’s why in order to ensure responsible growth – to bend the cost curve of government – Illinois needs a spending cap tied to Illinois’ economic growth. This would ensure the total share of government in economic output remains constant over time.

The Illinois Policy Institute has a package of solutions that allows for responsible increases in funding for every state agency, allowing government programs to meet their obligations, all without burdening Illinoisans with additional taxes.

If government departments and agencies simply constrained their spending to the growth rate of Illinois’ economy, the state could save hundreds of millions of dollars, covering over one-fifth of this year’s projected deficit.

What Illinois needs is a spending cap tied to economic growth. A number of other states, including Tennessee and Texas, have statutes that limit appropriations to the growth rate of state personal income. Government spending should not grow faster than taxpayers’ ability to pay the bills.

The American Federation of State, County and Municipal Employees could save the state millions of dollars annually by accepting a proposed contract that includes more reasonable contributions to workers’ health insurance premiums and a standard 40-hour workweek – 2.5 hours more than they currently must work before receiving overtime pay. This would simply place AFSCME members on the same footing as what the private sector considers a normal workweek before paying overtime, the national standard set by the Fair Labor Standards Act.5

Next, the state should end policies that favor select industries over others by handing out tax credits. Government should not be in the business of picking industry winners and losers. Not only is it unfair, it distorts the market, thus inefficiently spending taxpayer funds and making the state less prosperous.

The above policies could save the state hundreds of millions immediately – all while still increasing funding for most agencies.

The General Assembly needs to take responsibility for the state’s structural fiscal imbalance.

The No. 1 area where the General Assembly should place its focus is Illinoisans’ property tax burden. Illinoisans pay some of the highest property taxes in the nation. Not only that, but the way property values are assessed, and therefore the amount that each taxpayer pays, can be extremely unfair.6 The General Assembly needs to consider ways to reduce the property tax burden on Illinois families and businesses.

In 2017, the Institute proposed a real five-year property tax freeze, one that includes home rule and non-home rule local government units. The Institute continues to support this proposal in 2018. After the freeze ends, growth in property taxes should be capped by the growth rate of household income. Freezing the tax bill is a temporary solution that allows property values to increase, resulting in lower effective tax rates. In short, property taxes should not prevent Illinoisans from pursuing the American dream of homeownership, or suck away the savings of middle-class families.

A property tax freeze will ease the tax burden on Illinois households and give taxpayers more certainty when planning their futures. But the freeze is only a first step in a series of reforms Illinois needs.

The state needs to end unfair carve-outs that subsidize some select school districts at the expense of others. Subsidies as a result of tax increment financing, or TIF, districts and the Property Tax Extension Limitation Law, or PTELL, need to be repealed. They allow certain school districts to receive undeserved Illinois tax dollars. These subsidies unfairly divert money from needier school districts.

Ending these unfair subsidies would save Illinoisans hundreds of millions of dollars while bringing more fairness to the education funding formula.

After eliminating these carve-outs, the state must free citizens from the glut of local governments, and free local governments from the glut of unfunded mandates the state imposes on them. The state must make it easier to consolidate local governments to save citizens from the unnecessary costs of redundant services. They should also reduce costly mandates on local governments so that they function better with less taxpayer money.

Attacking the root of the problem will be one of the surest ways to make sure these reforms last into the future. That way, homeowners can breathe easier knowing they can plan for their futures without wondering if their tax bills will suddenly skyrocket.

Finally, one of the most pressing fiscal issues that has plagued Illinois in recent decades has been public employee pensions. The state has taken positive steps toward reform, but adopting the Illinois Policy Institute’s pension plan will ensure government worker retirements are better funded in the long run.

The Institute’s solution will move all new employees to a mandatory defined-contribution plan that will ensure the state pays for its promises. It will meet all the constitutional requirements set by the Illinois Supreme Court, and completely phase out the current broken pension system over time. This plan allows the state to pay $500 million less in taxpayer contributions than the current pension system requires in 2019. Contributions will then gradually increase to align with the projections of the Illinois Policy Institute’s plan.

With these reforms, Illinois can not only close its current budget deficit, but also put itself on the path to long-term fiscal stability — and give hope for growth and prosperity for years to come.

Smart spending cap

An increase in funding for state agencies at the growth rate of Illinois’ economy ($440 million in savings, $515 million in funding growth compared with 2017 appropriations)

Overcoming a budget crisis in this scenario doesn’t require the “gutting” of essential services the government provides. In fact, in a growing and healthy economy, government spending could continue to grow without requiring any tax increases. Illinois’ budget crisis could be solved, in part, by simply restraining government growth to what Illinoisans can afford to pay – that is, the growth rate of Illinois’ economy. This means introducing a spending cap.

Several states already restrict spending growth to the growth of personal income. Texas and Tennessee both constitutionally limit appropriations to the growth rate of state personal income.7,8 Those states have generated recent budget surpluses while not levying an income tax.

Since the turn of the century, Illinois’ economy has grown at an annual average rate of 2.89 percent in per capita terms. This means that increasing government spending annually at a rate of 2.89 percent would allow for increased government funding for essential services without having to make any changes to tax policy. Unfortunately, Illinois lawmakers have persistently overspent.

If policymakers adopted the Institute’s proposed spending cap and nothing else, the state could turn the current deficit into a budget surplus that begins to pay down the backlog of unpaid bills by 2025.9

However, the Insititute’s analysis has revealed several major agencies where expenditures have far exceeded the state’s ability to pay for them. Addressing these issues in the current year can help to immediately remedy the budget crisis.

The full implementation of the Institute’s plan would save the state $2.17 billion, resulting in a surplus in excess of $23 million by the end of fiscal year 2019. These savings, while still increasing funding for government programs from fiscal year 2017, would allow for the continued funding of essential government services, but also put the state on a path to pay down its unpaid bills and fully repeal the 2017 income tax hike.

So where can the state generate these savings?

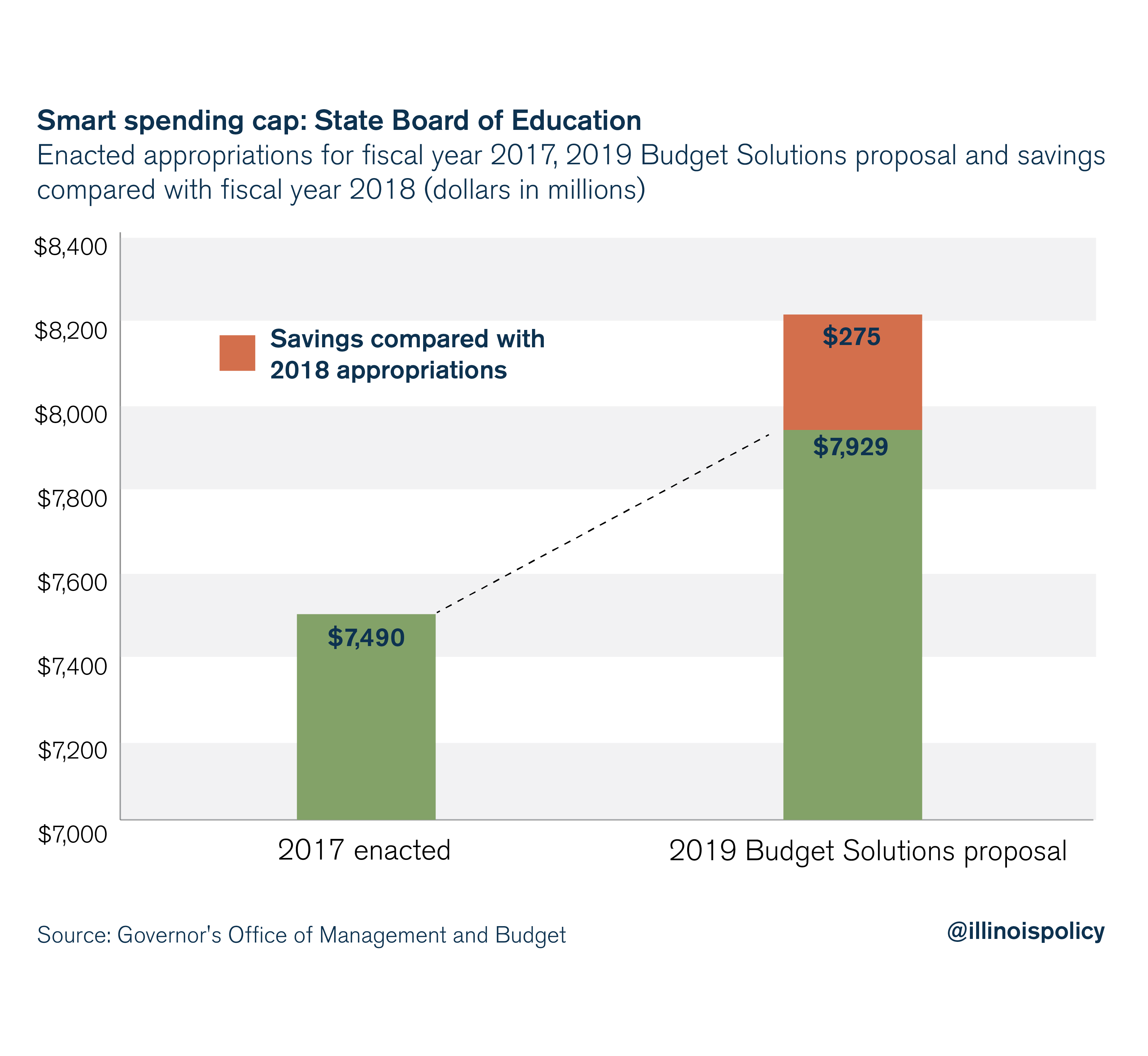

Grow State Board of Education funding vs. FY 2017 ($275 million in savings)

The number of students enrolled in Illinois’ public schools has declined for the past two school years consecutively. Despite these declining student populations, Illinois State Board of Education, or ISBE, funding has been increasing tremendously – up over $700 million from 2017 to 2018. The Institute’s proposed solution is to increase State Board of Education funding by 2.89 percent per year, per student from its 2017 level. Illinois spends $13,755 per student – more than any other state in the region.10 The Institute plan will increase that funding to nearly $13,975 per student.

This adjustment exceeds ISBE’s recommendation11 for funding in fiscal year 2018 and will save the state $275 million in fiscal year 2019, while still increasing opportunities for the youth of Illinois.12

This plan not only meets the evidence-based funding requirements and mandated categorical funds for fiscal year 2018, but also provides $439 million more in funding for schools compared with fiscal year 2017.

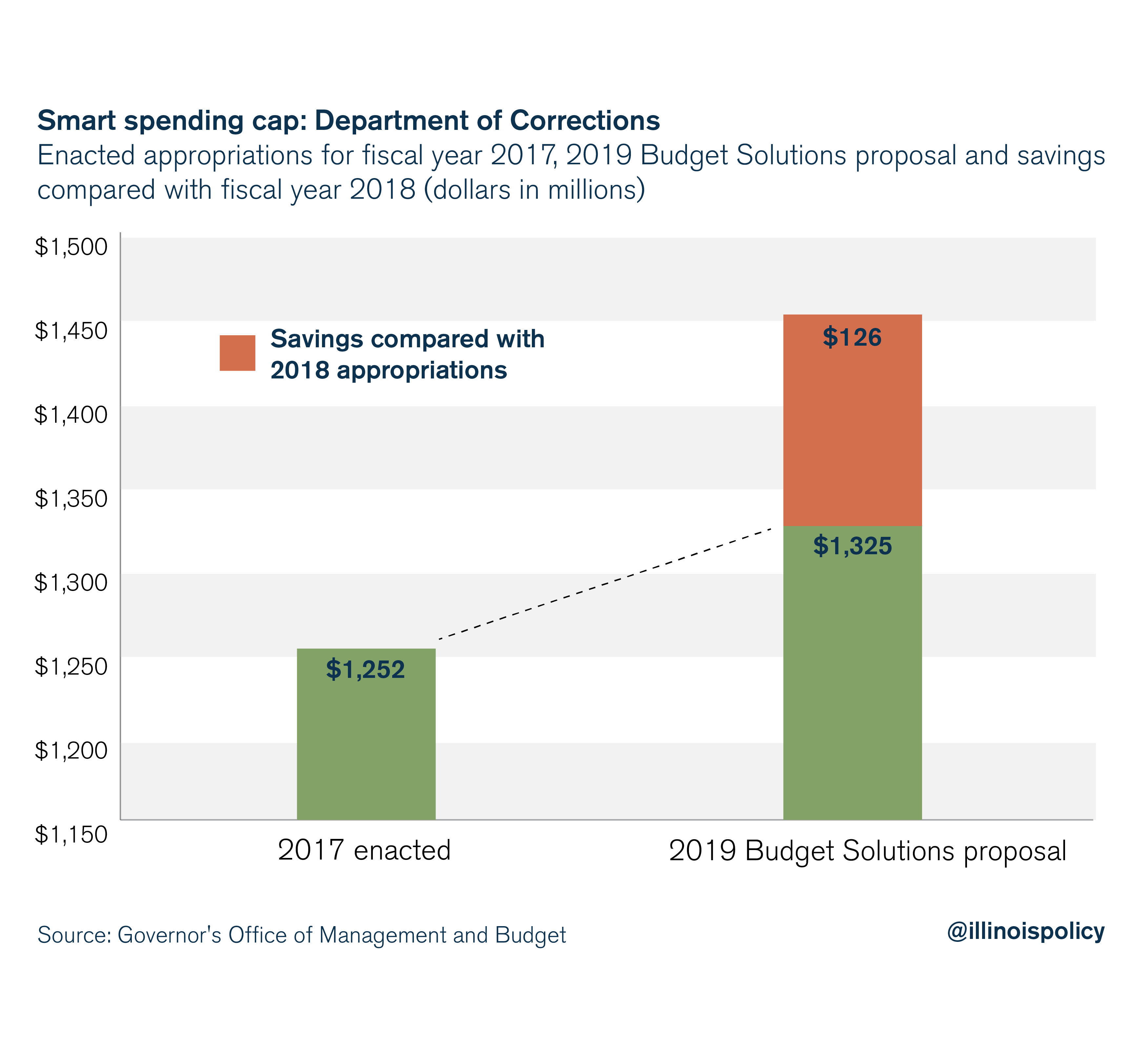

Grow Illinois Department of Corrections funding vs. FY 2017 ($126 million in savings)

Between 2016 and 2018, appropriations to the Illinois Department of Corrections, or IDOC, grew over 50 percent, exceeding $1.45 billion. But criminal justice experts largely recommend a shift away from punishment to deterrence. That means improving public safety comes from reducing Illinois’ prison population in favor of rehabilitation and alternative sentencing.13

A 2016 report from the Illinois State Commission on Criminal Justice and Sentencing Reform made specific recommendations to IDOC to reduce prison admissions and to reduce the length of prison stays in order to reduce recidivism and wasteful spending, and to improve public safety.14

Certainty of punishment, rather than severity of punishment, has long been known to be a more effective deterrent to criminal activity.15 Illinois should focus its resources on preventing crime from happening in the first place, not just punishing it. The goal of policing should be to reduce both prison populations and crime rates.

The Institute’s goal remains to reduce prison populations and to give nonviolent offenders a second chance, while reducing crime. Criminal justice reforms can accomplish just that.

The Illinois Policy Institute therefore recommends that IDOC restrict its spending growth to 2.89 percent. That represents an increase in spending of $73 million from fiscal year 2017, compared with the $199 million increase appropriated in fiscal year 2018.

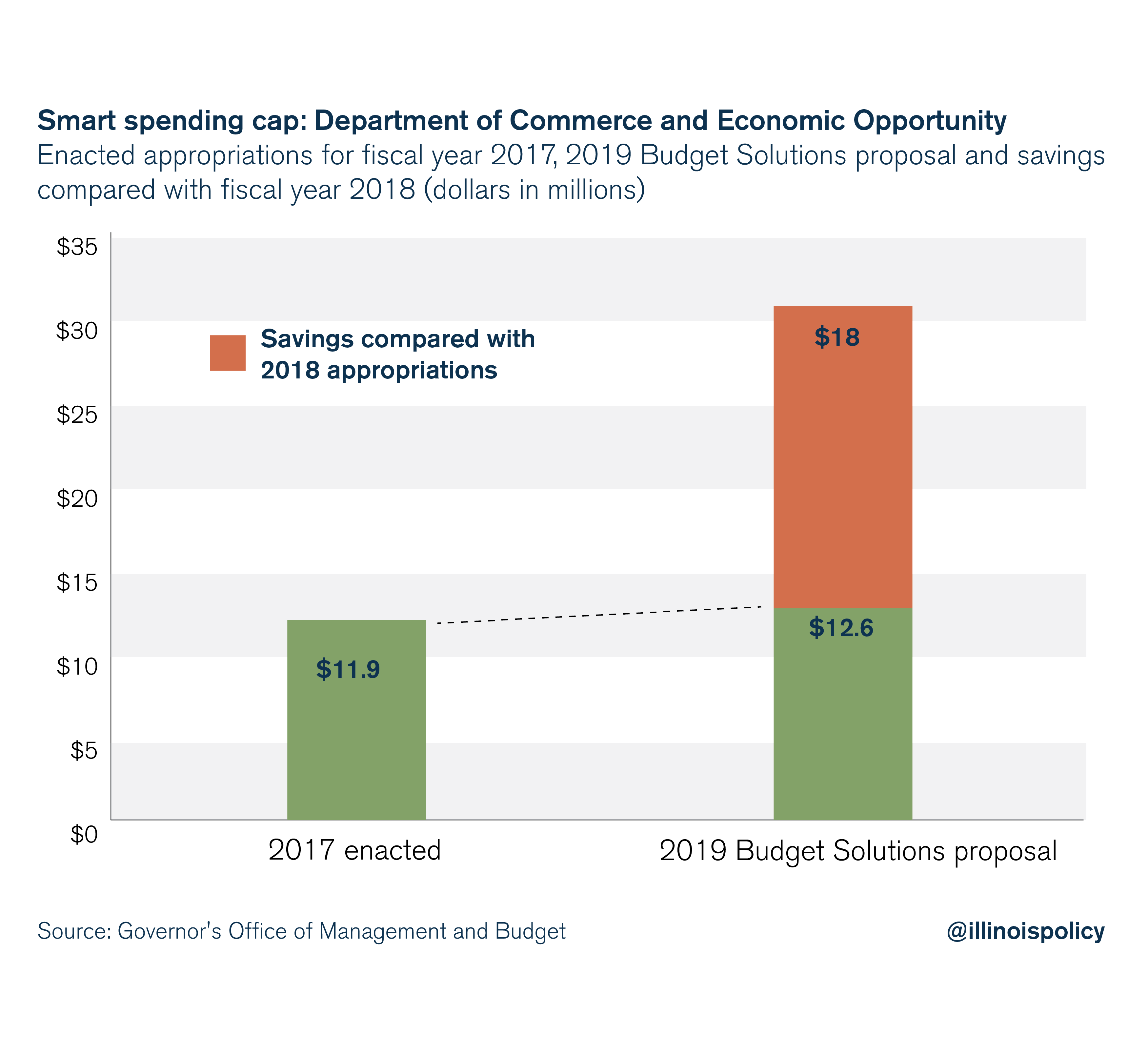

Grow Illinois Department of Commerce and Economic Opportunity funding vs. FY 2017 ($18 million in savings)

From fiscal years 2017 to 2018, funding for the Department of Commerce and Economic Opportunity, or DCEO, grew by more than 150 percent. That represents an increase of more than $18 million. This agency primarily serves to pick market winners and losers by awarding millions of dollars in grants and tax credits to select industries and businesses.

There are 1.2 million small businesses in Illinois, according to the U.S. Small Business Administration.16 However, only 84 businesses in all received tax credits under the DCEO’s Economic Development for a Growing Economy Tax Credit Program in 2016.

These taxpayer handouts to select businesses are unfair and anti-competitive. Though several areas of the agency – especially those geared toward promoting minority education and employment training – provide valuable services, the majority of spending has been driven up by grant expenses and administration costs.

Reducing DCEO’s funding increase to the 2.89 percent Illinoisans can afford would save taxpayers $18 million. That represents a spending increase of $700,000 from fiscal year 2017.

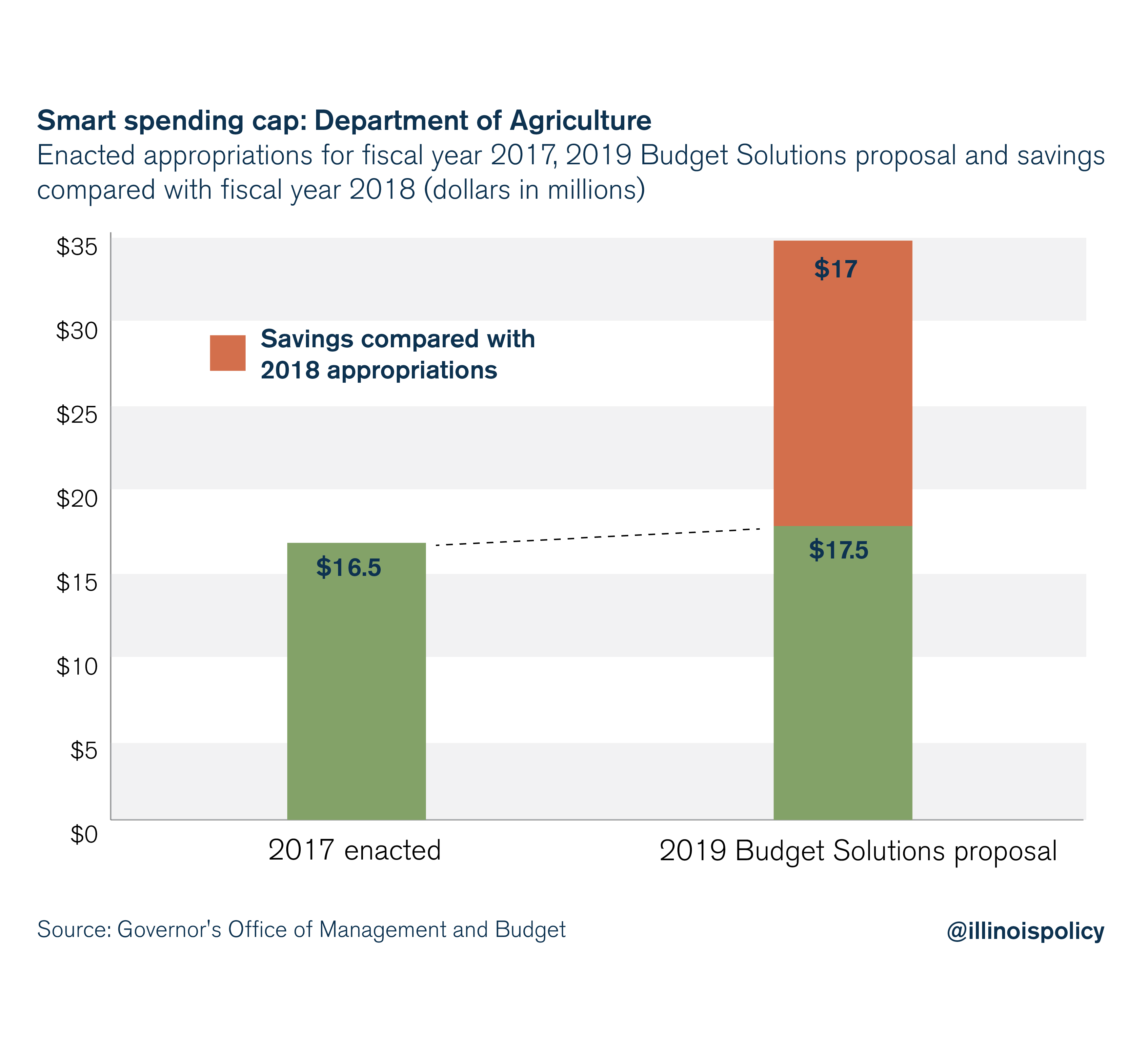

Grow Department of Agriculture funding vs. FY 2017 ($17 million in savings)

The fiscal year 2018 budget enacted in July 2017 more than doubled the amount of funding given to the Department of Agriculture. This increase comes in the form of more than $16 million of new spending for county fairs, grants and additional funding for university programs.

During a period of fiscal uncertainty, it is not appropriate to begin doubling funding to agencies.

By simply constraining the growth of the department to 2.89 percent, state government will save $17 million. That represents an increase in spending of $1 million from fiscal year 2017.

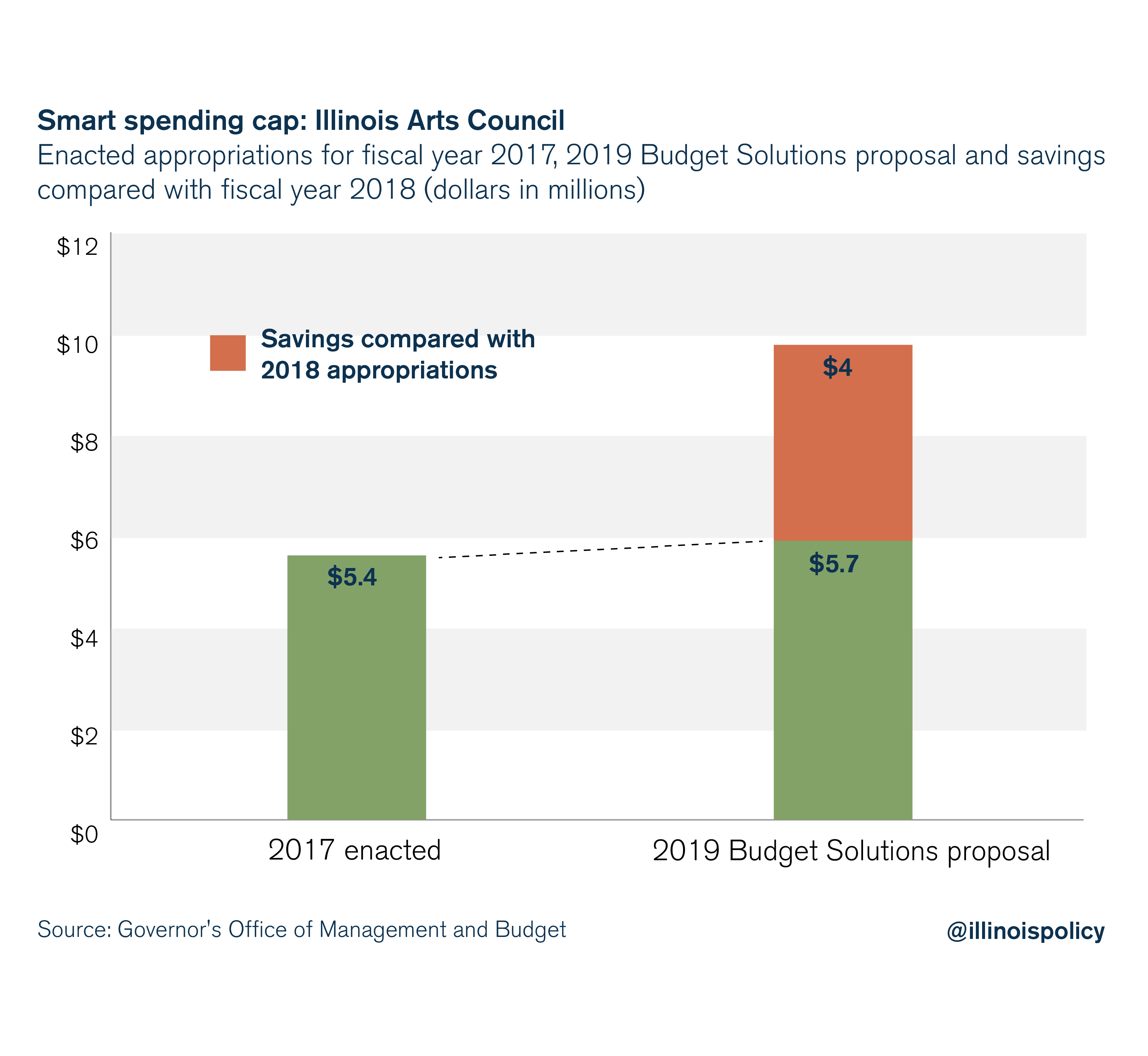

Grow Illinois Arts Council funding vs. FY 2017 ($4 million in savings)

Since 2016, the Illinois Arts Council – chaired by Shirley Madigan, wife of House Speaker Mike Madigan – has seen a 395 percent increase in funding. All of the increases in the 2018 budget stemmed from grant awards, totaling new spending of $8.5 million.

In times of severe budget crises, it is irresponsible to begin rapidly increasing funding to be doled out in the form of grants. Limiting the growth of the agency to the 2.89 percent state taxpayers can afford would save $4 million. The proposal still increases funding by $300,000 from fiscal year 2017.

Eliminating EDGE tax credits ($148 million in increased revenues)

The Economic Development for a Growing Economy, or EDGE, Tax Credit Program doles out tax credits to companies, which are meant to incentivize investment and employment. Most of these tax credits go to large corporations such as Amazon.17

The state doled out nearly $150 million in EDGE tax credits in 2016.18

While they do provide benefits to those companies that receive them, EDGE tax credits allow government to pick winners and losers in the marketplace, while forcing other taxpayers to unfairly shoulder a higher burden of taxation. The DCEO reports additional employment gains as a result of the tax credit, providing further proof that businesses and individuals create jobs when they are given reprieve from the burden of taxation.

Instead of allowing government to arbitrarily select winners and losers, and forcing other taxpayers to subsidize the process, the state should encourage economic development through persistent low, flat income taxes with a broad base, so that maximum revenue may be collected with minimum distortions to the marketplace.

Align AFSCME costs with what taxpayers can afford ($610 million in savings)

Illinois’ middle class and blue-collar workers are struggling amid one of the weakest economic expansions in the state’s history. Illinois has lagged behind the nation in both employment growth and income growth.

Meanwhile, public sector workers are demanding shorter hours and more overtime than their private sector counterparts or than public sector workers in other states. These demands are unreasonable since average annual compensation for state workers in Illinois has grown 36 percent faster than average private sector compensation for the past 10 years.19 Annual average growth of compensation from 2006 to 2016 for a private sector employee was 1.96 percent, whereas annual average growth in compensation during the same period of time for a state employee was 2.66 percent.

Take for example, a state worker in Illinois and a private sector worker both receiving $100,000 a year in compensation in 2006. If compensation for each worker had grown at the respective sector’s average annual growth rate, the state employee would have received over $130,000 worth of compensation by 2016, compared with $122,000 for the private sector employee.

Due to Illinois’ unfair labor laws, the American Federation of State, County and Municipal Employees has been able to hold taxpayers and the state budget hostage. AFSCME’s collective bargaining agreement expired in 2015, and union leaders are still unwilling to accept the reality of the state’s fiscal situation.

Meanwhile, other state employee unions have accepted a wage freeze in recognition of the realities of the state’s current fiscal condition. It is only after the Illinois Labor Relations Board declared an impasse that AFSCME claimed to accept a wage freeze. But that claim is misleading because that freeze would only apply to base wages. The union is still demanding all of the other wage increases promised under the last contract, including step increases.20 The contract is still tied up in litigation as of January 2018.

Despite representing the highest-paid state workers in the nation, AFSCME has demanded $3 billion in increased taxpayer costs in its contract.21 AFSCME rejected the standard 40-hour workweek, insisting on a 37.5-hour workweek. AFSCME also rejected the offer for the state to contribute 60 percent to employees’ health insurance premiums instead of the 77 percent it currently contributes.22 This continues as the state’s budget deficit is growing, and Illinois taxpayers will be on the hook for it.

Not even counting the wage freeze, reducing the state’s contribution for health care benefits to 60 percent from 77 percent could save over $400 million per year.23 Setting a 40-hour standard workweek would save another $16 million, and adjusting the way holiday overtime is computed would save another $12 million per year.24

In sum, by accepting these reforms, AFSCME could save the state an estimated $610 million this year.

Provide Illinoisans with property tax relief ($165 million in savings)

In Illinois, there is no tax that burdens residents more than property taxes. Illinoisans now pay some of the highest property taxes in the nation, and that burden is pushing many families out of their homes. Seniors can’t keep their homes in retirement, and middle-class families are being forced to find opportunities in nearby states.25

Illinois’ glut of local government bureaucracy and state mandates such as prevailing wage requirements drive up the cost of government operations,26 and thus Illinoisans’ tax bills.

Property taxes are stretching the budgets of Illinois families and diminishing their ability to prosper. Over the recession era (2008-2015), average property taxes paid in Illinois grew by nearly 48 percent, according to the U.S. Census Bureau’s Current Population Survey, or CPS. From 2014 to 2015 alone, average property taxes increased 17 percent. But average household income increased by only 7 percent from 2008-2015, according to the CPS. In other words, property taxes grew more than six times faster than household incomes in Illinois.

Property taxes should not prevent Illinoisans from pursuing the American dream of homeownership, or suck away the savings of middle-class families.

Illinoisans need property tax reform. First, Illinoisans need a real property tax freeze that includes all units of local government. Freezing the tax bill is a temporary solution that allows property values to increase, resulting in lower effective tax rates.

A property tax freeze will ease the burden on Illinois households and give taxpayers more certainty when planning their futures. But the freeze is only a first step in a series of reforms Illinois needs in order to reduce the property tax burden.

Reforms outlined in the Illinois Policy Institute plan would save the state $165 million.

Illinois should undertake a three-part process to rein in property taxes and reduce costs to local governments:

- Step No. 1: Property tax relief

- Step No. 2: Eliminate special carve-outs for select school districts

- Step No. 3: Eliminate state mandates on local governments and reform collective bargaining rules

Ending carve-outs and freezing property taxes will have an immediate impact on local communities’ budgets. To enable local governments to operate with reduced revenues, the state must reform many of the mandates – from prevailing wage requirements to collective bargaining rules – that drive up the cost of local government.

Step No. 1: Property tax relief

Freeze property taxes

The Institute’s tax plan freezes the property tax levy of every local government in Illinois for five years – including home rule and non-home rule local governments. Absent the passage of a local referendum to raise property taxes or the construction of new property, the amount each local government collects in property taxes would be frozen at its current amount.

The freeze will help Illinoisans’ incomes catch up with their tax bills and allow more homeowners to keep their homes.

Cap the growth in property taxes at Illinoisans’ ability to pay

Under current law, growth in property taxes is tied to inflation for a vast majority of local governments in Illinois. Those governments are subject to the Property Tax Extension Limitation Law, or PTELL, which limits the annual growth of governments’ property tax levies (i.e., the total amount of property tax revenues a local government demands annually) to 5 percent or the rate of inflation, whichever is less.27

But even with PTELL, homeowners across Illinois have seen their property tax bills grow far faster than their incomes.

Illinoisans’ property tax bills shouldn’t grow automatically based on inflation. Instead, any growth in future tax bills should be based on their ability to pay.

After the Institute’s five-year tax freeze, the annual growth in local government levies will be based on the annual growth in median household income.28

Linking property tax growth to homeowners’ ability to pay means Illinoisans will be better able to manage their annual tax bills. Further, this aligns the interest of government with taxpayers – both benefit from higher private sector income growth.

Allow tax increases only through referendum

Freezing property taxes will tempt local officials to raise local taxes and fees instead of enacting reforms.

To further protect taxpayers and encourage real reforms, any local governments’ attempts to raise additional revenue through any form of tax or fee should be subject to voter approval. This means that politicians can’t just go back to the well after they have misspent taxpayer money. They will have to appeal to voters to convince them that more funding is needed.

Under the Institute’s plan, local government that seeks additional revenues must submit its request to taxpayers through a special referendum.

Step No. 2: Eliminate special carve-outs for select school districts ($165 million in savings)

Every year, hundreds of millions of dollars in state education funds are carved out for a few school districts whose revenues are affected by local property tax caps and special economic zones.

School districts in communities with economic development zones called tax increment financing, or TIF, districts have been allowed to do something non-TIF districts can’t – hide large amounts of their property wealth from the state when applying for aid for education. School districts that can reduce their overall property wealth when applying for state aid look poorer, resulting in more aid from the state. For every additional dollar the state gives to districts located in TIFs, it’s one less dollar the state can give to districts without TIFs.

Chicago Public Schools, for example, has more than $6.6 billion of property wealth tied up in TIFs that it will keep off its aid request to the Illinois State Board of Education.29 As a result, the state will give CPS more aid than it would have had CPS reported all the property wealth in its district.

A similar practice of underreporting property value occurs for school districts operating under property tax caps, known as Property Tax Extension Limitation Law, or PTELL, districts. Districts subject to PTELL also get to underreport their property values when asking for state aid.

TIF and PTELL unfairness

The creation of local economic development zones and property tax caps is very much a local decision.

Take the city of Chicago. When Chicago officials create a new TIF district they are consciously deciding to keep future property wealth inside a development area. Officials know that will mean less future property wealth that Chicago Public Schools can count on for revenue.

Non-PTELL and non-TIF districts have been unfairly deprived of billions of dollars. PTELL districts alone have attracted over $7 billion in special subsidies since 2000, according to the Illinois State Board of Education.30

The money those select few districts receive is essentially a multimillion-dollar subsidy to relatively property-wealthy districts. These subsidies, resulting from the PTELL and TIF districts, defeat the whole purpose of the state providing needs-based education funds to districts across the state.31 The state cannot afford to give away subsidies to a select few districts when massive budget deficits and pension payments are cutting into funding for classrooms.

In 2017, PTELL cost the state $56 million in subsidies to school districts, with $40 million of that money going to Chicago Public Schools.32

Eliminating TIF and PTELL carve-outs would end those unfair subsidies and allow school funding to go to where it is needed – and could save the state $165 million in extra funding to relatively property-wealthy school districts.33

Step No. 3: Eliminate unfunded mandates

Besides the more prominent mandates imposed on local governments – collective bargaining, pension rules and prevailing wage requirements, for example – hundreds of other rules exist that impose significant financial burdens on the local governments that are subject to them.

The state’s Local Government Consolidation and Unfunded Mandates Task Force reported in 2015 that there are over 250 unfunded state mandates on the books, with an average of eight new unfunded mandates added per year.34

State mandates often force local governments to provide services or fulfill reporting requirements that may be unnecessary and even counterproductive. They restrict local governments’ ability to adjust to changing budgetary realities.

One-size-fits-all state mandates deny vastly different local governments the flexibility they need to manage their budgets.

For example, school districts across Illinois are burdened with a physical education mandate, a drivers’ education mandate and strict limitations on outsourcing services.35 Ending these mandates could save school districts hundreds of thousands of dollars every year.

Reforming unfunded mandates the state imposes on local governments will allow local governments to allocate funds in the way that best meets the needs of their districts, instead of the dictates of the state.

Reform collective bargaining rules

The collective bargaining rules the state imposes on local governments have a drastic effect on government spending for employee compensation. In 2014 alone, collective bargaining rules inflated state and local government spending by $4 billion to $9 billion.36

The problem is the rules of collective bargaining are state-imposed, offering no flexibility to Illinois’ local governments, which are all different sizes, serve different populations, and are operating in different economic climates.

Among neighboring states, Illinois’ collective bargaining rules are some of the least favorable to taxpayers. Many government workers are allowed to strike, there are no limits on the subjects of collective bargaining, and there is virtually no limit on the length of contracts. Every neighboring state has reformed one or more of these powers, providing more fairness to taxpayers at the negotiating table.37

The state’s one-size-fits-all rules should not hamstring local governments. Instead, individual local governments should have the right to reform their collective bargaining processes to match their unique economic and budgetary situations.

The state must pass collective bargaining reform that empowers local communities to negotiate more affordable contracts.

Removing some of the more stringent rules of the collective bargaining process, such as strike protection and forced arbitration, but still requiring compulsory bargaining, could save local governments $1 billion to $2 billion annually.

Workers’ compensation reform

Illinois’ workers’ compensation system is the costliest in the region and the eighth-costliest nationwide.38 Local governments often pay as much as three times more in workers’ compensation costs than comparable local governments in Indiana. As of 2015, Illinois’ local governments paid at least $700 million a year in workers’ compensation costs.39

Illinois lawmakers could help reduce costs for local governments by passing a reform law that adopts the federal definition of catastrophic injuries for the Public Safety Employee Benefits Act and eliminates the effective bump in take-home pay given to some injured government workers under the Public Employee Disability Act.40 These reforms will put Illinois on the same footing as neighboring states and at the federal standard, ensuring Illinois does not compromise worker health or safety while keeping costs reasonable.

In addition, state lawmakers should make several changes to the state’s Workers’ Compensation Act, including putting Illinois’ wage-replacement rates in line with those in surrounding states, and tying medical reimbursement rates to Medicare or group health.

Depending on the changes implemented, workers’ compensation reform could provide Illinois local governments with savings of hundreds of millions per year in payroll costs alone.

Local government consolidation

Illinois’ 7,000 units of local government – the most in the nation – are extremely expensive for taxpayers due to the inefficiencies they create and the administrative costs they generate. In many communities, multiple government bureaucracies perform functions and deliver services that could be consolidated under a single entity.

Consolidating local governments will save Illinoisans millions of dollars annually.

Unfortunately, Illinois law makes it difficult to successfully merge existing local governments. In many cases, it’s more difficult to consolidate local governments than it is to amend the Illinois Constitution.41

School districts are the one type of local government that residents are generally unwilling to change. The state can help demonstrate to local residents how school district consolidation will not only reduce their property taxes, but improve educational outcomes by removing layers of unnecessary bureaucracy in school administration.

To that end, the Illinois General Assembly should authorize the creation of an official District Consolidation Commission, which would function in a manner similar to the federal government’s Defense Base Closure and Realignment Commission. The commission’s consolidation recommendations would be approved by an up or down vote in the General Assembly, meaning no amendments would be permitted.42

If Illinois cuts just the number of school districts – not the number of schools – in half, taxpayers could see operating savings of nearly $130 million to $170 million annually and the state could conservatively save $3 billion to $4 billion in pension costs over the next 30 years.43

For example, Nebraska reduced its number of school districts to 249 from 898 between 1987 and 2013.44 Nebraska is currently ranked sixth in the nation in overall K-12 education, according to U.S. News and World Report.45 Nebraska is proof that consolidation of school districts does not come at the expense of education quality.

Medicaid reform ($310 million in savings)

Health care costs, largely made up of Medicaid expenses, are projected to consume 19 percent of the 2018 general fund budget.46

Despite the state government spending almost $14 billion on Medicaid,47 it has not improved outcomes for many recipients,48 including low-income minorities.49

Today, Medicaid patients are often forced to use lower-quality doctors, hospitals and specialists, if they can get access at all.

According to a report by physician placement and consulting firm Merritt Hawkins, 55 percent of doctors in major metropolitan areas refuse to take new Medicaid patients.50 Another study by the Department of Health and Human Services found 56 percent of Medicaid primary care doctors and 43 percent of specialists weren’t available to new patients.51

And without regular access to physicians, Medicaid patients are 65 percent more likely to visit emergency rooms than privately insured patients.52

The recent expansion of Medicaid enrollees in Illinois has denied access to revolutionary drugs for those who truly need them.53 Even when patients are able to get the drugs, patients are only allowed to get two weeks’ worth of medicine at a time, and if they fail to refill their prescriptions, the treatment is canceled altogether. Moreover, health outcomes for Medicaid patients are mediocre. A randomized study by the Oregon Health Study Group revealed that health results of Medicaid enrollees were not significantly better than those of people without access to any insurance.54 Medicaid’s rapid boom in enrollment has contributed to those poor outcomes.

In 2000, just 1.37 million, or 11 percent, of all Illinoisans were enrolled in Medicaid.55

As of 2015, enrollment had swelled to 3.2 million – a 135 percent increase. With more than a quarter of all Illinoisans on Medicaid, it is no longer a safety net for Illinois’ neediest residents. Medicaid over-enrollment means Illinois’ most vulnerable are getting crowded out of the care they need.

As the number of Medicaid enrollees has increased, costs have too. Between 2000 and 2015, general revenue fund, or GRF, and GRF-like Medicaid costs jumped by $7 billion.56

That increase alone is nearly what Illinois state government appropriates for K-12 education each year.

The recent addition of ObamaCare enrollees puts additional strain on an already overworked health care system. An additional 600,000 able-bodied Illinoisans have been added to the insured rolls, costing the state $1.8 billion in 2015 alone.57

Without serious Medicaid reforms, spending will continue to compromise other programs that help Illinoisans in need.

Instead of continuing to pour money into a failing system, Medicaid needs comprehensive reform based on expected changes at the federal level. The Illinois Policy Institute proposed the following changes in Budget Solutions 2018.58 Now the time is ripe to finally offer private insurance options to Illinois’ neediest residents through:

Federal block grants: Reform should begin with swapping out the current Medicaid financing system of federal matching funds for a block grant. With a block grant, Illinois state government would have an incentive to reform and innovate how it delivers care without fear of losing its federal funds.59

Premium assistance for Illinoisans: With funding secured, Illinois can then transform Medicaid’s fee-for-services and managed care programs into a sliding-scale, premium- assistance program based on need, allowing the state’s most vulnerable residents the opportunity to purchase private health insurance.

Premium support funds for nonelderly and nondisabled patients would be placed in a Medicaid savings account, or MSA, similar to a health savings account.60 Patients often find that doctors will not accept Medicaid, and their options can be severely limited. This plan allows them to be treated like any other patient and make their own choices about how to receive their health care.

Medicaid savings accounts: With MSAs, individuals can select the insurance that best fits their needs and preferences. Patients could also use any remaining funds in their accounts for health care expenses such as doctor visit co-pays, prescription drugs and hospital stays.61

To make these reforms work, Illinois must also lower costs wherever possible and revisit eligibility requirements to ensure the most vulnerable residents aren’t crowded out of the safety net.

Immediate solutions

The major reforms outlined above involve changes in federal law that may require time to enact. In the meantime, Illinois needs to pursue other improvements that will lower the cost burden of Medicaid:

Monitor eligibility throughout the year (State savings: $135 million)

The federal government requires each Medicaid enrollee’s eligibility be redetermined every 12 months. But life changes happen much more frequently. Monitoring eligibility through other state programs throughout the year would reduce ineligible expenses, focusing funding for those most in need. Based on other states’ changes in the frequency of their eligibility checks, Illinois can save as much as $135 million in the state portion of Medicaid costs.62

Lower drug costs

Medicaid enrollees not participating in a managed care program use an uncoordinated network of pharmacies to fulfill prescriptions. Purchases are reimbursed at regular, retail prices. Illinois’ Medicaid program should instead utilize a pharmacy benefit manager to leverage volume buying of commonly used medicines to reduce costs.63

This third party will aggressively manage utilization of pharmaceutical drugs and implement further cost-saving strategies: greater use of generics; prior approval of multiple-agent use; and bringing dispensing fees, ingredient costs, and drug utilization in line with Medicare.

Procurement reforms and competitive bidding for medical equipment (State savings: $55 million)

Many medical providers paid through Medicaid pass along their costs for major equipment to taxpayers. There are no restrictions on the amount of reimbursement, so there is little incentive to keep the costs of equipment down. The U.S. Department of Health and Human Services has found that millions of dollars in savings can be obtained simply by mimicking buying practices from Medicare.64

Based on the most recent purchasing data, Illinois stands to save as much as $55 million in 2018 by reforming procurement practices.

Repeal ObamaCare’s Medicaid expansion (State savings: $90 million)

ObamaCare expanded Medicaid eligibility to over 600,000 new enrollees in 2014 for all single, able-bodied adults – nearly double the original projections. This growth has taken vital resources away from those already in the program and most in need of services.65

ObamaCare is expected to cost Illinois’ general fund and related funds $1.78 billion in 2018 now that the state is required to pay 5 percent of total costs.66

Were Illinois to repeal the recent expansion, the state would save up to $90 million in 2019. As of early 2018, the federal government is allowing states to implement work requirements for Medicaid enrollment. A state’s “work requirement” can also allow for work alternatives, such as volunteering, caregiving, education and job training. Kentucky became the first state to take advantage of this option, but Illinois should follow to ensure resources are targeted to needier patients, rather than able-bodied adults.

Utilize ambulatory surgical centers (State savings: $30 million)

Many medical facilities outside of hospitals, known as ambulatory surgical centers, or ASCs, specialize in common, low-risk medical procedures that are completed at a significantly lower cost than at large hospitals. Seventy percent of all surgeries in the U.S. are performed on an outpatient or ambulatory basis.67

But Illinois continues to pay more for these procedures performed in hospitals. The state should lower the rates it pays to hospitals for these common procedures to level the playing field. At lower rates, hospitals will either defer services to ASCs or offer the same procedures at a more competitive rate.

These new rates will save Illinoisans over $30 million each year, based on Illinois’ actual costs in 2015.

End Illinois’ pension crisis through self-managed plans ($500 million in savings)

Illinois’ pension math simply doesn’t work.

It doesn’t work for younger government workers, who are forced to pay into a pension system that may never pay them benefits. It doesn’t work for taxpayers, who pay more and more each year toward increasingly insolvent pension funds. And it doesn’t work for Illinois’ most vulnerable, who have seen vital services cut to make room for growing pension costs.

This crisis is the result of skyrocketing benefits, not because Illinois hasn’t raised enough revenue.

Benefits have grown so much that politicians dramatically reduced them in 2010. New workers were stuck in a substandard, unfair Tier 2 system and forced to subsidize the benefits of older workers.68

Then in 2017, lawmakers passed a new, hybrid “Tier 3” pension plan that is part 401(k)-style self-managed plan, part defined-benefit traditional plan. This gives current employees the choice of opting into the hybrid plan, and gives new employees the option of opting out in favor of the Tier 2 plan.

The inclusion of a defined-contribution plan is a step in the right direction toward sustainable retirements for government workers. But both the Tier 2 and Tier 3 plans perpetuate defined-benefit pensions the state cannot afford. And those costs continue to increase.

The vast majority of current Illinois public employees and retirees are enrolled in what is called a “defined benefit” pension plan. This means the state pays a set pension benefit based on their age, salary and years of service.

However, in a “defined contribution” plan, an employee and employer have set contributions that they are required to make to a retirement fund throughout the course of their employment, and pension benefits are based on those contributions to the system.

In other words, a defined-contribution plan pays for itself, while a defined-benefit plan relies too heavily on promises of economic and population growth. Politicians overpromised and are now unable to deliver.

Accrued benefits have grown much faster than the state’s total revenues. By fiscal year 2016 the state’s combined pension systems were only 40 percent funded.69

Major credit rating agencies, such as Moody’s Investors Service and Fitch Ratings, have assigned Illinois the lowest credit rating in the nation – just one notch above junk status.70 This is because of irresponsible promises to pensioners.

Government worker pensions consume $7 billion from the state, or 19 percent of the 2018 general fund budget.71 That share is up 60 percent compared with fiscal year 2011,72 siphoning huge amounts of money away from social services for the developmentally disabled, grants for low-income college students and aid to home health care workers.73

Illinois must move away from its broken pension system and toward self-managed retirement plans that the private sector and many states have already embraced.

The way forward for state workers’ retirements

Last year, the Illinois Policy Institute published its Budget Solutions 2018, wherein the authors proposed the state move to a defined-contribution plan modeled after the state university workers’ self-managed plan.

The Institute continues that recommendation going into 2019.

Illinois laid the foundation for a comprehensive transformation of worker retirements in 1998 when it created a self-managed plan, or SMP, for its university workers. The defined-contribution 401(k)-style SMP now has 20,000 active and inactive participants, all of whom control their own retirement accounts.74

The SMP continues to attract new members every year. In 2014, 19 percent of new university workers chose to enroll in the plan.75

The status quo cannot continue. Illinois must follow the lead of the private sector and over a dozen other states in adopting defined-contribution pension plans, including Alaska, Michigan, Minnesota, Utah, West Virginia, Colorado, Florida, Indiana, Montana, North Dakota, Ohio and South Dakota.76

All these states have followed the lead of the private sector, where nearly 85 percent of workers are now enrolled in some form of defined-contribution plan.77

Illinois must follow in the footsteps of those states and the private sector if it is to end its pension crisis.

A self-managed retirement plan for state workers

The Illinois Policy Institute’s plan puts state worker retirements back on a path to financial security. The plan creates a mandatory SMP for new workers and an optional one for current workers. The plan would reduce – and eventually eliminate – the state’s defined-benefit pension plans.

In exchange, state workers would gain true retirement security by controlling and owning their own portable SMPs.

Under the Institute’s pension reform plan, all new workers would be required to enroll in a new SMP, the core of which is based on the State Universities Retirement System’s, or SURS’s, self-managed plan. The plan contains two key elements: an SMP and an optional, Social Security-like benefit.

All current workers are given the option to enroll in the SMP. If they opt in, their already-earned pension benefits are protected. They stop accruing benefits under the pension plan going forward.

Current workers who do not opt in to the SMP and current retirees would not be affected by the SMP.

Details of the plan

The core of the Institute’s retirement reform proposal is modeled after the defined- contribution-style SMP created for SURS in 1998.78

Under the SURS plan, each employee contributes 8 percent of his or her salary, and the employer contributes an equivalent of 7 percent of the employee’s salary into the employee’s SMP account annually.

Participants invest their money with investment service providers that have been chosen by SURS.

The SURS SMP continues to attract new members every year. Fifteen to 19 percent of new university workers have chosen to enroll in the SMP in recent years.79

Under the Institute’s retirement plan, new workers and current workers who opt in would own and control an SMP that contains two key elements: an SMP based on the SURS model and an optional Social Security-like benefit.

The SMP would allow workers access to market returns, while the Social Security-like benefit would provide retirement stability through fixed monthly benefit payments. As with the SURS SMP, state workers would not be allowed to borrow against or withdraw money from their accounts before they retire.

Self-managed plan: Each worker would contribute a mandatory 8 percent of his or her salary each pay period toward a retirement account he or she both owns and controls.80

The self-managed retirement account would give an employee the opportunity to participate in long-term market returns by investing in a broad range of options vetted by the state. The money in this account would grow over time through accruing employee contributions and investment returns during the employee’s working career.

The self-managed retirement accounts would be portable and transferable from job to job. This would allow state workers to change careers and take their retirement savings with them wherever they go.

When a state worker reaches retirement age, he or she would begin to withdraw funds from his or her self-managed account to provide income. The remaining assets in the account would continue to grow during retirement.

Social Security-like benefit: Employers would contribute a matching 7 percent of salary toward their employees’ retirements each pay period.

The employer contribution would be used to purchase an annuity-like contract each year from a vetted insurance company. These contracts would provide each employee with a fixed monthly benefit during retirement.

Employees would purchase a new annuity-like contract every year. Each additional contract would add to the total fixed monthly benefit an employee would receive during retirement.

Like the self-managed portion, the contracts purchased by the employee would be portable and transferable from job to job.

When state workers reach retirement age, their annuity-like contracts would begin to provide a steady stream of income annually. Because the contracts provide fixed annual payments, much like Social Security, they would provide workers with a retirement safety net independent of the SMP portion of their plan.

If a state worker does not wish to participate in the Social Security-like benefit, the employer’s 7 percent contribution would be deposited into the employee’s self-managed retirement account instead.

Plan results

To determine the total benefits and financial impact of eventually ending pensions, the Institute reform plan was analyzed by Segal Consulting, the actuarial firm used by the state for its annual pension analyses.

Segal’s analysis used 2015 data, the most recent data available at the time, and focused on the Teachers’ Retirement System, or TRS, as the proxy for the three major state pension plans.

Those projections were then extrapolated by the Institute to include the impact on the State Employees Retirement System, or SERS, and SURS.81

Segal ran two separate scenarios regarding the implementation of the Institute’s plan:

- Scenario 1: Assumes all current workers join the SMP.

- Scenario 2: Assumes only current workers who are members of Tier 2 join the SMP. (The state had not yet implemented Tier 3, so current Tier 3 members are not included)

- Both scenarios achieve a 90 percent funded ratio for the pension systems within 30 years, just as the current pension systems’ funding projections do. Scenario 1 can be considered the “best case scenario” under the Institute’s SMP. It assumes the unlikely case that all current state workers will join the optional defined-contribution plan upon its creation.

Scenario 2 can be considered the “worst case scenario” under the Institute’s SMP. It assumes that only current Tier 2 workers will join the defined-contribution plan.

In either case, the Institute’s plan does the following:

Under the status quo, promised benefits to Illinois workers will grow to over $350 billion by 2047.82 According to Segal’s analysis, the Institute’s plan under Scenario 2 decreases accrued pension liabilities by over 15 percent compared with the status quo (baseline).

Benefits of moving to an SMP

To achieve the above goals – including ending unfair Tier 2 pension benefits – the state must invest the equivalent of a total of $7 billion to $18 billion (likely closer to $18 billion) in today’s dollars over the next 30 years. That amount depends on how many and which tier of workers opt in to the SMP. The more Tier 1 members who opt in, the lower the cost will be.

While $7 billion to $18 billion might sound like a high number, it pales in comparison with the costs the defined-benefit plans have extracted from taxpayers and retirees over the last 30 years. Year after year, despite increasingly larger contributions by taxpayers and relatively strong financial markets, the shortfall – and subsequent cost – of pensions has only grown. In 1996, pension debt totaled just $20 billion. Today, it’s $130 billion.83

In fact, in 2016 alone, the pension shortfall jumped an incredible $19 billion despite:

- Record-high stock markets84

- $8 billion in contributions by taxpayers in 201685

- Pensions consuming 25 percent of the state’s general fund budget86

- The ever-larger subsidy that Tier 2 workers provide as more and more post-2011 workers join the state workforce87

Opponents of SMPs will say the investment needed to implement SMPs is too high. But the costs of staying with the current pension plan are sky-high, and they are on a path to bankrupting the state and state worker retirements. Illinois cannot afford to continue the current pension system.

Here are the main reasons SMPs make sense for active state workers, retirees and all Illinoisans:

SMPs provide stable and predictable costs going forward

Pension liabilities have grown worse year after year due to failed actuarial assumptions such as investment returns and mortality rates. The state has little to no idea how much more pensions are going to cost in the future. That’s been true for the past 30 years, and there’s no reason to expect anything different in the future.

Pension plans are inherently unpredictable and unmanageable. That’s why Illinois’ pension debt has reached record levels despite the billions of extra dollars contributed by taxpayers over the past decade.

In contrast, defined-contribution plans are a stable and predictable way to budget for retirement costs. Instead of the growing costs associated with traditional pension plans, defined-contribution retirement plans are a known cost – a fixed percentage of payrolls each year.

The state’s SMP employer costs will equal a flat 7 percent of payroll annually under the Institute’s plan.

Until Illinois gets politicians completely out of the pension business, the state will never be certain what its retirement costs will be and pensions will continue to crowd out other core services. That’s why moving to the known and manageable costs of a defined-contribution plan is so important.

A significant reduction in accrued liabilities

The Institute’s SMP begins to end the state’s pension crisis by slowing down and eventually reversing the accrual of pension benefits (accrued liabilities) for state workers.

According to Segal’s analysis, the Institute’s plan under Scenario 2 decreases liabilities by 21 percent compared with the status quo.

An end to the defined-benefit pension system

Creating an optional SMP for current state workers would give them the ability to leave the unfair pension system and control their own retirements.

Under Scenario 2 of the defined-contribution plan, all Tier 2 workers are assumed to switch to the SMP in 2018. Afterward, the proportion of workers paying into the SMP would grow steadily over the years as current workers retire and new ones are hired.

The state’s goal has always been to provide a secure, sustainable and fair retirement to all state workers.

The Institute’s SMP provides that.

Protection of funding for social services and avoidance of tax hikes

The state’s pension crisis has grown despite massive taxpayer contributions and pension bond repayments. Those costs have grown to consume a large portion of the state’s budget, crowding out spending on vital social services for the developmentally disabled, grants for low-income college students and aid to home health care workers, to name just a few programs. To protect spending for those services, the Institute’s plan alters pension costs by $500 million in 2019. That is on top of the $500 million the new Tier 3 plan is projected to save, according to the Commission on Government Forecasting and Accountability.88

Phasing in the cost of actuarial changes will reduce pension costs by $640 million in 2018

Currently, the pension systems have the power to demand billions of additional dollars from the state budget annually by changing their actuarial assumptions. That includes lowering investment assumptions, altering mortality assumptions and other actuarial items. Those changes are based entirely on the funds’ discretion, and their impact on the budget is instantaneous, hurting everything from classroom funding to social services.

For example, in 2012, TRS lowered its investment rate assumptions to 8 percent from 8.5 percent. That change forced the state to increase its contributions to the pension funds by more than $500 million compared with the projections prior to the change. Lowering the assumed return reveals the true cost of the pension system, but the arbitrary control of the pension boards to alter the assumed returns makes budgeting an uncertain endeavor.

Adjusting assumptions that govern the state’s contributions would be completely unnecessary once all employees are in a defined-contribution plan.

The assumptions that govern the state’s contribution toward state workers’ pensions were changed again in 2017. SERS’s and TRS’s assumption changes will increase the state’s 2018 contributions by $800 million compared with last year’s cost projection for 2018.

No other institution can automatically carve out billions from the state budget like the pension funds can. Social services and education can’t automatically take billions more from the state if they feel their costs have changed.

The impact of actuarial changes on the budget and other programs should not be immediate. Instead, they should be treated in the same way the pension funds treat investment returns. The funds’ investment returns are smoothed over five years to reduce the impact of negative markets on the pension plans’ performance. The same rationale should be applied to changes in actuarial assumptions.

Under the Institute’s plan, the costs of any pension funds’ actuarial changes will be phased in over a five-year period. For example, the projected $800 million increase in state contributions due to changes in actuarial assumptions in 2018 would fall to $160 million this year. The remaining $640 million would be spread over the remaining four years.

2019 payment $500 million less than current projections

No other plan does what the Institute’s plan does. It protects worker benefits in accordance with the requirements of the Illinois Constitution while initiating the ending of the broken pension system, eliminating the unfair Tier 2 benefit structure, and providing real retirement security to state workers. And it is part of an overall plan that avoids tax hikes on Illinoisans and reprioritizes spending on social services.

The Institute’s reforms allow the plan to begin with a contribution toward state worker retirements that is $500 million less than the required contribution in 2019.89 Contributions then increase gradually to be in line with Segal’s Scenario 2 projections, which are based on a fixed percentage of payroll.

The pension systems will reach 90 percent funded in 2047 under the Institute’s plan. Afterward, state contributions will begin to decline until they reach a constant 7 percent of payroll as designed under the SMP.

It will take decades to clean up the mess that Illinois’ politicians have created, but the Illinois Policy Institute’s mandatory SMP for all new public workers puts the state on that path.

Conclusion

This report provides a path toward a responsible budget for Illinois that averts future tax increases. With the implementation of the plan put forth by the Illinois Policy Institute, the state could soon find itself with a budget surplus.

In the long term, the Institute’s plan will continue to generate annual budget surpluses so that lawmakers can begin working to provide tax relief for all Illinoisans by repealing the 2017 income tax hike.

A fiscally solvent state government will restore a sense of security about the future, making Illinois a more attractive place to put down roots and to invest. Illinois should be a place where families can prosper. Working toward that future means fixing the state’s broken budgeting.

Endnotes

- The authors thank Chris Lentino for his research assistance.

- Assuming revenues grow at the average annual rate seen from 2011-2014 and lawmakers adopt a 2.89 percent cap on the growth rate of expenditures.

- Orphe Divounguy, “Rising property tax burdens squeeze Illinois families,” Illinois Policy Institute, Winter 2018.

- Christine D. Romer and David H. Romer, “The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,” American Economic Review, June 2010.

- Fair Labor Standards Act of 1938, 29 U.S.C. § 2017.

- Orphe Divounguy, “Rising property tax burdens squeeze Illinois families,” Illinois Policy Institute, Winter 2018.

- Tex. Const. Art. VIII, § 22.

- Tenn. Const. Art. II, § 24.

- Assuming that revenues grow at the average annual rate seen from 2011-2014 and a 2.89 percent cap on the growth rate of expenditures is adopted.

- U.S. Census Bureau, Annual Survey of School System Finances (FY 2015), June 14, 2017.

- Illinois State Board of Education, FY 2018 Budget Request, June 24, 2017.

- Illinois State Board of Education, FY 2018 Operating Budget.

- “Broken: The Illinois Criminal Justice System and How to Rebuild It,” ACLU Illinois, December 1, 2017.

- “Final Report (Parts I and II), Illinois State Commission on Criminal Justice and Sentencing Reform,” December 2016.

- Valerie Wright, “Deterrence in Criminal Justice: Evaluating Certainty vs. Severity in Punishment,” November 2010.

- U.S. Small Business Administration, Illinois Small Business Profile, 2016, March 9, 2016.

- Brendan Bakala, “Amazon received more than $112 million in EDGE tax credits in 2016,” Illinois Policy Institute, April 14, 2017.

- Illinois Department of Commerce and Economic Opportunity, Economic Development for a Growing Economy (EDGE) Tax Credit Program Annual Report (2016), June 30, 2017.

- Illinois Policy Institute calculations using Bureau of Economic Analysis 2006-2016 private nonfarm compensation and employment data and 2006-2016 state employee compensation and employment data.

- Mailee Smith, “AFSCME pay decision reveals high cost of government worker unions,” Illinois Policy Institute, November 9, 2017.

- Ibid.

- Ibid.

- Ted Dabrowski and John Klingner, “AFSCME’s contract demands: A close look at the $3B hit to taxpayers,” Illinois Policy Institute, February 8, 2017.

- Ibid.

- Erik Randolph, Ted Dabrowsk and John Klingner, “Growing Out of Control: Property Taxes Put Increasing Burden on Illinois Taxpayers,” Illinois Policy Institute, November 2015.

- Brian Costin, “Too Much Government: Illinois’ Thousands of Local Governments,” Illinois Policy Institute, November 2013.

- Illinois Department of Revenue, An Overview of the Property Tax Extension Limitation Law by Referendum.

- Each year the U.S. Census Bureau’s American Community Survey publishes the median household income for every state in the nation. The Institute’s plan would use this single measure to determine the growth in local tax levies across Illinois.

- Illinois Department of Revenue, 2015 Property Tax Statistics.

- Ted Dabrowski and John Klingner, “How TIFs and PTELL warp fairness in school funding,” Illinois Policy Institute, August 8, 2017.

- Ted Dabrowski, Josh Dwyer and John Klingner, “Understanding Illinois’ Broken Education Funding System: A Primer on General State Aid,” Illinois Policy Institute, October 3, 2013.

- Ted Dabrowski and John Klingner, “How TIFS and PTELL warp fairness in school funding,” Illinois Policy Institute, August 8, 2017.

- Ibid.

- Task Force on Local Government Consolidation and Unfunded Mandates, Delivering Efficient, Effective and Streamlined Government to Illinois Taxpayers, December 17, 2015.

- Mark Fitton, “Rauner Backs Plan to Eliminate Unfunded School Mandates,” Illinois Policy Institute, February 20, 2016.

- Geoffrey Lawrence, James Sherk, Kevin D. Dayaratna, PhD, and Cameron Belt, How Government Unions Affect State and Local Finances: An Empirical 50-State Review, (The Heritage Foundation, Institute for Economic Freedom and Opportunity, Special Report, April 11, 2016).

- Mailee Smith, “Rigged: How Illinois labor laws stack the deck against taxpayers,” Illinois Policy Institute, Winter 2017.

- Chris Day, Mike Manley and Jay Dotter, 2016 Oregon Workers’ Compensation Premium Rate Ranking Summary, State of Oregon Department of Consumer and Business Services, October 2016.

- Michael Lucci and Mindy Ruckman, “Workers’ compensation for state, county and municipal workers costs Illinois taxpayers $400 million per year,” Illinois Policy Institute, 2017.

- Ibid.

- Costin, “Too Much Government.”

- Dabrowski, “Too Many Districts.”

- Ibid.

- Cory D. Worrell, The History of Nebraska Public School Reorganization Over the Past 30 Years and How This History Might be Used to Predict Nebraska School Reorganization in the Future: A Mixed Methods Study, University of Nebraska-Lincoln, April 8, 2015.

- “Education Rankings,” U.S. News & World Report, 2018.

- Governor’s Office of Management and Budget, “State of Illinois Financial Walkdown,” October 11, 2017.

- Ibid.

- Kevin D. Dayaratna, “Studies Show: Medicaid Patients Have Worse Access and Outcomes than the Privately Insured,” The Heritage Foundation Backgrounder No. 2740, November 9, 2012.

- Nimrah H. Imam, “The Limits of Accessibility Under the Affordable Care Act,” (2017), Scripps Senior Theses, 916.

- Merritt Hawkins, 2014 Survey Physician Appointment Wait Times and Medicaid and Medicare Acceptance Rates.

- Daniel R. Levinson, “Access to Care: Provider Availability in Medicaid Managed Care,” Department of Health and Human Services, Office of Inspector General, December 2014.

- Carolyn Y. Johnson, “More Evidence Expanding Medicaid Increases Emergency Room Visits,” Washington Post, October 19, 2016.

- Lisa Schencker, “State Switches Stance on Hepatitis C Drugs, Expands Access, But Not All Medicaid Patients Qualify,” Chicago Tribune, September 12, 2016.

- Avik Roy, “Oregon Study: Medicaid ‘Had No Significant Effect’ on Health Outcomes vs. Being Uninsured,” Forbes, May 2, 2013.

- Governor’s Office of Management and Budget, Governor’s Recommended Fiscal Year 2017 Budget, 2016.

- Ibid.

- Ibid.

- Ted Dabrowski, Craig Lesner, John Klingner and Michael Lucci, “Budget Solutions 2018: Balancing the state budget without tax hikes,” Illinois Policy Institute, Winter 2017.

- John Daniel Davidson, “How States Could Transform Medicaid with a Block Grant,” National Review, October 7, 2015.

- Naomi Lopez Bauman, “Improve Health Care for Medicaid Patients While Controlling Costs for Taxpayers,” Illinois Policy Institute, 2015.

- “Medicaid Expansion in Michigan,” The Henry J. Kaiser Family Foundation, January 8, 2016.

- “Periodic Redeterminations of Medicaid Eligibility,” 42 CFR 435.916.

- Jonathan Ingram, “Medicaid 59: A Detailed List of Reforms,” Illinois Policy Institute, May 21, 2012.

- “State Medicaid Agencies Can Significantly Reduce Medicaid Costs for Durable Medical Equipment and Supplies,” Department of Health and Human Services, September 2015.

- Jonathan Ingram, “Illinois Medicaid Expansion Enrollment at Nearly Double Original Projections,” Illinois Policy Institute, September 11, 2015.

- “Fiscal Year 2017 Budget Overview,” Illinois Department of Healthcare and Family Services, February 17, 2016.

- Don Sadler, “The Ins & Outs of Ambulatory Surgery Centers,” OR Today, November 1, 2014.

- Teachers’ Retirement System, Teachers’ Retirement System Actuarial Report 2015, (2015).

- “Special pension briefing,” Commission on Government Forecasting and Accountability, November 2017.

- Austin Berg, “Illinois borrowing $750M at near-junk credit rating,” Illinois Policy Institute, November 29, 2017.

- Governor’s Office of Management and Budget, “State of Illinois Financial Walkdown,” October 11, 2017.

- Governor’s Office of Management and Budget, Three Year Budget Projection (General Funds), FY12-FY14, January 20, 2011.

- Ted Dabrowski and John Klingner, “Taxpayers Forced to Pay $421 Million More for Teacher Pensions,” Illinois Policy Institute, August 29, 2016.

- State Universities Retirement System, Actuarial Valuation Report 2015, November 2015.

- Benjamin VanMetre, “Record number of Illinois government workers opt out of pensions, into 401k-style plans” Illinois Policy Institute, September 3, 2014.

- R. K. Snell, “State defined contribution and hybrid retirement plans”, National Conference of State Legislatures, July 2012.

- Benjamin VanMetre, “7 in 10 Fortune 100 Companies Provide Only Defined Contribution, 401(k) Style Retirement Plans,” Illinois Policy Institute, July 2013.

- State Universities Retirement System, Self-Managed Plan Member Guide.

- Benjamin VanMetre, “Record number of Illinois government workers opt out of pensions, into 401k-style plans,” Illinois Policy Institute, September 3, 2014.

- For members of SERS who participate in Social Security, the employee contribution will be 3 percent of salary. Employer contributions will also be 3 percent of salary.

- The Institute utilized an analysis provided by Segal, the actuary firm that produces pension analysis for the state, which illustrates the effect on the Illinois Teachers’ Retirement System, or TRS, of a 100 percent Tier 2 employee migration to a new, proposed Tier 3 plan. Measures such as actuarial accrued liability, or AAL, and system, assets and annual payments from this analysis were used to extrapolate estimated effects for the state’s two other major pension funds: the State Employees’ Retirement System and the State Universities Retirement System. Based on this methodology, $116.1 billion of TRS AAL accounts for 56.54 percent of the $205.3 billion combined total of the three pension funds. Extrapolating to the other pension funds using this ratio results in annual payments equivalent to 23 percent of estimated general revenue fund expenditures and 50 percent of projected payroll of the three funds. However, AAL decreases $77 billion – a 21 percent reduction – compared with the status quo. General revenue was assumed to grow 3 percent annually.

- Commission on Government Forecasting and Accountability, Financial Condition of the Illinois State Retirement Systems as of June 30, 2015.

- John Klingner, “State of Illinois’ Pension Debt Jumps to $130 Billion,” Illinois Policy Institute, November 15, 2016.