Fact-checking Madigan: Rauner’s agenda is packed with budgetary items

Though Illinois Democrats insist Gov. Bruce Rauner’s reform agenda has nothing to do with the state’s budget, Rauner’s original proposed spending reforms would allow the state to balance its budget without hitting up taxpayers for more revenue.

Illinois Democrats repeatedly claim that Gov. Bruce Rauner’s agenda is full of nonbudgetary items, and thus shouldn’t be part of budget negotiations.

But the governor’s original agenda is packed with budgetary items.

Workers’ compensation costs Illinois state and local governments $1 billion each year.

If Illinois enacted prevailing wage reform, state and local governments could save $600 million.

And that’s just the beginning.

The truth is it’s impossible to pass a budget without making decisions about Rauner’s original reform agenda.

The problem for legislative Democrats is that tackling these reforms would upset the status quo. Instead, their plans – namely, hiking taxes on overburdened state taxpayers – would leave Illinois’ major spending drivers in place, which will force more overspending, more tax hikes, and an even bigger financial crisis.

When Democrats call on the governor to “focus on the budget,” what they’re really saying is “stick to the budgetary approach that relies entirely on tax hikes.”

The “Turnaround Agenda” is full of direct budgetary items

Rauner’s “Turnaround Agenda” originally contained more than 40 reform proposals. Many parts of the agenda are directly related to spending drivers within the budget.

- Collective bargaining: Reforming collective bargaining allows the government to manage payroll costs and government work rules, which are major spending drivers. A study by The Heritage Foundation found that Illinois’ state and local spending would be $2 billion-$10 billion lower per year had government not granted such significant bargaining powers to unions.

- Pensions: Illinois’ unfunded pensions require huge debt payments that in turn force huge tax hikes. The interest on Illinois’ state pension debt is $9.1 billion per year, and Illinois isn’t even covering it. Some local pensions are even more drastically underfunded. Pensions must be reformed or taxpayers will face tax increases indefinitely.

- Prevailing wage: Government construction costs are high because of prevailing wage laws, which inflate payroll costs and mandate union work regulations. Project labor agreements similarly undermine competitive bidding. Forthcoming research from the Illinois Policy Institute finds that governments could save over $600 million per year through prevailing wage reform.

- Workers’ compensation: State and local governments pay approximately $1 billion per year in workers’ compensation costs. Bringing Illinois’ costs in line with those of other states in the region would save taxpayers more than $300 million per year.

- Procurement: State government makes billions of dollars in purchases each year. These costs can be streamlined and consolidated by reforming procurement rules, which in turn could save taxpayers hundreds of millions of dollars per year.

- Consolidation: Illinois has nearly 7,000 units of local government. Allowing taxpayers to consolidate units of local government will save tax dollars on duplicative work, salaries and pensions.

These cost drivers are directly related to the budget, and these are all direct budget issues. And there are still more Rauner reform items that would bring savings by controlling spending. Without such spending reforms, the only option is to raise taxes again and again.

If there’s a criticism to be made of Rauner’s agenda it’s that he dropped too many commonsense reforms to try to reach a deal. But the people of Illinois want a balanced budget without tax increases, and these reforms are the way to get there.

Economic growth would have a large but indirect effect on the budget

Economic growth is the largest driver of a growing tax base and more tax revenues over the long run. Illinois’ weak economic growth, manifested in the state’s terrible personal income gains, results in a smaller economy and fewer taxpayers than the state should have.

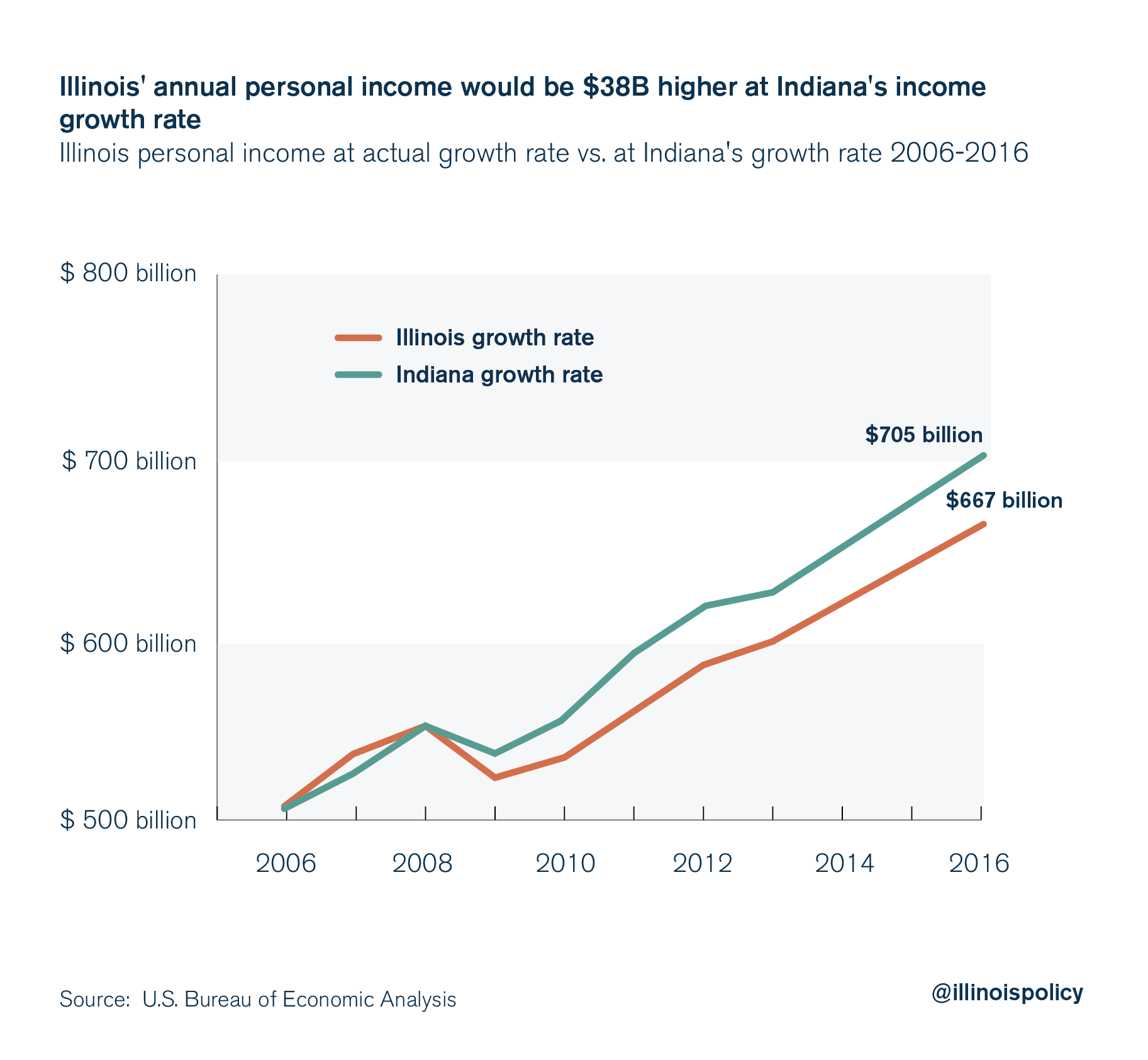

For example, if Illinois’ personal income had grown like Indiana’s over the last decade, Illinois’ economy would be generating $38 billion of additional annual personal income. This additional income would contribute approximately $4 billion in additional tax dollars to state and local coffers.

Illinois’ weak economy and slow jobs growth are major budgetary issues, and contribute to slumping tax revenues.

Democrats’ plan is to raise taxes, and Illinoisans don’t want it

Democrats have tried to define all of Rauner’s reforms as out-of-bounds, nonbudgetary items. They’re wrong. Rauner’s major proposals would change the cost curve of government spending and allow for a balanced budget without tax hikes.

For their part, Illinois Democrats have offered tax hikes and a number of changes that would likely drive up government costs. But Illinoisans don’t want any more tax hikes.

A May Illinois Policy Institute-commissioned poll shows 64 percent of Illinoisans surveyed oppose raising income taxes to balance the budget. The people don’t want what Democrats are trying to force on them.

Rauner should stick to his guns and require that the budget be balanced through spending reforms, not through tax increases.

The people of Illinois would be with him, and it’s the fair thing to do.

Too many special interests have grown rich as a result of government spending. This time, Illinois politicians should put taxpayers first, and require special interests to make some sacrifices.