A tale of two governors: Wisconsin vs. Illinois

In January 2011, the governors of Wisconsin and Illinois took office for their first elected terms. They set their states on two very different paths: one that led to recovery, and one that led to further decline. Gov. Pat Quinn saw a hole in pension funding, so he raised income taxes on all Illinoisans by...

In January 2011, the governors of Wisconsin and Illinois took office for their first elected terms. They set their states on two very different paths: one that led to recovery, and one that led to further decline.

Gov. Pat Quinn saw a hole in pension funding, so he raised income taxes on all Illinoisans by 67 percent, swallowing an additional $32 billion of Illinois’ production in the form of new taxes.

Wisconsin Gov. Scott Walker also had a hole in his state budget, but he took office under the promise of labor reform and lower taxation. Walker achieved significant public-sector labor reforms and a reduction in the state regulatory burden. As a result, the Badger State budget flipped from a $2 billion deficit to a nearly $1 billion surplus.

Walker also cut taxes along the way, putting $2 billion back in the pockets of Wisconsinites.

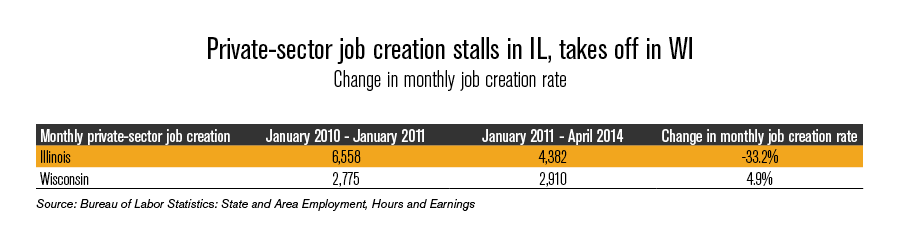

The results speak for themselves. Aside from fixing the state’s balance sheet, Wisconsin’s private-sector jobs recovery accelerated under Walker’s leadership. Meanwhile, Quinn’s tax hike slammed the brakes on Illinois’ private-sector jobs recovery.

In terms of overall employment gains, the same story played out with more drama. Illinois’ monthly employment gains have decelerated by more than 60 percent since the Quinn tax hike. Wisconsin shows the same acceleration in overall employment as with private-sector jobs.

When Walker took office, Wisconsinites faced the heaviest state and local tax burden in the Midwest, and the fifth-heaviest tax burden nationally. Since that time, Michigan, Ohio, Indiana and Iowa have all cut taxes to become more competitive, while Minnesota has cut some taxes and raised others.

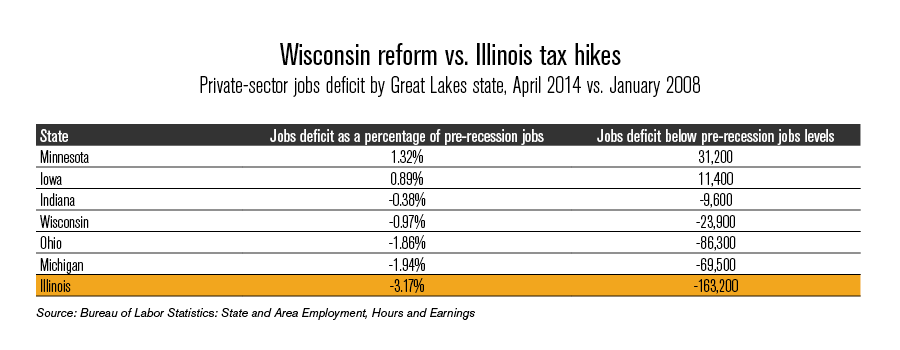

Despite Walker’s gains to Wisconsin’s benefit, clever job-creation studies have been crafted from data sets and timelines cherry-picked to diminish Walker’s performance. One such study from the University of Wisconsin Oshkosh misidentifies the timeline of the Great Recession, projects post-recession job creation from a baseline period that doesn’t include recessions and ignores the fact that Wisconsin is nearer to recovering to pre-recession jobs levels than three of its six neighbors. All of these tactics are used to support the false claim that Walker’s Wisconsin is the laggard state of the Great Lakes, and placing the blame at Walker’s desk.

Illinois and Wisconsin remain uncompetitive states in terms of regulatory and tax burden, but Wisconsin has taken steps to address these roadblocks to growth. With the help of reforms and tax cuts, Walker has managed to keep up with peer states on the road to recovery. Meanwhile, Illinois has fallen off the back of the cart.

This divergence has placed Wisconsin years closer than Illinois to a recovery of pre-recession jobs levels. Quinn’s leadership puts Illinois last in the Great Lakes region, while Wisconsin has stayed competitive.

Voters in Wisconsin and Illinois would do well to consider the different paths their states took in 2011, and the trajectory they’ve followed since. While Quinn has been busy talking about a comeback, Walker has been busy making one happen.