Cullerton spending cap would avert future Illinois tax hikes

State spending has grown nearly 50 percent faster than Illinoisans’ incomes during the past decade. State Sen. Tom Cullerton, D-Villa Park, has proposed a constitutional spending cap that offers a long-term solution to the state’s budgetary problems.

Illinoisans can attribute their state’s poor fiscal condition to a simple fact: Lawmakers in Springfield spend more than taxpayers can afford. That could change if the state puts the right mechanism in place.

State Sen. Tom Cullerton, D-Villa Park, filed a proposed constitutional amendment Feb. 15 that would limit the growth in state government spending, tying it to the rate of growth in Illinois’ economy.

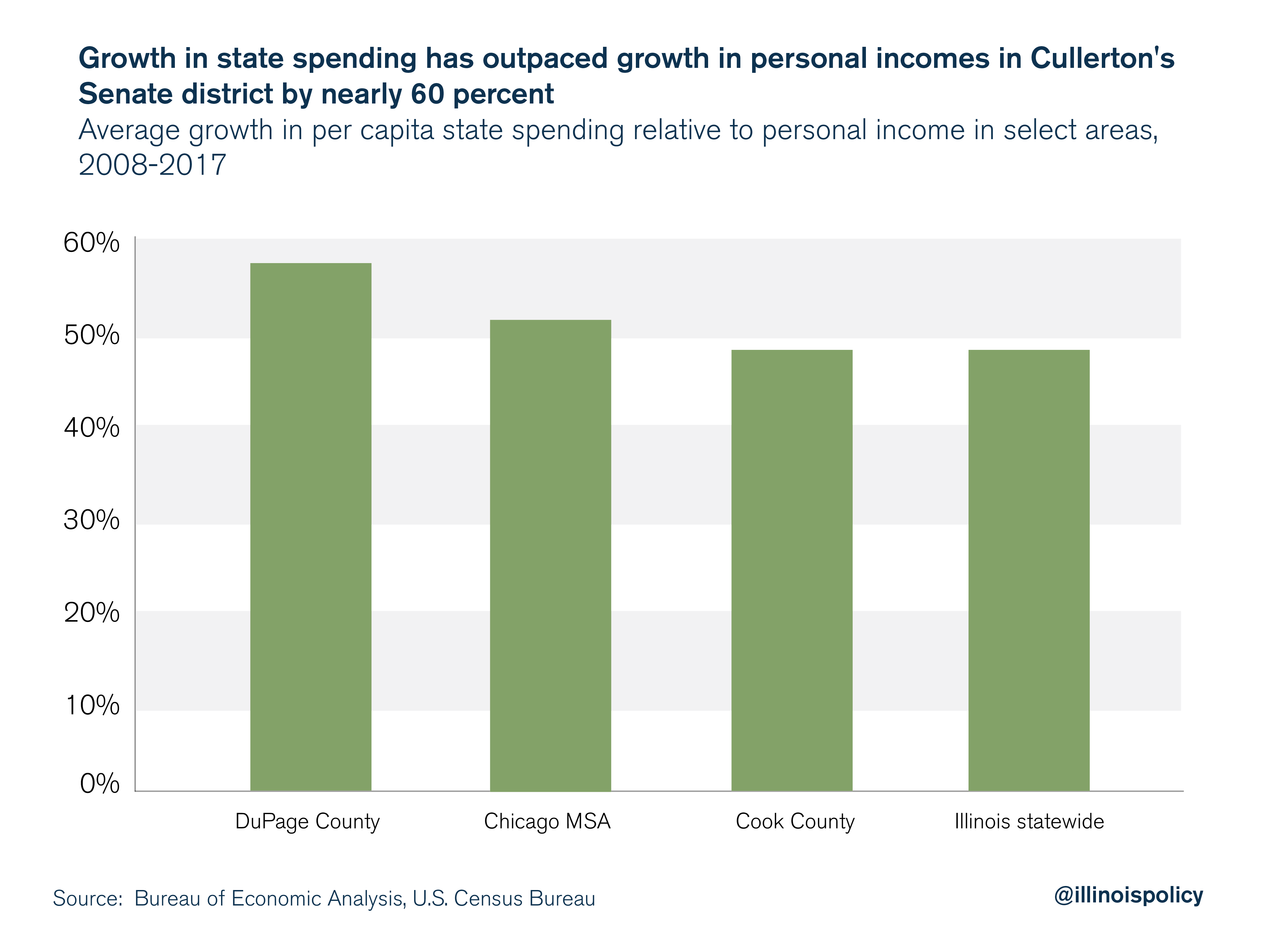

Residents in Cullerton’s district, which includes parts of DuPage and Cook counties in the Chicago Metropolitan Statistical Area, should be especially relieved by their lawmaker’s spending cap proposal. State spending has grown as much as 57 percent faster than residents’ personal incomes in that area.

Illinois’ pattern of irresponsible spending is longstanding: Between 2007 and 2017, growth in state spending outpaced Illinoisans’ personal incomes by an average annual rate of 48 percent. Illinoisans’ incomes grew at an average annual rate of 2.52 percent during that time, while state spending grew by 3.72 percent.

Illinois’ pattern of irresponsible spending is longstanding: Between 2007 and 2017, growth in state spending outpaced Illinoisans’ personal incomes by an average annual rate of 48 percent. Illinoisans’ incomes grew at an average annual rate of 2.52 percent during that time, while state spending grew by 3.72 percent.

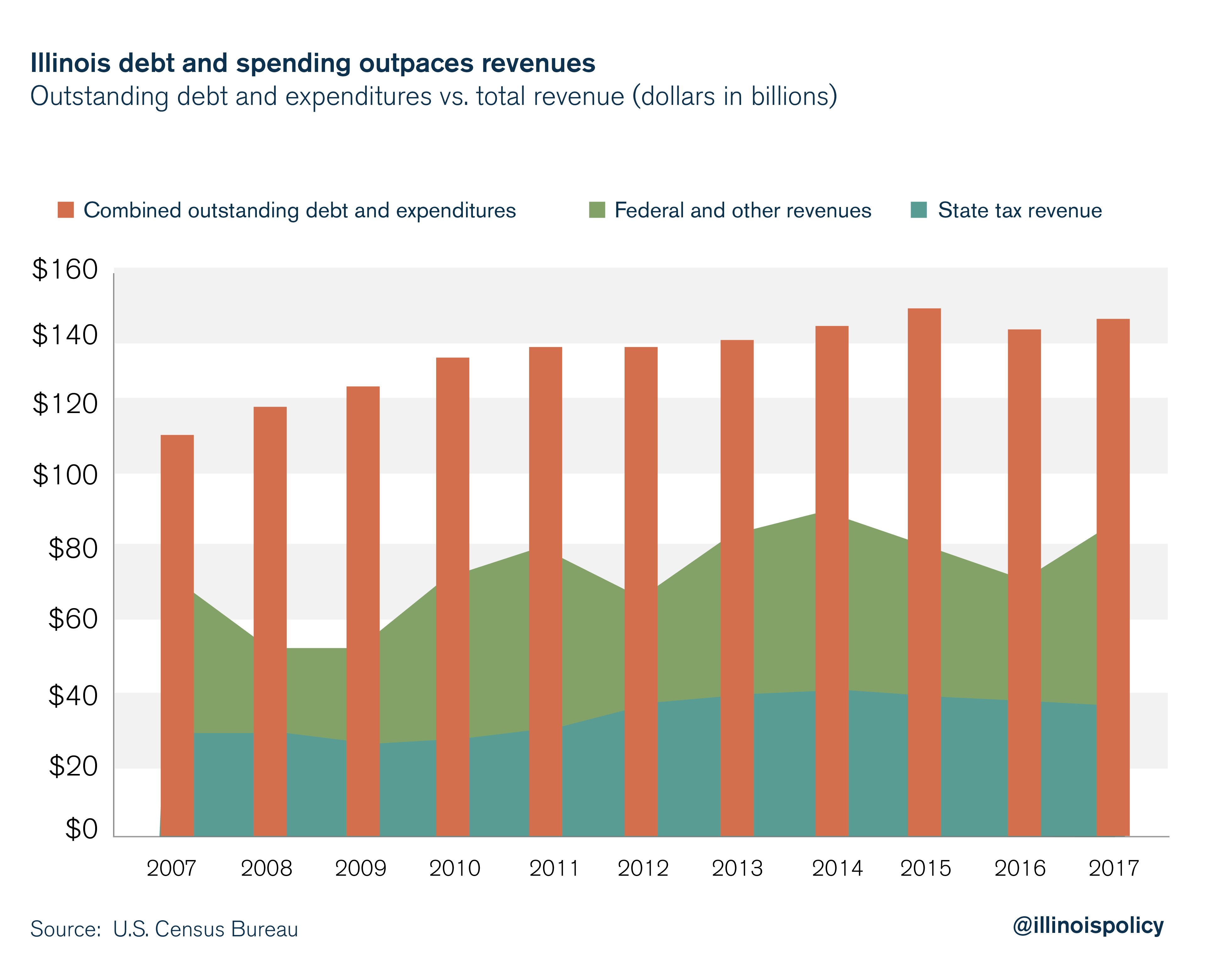

Despite two historic income tax hikes, out-of-control spending has prevented the state from getting its fiscal house in order.

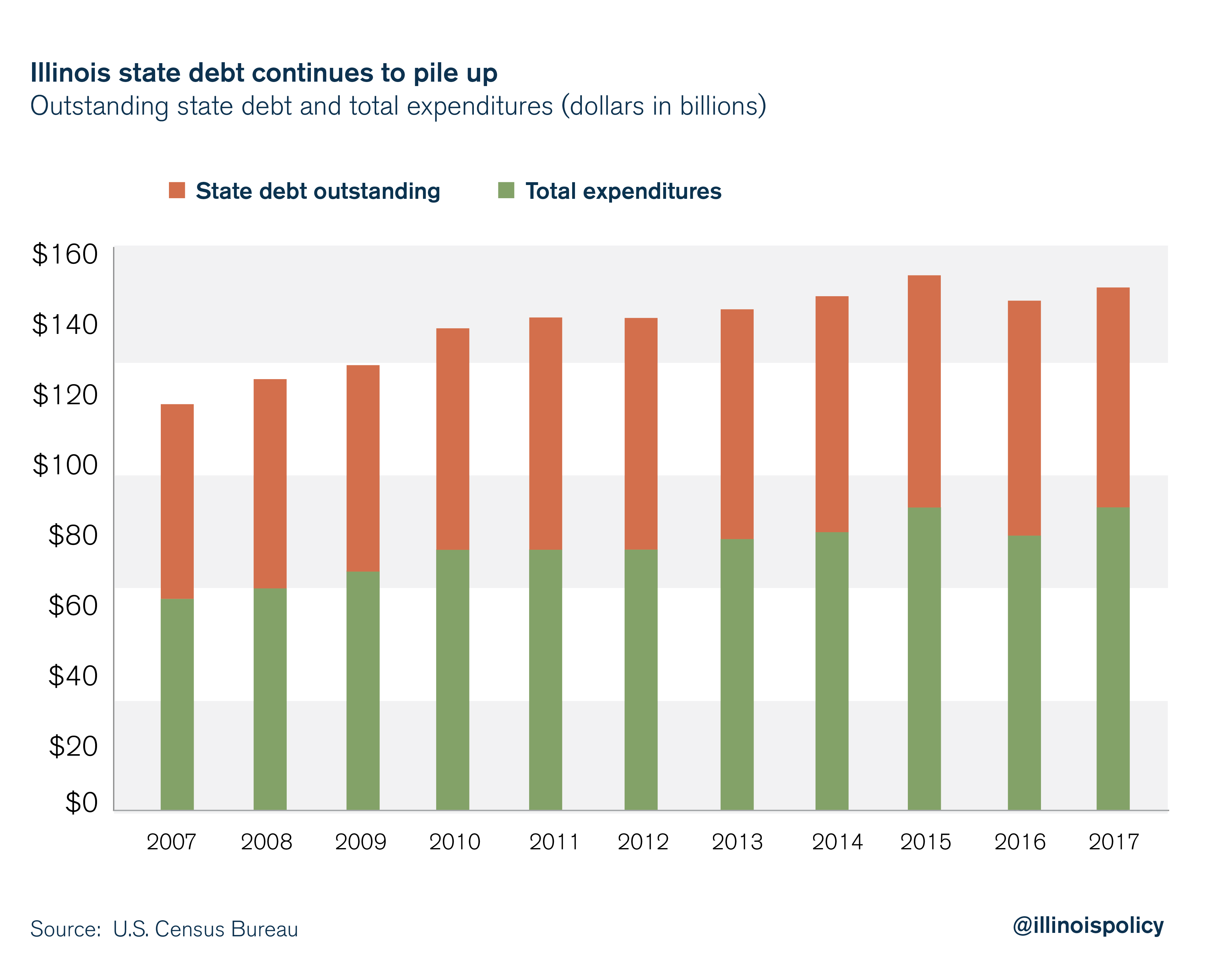

Illinois’ outstanding debt is already sky-high, thanks to borrowing plus the interest that collects on the principal each year. If the General Assembly continues to spend at the current pace, the state’s revenues will never be able to catch up.

Without a mechanism for limiting the growth in spending to a sustainable level, more painful tax hikes could be on the horizon. But if Illinois moves to enforce fiscal discipline on its state lawmakers, it would join 27 other states that as of 2015 had tax or spending limits – 15 of those enshrined in state constitutions.

In 2018, Cullerton sponsored a proposed spending cap amendment that earned bipartisan support in the Illinois Senate.

When government spending outpaces growth in the state’s economy, lawmakers have two options: raise taxes or borrow more money.

Binding growth in Illinois’ discretionary spending to its economy would provide certainty by telling lawmakers what is available to spend, not just estimating a number and hoping it is close to what they want to spend. With a constitutional spending cap, Illinoisans could be certain they’re getting a state government they can afford – a crucial first step toward restoring confidence that families and business will not be taxed out of Illinois.