Bill would expand airport property tax boundaries in Rock Island County

House Bill 5816 would put all Rock Island County property taxpayers on the hook for costs at the Quad City International Airport.

A new proposal in the Illinois House of Representatives would expand the boundaries of airport authority property taxes to more Rock Island County residents, potentially raising property tax bills for thousands.

House Bill 5816, filed by state Rep. Jay Hoffman, D-Swansea, would create three new airport authorities with expanded property tax reach.

The bill would create the Metropolitan Airport Authority of Rock Island County to fund the Quad City International Airport, the Central Illinois Airport Authority to fund McLean County’s Central Illinois Regional Airport, and the Chicago Rockford International Airport Authority to fund the Chicago Rockford International Airport.

The new Metropolitan Airport Authority of Rock Island County would “include all of the territory within the corporate limits of Rock Island County.”

This would mean residents in townships within Rock Island County that do not currently pay property taxes for Rock Island’s airport would now be required to pay such taxes under the new airport authority. According to the Quad-City Times, the townships currently not being taxed for the airport include: Cordova, Coe, Canoe Creek, Zuma, Port Byron, Rural, Bowling, Edgington, Andalusia, Buffalo Prairie and Drury.

For Rock Island County homeowners in those townships, this proposed airport authority would serve as a brand-new cost-driver for their property tax bill. At the same time, the broader tax base would decrease the burden on those who pay for the airport currently, at least in the short term.

Illinois has nearly 7,000 units of local government. A typical Illinois household sees its property tax bill divided between many local taxing bodies, including school districts, municipalities, townships, community colleges, airports, park districts and more. Each unit of local government levies a property tax to fund its operation.

And these property taxes are catching up to Rock Island County.

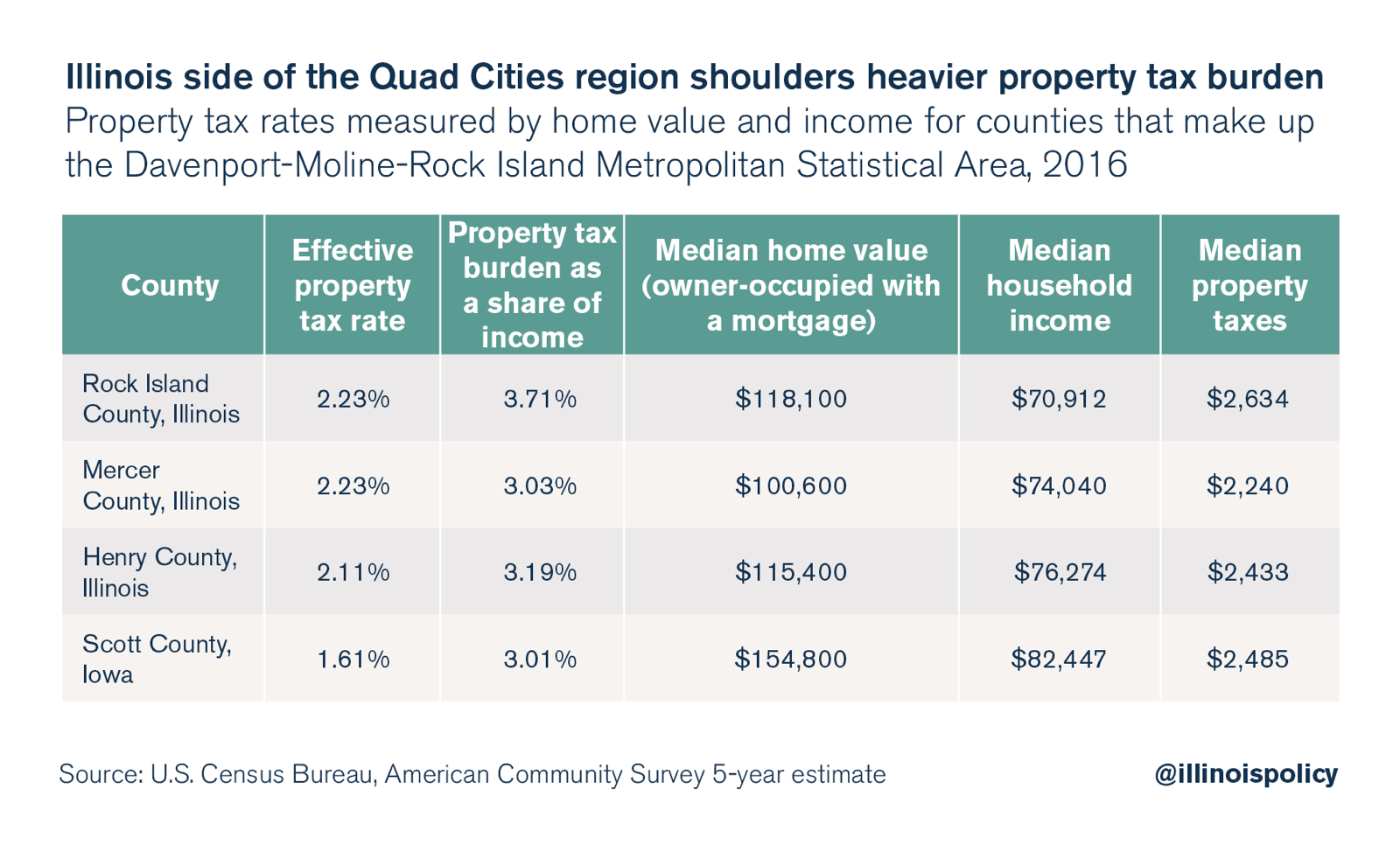

Rock Island County residents have seen their property taxes far outpace what their Iowa neighbors pay. Despite the fact that median home values are 31 percent higher in Scott County, Iowa, than they are in Rock Island County, Rock Island County homeowners’ median property tax bills are 6 percent higher.

As a share of residents’ income, the property tax burden in Rock Island County is 39 percent higher than Scott County’s property tax burden.

And this problem isn’t just in Rock Island County.

Statewide, average property tax bills in Illinois grew six times faster than household incomes from 2008-2015.

While local leaders play a significant role in crafting local budgets, Springfield’s policies ultimately make property tax hikes inevitable for Illinois residents. Unfunded mandates, costly pensions, the high number of local governments, high workers’ compensation costs and unfair bargaining powers for government worker unions all contribute to Illinoisans’ sky-high property tax bills.

HB 5816 would constitute another state-imposed cost-driver for many residents of Rock Island County.