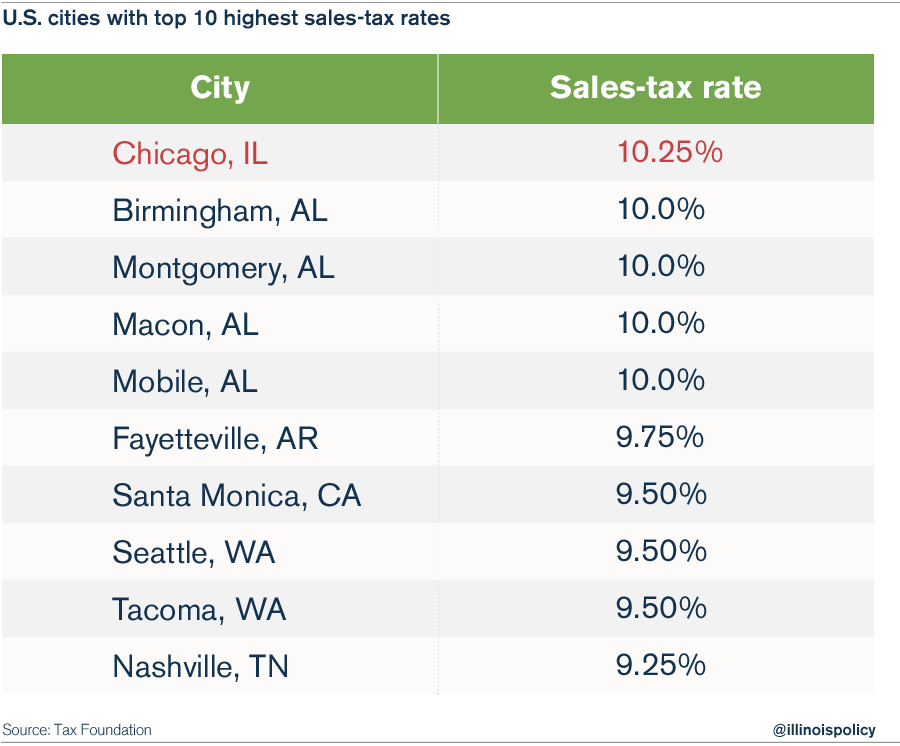

Chicago now home to the nation’s highest sales tax

Buying local just got a lot less appealing for Chicagoans. The city reclaimed the highest sales-tax rate of any major city in the nation on July 15, when the Cook County Board, which oversees Illinois’ largest city, voted to raise its portion of the sales tax, bringing Chicago’s combined rate to 10.25 percent from 9.25...

Buying local just got a lot less appealing for Chicagoans.

The city reclaimed the highest sales-tax rate of any major city in the nation on July 15, when the Cook County Board, which oversees Illinois’ largest city, voted to raise its portion of the sales tax, bringing Chicago’s combined rate to 10.25 percent from 9.25 percent.

Chicago is now right back where it was in 2008, when the county raised its rate to 1.75 percent from 0.75 percent (the same leap as the 2015 increase). Aides for Cook County Board President Toni Preckwinkle estimated that the tax-hike will bring in $474 million a year, according to the Chicago Tribune.

Former Cook County Board President Todd Stroger hiked the sales-tax rate in 2008, and lost his re-election bid to Preckwinkle in 2010. Back then, Preckwinkle benefited from momentum against Stroger’s unpopular tax hike, which she ultimately peeled back. But her quick about-face shows Chicago politicians increase and decrease the sales-tax rate as it’s convenient.

A sales tax is one of the most transparent ways for government to raise revenues, but it doesn’t exist in a vacuum. Chicago imposes its sales tax on top of myriad other taxes residents pay, including property taxes, and other taxes and fees.

Mayor Rahm Emanuel has also revealed a plan to increase Chicagoans’ property taxes by $175 million over one year to cover city debt.

Unfortunately, other factors make it expensive to live in the city, as well. Illinois has the highest cellphone taxes in the nation. In July, City Council passed a 56 percent increase on the city’s cellphone surcharge, adding an additional $84 in taxes each year for a family of four with four cell phones and a landline. In 2013, City Council raised the tax rate on cable to 6 percent from 4 percent – the city is raising the rate again, this time all the way up to 9 percent, costing Chicagoans an extra $12 million in taxes, according to the Chicago Sun-Times. Now the city is foisting an additional 9 percent tax on online streaming services such as Netflix.

Property taxes, surcharges and entertainment taxes are all methods City Council has been using repeatedly as a method to drum up revenue to fund the city’s financial problems. But Chicago’s population is growing at a snail’s pace, gaining just 82 residents in 2014 after a decade of population decline.

Chicago leaders can only squeeze so much out of the city’s remaining residents.