As nation celebrates small businesses, Illinois considers taxing them more

Most new jobs in Illinois are created by small businesses, yet state leaders are asking voters to hurt them by raising taxes on these employment dynamos.

Nov. 30 marks Small Business Saturday in the United States: the Saturday after Thanksgiving when Americans are encouraged to “shop small” in support of their local retailers.

Illinoisans should be especially thankful for their small business community.

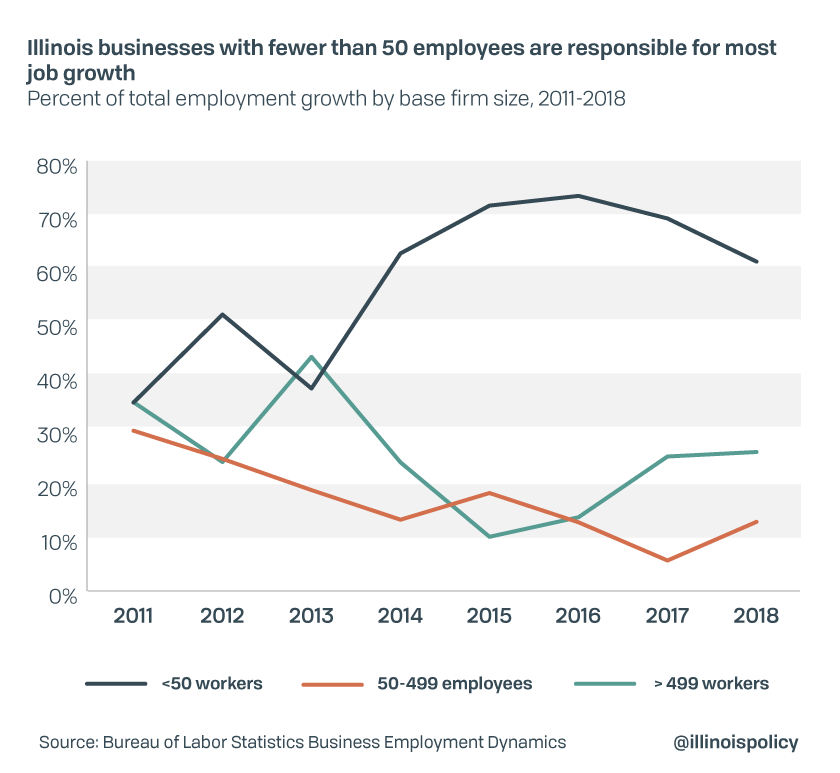

Businesses with fewer than 50 employees created the vast majority of net new jobs in Illinois in 2018, according to data from the Bureau of Labor Statistics. These businesses accounted for 61% of jobs growth. In fact, small businesses have been the primary driver of Illinois’ recovery from the Great Recession. From 2011-2018, small businesses generated nearly 311,000 jobs in Illinois, or 58% of all jobs created over that time period.

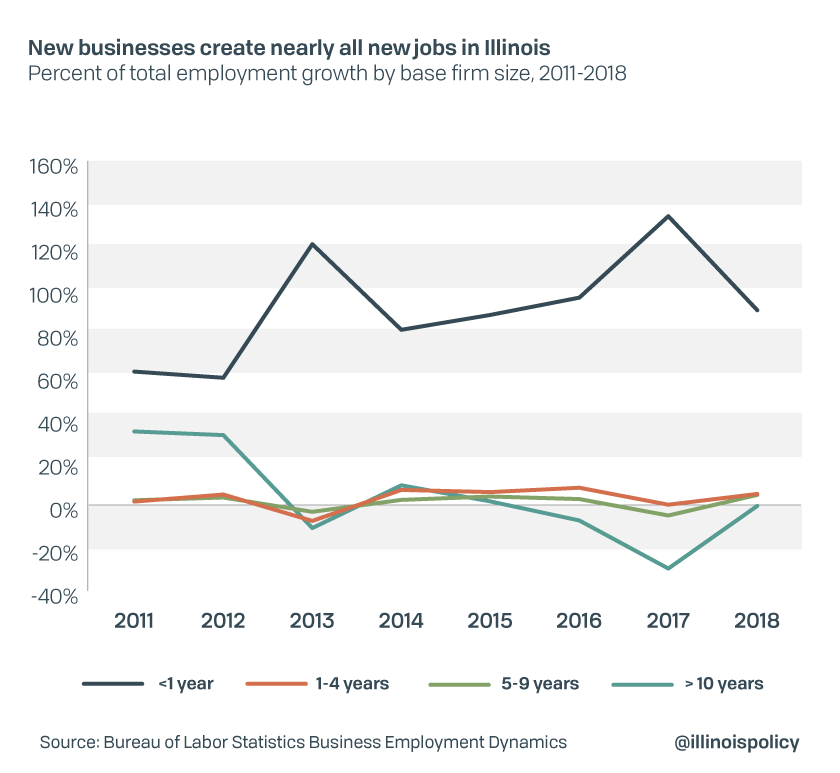

Not only does Illinois rely heavily on “mom and pop” shops for job creation, but the businesses adding the most jobs are also new enterprises. In 2018, 91% of net new jobs were created at businesses that were less than a year old. This has been the trend for most of the economic recovery.

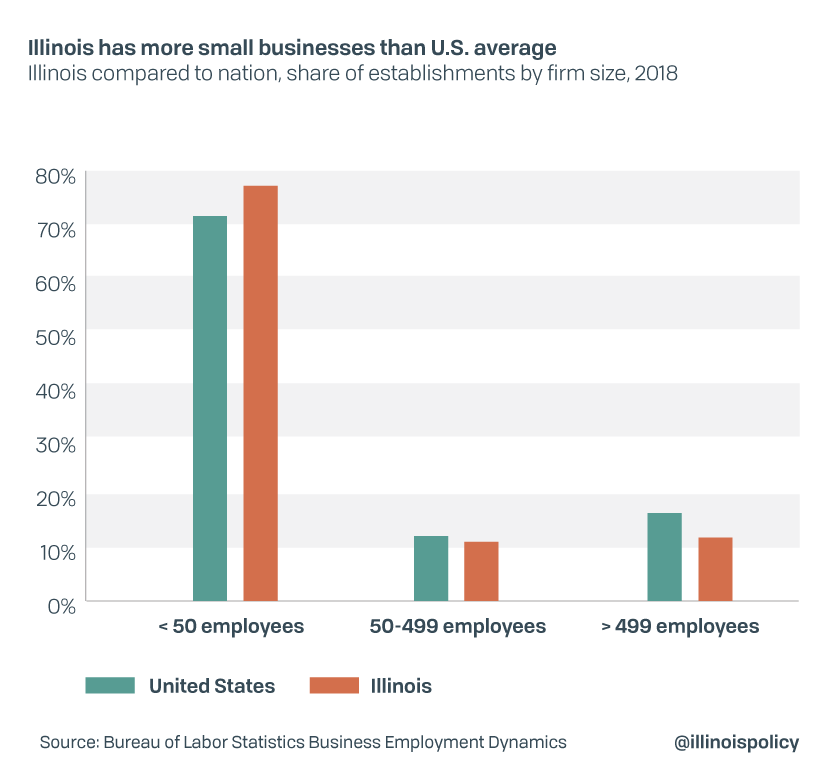

The relative success of small businesses is welcome news, as Illinois has a greater share of small businesses than the national average. In fact, more than 77% of businesses in Illinois are small businesses employing fewer than 50 employees. The rest of the nation has a much greater concentration of large businesses (500 or more employees) than Illinois.

While new and small businesses have been driving jobs growth in Illinois, they are succeeding in spite of major hurdles put up by the state. Illinois’ high-tax environment has created one of the least-friendly business tax climates when compared to neighboring states, primarily driven by high property taxes, unemployment insurance and corporate taxes. Taxes were also one of the primary reasons Illinois was considered the least-friendly state for small businesses in 2018 in a survey by online business service company Thumbtack.

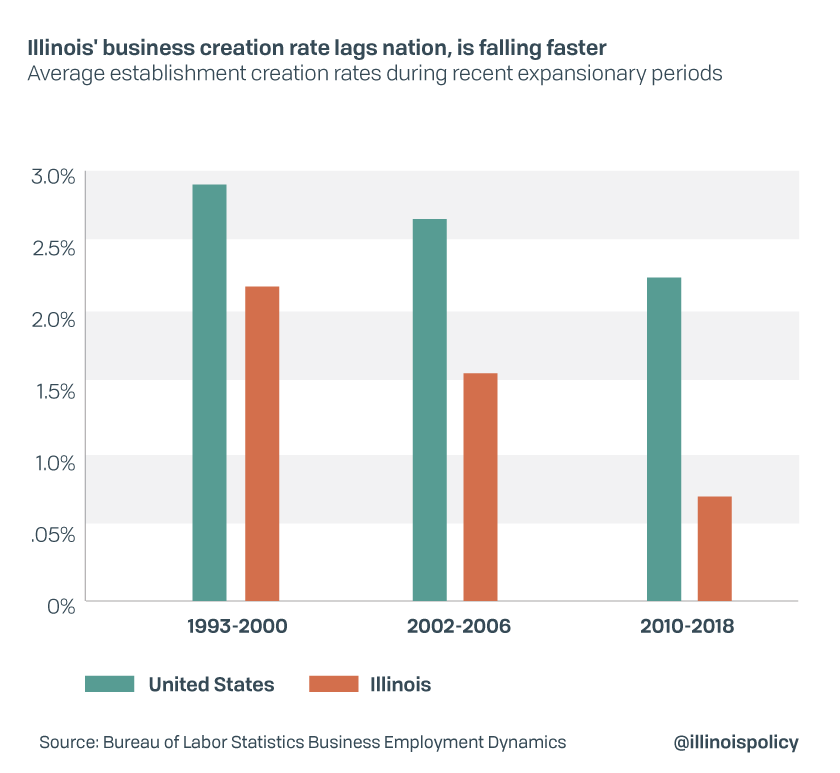

An unfriendly business environment is bad news for Illinoisans who heavily rely on entrepreneurial activity for job creation. While business creation rates across the country have been dropping, the decline has been even more pronounced in Illinois, likely due in part to the poor business environment.

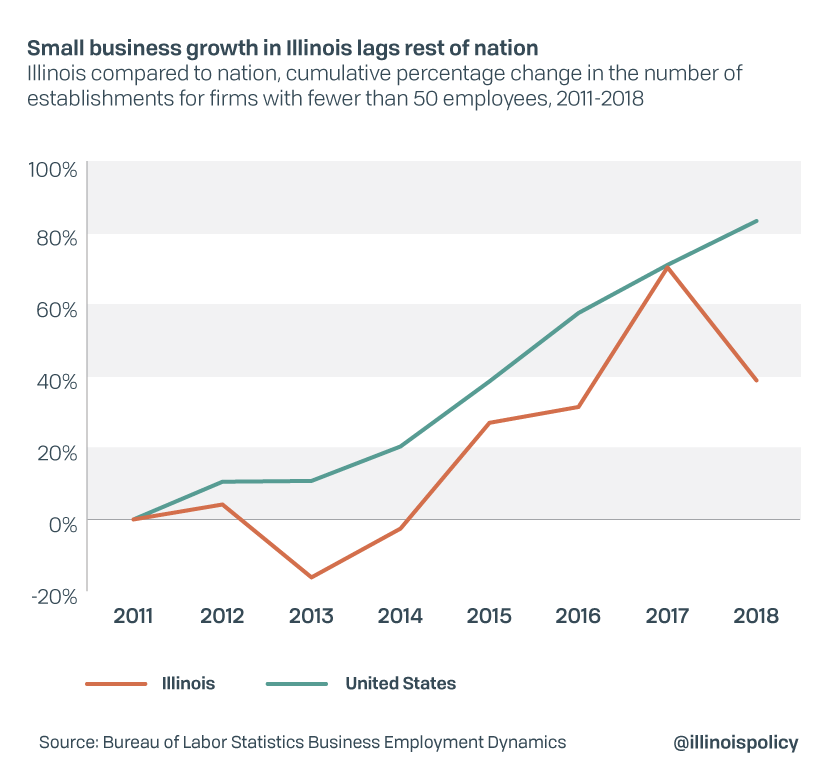

Not only are business creation rates falling, but growth of small businesses in Illinois is also lagging the rest of the nation despite the state being more dependent on these businesses. Since 2011, when establishment growth in Illinois resumed after the recession, the U.S. has created small businesses at more than double the rate of Illinois: 8.3% nationally compared to 3.9% in the state. In fact, Illinois in 2018 shed 4,666 small businesses, a 2.9% decline.

Making matters even worse, the state’s business environment is at risk of further deterioration as Illinois considers scrapping the state’s constitutionally protected flat income tax for a progressive income tax. Voters will get the opportunity to accept or reject the amendment Nov. 3, 2020.

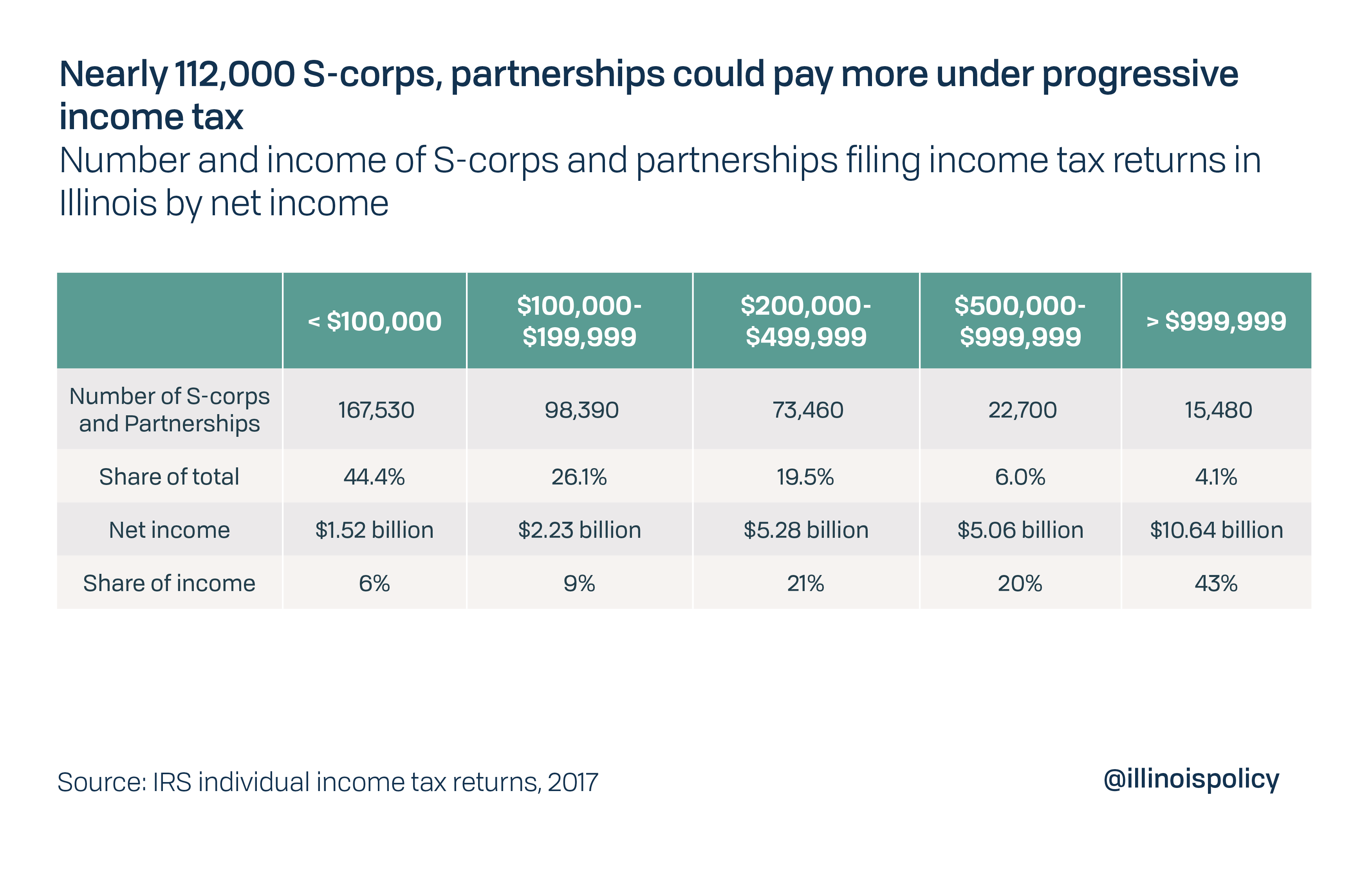

If the constitutional change is approved by voters, lawmakers have already passed a rate structure that would result in a $3.4 billion tax hike for Illinoisans, with rates ranging from 4.75% to 7.99%. As S-corps and partnerships are the most common filing status for small businesses, the progressive tax structure passed by the General Assembly could affect nearly 112,000 such entities in Illinois – 30% of them.

Particularly harmful for these businesses is a “re-capture” provision that would retroactively tax all income at the top marginal rate of 7.99% once an earner makes more than $1 million.

However, the tax increase would affect more than just those being asked to pay more, as an increase in the top marginal tax rate is associated with a decrease in hiring activity of entrepreneurs and lower wages for their employees. For those employed by businesses that are affected by the top income tax rate of 7.99%, that means workers could expect their own before-tax wages to fall by 1.2% while job seekers face a 0.4% decrease in the number of new hires at these businesses.

Matters would be even worse for small businesses that file as C-corps in Illinois. Illinois’ total corporate income tax would rise to the third-highest in the nation should voters approve Pritzker’s constitutional amendment.

Illinois businesses currently pay a total income tax rate of 9.5% – this includes a 7% corporate income tax plus a 2.5% Personal Property Replacement Tax, or PPRT. Under Pritzker’s plan, the total corporate income tax rate would increase to 10.49% (7.99% corporate income tax plus 2.5% PPRT).

That would be the third-highest rate in the nation, behind only Iowa at 12% and New Jersey at 11.5%. And notably, Iowa’s rate is scheduled to drop to 9.8% by 2021, while New Jersey’s temporary 11.5% income tax surcharge on businesses earning more than $1 million is set to drop to 10.5% in 2020 and expire in 2022. The change in the Illinois constitution to allow for a progressive income tax would also allow lawmakers to levy a business income tax rate as high as high as 15.28% – by far the highest in the nation.

Bad for businesses and employees

Illinois should be encouraging families and businesses to succeed, not punishing them with higher taxes. Much of the academic evidence suggests increased tax rates on businesses discourage productive activity by those businesses.

Higher taxes reduce the growth of small firms, capital investment by entrepreneurs and hiring. Additionally, increases in average and marginal income tax rates reduce the likelihood of self-employment. Meanwhile, reductions in tax rates are associated with greater probabilities of self-employment.

Progressive taxes also may discourage risk taking, including investment, because entrepreneurs save little in taxes on any losses they incur but can owe substantial taxes on any profits. The more progressive the tax schedule, the lower the expected after-tax return of risk taking becomes. As a result, a progressive rate schedule discourages the risk taking necessary for expanding and creating new businesses and products.

Even workers who may not initially be hit with a progressive income tax hike can expect to be hurt by one. Because progressive income taxes lower the return on new physical capital investments, businesses will be less likely to invest in Illinois, meaning slower wage and employment growth. Progressive taxes also deter investment in human capital, such as education and skills, that boost individuals’ productivity and earning potential, further hindering the earning prospects of workers.

While a progressive income tax may offer some residents a slightly lower income tax burden, the negative effects of the tax – job losses and decreased productivity from a reduction in all forms of investment – cause pre-tax incomes adjusted for the cost of living, or real purchasing power, to decline. This leaves everyone worse off than they would be under a flat tax system, even one that raises just as much tax revenue.

A real solution

Illinois should recognize how much residents depend on the state’s small businesses. And rather than constantly looking to raise more taxes,the state should enact spending reforms to restore fiscal health and create a climate more hospitable to the creation of new businesses and the growth of jobs and wages.

First, Illinois must address its pension problem, which, despite two record income tax hikes within the past decade, continues to grow. Though pensions take up more than 25% of general fund expenditures, the funds are no more solvent. But by amending the Illinois Constitution to allow for the adjustment of the growth rate of not-yet-accrued benefits, the state can reduce pension debt and ensure the plans can support retirees without overwhelming taxpayers. Such changes could include increasing the retirement age for younger workers, tying annual benefit increases to the actual cost of living and making retirement plans more closely resemble 401(k)s for new workers.

Second, a spending cap could help the state meet Illinois’ balanced budget requirement, which has been ignored for 18 years. One interesting proposal would be a smart spending cap that ties government spending growth to Illinois’ total growth in gross domestic product. Texas and Tennessee have implemented something similar to this, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Responsible government spending growth that taxpayers can afford would provide more stability for families and businesses. But if the state substitutes tax hikes for necessary reforms, Illinois can expect to see business creation rates continue to crater and the outcomes for employees to continue to lag the rest of the nation.