Chicago pension funds have $0.36 for every $1 needed to pay out future benefits

Moody’s Investors Service recently cut the city of Chicago’s credit rating to Baa1 from A3, citing pension debt as a key factor in the downgrade. Chicago’s now has the lowest credit rating of all the major cities in the U.S., with the exception of Detroit. Moody’s saw something that’s being ignored by Illinois lawmakers –...

Moody’s Investors Service recently cut the city of Chicago’s credit rating to Baa1 from A3, citing pension debt as a key factor in the downgrade. Chicago’s now has the lowest credit rating of all the major cities in the U.S., with the exception of Detroit.

Moody’s saw something that’s being ignored by Illinois lawmakers – skyrocketing pension payments due next year.

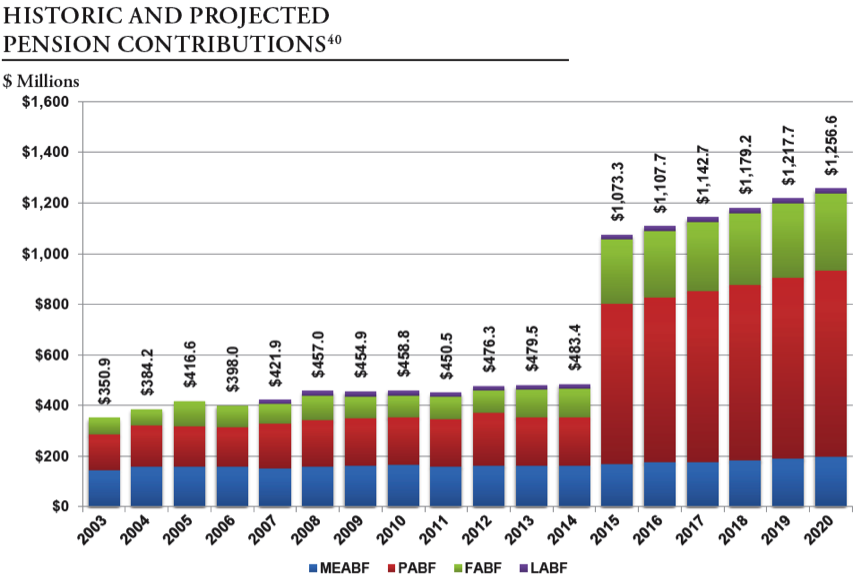

The city’s contribution to its four pension systems is set to more than double to $1 billion in 2015. These increased payments are needed to plug the massive funding shortfall the city now faces in the following pension funds:

- Municipal Employees’ Annuity and Benefit Fund (MEABF)

- Laborers’ and Retirement Board Employees’ Annuity and Benefit Fund (LABF)

- Firemen’s Annuity and Benefit Fund (FABF)

- Policemen’s Annuity and Benefit Fund (PABF)

Collectively, these pension funds have just $0.36 for every dollar they should have in the bank today to pay out future benefits.

In fact, the systems are in such crisis that according to the city’s own analysis: “If nothing is done to address the situation, and the MEABF will likely exhaust its assets in or around 2024, with the LABF following around 2027.”

Legislation passed by the state in 2010 requires the city to ramp up its 2015 pension payment by contributing an actuarially determined amount necessary to bring PABF and FABF to a 90 percent funding level by 2040. These changes require the city’s contribution to increase to $1.1 billion in 2015 from $483 million in 2014.

Source: City of Chicago Annual Financial Analysis 2013

If the 2010 pension legislation applied to all four of the city’s pension funds, the city’s 2015 pension contribution would nearly quadruple to $1.7 billion. That means the city would need to come up with an additional $1.2 billion.

Without real pension reform, the city would need to increase property taxes and cut services.