Four factors that created the CPS pension crisis

How Illinois politicians turned what was meant to provide government workers with retirement security into a political slush fund.

Chicago Public Schools, or CPS, is facing a pension shortfall of $9.5 billion, a credit rating that’s been downgraded to junk and multiyear, billion-dollar deficits. This crisis is arguably the best example of how Illinois politicians use and abuse pensions – from pension spiking and pickups to double dipping and skipped payments – turning what was meant to provide government workers with retirement security into a political slush fund.

The current narrative is that historically CPS didn’t have enough money to fund both teacher pensions and classrooms – that it had no choice but to shortchange pensions. But a close review of the school district’s finances over the past 20 years finds that revenue was never the issue: Illinois and Chicago taxpayers contributed more than enough money to pay for both, had those funds been properly managed.

The following four factors created the crisis:

- CPS officials made decisions that were politically beneficial in the short term, but yielded disastrous long-term consequences.

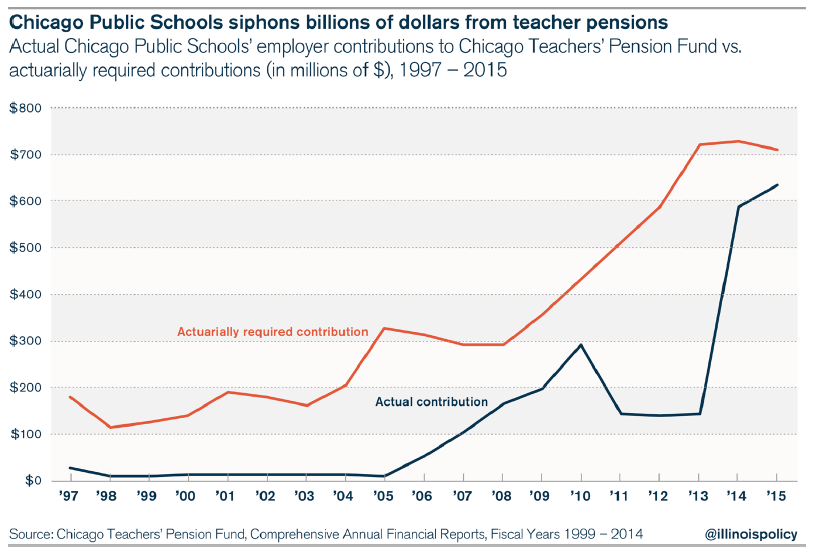

Mismanagement and shortsighted decision-making have resulted in fiscal calamity for CPS and its teachers’ pensions. Pension pickups and holidays shorted more than $5 billion away from the Chicago Teachers’ Pension Fund, or CTPF.

- Pension pickups: Since 1981, CPS has paid the vast majority of what teachers are supposed to contribute toward their pensions. Over the last decade, CPS has spent more than $1.2 billion on these pension pickups. Had teachers made their own pension contributions, CPS could have increased the employer’s contribution by that amount.

- Pension holidays: In 1995, and again in 2010, CPS officials – with the consent of the Illinois General Assembly – enacted pension holidays, diverting billions of dollars intended to fund the pension system toward school operations and salaries. This shorted the pension system by almost $3 billion over the course of the holidays.

- CPS had enough revenue to fund pensions and classrooms – but officials squandered it.

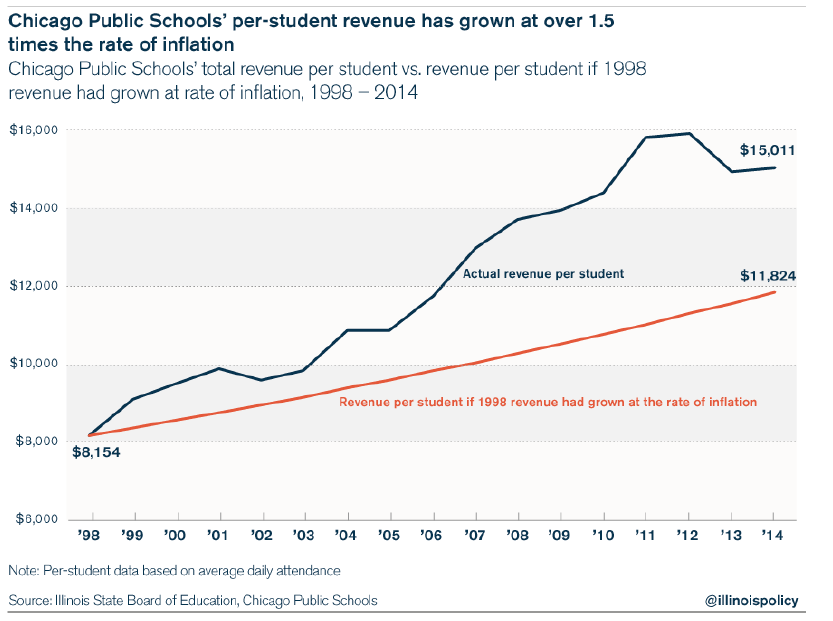

Taxpayer-provided CPS revenue has more than doubled to $5.3 billion since 1997. When measured in per-student terms, CPS revenues grew at more than 1.5 times the rate of inflation during that time period.

The state – and by extension, Illinois taxpayers – has also paid its share. In fact, Springfield contributed $1.83 billion to CPS in 2014, up over 80 percent from 1998’s contribution. That means state funding to CPS has grown by over 1.5 times the rate of inflation since 1998.

- When taxpayer money was redirected away from pensions, it went toward a growing CPS payroll, which increased pension benefits.

When the district leadership gained the General Assembly’s approval to skip required pension payments, billions in taxpayer pension contributions were redirected toward CPS operational expenses – most notably, to salaries.

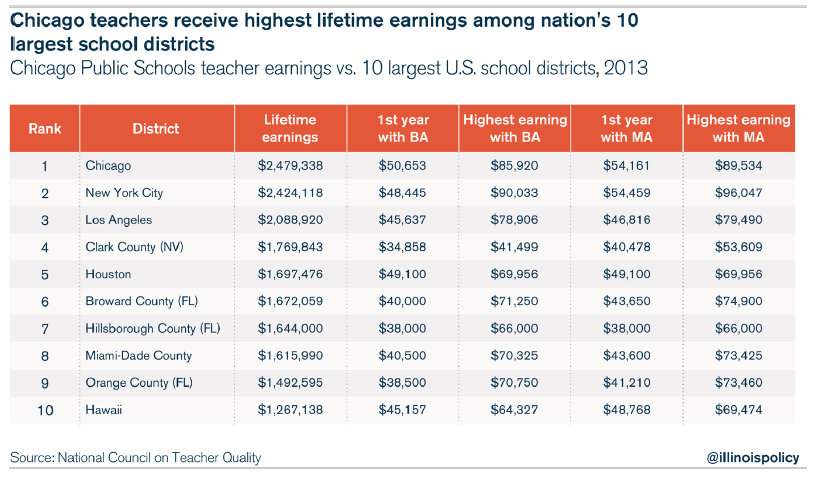

Overall, CPS payroll growth from 1998 to 2012 resulted in average covered payroll growing by 80 percent, almost twice the rate of inflation.

- Those raises propelled Chicago teachers’ lifetime earnings to the highest in the nation when compared to the U.S.’ 10 largest school districts, according the National Council on Teacher Quality.

- The pay increases also helped boost benefits to an unsustainable growth rate of 6 percent yearly over a 17-year period. Had benefits grown at a more modest rate of 4 percent, the pension fund’s unfunded liability would be at least $5.3 billion less than it is today.

If the money for pensions had not been diverted, teacher retirements would have been more secure thanks to a well-funded pension system, and teachers could still have received modest salary increases and higher levels of job security from 2004 to 2014.

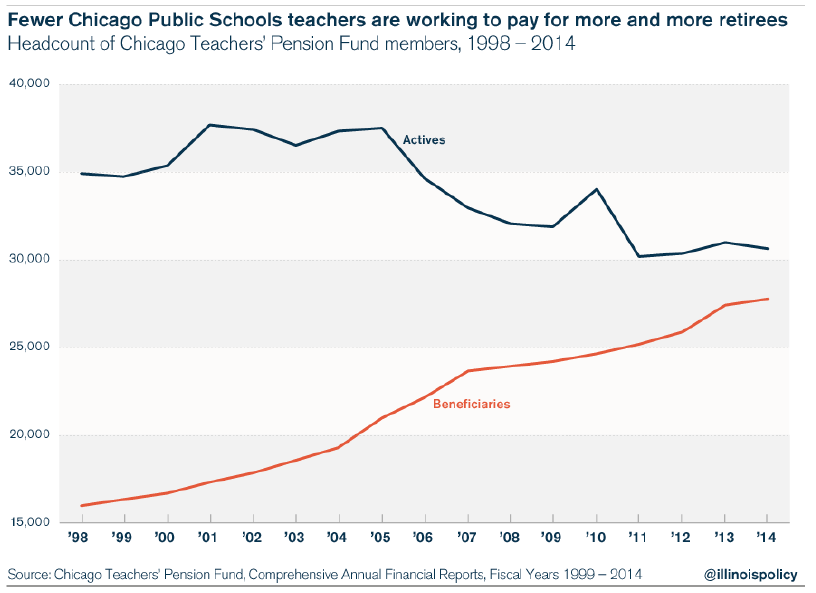

- Retired CTPF beneficiaries are on track to surpass the number of active workers paying into the system.

The number of beneficiaries under the CTPF – along with their increased final salaries – continues to rise, while the number of active members contributing into the fund has declined by 12 percent since 1998. That means more and more annuitants are drawing benefits from the pension fund compared to active workers contributing to it, pushing teachers’ pensions closer to insolvency.

More tax dollars won’t fix a broken system

Politicians squandered taxpayers’ dollars over the past two decades – and now they’re coming back for more. City leaders are calling on Chicagoans to pay billions more in property and other taxes to clean up their mess.

But before taxpayers put in another penny, they need a guarantee this won’t happen again. And that means ending the failed pension system for new teachers

Pension systems are inherently political, opaque and void of accountability. As long as politicians maintain control over pensions, they’ll always find ways to exploit them and pass on the costs to taxpayers.

Instead, teachers and taxpayers deserve a guarantee in the form of self-managed plans such as 401(k)s. Pension benefits earned to date would be protected, but all new teachers would receive a 401(k) plan – owned and controlled by teachers – which politicians can’t touch.

That would mean real retirement security for teachers and the ability of taxpayers to finally hold politicians accountable.

Defined contribution plans won’t make up for the political chicanery of the last twenty years, but at least they’ll end it going forward.